UNIT III

Amalgamation of Firms

Question Bank

Part A

Q1) What is a "Merger" of a Partner Company? State its purpose. (5 marks)

A1) Amalgamation means a merger or merger. When two or more entities merge or combine into one entity, it is known as a "Merger." Similarly, when two or more union corporations merge, it is a "merger of union corporations".

Including the merger of her two or more single traders into the company

The scope of this chapter is broad enough to include situations where two or more individual traders merge to form a new partnership. This is generally known as a "merger to a partner company".

It also includes the merger of one or more single traders and one or more of his partnerships.

The scope of this chapter also includes situations where one or more sole ownerships he merges with one or more partnership companies to establish a new company.

Purpose of the Amalgamation of Companies:

The main purposes of the merger of the businesses are:

1. To avoid competition:

The main purpose of a merger is to avoid competition between companies. This provides the corporate a foothold over its competitors.

2. To Scale Back Costs:

The merged company can cash in of operating costs by lowering production costs. This is often possible for a "large economy".

3. The way to get financially:

The merged company will benefit financially within the sort of tax benefits, improved creditworthiness and lower borrowing rates.

4. To realize growth:

The merged company can pool resources to market internal growth and stop the emergence of latest competitors.

5. To diversify activities:

Diversifying your business across two or more industries can reduce your company's risk. In some cases, it can act to hedge weaker merger operations with stronger ones.

Q2) What are the Various forms of corporate "merger"? (5 marks)

A2)

Q3) Explain the Accounting Procedure in own words. (5 marks)

A3) You need to study the accounting of "old companies" and "new companies".

Old Company: If there is a merger of companies, in the case of an old company, there are basically four things that happen.

The old company has dissolved: The old company has dissolved. They are involved. All results of the dissolution (see Chapter 3) follow. Assets and liabilities are either taken over by the new company or disposed of.

Financial Statements: As a result, the company's accounting books are closed as they were in the case of dissolution.

Asset and Liability Valuation: For this purpose, it is necessary to revaluate the existing assets and liabilities of the old company. Unrecorded assets and liabilities must also be considered for such valuations. This is done by mutual agreement.

Partner's final capital to check: At the time of the merger, the assets and liabilities of the old company will be taken over by the new company and an amount equal to this value (as mutually agreed) will be credited to the new company's capital account. When an old company partner becomes a new company partner. Therefore, needs to confirm the final capital of the partners of the old company, and the same becomes the starting capital of these partners of the new company.

New Office

Establishment of new company: Except in the case of absorption (Section 4.4), a new company will be established and take over the business of the old company.

Taking over the assets and liabilities of the old company: The basic purpose of the new company is to take over the running business using the assets and liabilities of the old company at an agreed price. The agreed value of an asset minus the agreed value of an inherited liability is called the "purchase consideration" or "price".

New Company Partner Capital: The "purchase consideration" above will not be paid in cash to the old partner as in the case of a normal dissolution. The “Purchase Consideration” will be credited to the capital account of the new company's old partner, as confirmed and explained in Section 5.1.4.

Devising a new share of profits: Partners united in a merger must agree to a new share of profits.

Partner Capital Restructuring: Often, the new company's partner's capital is restructured based on the new profit share. This may require the introduction of additional cash capital and, in some cases, the withdrawal of surplus capital. Excesses / shortages may even be transferred to your partner's checking / loan account.

Q4) What are the ways to close the books of an old company? (8 marks)

A4) In the case of a merger, "Old Enterprise: Dissolve. Therefore, conceptually, all the principles described in Chapter 3," Dissolution of Partnership Farms "apply to such farms. The old company passes the following entries:

The entries are:

Step 1: Open a Realization Account and a Partner's Capital Account.

Step 2: Same as step 1 of the reassessment method (see Section 6.1.1). Transfer the partner's capital to the partner's capital A / C credit side and transfer the past profits and reserves. The entries are:

Reserve P/L A/c Dr. To Partners Capital A/c (Various past profit transferred) | XX |

XX |

Step 3: Transfer all assets to the realization account. The entries are:

Realisation A/c Dr. To Concerned asset A/c (Various assets transferred) | XXX |

XXX |

What students should be aware of here is that the new company will take over due to the merger, so cash and bank balances (accounts) will be transferred.

However, you should not transfer your cash / bank account to a cash account if all your assets and liabilities are not taken over by the company.

Step 4: Transfer all debt to the realized account. The entries are:

Concerned liabilities A/c Dr. To Realisation A/c (Various liabilities transferred) | XXX |

XXX |

Step 5: Find out the consideration for the new company's takeover of assets and liabilities. A separate statement is usually created for the "Purchase Consideration". Then the following entry is passed:

Business purchase A/c Dr. To Realisation A/c (Value of purchase consideration on amalgamation now recorded) | XXX |

XXX |

Step 6: Assets that were not taken over by the new company and were sold to the outside world / taken over by a partner:

Cash/Bank/Partners capital A/c Dr. To Concerned asset A/c (Entry at agreed value) | XXX |

XXX |

Gain / Loss of such sale / acquisition transferred to Realization A / c:

Profit | Asset A/c Dr. To Realisation A/c | XXX |

XXX |

Loss | Realisation A/c Dr. To Asset A/c | XXX |

XXX |

Step 7: Partner disclaims / takes over responsibility instead of new company taking over responsibility

Concerned Liability A/c Dr. To Cash/Bank/Partners Capital A/c (Entry at agreed value) | XXX |

XXX |

Gains / losses from such emissions / take-backs transferred to Realization A / c:

Profit | Concerned Liability A/c Dr. To Realisation A/c (Surplus Transferred as Liability taken over at Lower Value) | XXX |

XXX |

Loss | Realisation A/c Dr. To Concerned liability A/c | XXX |

XXX |

Profit | Realisation A/c Dr. To Partners Capital A/c | XXX |

XXX |

Loss | Partners’ Capital A/c Dr. To Realisation A/c | XXX |

XXX |

Step 8: Realization A / c is closed by transferring profit or loss to the partner's capital account at a profit-sharing ratio.

Step 9: The final entry:

Partners’ capital A/c Dr. To Business Purchase A/c (Entry to Close the Books of the “Old Firm”) | XXX |

XXX |

Q5) Write short note on Accounting for Mergers. (8 marks)

A5) ICAI has made this AS mandatory since January 4, 1995. The AS handles the accounting for mergers and the processing of the resulting goodwill or reserves. This is primarily intended for businesses, and only some of its requirements apply to partners' accounts, etc.

It states that there are two main ways to account for a merger.

The use of the "equity pooling method" is not discussed here as it is limited to mergers of companies.

The purchase method of accounting for mergers applies the same principles to the purchase of this regular asset. The problem in is solved using this method.

In this way, the assets and liabilities of the transferring company are either taken over by the new company at their existing value or the consideration is allocated to the individual assets and liabilities based on their fair value at that time, according to the contract. The date of the merger. The reserve will not be taken over by the new company, but will be distributed among the partners of the merged company.

AS 14 sets out the accounting procedures that should be followed in the books of the purchasing / transferring company, but does not specify the specific method that should be followed when closing the books of the merged company.

In the above accounting, students are aware of the following:

(i) If the consideration paid exceeds the net assets (assets-liabilities) acquired, the resulting amount is "GOOD WILL".

(ii) Alternatively, if the consideration paid is less than the net assets acquired, it is a "capital reserve".

Such goodwill resulting from the merger should be systematically amortized by the new company over its useful life. Generally, the amortization period should not exceed 5 years.

Para 45 of AS 14 sets disclosure requirements in the first financial statements of the new company after the merger.

Q6) Define Amalgamation. (5 marks)

A6) You have studied the units related to the final accounting of a partnership company in the XIIth standard. These final accounts are similar to the final accounts of individual traders, but with certain changes in the profit / loss distribution of partners in the profit-sharing ratio. However, there are various transactions that affect the accounting of a general partnership, such as partnership, retirement, death of the partnership, partnership, dissolution, and conversion of the partnership.

In this unit we will understand the need to learning Accounting for Mergers of Partnership Companies.

Meaning of Amalgamation of Partnership Companies:

A merger means merging or merging two or more business units that operate the same type of business to form a new business unit.

A merger of union corporations means that two or more union corporations merge to form a new union corporation. The merger of two or more existing partnership companies doing the same type of business, terminating another entity and forming a new company is called a partnership company merger.

Mergers can be formed in one of the following ways:

Q7) Write short note on Books of the New Firm. (5 marks)

A7) The entries in the books of the new firm can be divided into following stages:

1. Recording of the assets and liabilities taken over:

Debit: all assets’ accounts (which are taken over)

Credit: all liabilities accounts (which are taken over)

Credit: Partner’s capital accounts (as per the final balances in the capital accounts in the old firm)

With this entry the final capitals of the partners in the old firm become their initial capitals in the new firm.

2. Restructuring of partners capitals:

The partners may decide a particular capital structure in the new firm, which has to be contributed by the partners in their new profit-sharing ratio. Accordingly, the partners may bring further capital or withdraw excess capital. Alternatively, the excess or deficit may be transferred to current or loan accounts.

3. Removing effects of inter firm transactions of old firms:

(1) If debtors of one of the old firms, are creditors of the other firm the same party will be reflected as both debtor and creditor in the amalgamated firm,

Q8) What entries are being passed at time of cancellation of Debtors and Creditors Account. (5 marks)

A8) (1) If one of the debtors of the old company is the creditor of the other company, the same party will be reflected in both the debtor and the creditor of the merged company, and the common amount will be cancelled as follows.

Sunday Creditors A/c Dr. To Sundry Debtors A/c | XXX |

XXX |

(2) If the old company before the merger was a debtor / creditor of each other, the common amount will be cancelled in the company after the merger as follows.

Sundry Creditors A/c Dr. To Sundry Debtors A/c | XXX |

XXX |

(3) Similarly, if the old companies were accepting or withdrawing bills from each other, the same procedure would be performed.

Bills Payable A/c Dr. To Bills Receivable A/c | XXX |

XXX |

A similar method is used for cancellation of business-to-business loans.

(4) If one company purchased goods from the other company prior to the merger and all or part of the goods are still in stock or on the date of the merger, by the company that sold those goods. The amount of profit obtained is reduced from the combined inventory value as follows.

Goodwill A/c Dr. To Stock A/c | XXX |

XXX |

Q9) Distinguish between Amalgamation v/s Absorption. (5 marks)

A9) Where two or more existing business entities merge themselves to form a new business entity it is “amalgamation”. Therefore, the old entities are taken over by the newly formed business entity, e.g., where two firms viz. M/s AB & Co. And M/s. CD & Co. Merge to form a new firm M/s. ABCD & Co.

In absorption, one or more existing business entities are taken over by another existing business entity. No new business entity is formed for the purpose. E.g., where a firm AB & Co. ‘absorbs’ another firm CD & Co., it is known as absorption of CD & Co. By AB & Co.

Hence, whereas in amalgamation, all the old business entities are closed and a new business entity is formed, in absorption, one old entity will continue after taking over the other entity or entities.

Comparison Table Between Amalgamation and Absorption

Parameter of Comparison | Amalgamation | Absorption |

Meaning | Two or more different companies join to become one, the process is called Amalgamation. | When one company takes over the business of another company, the process is called Absorption. |

New entity | The new entity is formed. | No new entity is formed. |

Minimum number of companies involved | In the process of amalgamation, there are at least three companies involved (two liquidating and one newly formed). | While in Absorption there are at least two companies involved. |

Liquidating companies | At least two companies liquidate. | Only one company is liquidated (whose business is overtaken by the other). |

Domination | No company dominates any other company. | The bigger company dominates the weaker company. |

Q10) What are the different forms of ‘Amalgamation’ of firms? (5 marks)

A10) Amalgamation of firms may take any of the following forms:

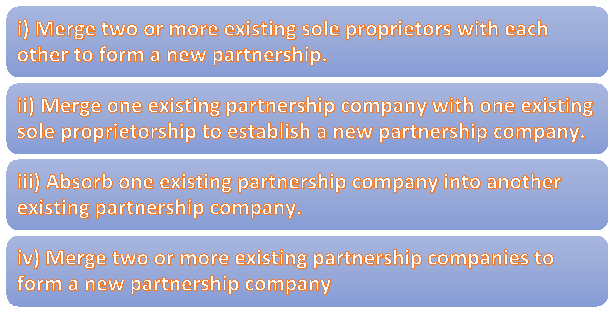

Amalgamation of Two or more Sole-traders: Here, two or more sole-traders amalgamate themselves into a new partnership firm. E.g., Mr. A and Mr. B, two Chartered Accountants, practicing separately, merge their practice to form a new firm of Chartered Accountants viz. M/s AB.

Amalgamation of Sole-trader and Firm: Here, one or more existing sole-traders merge with one or more existing partnership firms, so that the existing entities lose their identity and a new partnership firm is formed to take over their businesses. E.g., Mr. X, a proprietor and M/s. YZ, a partnership firm, who are doing businesses separately, amalgamate to form a new firm, M/s. XYZ.

Amalgamation of Two or more Partnership Firms: Here, two or more existing partnership firms merge and form a new firm to take over the businesses of the existing firms. E.g., M/s. PQ and M/s. RS, two partnership firms doing competing businesses, amalgamate to form a new partnership firm viz. M/s PQRS. In all the above cases, A, B, X, YZ, PQ and RS lose their individual identity, close their businesses and new firms, M/s. AB, M/s. XYZ and M/s. PQRS respectively, come into existence to take over businesses.

Absorption: In this case, all the merging units do not lose their identity. One of them will continue to exist after taking over the other existing units. E.g., M/s. JK and M/s. MN are in competing business. M/s. JK absorbs or takes over M/s. MN so that M/s. MN is dissolved and M/s. JK continues to exist. It now has the assets and liabilities taken over from M/s. MN, in addition to its existing assets and liabilities.

Part B

Q11) The following is the Balance Sheet of Kumar Ltd as on 30th September, 2009

Balance Sheet as on 30th September, 2009

Liabilities | Rs | Assets | Rs |

Authorized Share Capital |

| Land & Buildings | 200000 |

10000 Equity Shares of Rs100 | 1000000 | Plant & Equipment’s | 300000 |

1000 6% Preference Shares of |

|

|

|

Rs 100 each | 100000 | Furnitures | 65000 |

Total | 1100000 | Patents | 45000 |

Issued capital |

| Sundry Debtors | 149450 |

6,000 Equity Shares | 600000 | Inventory | 68950 |

1000 6% Preference Shares of |

|

|

|

Rs 100 each | 100000 | Cash | 3700 |

10% Debentures | 100000 | Profit & loss A/C | 307900 |

Sundry Creditors | 100000 |

|

|

Bank Overdraft | 240000 |

|

|

| 1140000 |

| 1140000 |

A new Company Kishor Ltd was formed to take over this company. The Authorized capital of the new company was Rs 1500000 divided into 100000 Equity shares of Rs 10 each and 5000 7% Preference shares of Rs 100 each. The terms and conditions agreed for this were as follows:

- 10% debenture holders agreed to take new 9%Debentures of Rs.95000 in full satisfaction.

- 6% Preference shareholders were to receive 3 new 7% Preference shares of Rs.100 each for every 4 old preference shares.

- The equity shareholders to receive 30,000 Equity shares of Rs.10 each, credited as Rs.8 paid up

- Kishor Ltd. To issue 20,000 equity shares of Rs.10 each at par for cash

- Kishor Ltd to make a call of Rs.2 per share on shares issued to Kumar Ltd.

You are required to give necessary Ledger A/c s to close the books of Kumar ltd and Journal entries in the books of Kishor Ltd and Balance Sheet of Kishor Ltd.(12 marks)

A1)

Statement of Purchase consideration: (Net Payment method)

750 7% Preference shares of Rs.100 each 75000

30,000 Equity shares of Rs.10 each Rs. 8 paid up 240000

315000

Goodwill/Capital reserve (Net Assets taken over)

Land & Buildings | 200000 |

|

Plant & Equipments | 300000 |

|

Furnitures | 65000 |

|

Patents | 45000 |

|

Sundry Debtors | 149450 |

|

Inventory | 68950 |

|

Cash | 3700 | 832100 |

|

|

|

Less: Liabilities taken over at agreed values |

| |

10% Debentures | 100000 |

|

Sundry Creditors | 100000 |

|

Bank Overdraft | 240000 | 440000 |

Net Assets taken over |

| 392100 |

Purchase consideration |

| 315000 |

Capital Reserve |

| 77100 |

In the books of Kumar Ltd

Realization A/c

To Land & Buildings | 200000 | By 10% Debentures | 100000 |

To Plant & Equipments | 300000 | By Sundry Creditors | 100000 |

To Furnitures | 65000 | By Bank Overdraft | 240000 |

To Patents | 45000 | By Kishor | 315000 |

To Sundry Debtors | 149450 | By Pref Shareholders A/c | 25000 |

To Inventory | 68950 | By Equity Share holders A/c | 52100 |

To Cash | 3700 |

|

|

| 832100 |

| 832100 |

Equity Shareholders A/c

To Profit & Loss A/c | 307900 | By Equity Share Capital A/c | 600000 |

To Realization A/c | 52100 |

|

|

To Equity shares in Kishor Ltd |

240000 |

|

|

| 600000 |

| 600000 |

Kishor Ltd A/c

To Realisation A/c | 315000 | By Pref Shares in Kishor Ltd A/c By Equity Shares in Kishor Ltd A/c |

75000

240000 |

315000 | 315000 |

Preference Share Holders A/c

To Preference Shares in Kishor Ltd To Realisation A/c |

75000 25000 |

By Preference Share capital A/c |

100000 |

100000 | 100000 |

Equity Shares in Kishor Ltd

To Kishor Ltd | 240000 | By Equity Share Holders A/c | 240000 |

240000 | 240000 |

Preference Shares in Kishor Ltd

To Kishor Ltd | 75000 | By Preference Share Holders | 75000 |

75000 | 75000 |

Journal Entries in the Books of Kishor Ltd.

1 | Business Purchase A/c Dr To Liquidator of Kumar Ltd (Being Business Purchased) | 315000 |

315000 |

2 | Land and Buildings Dr Plant and Equipments Dr Furnitures Dr Patents Dr Sundry Debtors Dr Inventry A/c Dr Cash Dr To Business Purchase A/c To Sundry Creditors To Debentures To Bank Overdraft To Capital Reserve (Being Sundry Assets and Liabilities taken over recorded) | 200000 300000 65000 45000 149450 68950 3700 |

315000 100000 100000 240000 77100 |

3 | Liquidator of Kumar Ltd Dr To Equity Share Capital A/c To 7%Preference Share Capital A/c (Being Purchase Consideration Discharged.) | 315000 |

240000 75000 |

4 | Bank A/c Dr To Equity Share Capital A/c (Being 20000 Equity shares of Rs 10 each issued for cash.) | 200000 |

200000 |

5 | Equity Share Call A/c Dr To Equity Share Capital A/c (Being call made at Rs 2 per share on 30000 equity shares) | 60000 |

60000 |

6 | Bank A/c Dr To Equity Share Call A/c (Being Call amount received.) | 60000 |

60000 |

Balance Sheet of Kishor Ltd.

Liabilities | Rs | Assets | Rs |

Authorised Share Capital |

| Land & Buildings | 200000 |

100000 Equity Shares of Rs10 |

|

|

|

Each | 1000000 | Plant & Equipments | 300000 |

5000 7% Preference Shares of |

|

|

|

Rs 100 each | 500000 | Furnitures | 65000 |

Total | 1500000 | Patents | 45000 |

Issued capital |

| Sundry Debtors | 149450 |

50000 Equity Shares of Rs 10 |

|

|

|

Each | 500000 | Inventory | 68950 |

750 7% Preference Shares of |

|

|

|

Rs 100 each | 75000 | Cash | 3700 |

Capital Reserve | 77100 | Bank Balance | 20000 |

10% Debentures | 100000 |

|

|

Sundry Creditors | 100000 |

|

|

| 852100 |

| 852100 |

Q12) The following are the Balance Sheets of P Ltd and S Ltd as on 31st March, 2009 Balance Sheet as on 31st March, 2009

Liabilities | P Ltd | S Ltd | Assets | P Ltd | S Ltd |

Equity Share Capital (Rs |

|

| Land and Building | 250,000 | 155000 |

10 each) | 500,000 | 300,000 |

|

|

|

14% Preference Share |

|

|

|

|

|

Capital (Rs 100 each) | 220,000 | 170,000 | Plant and Machinery | 325,000 | 170000 |

General Reserve | 50,000 | 25,000 | Furniture and Fittings | 57,500 | 35000 |

Export Profit Reserve | 30,000 | 30,000 | Investments | 125,000 | 95000 |

Profit and Loss A/c | 75,000 | 50,000 | Stock | 90,000 | 103000 |

13% Debentures | 50,000 | 35,000 | Debtors | 72,500 | 52000 |

Sundry Creditors | 65,000 | 50,000 | Cash and Bank | 70,000 | 50000 |

| 990,000 | 660,000 |

| 990,000 | 660000 |

P Ltd takes over S Ltd on 1st April, 2009. P Ltd discharges the Purchase Consideration as below:

Issued 35000 equity shares of Rs 10 each at par to the equity shareholders of S Ltd.

Issued 15% Preference Shares of Rs 100 each

To discharge the Preference share holders of S Ltd at 10% premium.

The Debentures of S Ltd will be converted into equivalent numbers of debentures of P Ltd.

You are required to give necessary ledger accounts to close the books of S Ltd and Journal entries in t the books of P Ltd and Balance sheet of P Ltd after absorption.(8 marks)

A2)

Statement of Purchase consideration: (Net Payment method)

35000 equity shares of Rs 10 each 350000

1870 15%Preference Shares of Rs 100 each

(Old Preference Share Capital 170000

Add : 10%Premium 17000 187000

537000

In the books of S Ltd

Realization A/c

To Land and Buildings | 155000 | By 13% Debentures | 35000 |

To Plant and Equipments | 170000 | By Current Liabilities | 50000 |

To Furnitures | 35000 | By P Ltd | 537000 |

To Investment | 95000 | By Equity Share holders A/c | 55000 |

To Inventory | 103000 |

|

|

To Sundry Debtors | 52000 |

|

|

To Cash | 50000 |

|

|

To Preference Share |

|

|

|

Holders | 17000 |

|

|

| 677000 |

| 677000 |

Equity Shareholders A/c

To Realisation A/c To Equity Shares In P Ltd | 55000 350000 |

By Equity Share Capital A/c By General Reserve A/c By Profit & Loss A/c By Export Profit Reserve |

300000 25000 50000 300000 |

405000 | 405000 |

P Ltd A/c

To Realisation A/c | 537000 | By Equity Shares in P Ltd By Preference Shares in P Ltd | 350000 187000

|

537000 | 537000 |

Preference Share Holders A/c

To Preference Shares in P Ltd | 187000 |

By Preference Share capital A/c By Realisation A/c |

170000 17000 |

187000 | 187000 |

Equity Shares in P Ltd

To P Ltd A/c | 350000 | By Equity Share Holders A/c | 350000 |

350000 | 350000 |

Preference Shares in P Ltd

To P Ltd A/c | 187000 | By Preference Share Holders A/c | 187000 |

187000 | 187000 |

Journal Entries in the books of P Ltd

Sr.No | Particulars | Dr. Rs. | Cr. Rs. |

i. | Business Purchase A/c Dr. | 5,37,000 |

|

| To Liquidator of Q Ltd. |

| 5,37,000 |

| (Being Business of Q Ltd. Purchased) |

|

|

|

|

|

|

Ii. | Building A/c Dr. | 155000 |

|

| Machinery A/c. Dr. | 170000 |

|

| Furniture and Fittings Dr | 35000 |

|

| Investment Dr | 95000 |

|

| Stock Dr. | 103000 |

|

| Debtors Dr. | 52000 |

|

| Cash and Bank A/c. Dr. | 50000 |

|

| To 13 % Debentures |

| 35000 |

| To Current Liabilities |

| 50000 |

| To Business Purchase |

| 537000 |

| To Capital Reserve |

| 38000 |

| (Being sundry assets & liabilities taken over of Q Ltd. Recorded) |

|

|

|

|

|

|

Iv. | Liquidator of P Ltd. A/c Dr. | 1875000 |

|

| To Equity share capital A/c |

| 1250000 |

| To Securities Premium A/c |

| 625000 |

| (Being Purchase consideration discharge) |

|

|

|

|

|

|

v. | Liquidator of Q Ltd. A/c. Dr. | 537000 |

|

| To Equity Share Capital A/c. |

| 350000 |

| To 15% Preference Share Capital A/c. |

| 187000 |

| (Being purchase consideration discharged) |

|

|

|

|

|

|

Vi. | Amalgamation Adjustment A/c. Dr. | 30000 |

|

| To Export profit reserve |

| 30000 |

| (Being statutory reserve maintained) |

|

|

|

|

|

|

Vii. | 13% Debentures in Q Ltd. A/c. Dr | 35000 |

|

| To 13% Debentures |

| 35000 |

Balance Sheet as on 31st March, 2009

Liabilities | Rs | Assets | Rs |

Equity Share Capital (Rs |

| Land and Building |

|

10 each) | 850,000 |

| 405,000 |

14% Preference Share |

|

|

|

Capital (Rs 100 each) | 220,000 | Plant and Machinery | 495,000 |

15% Preference Share |

|

|

|

Capital (Rs 100 each) | 187,000 | Furniture and Fittings | 92,500 |

General Reserve | 50,000 | Investments | 220,000 |

Export Profit Reserve | 60,000 | Stock | 193,000 |

Capital Reserve | 38,000 | Debtors | 124,500 |

Profit and Loss A/c | 75,000 | Cash and Bank | 120,000 |

13% Debentures | 85,000 | Amalgamation Adjustment A/c | 30000 |

Current Liabilities | 115,000 |

|

|

| 1,680,000 |

| 1,680,000 |

Q13) The following is the Balance Sheet of Shy Ltd as on 30th September, 2009

Balance Sheet as on 30th September, 2009

Liabilities | Rs | Assets | Rs |

Issued capital |

| Land & Buildings | 85000 |

18000 Equity Shares of Rs10 |

| Plant & Equipments | 45000 |

General Reserve | 24000 | Furnitures | 15000 |

Profit & loss | 10400 | Trademarks | 7000 |

12% Debentures | 80000 | Investments | 23000 |

Sundry Creditors | 63720 | Sundry Debtors | 60000 |

|

| Stock | 112000 |

|

| Bank | 11120 |

| 358120 |

| 358120 |

Shy Ltd was absorbed by Chai Ltd., on the following terms and conditions:

- All liabilities and all assets are to be taken over except Investments which were sold by Shy Ltd. At 90% of book value.

- Debentures of Shy Ltd, to be discharged at a discount of 10% by the issue of 14% debentures of Rs 100 each in Chai Ltd.

- Trademarks were found useless.

- Issue of one equity share of Rs 10 each in Chai Ltd., issued at Rs 12 and a cash payment of Rs 3 for every s hare in Shy Ltd.

- Cost of absorption paid : Rs 1160

- Shy Ltd. Sold half the shares received from Chai Ltd. At Rs 15 per share.

You are required to give necessary Ledger A/c s to close the books of Shy Ltd. And Journal entries in the books of Chai Ltd.(8 marks)

A3)

Statement of Purchase consideration: (Net Payment method)

18000 Equity shares of Rs.10 each at Rs.12 per share 216000

Cash at Rs. 3 per share on 18000 Equity shares 54000

Purchase Consideration 270000

Goodwill/Capital reserve (Net Assets taken over)

Land & Buildings | 85000 |

|

Plant & Equipments | 45000 |

|

Furnitures | 15000 |

|

Sundry Debtors | 60000 |

|

Stock | 112000 |

|

Bank | 11120 |

|

|

| 328120 |

Less : |

|

|

Liabilities taken over |

|

|

Debentures | 80000 |

|

Creditors | 63720 | 143720 |

Net assets taken over |

| 184400 |

Less : |

|

|

Purchase consideration |

| 270000 |

Goodwill |

| 85600 |

In the books of Shy Ltd

Realization A/c

To Land & Buildings | 85000 | By 10% Debentures | 80000 |

To Plant & Equipments | 45000 | By Sundry Creditors | 63720 |

To Furnitures | 15000 | By Chai Ltd. | 270000 |

To Trademarks | 7000 | By Bank (Investment sold) | 20700 |

To Sundry Debtors | 60000 | By Bank (shares sold) | 27000 |

To Bank | 11120 |

|

|

To Investments | 23000 |

|

|

To Stock | 112000 |

|

|

To Equity Share holders A/c | 103300 |

|

|

| 461420 |

| 461420 |

Equity Shareholders A/c

To Bank A/c To Equity Shares in Chai Ltd | 209700 108000 | By Equity Share Capital A/c By Profit & Loss A/c By General Reserve A/c By Realisation A/c | 180000 10400 24000 103300 |

317700 | 317700 |

Chai Ltd A/c

To Realisation A/c | 270000 | By Equity Shares in Chai Ltd By Bank | 216000 54000 |

270000 | 270000 |

Bank A/c

To Equity shares in Chai Ltd To Realisation A/c To Chai Ltd. | 135000 20700 54000 |

By Equity Shareholders A/c |

209700 |

209700 | 209700 |

Equity Shares in Chai Ltd

To Chai Ltd. To Realisation A/c | 216000 27000 | By Bank By Equity Share Holders A/c | 135000 108000 |

| 243000 |

| 243000 |

Journal Entries in the Books of Chai Ltd.

1 | Business Purchase A/c To Liquidator of Shy Ltd (Being Business Purchased) | Dr | 270000 |

270000 | |

2 | Land and Buildings Dr Plant and Equipments Dr Furniture Dr Sundry Debtors Dr Stock Dr Bank Dr Goodwill (Bal Fig) Dr To Business Purchase A/c To Sundry Creditors To Debentures (Being Sundry Assets and Liabilities taken over recorded) | 85000 45000 15000 60000 112000 11120 85600 |

270000 63720 80000

| ||

3 | Liquidator of Shy Ltd To Equity Share Capital A/c To Securities Premium A/c To Bank (Being Purchase Consideration Discharged.) |

| Dr | 270000 |

180000 36000 54000 |

4 | Goodwill A/c To Bank (Being amalgamation expenses paid) | Dr. |

| 1160 |

1160 |

5 | Debentures in Shy A/c Dr. To Debentures in Chai Ltd A/c (Being new debentures issued in satisfaction of old Debentures) | 72000 |

72000 | ||

Q14) A Ltd and B Ltd agreed to amalgamate and form a new company C Ltd. Which will take over all the assets and liabilities of the two companies.

The assets and liabilities of A Ltd are to be taken over at a book value for shares in C Ltd. At the rate of 5 shares in C Ltd. At 10% premium (i.e. Rs 11 per share) for every four shares in A Ltd.

In the case of B Ltd:

The debentures of B Ltd. Would be paid off by the issue of an equal no. Of debentures in C Ltd.

The 11.5% Preference Shareholders of B Ltd. Would be allotted four 12% Preferences of Rs 100 each in C Ltd. For every five Preference shares in B Ltd.

Sufficient shares of C Ltd would be allotted to the equity share holders to cover the balance on their account after adjusting asset values by reducing Plant and Machinery by 10% and providing 5% on sundry debtors.

The summarized Balance Sheets of the two companies just prior to amalgamation were as follows:

Liabilities | A Ltd. | B Ltd | Assets | A Ltd. | B Ltd |

Issued capital |

|

| Plant & Equipments | 800000 | 800000 |

Equity Capital of Rs10 each | 400000 | 500000 | Stock | 65000 | 60000 |

11.5 Preference Shares of Rs 100 each. |

|

300000 | Profit and Loss A/c |

| 140000 |

12% Debentures |

| 200000 | Sundry Debtors | 95000 | 50000 |

Profit & loss A/C | 500000 |

| Bank | 65000 | 40000 |

Sundry Creditors Contingency Reserve | 75000 50000 | 90000 |

|

|

|

| 1025000 | 1090000 |

| 1025000 | 1090000 |

Show the Journal entries in the books of both the companies.(8 marks)

A4)

Statement of Purchase consideration for A Ltd.(Net Payment Method)

5 Equity Shares of Rs 10 each at 10% premium for

Every four shares in A Ltd. 550000

(40000 shares/4 x 5= 50000 shares x Rs.11)

Statement of Purchase Consideration for B Ltd(Net Assets Method) &

Net Assets taken over of A Ltd.

Assets Taken Over: | A Ltd | B Ltd |

Plant & Equipments | 800000 | 720000 |

Stock | 65000 | 60000 |

Sundry Debtors | 95000 | 47500 |

Bank | 65000 | 40000 |

| 1025000 | 867500 |

Less: Liabilities taken over |

|

|

Debentures |

| 200000 |

Sundry creditors | 75000 | 90000 |

Net Assets | 950000 | 577500 |

Less: P.C | 550000 |

|

Capital Reserve | 400000 |

|

P.C (Net Assets Method) |

| 577500 |

In the books of A Ltd and B Ltd

Realization A/c

Particulars | A Ltd | B Ltd | Particulars | A Ltd | B Ltd |

To Plant & Equipments A/c |

800000 |

800000 | By Debentures A/c |

| 200000 |

To Stock A/c | 65000 | 60000 | By Creditors A/c | 75000 | 90000 |

To Sundry Debtors A/c | 95000 | 50000 | By C Ltd A/c | 550000 | 577500 |

To Bank A/c | 65000 | 40000 | By Preference Shareholders A/c |

|

60000 |

|

|

| By Equity Share holders A/c | 400000 | 22500 |

| 1025000 | 950000 |

| 1025000 | 950000 |

C Ltd A/c

Particulars | A Ltd | B Ltd | Particulars | A Ltd | B Ltd |

To Realisation A/c | 550000 | 577500 | By Equity Shares in C Ltd By Preference Shares in C Ltd | 550000 | 337500

240000 |

550000 | 577500 | 550000 | 577500 |

Equity Shareholders A/c

Particulars | A Ltd | B Ltd | Particulars | A Ltd | B Ltd |

To Profit & Loss A/c To Equity shares in C Ltd To Realisation A/c |

550000 400000 | 140000 337500 22500 | By Equity Share Capital A/c By Profit & Loss A/c By General Reserve A/c | 400000 500000

50000 | 500000

|

950000 | 500000 | 950000 | 500000 |

Preference Share Holders A/c

To Preference Shares in C Ltd To Realisation A/c |

| 240000 60000 |

By Preference Share capital A/c |

|

300000 |

300000 | 300000 |

Equity Shares in C Ltd

To C Ltd A/c

|

| 337500 | By Equity Share Holders A/c | 550000 | 337500 |

| 550000 | 337500 |

| 550000 | 337500 |

Preference Shares in C Ltd

To C Ltd | B Ltd 240000 |

By Preference Share Holders A/c | B Ltd 240000 |

240000 | 240000 |

Journal Entries in the Books of C Ltd.

1 | Business Purchase A/c Dr To Liquidator of A Ltd A/c To Liquidator of B Ltd A/c (Being Business Purchased) | 1127500 |

550000 577500 | |

2 | Plant and Equipments A/c Dr Stock A/c Dr Debtors A/c Dr Bank A/c Dr To Business Purchase A/c To Sundry Creditors To Capital Reserve A/c (Being Sundry Assets and Liabilities taken over recorded) |

| 800000 65000 95000 65000 |

550000 75000 400000 |

3 | Plant and Equipments A/c Dr Stock A/c Dr Debtors A/c Dr Bank A/c Dr To Business Purchase A/c To Sundry Creditors To Debentures (Being Sundry Assets and Liabilities taken over recorded) |

| 720000 60000 47500 40000 |

577500 90000 200000 |

4 | Liquidator of A Ltd Dr To Equity Share Capital A/c To Security Premium A/c (Being Purchase Consideration Discharged.) | 550000 |

500000 50000 | |

5 | Liquidator of B Ltd Dr To Equity Share Capital A/c To Preference Share Capital A/c (Being Purchase Consideration Discharged.) | 577500 |

337500 240000 | |

6 | Old Debentures A/c To New Debenture A/c To Capital Reserve A/c (Being old Debentures settled at 10% discount.) | Dr | 200000 |

180000 20000 |

Balance Sheet of C Ltd.

Liabilities | Rs | Assets | Rs |

Issued capital |

| Plant & Equipments | 1520000 |

Equity Capital of Rs10 each | 837500 | Stock | 125000 |

11.5 Preference Shares of Rs |

|

|

|

100 each. | 240000 | Sundry Debtors | 142500 |

12% Debentures | 180000 | Bank | 105000 |

Sundry Creditors | 165000 |

|

|

Security Premium | 50000 |

|

|

Capital Reserve | 420000 |

|

|

| 1892500 |

| 1892500 |

Q15) Following were the balance sheets as on March 2014 of two firm’s M/s A & B and M/s C & D:

Balance Sheet

Liabilities | A & B | C & D | Assets | A & B | C & D | |

Sundry Creditors | 20,000 | 10,000 | Cash at bank |

| 15,000 | 8,000 |

Bills Payable | 5,000 | – | Investment at Cost |

| 10,000 | 8,000 |

Bank Overdraft | 2,000 | 10,000 | Debtors | 10,000 |

|

|

E’s Loan | 6,000 | – | Less: Provision | 1,000 |

|

|

Capitals |

|

|

|

| 9,000 | 8,000 |

A | 35,000 |

| Furniture |

| 12,000 | 6,000 |

B | 22,000 |

| Premises |

| 30,000 | – |

C |

| 36,000 | Land |

| – | 50,000 |

D |

| 20,000 | Machinery |

| 15,000 | – |

General Reserve | 8,000 | 3,000 | Goodwill |

| 9,000 | – |

Investment Fluctuation | 2,000 | 1,000 |

|

|

|

|

Fund |

|

|

|

|

|

|

| 1,00,000 | 80,000 |

| 1,00,000 | 80,000 | |

It was decided by both the firms to amalgamate their business on 1st April 2014 for this purpose it was decided that the new firm shall not take furniture of both the firms and shall take over investment at 10

% Less than the cost land at 80,000 premises at 45,000, machinery at 9,000 New firm agreed to take over only trade liabilities of both the firms and to pay 12,000 to each firm as goodwill Unrecorded typewriter with C & D valued at 800 was not taken over by the new firm. (8 marks)

A5) Journal in the Books of M/s. A & B

Date 31/3/14 | Particulars | L F | Debit | Credit | |

| Realisation A/c To Cash at Bank A/c To Investment A/c To Debtors To Furniture A/c To Premises A/c To Machinery A/c To Goodwill (Being Transfer of Assets to Realisation A/c) | Dr. |

| 1,01,000 |

|

| 15,000 | ||||

| 10,000 | ||||

| 10,000 | ||||

| 12,000 | ||||

| 30,000 | ||||

| 15,000 | ||||

| 9,000 | ||||

Creditors A/c Balance Payable A/c Bank OD A/c Provision for Doubtful Debt A/c A’S Loan A/c To Realisation (Being Transfer of Liabilities to Realisation A/c) | Dr. Dr. Dr. Dr. Dr. | 20,000 |

| ||

5,000 |

| ||||

2,000 |

| ||||

1,000 |

| ||||

6,000 |

| ||||

| 34,000 | ||||

Investment Fluctuation Fund A/c To Realisation A/c | Dr. | 1,000 |

| ||

| 1,000 | ||||

| (Being Reduction in the Value of Investment Accounted for) |

|

|

| |

General Reserve A/c Dr. To A’s Capital A/c To A’s Capital A/c (Being Reserve Distributed to old Partners in Profit Sharing Ratio) | 8,000 |

4,000 4,000 | |||

New Firm A/c To Realisation A/c (Being Purchase Consideration Recorded) | Dr. | 66,000 |

66,000 | ||

A’s Capital A/c B’s Capital A/c To Realisation A/c (Being Furniture taken over by Partners) | Dr. Dr. | 6,000 6,000 |

12,000 | ||

Investment Fluctuation Fund A/c Dr. To A’s Capital A/c To B’s Capital A/c (Being Surplus Balance Transferred to Partner’s Capital Accounts. | 1,000 |

500 500 | |||

Realisation A/c Dr. To A’s Capital A/c To B’s Capital A/c (Being Profit on Realisation Distributed to Partners in Profit) | 12,000 |

6,000 6,000 | |||

A’s Capital A/c B’s Capital A/c To New Firm A/c (Being balances in Partner’s Capital A/c Adjusted) | Dr. Dr. | 39,500 26,500 |

66,000 | ||

Ledger Accounts

Dr. Realisation A/c

|

|

|

| ||

To Sundry Assets: |

|

| By Sundry Liabilities |

|

|

Cash at Bank | 15,000 |

| Creditors | 20,000 |

|

Investment | 10,000 |

| Bills Payable | 5,000 |

|

Debtors | 10,000 |

| Bank Overdraft | 2,000 |

|

Furniture | 12,000 |

| RDD | 1,000 |

|

Premises | 30,000 |

| A’s Loan | 6,000 | 34,000 |

Machinery | 15,000 |

| By Investment Fluctuation |

| 1,000 |

|

|

| Fund A/c |

|

|

Goodwill | 9,000 | 1,01,000 | By Business Purchase A/c |

| 66,000 |

To Realisation Profit |

|

| By Partners Capital A/c |

| 12,000 |

A | 6,000 |

| (Furniture taken over) |

|

|

B | 6,000 | 12,000 |

|

|

|

|

| 1,13,000 |

|

| 1,13,000 |

Partner’s Capital A/c Cr.

Dr

| A | B |

| A | B |

To Furniture | 6,000 | 6,000 | By Balance b/d | 35,000 | 22,000 |

To Business Purchase A/c | 39,500 | 26,500 | By Realisation A/c By General Reserve By Inv.fluctuation Fund | 6,000 4,000 500 | 6,000 4,000 500 |

| 45,500 | 32,500 |

| 45,500 | 32,500 |

Dr. New Firm A/c (Business Purchase A/c) Cr.

|

| ||

To Realisation A/c | 66,000 | By Capital accounts: A B | 39,500 26,500 |

| 66,000 |

| 66,000 |

Working Note: Value of Business Purchase:

Particulars | A & B | C & D | ||

Assets taken over: Cash (*15,000 –2,000 – 6,000) Investment Debtors Land/Premises Machinery Goodwill Less: Liabilities Creditors RDD Bills payable |

*7,000 |

|

8,000 |

|

9,000 |

| 7,200 |

| |

10,000 |

| 8,000 |

| |

45,000 |

| 80,000 |

| |

9,000 |

| – |

| |

12,000 | 92,000 | 12,000 | 1,15,200 | |

20,000 |

| 10,000 |

| |

1,000 |

| – |

| |

5,000 | (26,000) |

| (10,000) | |

|

| 66,000 |

| 1,05,200 |

Journal Entries in the Books of M/s. C & D

Date | Particulars | LF | Debit | Credit | |

| Realisation A/c To Bank A/c To Investment A/c To Debtors A/c To Furniture A/c To Land A/c (Being Assets Transferred) | Dr. |

| 80,000 |

|

| 8,000 | ||||

| 8,000 | ||||

| 8,000 | ||||

| 6,000 | ||||

| 50,000 | ||||

| Creditors A/c To Realisation A/c (Being Liabilities transferred) | Dr. |

| 10,000 |

10,000 |

| Investment Fluctuation Fund A/c To Realisation A/c To C’s Capital A/c To D’s Capital A/c (Being reduction in value of investments transferred to Realisation A/c and balance distributed to Partners in profit sharing ratio) | Dr. |

| 1,000 |

|

| 800 | ||||

| 100 | ||||

| 100 | ||||

| General Reserve A/c | Dr. |

| 3,000 |

|

| To C’s Capital A/c To D’s Capital A/c (Being general reserve distributed to partners in profit sharing ratio) |

|

| 1,500 1,500 | |

| Bank Overdraft A/c To C’s Capital A/c To D’s Capital A/c (Being Liabilities taken over by partners) | Dr. |

| 10,000 |

5,000 5,000 |

| New Firm A/c To Realisation A/c (Being Purchase Consideration Recorded) | Dr. |

| 1,05,200 |

1,05,200 |

| C’s Capital A/c D’s Capital A/c To Realisation A/c (Being Furniture taken over) | Dr. Dr. |

| 3,000 |

|

3,000 |

| ||||

| 6,000 | ||||

| C’s Capital A/c D’s Capital A/c To Realisation A/c (Being Type writer taken over) | Dr. Dr. |

| 400 |

|

400 |

| ||||

| 800 | ||||

| Realisation A/c To C’s Capital A/c To D’s Capital A/c (Being Profit on Realisation Transferred in Profit Sharing Ratio) | Dr. |

| 42,800 |

|

| 21,400 | ||||

| 21,400 | ||||

| C’s Capital A/c D’s Capital A/c To New Firm A/c (Being Balance in Partner’s Capital A/c Adjusted) | Dr. |

| 60,600 |

|

Ledger Accounts

Dr. Realisation A/c Cr.

|

|

| ||

To Sundry Assets: Cash at Bank Investment Debtors Furniture Land To Partner’s Capital: C D |

8,000 8,000 8,000 6,000 50,000 |

80,000

42,800 | By Sundry liabilities: Creditors By Investment fluctuation fund By Business purchase A/c By Partner’s capital A/c (furniture) By Partner’s capital A/c (typewriter) |

10,000 800 1,05,200 6,000 800 |

21,400 21,400 | ||||

|

| 1,22,800 |

| 1,22,800 |

Dr. Partner’s Capital A/c Cr.

| C | D |

| C | D |

To Realisation (Furniture) | 3,000 | 3,000 | By Balance b/d | 36,000 | 20,000 |

To Realisation (typewriter) | 400 | 400 | By Realisation | 21,400 | 21,400 |

To Balance c/d | 60,600 | 44,600 | By Bank o/d | 5,000 | 5,000 |

|

|

| By General Reserve | 1,500 | 1,500 |

|

|

| By Inv. Fluctuation Fund | 100 | 100 |

| 64,000 | 48,000 |

| 64,000 | 48,000 |

Dr. New Firm A/c (Business Purchase A/c) Cr.

|

| ||

To Realisation A/c | 1,05,200 | By Partners Capital A/c: C D | 60,600 44,600 |

| 1,05,200 |

| 1,05,200 |

Journal Entries in the Books of New Firm

Date 1/4/14 | Particulars | LF | Debit | Credit | |

(1) | Bank A/c Investments A/c Debtors A/c Premises A/c Machinery A/c Goodwill A/c To Sundry Creditors A/c To Bill payable A/c To Provision for Doubtful Debts A/c To A’s Capital A/c To B’s Capital A/c (Being Assets and Liabilities Taken over at Revised Values Credited to Capital of A & B) | Dr. Dr. Dr. Dr. Dr. Dr. |

| 7,000 |

|

| 9,000 |

| |||

| 10,000 |

| |||

| 45,000 |

| |||

| 9,000 |

| |||

| 12,000 |

| |||

|

| 20,000 | |||

|

| 5,000 | |||

|

| 1,000 | |||

|

| 39,500 | |||

|

| 26,500 | |||

(2) | Bank A/c Investments A/c Debtors A/c Land A/c Goodwill A/c To Sundry Creditors A/c To C’s Capital A/c To D’s Capital A/c (Being Assets and Liabilities of the Firm C and D taken over at Revised Value) | Dr. Dr. Dr. Dr. Dr. |

| 8,000 |

|

| 7,200 |

| |||

| 8,000 |

| |||

| 80,000 |

| |||

| 12,000 |

| |||

|

| 10,000 | |||

|

| 60,600 | |||

|

| 44,600 | |||

(3) | A Current A/c B’s Current A/c To A’s Capital A/c | Dr. Dr. |

| 500 |

|

| 13,500 |

| |||

|

| 500 | |||

| To B’s Capital A/c (Being shortfall in amount of fixed capital debited to current A/cs) |

|

| 13,500 | |

(4) | C’s Capital A/c D’s Capital A/c To C’s Current A/c To D’s Current A/c (Being Amount Excess over the Fixed Capital Transferred to Respective Current A/cs) | Dr. Dr. |

| 20,600 |

|

| 4,600 |

| |||

|

| 20,600 | |||

|

| 4,600 | |||

Balance Sheet of New Firm as on 1st April 2014

Liabilities | Assets |

| ||

Sundry Creditors | 30,000 | Bank Investment Debtors Less: Provision

Machinery Premises Land Goodwill Partner’s Current A/cs: A B |

| 15,000 |

Bills Payable | 5,000 |

| 16,200 | |

Partner’s Capital A/cs: |

| 18,000 |

| |

A | 40,000 | 1,000 | 17,000 | |

B | 40,000 |

|

| |

C | 40,000 |

| 9,000 | |

D | 40,000 |

| 45,000 | |

|

|

| 80,000 | |

Partner’s Current A/c |

|

| 24,000 | |

C | 20,600 | 500 |

| |

D | 4,600 | 13,500 | 14,000 | |

| 2,20,200 |

|

| 2,20,000 |

Notes: 1. Loss on investment is to be net out of investment fluctuation fund. The remaining fund is treated as accumulated profit.

2. Since there is no sufficient bank balance in the firm C and D. Liabilities not taken over have been transferred to capital accounts. Alternatively, it can be presumed that they have brought in the required money to pay off the liabilities. Of course, the net effect would be the same.

3. Trade liabilities include liabilities on account of goods. Bank overdraft is a liability but not trade liability. Similarly, salary outstanding, loans, etc., are all liabilities but not trade liabilities.

Working Note: For adjustment of capital:

| A | B | C | D |

Opening Balance | 39,500 | 26,500 | 60,600 | 44,600 |

Surplus/Deficit | +500 | +13,500 | –20,600 | –4,600 |

Required | 40,000 | 40,000 | 40,000 | 40,000 |

Q16) J and K were in partnership sharing profits and losses in the ration of 3:2. They were dealing in retail merchandising in the trade name of J & Co. Their balance sheet as on December 31, 2014 was as follows:

Liabilities | Assets | |||

Sundry Creditors |

| 15,000 | Cash at bank | 4,000 |

Capital A/cs: |

|

| Sundry debtors | 10,000 |

J | 75,000 |

| Stock-in-trade | 16,000 |

K | 60,000 | 1,35,000 | Furniture and fixtures | 15,000 |

|

| Delivery van Godown Land and building | 25,000 5,000 75,000 | |

| 1,50,000 |

| 1,50,000 | |

M and N were in partnership in the trade name of M & Co. Sharing profit and losses in the ratio of 2:3 doing the same business as J & Co. The balance sheet of M & Co. As on December 31, 2014 was as follows:

Liabilities |

| Assets | ||

Sundry Creditors |

| 6,000 | Sundry Debtors | 8,000 |

Bank Overdraft |

| 4,000 | Stock in Trade | 18,000 |

Capital A/cs: |

|

| Furniture and Fixtures | 10,000 |

M | 40,000 |

| Delivery van | 20,000 |

N | 60,000 | 1,00,000 | Land and Building | 54,000 |

|

| 1,10,000 |

| 1,10,000 |

It was mutually agreed by both the firms to amalgamate their businesses as on January 1, 2015 in trade name of F & Co. On the following terms and conditions:

| J & Co. | M & Co. |

Stock-in-trade | 18,000 | 14,000 |

Delivery Van | 20,000 | 18,000 |

Furniture and Fixture | 12,000 | – |

Land and Building | 90,000 | – |

Goodwill | 20,000 | 15,000 |

(1) F & Co. Should take over the assets of the two firms, as detailed below:

(2) It was mutually agreed that F & Co., was not to take over the furniture and fittings and land and building of M & Co. However, these assets were sold at 72,000 in cash on January 1, 2015.

(3) K took over the possession of the godown of his firm for a consideration of 4,000.

(4) It was decided to make provision for doubtful debts at 10% on the sundry debtors and also make a provision for discount at 5% on sundry creditors of both the firms.

(5) All the partners unanimously agreed to have a new profit-loss sharing ratio as follows: J – 2: K – 1: M – 1: and N – 2.

(6) The capital of F & Co. Was fixed at 2,40,000 and the partners were required to adjust their capitals in tune with their profit-loss sharing ratio, by making necessary adjustments in cash.

You are required to:

(i) Pass journal entries for opening new books. (7 marks)

(ii) Prepare Realisation accounts of the old partnership firms.

A6) Ledger Accounts in the Books of J & Co.

Dr. Realisation A/c Cr.

Particulars |

| Amount | Particulars | Amount |

To Sundry Assets |

|

| By Sundry Creditors | 15,000 |

Sundry Debtors | 10,000 | By K’s Capital A/c (Godown) | 4,000 | |

Stock | 16,000 | By F & C. A/c (Purchase | 1,58,750 | |

|

| Consideration) |

| |

Furniture and Fixtures | 15,000 |

|

| |

Delivery Van | 25,000 |

|

| |

Godown | 5,000 |

|

| |

Land and Building | 75,000 |

|

| |

Cash | 4,000 |

|

| |

To Profit Realisation Transferred to: |

|

|

| |

J’s Capital A/c | 16,650 |

|

|

|

K’s Capital A/c | 11,100 | 27,750 |

|

|

| 1,77,750 |

| 1,77,750 |

Dr Realisation A/c Cr.

Liabilities | Assets | ||

To Sundry Assets |

| By Sundry Creditors | 6,000 |

Stock | 18,000 | By Bank Overdraft | 4,000 |

Sundry Debtors | 8,000 | By F and Co. A/c (Purchase Consideration) | 1,16,500 |

Furniture and fixture | 10,000 |

|

|

Delivery Van Land and Building To Profit on Realisation Transferred to M’s Capital A/c 6,600 N’s Capital A/c 9,900 | 20,000 54,000

16,500 |

|

|

| 1,26,500 |

| 1,26,500 |

Q17) R and S are partners of Don & Co. Sharing profits and losses in the ratio of 3:1 T and U are partners of John & Co. Sharing profits and losses in the ratio of 2:1. On 31st July 2014, they decided to amalgamate and form a new firm M/s Don & John where in R, S, T and U were to be the partners sharing profits and losses in the ratio of 4:2:3:2. Their balance sheets on that date were as under:

Liabilities | Don & Co. | John & Co. | Assets | Don & Co. | John & Co. |

Creditors | 16,000 |

| Cash | 10,000 | 5,000 |

Ram aur Shyam | 40,000 | – | Bank | 15,000 | 20,000 |

Don & Co. | – | 50,000 | Debtors: |

|

|

Others | 60,000 | 58,000 | John & Co. | 50,000 | – |

Reserves Capital | 25,000 | 50,000 | Ram aur Shyam | – | 30,000 |

R | 1,20,000 | – | Others | 80,000 | 1,00,000 |

S | 80,000 | – |

|

|

|

T | – | 1,00,000 | Stock | 60,000 | 70,000 |

U | – | 50,000 | Furniture & Office |

|

|

|

|

| Equipment | 10,000 | 3,000 |

|

|

| Vehicles | – | 80,000 |

|

|

| Plant & Machinery | 75,000 | – |

|

|

| Building | 25,000 |

|

| 3,25,000 | 3,08,000 |

| 3,25,000 | 3,08,000 |

The amalgamated firm took over the business on the following terms:

(a) Goodwill of Don & Co. Was worth 60,000; Goodwill of John & Co. Was 50,000. However goodwill account was not to be opened in the books of accounts. The adjustments for the change in the profit share are to be recorded through the capital accounts of the partners.

(b) Buildings, plant and machinery and vehicles are taken over at 50,000. 90,000 and 1,00,000 respectively.

(c) Provision for doubtful debts has to be carried forward at 4,000 in the case of Don & Co. And 5,000 in the case of John & Co.

You are asked to:

- Compute the adjustment for goodwill

2. Pass the entries in the books of Don and John assuming that excess capitals with reference to share in profits are to be transferred to loan accounts. (8 marks)

A7) Computation of Adjustment for Goodwill

| Old Share in Goodwill | New Share in Goodwill | Change | ||

| |||||

R | 3/4 of 60,000 | 45,000 | 4/11 | 40,000 | (–)5,000 |

S | 1/4 of 60,000 | 15,000 | 2/11 | 20,000 | (+)5,000 |

T | 2/3 of 50,000 | 33,333 | 3/11 | 30,000 | (-)3,333 |

U | 1/3 of 50,000 | 16,667 | 2/11 | 20,000 | (+)3,333 |

|

| 1,10,000 |

| 1,10,000 |

|

Journal Entries M/s Don and John

Date 31/7/14 | LF | Debit | Credit | |

(1) | Cash A/c Dr. Bank A/c Dr. John & Co’s A/c Dr. Debtors A/c Dr. Stock A/c Dr. Furniture and office equipment A/c Dr. Plant and machinery A/c Dr. Building A/c Dr. To Provision for doubtful debts A/c To Ram aur Shyam A/c To Creditors A/c To B capital A/c To S capital A/c (Being the assets and liabilities of Don & Co. Taken over) |

| 10,000 |

|

| 15,000 |

| ||

| 50,000 |

| ||

| 80,000 |

| ||

| 60,000 |

| ||

| 10,000 |

| ||

| 90,000 |

| ||

| 50,000 |

| ||

|

| 4,000 | ||

|

| 40,000 | ||

|

| 60,000 | ||

|

| 1,65,750 | ||

|

| 95,250 | ||

|

|

| 3,65,000 | 3,65,000 |

Note: Working to arrive at capital balance:

Particulars | |||

Balance as per balance sheet | 1,20,000 | 80,000 | |

Reserves | 18,750 | 6,250 | |

Profit on revaluation: |

|

|

|

Buildings | 25,000 | ||

Plant | 15,000 | ||

Provision for doubtful debts | 40,000 4,000 |

|

|

Revaluation Profit (3:1) | 36,000 | 27,000 | 9,000 |

| 1,65,750 | 95,250 | |

Note: Working for capitals.

Particulars | ||

Balance as per Balance Sheet Reserves Profit on Revaluation Vehicles 20,000 Less: Provision for Doubtful Debts 5,000 Revaluation Profit (2:1) 15,000 | 1,00,000 33,333

10,000 | 50,000 16,667

5,000 |

| 1,43,333 | 71,667 |

We now record adjusting entries for goodwill and writing off the inter-firm debts.

Date |

| LF | Debit | Credit |

(3) | S’s capital A/c Dr. U’s capital A/c Dr. To R’s Capital A/c To T’s Capital A/c (Being the purchase of goodwill by the former partners from the latter Partners on amalgamation of the two firms) |

| 5,000 3,333 |

5,000 3,333 |

(4) | Don & Co.’s A/c Dr. To John & Co’s A/c (Being the closure of the above 2 accounts by transferring the balances on amalgamation of the 2 firms) |

| 50,000 |

50,000 |

Working for Balance Sheet

(1) The debit balance in Ram aur Shyam’s account (vide entry No. 2 will be adjusted against the credit balance in Ram aur Shyam’s account (vide entry no. 1). Ram aur Shyam will appear as net creditor for only 10,000 ( 40,000 – 30,000)

(2) Capital balances:

Share | R 4/11 | S 2/11 | T 3/11 | U 2/11 |

Entry no. 1 2 | 1,65,750 — | 95,250 — | — 1,43,333 | — 71,667 |

3

Capitals Required on the Basis of U’s Capital which is the Lowest | (+) 5,000 1,70,750 1,36,668 | (–) 5,000 90,250 68,334 | (+) 3,333 1,46,666 1,02,501 | (–)3,333 68,334 68,334 |

Transfer to Loan | 34,082 | 21,916 | 44,165 | Nil |

Date | Particulars | LF | Debit | Credit |

(5) | B’s Capital A/c Dr. S’s Capital A/c Dr. T’s Capital A/c Dr. To R’s Loan A/c To S’s Loan A/c To T’s Loan A/c (Being Excess Capital with Reference to Share in Profits Transferred to Loan Accounts) |

| 34,082 21,916 44,165 |

34,082 21,916 44,165 |

M/s Don and John Balance Sheet as on 1st August 2014

Liabilities | Assets | |||

Ram aur Shyam |

| 10,000 | Cash | 15,000 |

Other Creditors |

| 1,18,000 | Bank | 35,000 |

Loans |

|

| Debtors 1,80,000 |

|

B | 34,082 |

| Less: Provision for Doubtful Debts 9,000 | 1,71,000 |

S | 21,916 |

|

|

|

T | 44,165 | 1,00,163 | Stock | 1,30,000 |

Capitals: |

|

| Furniture and Office Equipment | 13,000 |

B | 1,36,668 |

| Vehicles | 1,00,000 |

S | 68,334 |

| Plant and Machinery | 90,000 |

T | 1,02,501 |

| Building | 50,000 |

T | 68,334 | 3,75,837 |

|

|

| 6,04,000 |

| 6,04,000 | |

Q18) A and Co. (consisting of A and B as partners sharing profits and losses in the ratio of 2:1) and C & Co. (consisting of A and B as partners) decide to amalgamate their businesses with effect from December 31, 2014 on which date their respective Balance Sheets as under:

Liabilities |

| A & Co. | C & Co. | Assets | A & Co. | C & Co. |

Capitals |

|

|

| Goodwill | – | 12,000 |

A |

| 10,000 | 25,000 | Motor Vehicle | 10,000 | 8,000 |

B |

| 10,000 | – | Furniture | 2,000 | 5,000 |

C |

| – | 5,000 | Stock | 8,000 | 25,000 |

Investment Fluctuation |

|

|

| Debtors | 8,000 | 2,000 |

Reserves |

| – | 2,000 | Investments: |

|

|

Sundry Creditors |

| 8,000 | 15,000 | Shares in C Ltd. | – | – |

Bills Payable |

| 2,000 | 13,000 | Cash at Bank | 2,000 | 8,000 |

|

| 30,000 | 60,000 |

| 30,000 | 60,000 |

Note: (1) Included in the above Balance Sheet was an amount of 1,000 owing by A & Co. To C & Co.

On the above date the investment held by C & Co. In C Ltd. Were realized at 5,500. These had earlier been fully written off.

Goodwill of A & Co. Was to be valued at Nil.

Show journal entries in the books of the new amalgamated firm to record the opening entries and prepare the Balance Sheet of the new firm. (8 marks)

A8) Journal Entries in Books of the Amalgamated Firm

Date 31/12/14 | Particulars | LF | Debit | Credit |

| Motor Vehicles A/c Dr. Furniture A/c Dr. Stock A/c Dr. Debtors A/c Dr. Bank A/c Dr. To Bills Payable A/c To Sundry Creditors A/c (8,000–1,000) To Sundry Debtors A/c (inter firm debts) To A’s Capital A/c To B’s Capital A/c (Being the Assets and Liabilities of M/s × & Co. Taken over) |

| 10,000 |

|

2,000 |

| |||

8,000 |

| |||

8,000 |

| |||

2,000 |

| |||

| 2,000 | |||

| 7,000 | |||

| 1,000 | |||

| 10,000 | |||

| 10,000 | |||

|

Goodwill A/c Dr. Motor Vehicles A/c Dr. Furniture A/c Dr. Stock A/c Dr. Debtors A/c Dr. Debtors A/c (inter-firm debts) Dr. Bank A/c Dr. To Sundry Creditors A/c To Bills payable A/c To A’s capital A/c To C’s Capital (Being the assets and liabilities of M/s Z & Co. Taken over) | 30,000 | 30,000 | |

12,000 |

| |||

8,000 |

| |||

5,000 |

| |||

25,000 |

| |||

1,000 |

| |||

1,000 |

| |||

13,500 |

| |||

| 15,000 | |||

| 13,000 | |||

| *28,750 | |||

| *8,750 | |||

65,500 | 65,500 |

| X | Z |

Capitals as per Balance Sheet | 25,000 | 5,000 |

Investment Fluctuation Reserve | 1,000 | 1,000 |

Profit re: Z Ltd. Shares | 2,750 | 2,750 |

| 28,750 | 8,750 |

Balance Sheet of the Amalgamated Firm as on 31 st December 2014

Liabilities | Assets | |||

Capital Accounts: |

|

| Goodwill | 12,000 |

A | 38,750 |

| Furniture | 7,000 |

B | 10,000 |

| Motor Vehicles | 18,000 |

C | 8,750 | 57,500 | Stock | 33,000 |

Sundry Creditors |

| 22,000 | Debtors | 9,000 |

Bills Payable |

| 15,000 | Bank | 15,500 |

| 94,500 |

| 94,500 | |

Q19) 9: M/s. A & Co. Have A & B as partners decided to amalgamate with M/s. C & Co. Having C and D partners on the following terms and conditions:

(i) The new firm M/s. MO & Co. To consider Goodwill of both the firms at 12,000 each.

(ii) The new firm to take over investments at 10% depreciation; Debtors and Furniture at book value; Premises at 53,000; Land at 66,800; Machinery at 9,000 and such cash which remained after discharge of partners’ loans by the respective old firms before amalgamation.

(iii) The new firm also assumed other liabilities of old firms.

The following were the Balance Sheets of both the firms on the date amalgamation:

Liabilities | A & Co. | C & Co. | Particulars | A & Co. | C & Co. |

Creditors | 20,000 | 10,000 | Cash | 15,000 | 12,000 |

Bills Payable | 5,000 | – | Investments | 10,000 | 8,000 |

Loans: A | 8,000 | – | Debtors | 9,000 | 4,000 |

C | – | 10,000 | Furniture | 12,000 | 6,000 |

Reserves | 10,000 | 4,000 | Premises | 35,000 |

|

Capital A | 35,000 | – | Land | – | 50,000 |

B | 22,000 | – | Machinery | 14,000 |

|

C | – | 36,000 | Goodwill | 5,000 |

|

D | – | 20,000 |

|

|

|

| 1,00,000 | 80,000 |

| 1,00,000 | 80,000 |

Included in Debtors of A & Co. Was 3,000 receivable from X & Co. And included in creditors of C & Co. Was 5,000 payable to X & Co.

Prepare following ledger Accounts in each case:

- Realisation Account.

- Partners’ Capital Accounts.

- New Firm Account; and also prepare the Balance Sheet of the New Firm. (7 marks)

A9)

In the Books of A & Co.

Dr. Realisation A/c Cr.

Particulars | Particulars | ||

To Sundry Assets: Cash (15,000 – 8,000) 7,000 Investment 10,000 Debtors 9,000 Furniture 12,000 Premises 35,000 Machinery 14,000 Goodwill 5,000 To Profit on Realisation to: M 9,500 N 9,500 |

92,000 | By Sundry Liabilities: Creditors 20,000 Bills Payables 5,000

By MO & Co. A/c (Purchase Consideration) |

25,000

86,000 |

| 19,000 |

|

|

| 1,11,000 |

| 1,11,000 |

In the Books of C & Co.

Dr. Realisation A/c Cr.

Particulars | Particulars | ||

To Sundry Assets: |

| By Sundry Liabilities: Creditors

By MO & Co. A/c (Purchase Consideration) |

|

Cash (12000 – 10,000) 2,000 |

| 10,000 | |

Investment 8,000 |

|

| |

Debtors 4,000 |

| 88,000 | |

Furniture 6,000 |

|

| |

Land 50,000 | 70,000 |

| |

To Profit on Realisation to: |

|

| |

C 14,000 |

|

| |

D 14,000 | 28,000 |

| |

| 98,000 |

| 98,000 |

Partner’s Capital A/cs

Particulars | A | B | Particulars | A | B |

To MO & Co. A/c | 49,500 | 36,500 | By Balance b/d | 35,000 | 22,000 |

|

|

| By Reserves A/c | 5,000 | 5,000 |

|

|

| By Realisation A/c | 9,500 | 9,500 |

| 49,500 | 36,500 |

| 49,500 | 36,500 |

Dr. MO & Co. A/c Cr.

Particulars | Particulars | ||

To Realisation A/c | 86,000 | By M’s Capital A/c By N’s Capital A/c | 49,500 36,500 |

| 86,000 |

| 86,000 |

Partner’s Capital A/c

Dr Cr.

Particulars | C | D | Particulars | C | D |

To MO & Co. A/c | 52,000 | 36,000 | By Balance b/c | 36,000 | 20,000 |

|

|

| By Reserves A/c | 2,000 | 2,000 |

|

|

| By Realisation A/c | 14,000 | 14,000 |

| 52,000 | 36,000 |

| 52,000 | 36,000 |

Dr. MO & Co. A/c Cr.

Particulars | Particulars | ||

To Realisation A/c | 88,000 | By C’s Capital A/c By D’s Capital A/c | 52,000 36,000 |

| 88,000 |

| 88,000 |

MO & Co. Balance Sheet as at 31-12-2014

Liabilities | Assets | |||

Capital Accounts: |

|

| Fixed Assets: |

|

A | 49,500 | Goodwill | 24,000 | |

B | 36,500 | Land | 66,800 | |

C | 52,000 | Premises | 53,000 | |

D 36,000 | 1,74,000 | Plant and Machinery | 9,000 | |

|

| Furniture | 18,000 | |

Current Liabilities: |

| Investments | 16,200 | |

Sundry Creditors (30,000 – 3,000) | 27,000 | Current Assets: |

| |

Bills Payable | 5,000 | Debtors (13,000 – 3,000) | 10,000 | |

|

| Cash in Hand | 9,000 | |

| 2,06,000 |

| 2,06,000 | |

Note: Since X & Co. Becomes both debtor and creditors, its debits are set off against credit.

Q20) Raj and Rohan are two sole traders. Their Balance Sheets as on 1st January, 2014 are given below:

Raj’s Balance Sheet as at 1st January, 2014

Liabilities | Assets | ||

Sundry Creditors Bank Overdraft Capital Account | 10,000 5,000 15,000 | Plant and Machinery Stock in Trade Sundry Debtors | 7,500 10,000 12,500 |

| 30,000 |

| 30,000 |

Rohan’s Balance Sheet as at 1st January, 2014

Liabilities | Assets | ||

Sundry Creditors | 8,500 | Plant and Machinery | 10,500 |

Capital Account | 20,000 | Stock in Trade | 5,000 |

|

| Sundry Debtors | 11,000 |

|

| Cash at Bank | 2,000 |

| 28,500 |

| 28,500 |

They agree to amalgamate their business as on 1st January, 2014. The following revaluations were to be made:

(1) Plant and Machinery were to be reduced by 10%

(2) Stock in Trade was to be reduced in case of Raj by 20% and in case of Rohan by 10%.

(3) A reserve of 2½% is to be raised against Sundry Debtors.

(4) Each partner is to be credited with Goodwill of 5,000.

(5) The bank overdraft of Raj is to be paid off by him.

Included in debtors of Raj is 2,000 due from Rohan and the same amount is included in creditors of Rohan.

You are required to give the journal entries for recording the above transactions in the books of Raj and Rohan. Give also the amalgamated balance sheet of the New Firm as on 1st January, 2014.( 8 marks)

A10)

Journal Entries in the Books of Raj

Date 1/1/14 | Particulars | LF | Debit | Credit | |

(1) | Realisation A/c | Dr. |

| 30,000 |

|

| To Plant and Machinery A/c |

|

| 7,500 | |

| To Stock in Trade A/c To Stock in Debtors A/c (Being assets transferred to Realisation account) |

|

| 10,000 12,500 | |

(2) | Sundry Creditors A/c To Realisation A/c (Being liabilities transferred to realization account) | Dr. |

| 10,000 |

10,000 |

(3) | M/s Raj and Rohan A/c To Realisation A/c (Being purchase consideration due) | Dr. |

| 21,937 |

21,937 |

(4) | Realisation Raj To Raj Capital A/c (Being profit on realizations) | Dr. |

| 1,937 |

1,937 |

(5) | Bank Overdraft A/c To Raj Capital A/c (Being bank overdraft taken over by Raj personally) | Dr. |

| 5,000 |

5,000 |

(6) | Raj Capital A/c To M/s Raj and Rohan A/c (Being capital account settled) | Dr. |

| 21,937 |

21,937 |

Journal Entries in the Books of Rohan

Date | Particulars | LF | Debit | Credit | |

(1) | Realisation A/c To Plant and Machinery A/c To Stock in Trade A/c To Sundry Debtors A/c To Cash at Bank A/c (Being assets transferred to realizations account) | Dr. |

| 28,500 |

|

|

| 10,500 | |||

|

| 5,000 | |||

|

| 11,000 | |||

|

| 2,000 | |||

(2) | Sundry Creditors A/c To Realisation A/c (Being liabilities transferred to realizations account) | Dr. |

| 8,500 |

8,500 |

(3) | M/s Raj and Rohan A/c To Realisation A/c (Being purchase consideration due) | Dr. |

| 23,175 |

23,175 |

(4) | Realisation A/c To Rohan Capital A/c | Dr. |

| 3,175 |

|

| (Being profit on realizations) |

|

| 3,175 |

(5) | Rohan Capital A/c Dr. To M/s Raj and Rohan A/c (Being capital account settled) |

| 23,175 |

23,175 |

M/s. Raj and Rohan Balance Sheet as at 1-1-2014

Liabilities | Assets | ||||

Capital Accounts: |

|

| Fixed Assets: Goodwill Plant and Machinery Current Assets Stock Debtors Less: Provision For Bad Debts Cash at Bank |

21,500

(538) |

|

Raj | 19,987 |

| 10,000 | ||

Rohan | 25,175 |

| 16,200 | ||

|

| 45,162 |

| ||

Sundry Creditors |

| 16,500 | 12,500 | ||

|

|

|

20,962 | ||

|

|

| 2,000 | ||

| 61,662 |

| 61,662 | ||

Working Note

Particulars | Raj | Rohan |

Assets: |

|

|

Cash at Bank | – | 2,000 |

Plant and Machinery (90% of book value) | 6,750 | 9,450 |

Stock in Trade (Agreed value) | 8,000 | 4,500 |

Debtors (book value) | 10,500 | 11,000 |

Goodwill (agree value) | 5,000 | 5,000 |

| 30,250 | 31,950 |

Less: Liabilities: |

|

|

RDD (2½% of debtors) | 263 | 275 |

Creditors (book value) | 10,000 | 6,500 |

| 10,263 | 6,775 |

Purchase Consideration | 19,987 | 25,175 |