UNIT IV

Conversion / Sale of a Partnership Firm into a Ltd. Company

Question Bank

Part A

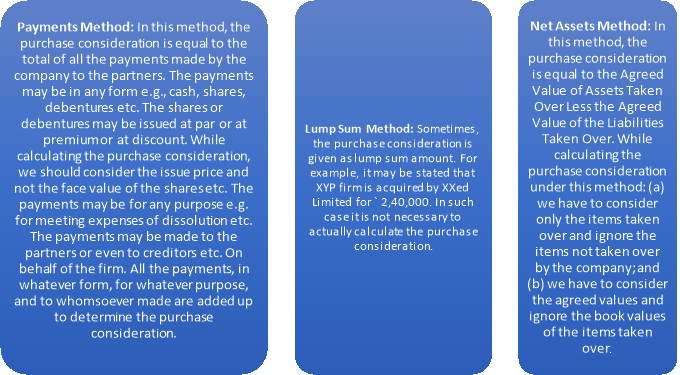

Q1) What is Purchase Consideration? Explain its methods. (5 marks)

A1) Meaning: On sale or conversion, the limited company takes over the business of the firm for an agreed price. This price is known as “purchase consideration”. It is the price paid for taking over the net assets (assets less liabilities) of the firm. The price may be settled by the company partly by paying cash and partly by allotting its shares and debentures to the partners.

Methods: The amount of purchase consideration may be determined by three methods: (1) Lump Sum Method (2) Payments Method or (3) Net assets Method:

Q2) How are shares or debentures shared among the partners?(5 marks)

A2) The division can be made in any of the following ways:

Specific Ratio: If any specific ratio is given, the shares or debentures are divided in the given ratio. If there is any specific agreement among the partners, the shares or debentures must be divided among the partners in the agreed ratio.

Equitable Approach: If it is stated that the purchase consideration should be distributed equitably (fairly): (a) equity shares should be divided among the partners in their profit-sharing ratio; and (b) preference shares and debentures should be divided among the partners in the ratio of their capitals. This is known as the equitable approach because it is fair and just to all the partners. It ensures that future profits (equity dividends) are shared in the profit-sharing ratio and a fixed return (preference dividend/debenture interest) is assured on the capitals. This method is also used when it is stated that the distribution should be in such a way that there is no effect on the partners’ rights.

Legal Approach: If no instructions are given, shares and debentures should be divided in the ratio of the partners’ capitals. This is known as the legal approach because it is in accordance with the provisions of Section 48 (b) of the Indian Partnership Act, 1932.

Note: Shares or debentures are always issued in whole numbers and not in fractions. If after distribution, a partner is entitled to get 100 and 1/2 shares, he should be given 100 shares and the value of 1/2 share should be paid in cash.

Q3) Distinguish between conversion of firm into company and sale of firm to company. ( 8 marks)

A3) Conversion: A firm may be converted by the partners into a limited company. This is done to take the following advantages: (a) a company is not affected by death or retirement of a member. (b) the liability of shareholders is limited. (c) the shares are easily transferable. (d) there is no limit on the maximum number of shareholders. (e) a limited company can raise large capital from public and carry on the business on a much larger scale. In fact, the partners themselves are the promoters of the new company. The name of the company may be similar. Thus a firm M/S Tata may become, after conversion, M/S Tata Company Limited.

Sale: In some cases the firm may be sold to an existing limited company. In case of a sale the present partners may not become directors of the company. There may be a change of management.

Chiefly with the objective of limiting the personal liabilities of the partners, an existing partnership firm may sell its entire business to an existing limited company, or may convert itself into a limited company. The former is the case of absorption of a partnership firm by the joint stock company whereas, the latter is the case of flotation of a new joint stock company so as to take over the business of the partnership firm.

In both of these cases, the existing partnership firm is dissolved and all the books of accounts are closed. Thus, when a partnership firm is sold or converted into a company, the same accounting procedure is followed as for simple dissolution of a firm.

The purchase consideration (price) in between the vendor (dissolving) firm and the purchasing company is fixed as mutually agreed upon. It may or may not be specified in a lump sum figure. When it is not specified in a lump sum figure, the difference of agreed values of acquired assets over agreed amount of liabilities are undertaken.

The purchase price is discharged by the purchasing company either in the form of cash or shares (equity or preference) or debentures or a combination of two or more of these. The shares or debentures may be issued by the purchasing company, at par, at a premium or at a discount.

In the absence of any agreement, the shares received from the purchasing company is distributed among partners in the ratio of their final claim i.e. in the ratio of their capital standing after all the adjustments.

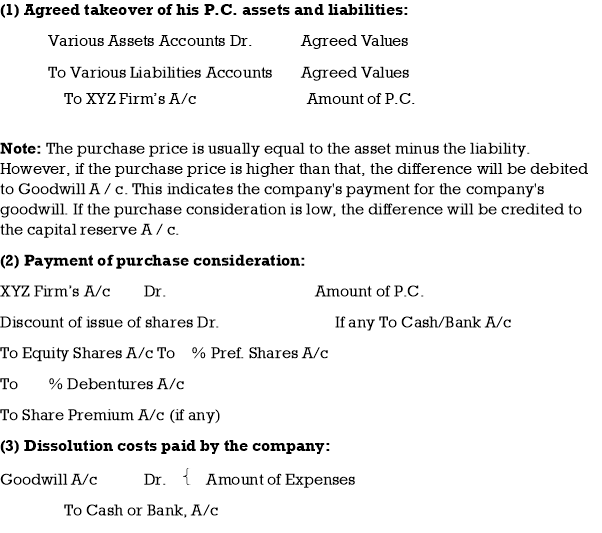

Q4) Explain the entries passed in the books of a company taking over a firm. ( 5 marks)

A4) The following entries are passed in the books of the company:

Q5) What do you mean by ‘Distribution’ of Purchase Consideration? (5 marks)

A6) First the shares or debentures received from the company are divided among the partners. Then the final balance in capital accounts is paid in cash in the end. So, there is no question of dividing the cash in any particular ratio. If the partner’s capitals are not in their profit-sharing ratio, the question arises as to how the equity shares etc. Should be divided among the partners. It is to be decided whether the shares etc. should be divided in the profit-sharing ratio or in the ratio of capitals. This decision will have effect on the future rights (equity dividends) of the partners. The division can be made in any of the following ways:

Specific Ratio: If any specific ratio is given, the shares or debentures are divided in the given ratio. If there is any specific agreement among the partners, the shares or debentures must be divided among the partners in the agreed ratio.

Equitable Approach: If it is stated that the purchase consideration should be distributed equitably (fairly): (a) equity shares should be divided among the partners in their profit-sharing ratio; and (b) preference shares and debentures should be divided among the partners in the ratio of their capitals. This is known as the equitable approach because it is fair and just to all the partners. It ensures that future profits (equity dividends) are shared in the profit-sharing ratio and a fixed return (preference dividend/debenture interest) is assured on the capitals. This method is also used when it is stated that the distribution should be in such a way that there is no effect on the partners’ rights.

Legal Approach: If no instructions are given, shares and debentures should be divided in the ratio of the partners’ capitals. This is known as the legal approach because it is in accordance with the provisions of Section 48 (b) of the Indian Partnership Act, 1932.

Note: Shares or debentures are always issued in whole numbers and not in fractions. If after distribution, a partner is entitled to get 100 and 1/2 shares, he should be given 100 shares and the value of 1/2 share should be paid in cash.

Q6) Explain the entries passes in the books of the firm on sale to company. (8 marks)

A7) The entries in the books of the firm are passed in the following manner:

Step 1: Transfer all recorded assets and liabilities(whether or not taken over by the purchasing company) to the Realization account, except cash and bank balance if not taken over by the purchasing company.

Realization A/C..................Dr.

To sundry assets

Sundry liabilities..................Dr.

To Realization A/C

Step 2: Make purchase consideration(price) due.

Purchasing company...........Dr.

To Realization A/C

Step 3: If, there remain any assets(whether or not recorded) not taken over by the purchasing company, it may be sold, or may be taken by one of the partners or may be shared among the partners.

Bank A/C..................Dr.

To realization A/C

Partner's capital A/C...............Dr.

To Realization A/C

Partners' capital A/C(capital ratio)............Dr.

To realization A/C

Note: If such unsold assets are considered worthless, they should be shared among the partners in profit sharing ratio.

Step 4: The liabilities (whether or not recorded) by the purchasing company may be discharged or may be assumed by any one of the partners, or must be shared by the partners in their capital ratio.

Realization A/C .............Dr.

To Bank A/C

If such liability assumed by one of the partners:

Realization A/C...............Dr.

To Partner's capital A/C

If such liability has to be assumed by all partners:

Realization A/C................Dr.

To Partners' capital A/C(capital ratio)

Step 5: When the realization expenses is paid, Realization account is debited.

Realization A/C.............Dr.

To Bank

Step 6: Close the realization account by transferring the balance(profit or loss) to the capital of the partners in profit sharing ratio.

Realization A/C..............Dr.

To Partners' capital A/C(profit sharing ratio)

Partners' capital A/C............Dr.

To realization A/C

Step 7: On the receipt of purchase consideration(price), cash/bank account, equity shares in purchasing company or preference shares in purchasing company at their issue prices are debited and purchasing purchasing company's account is credited.

Cash/bank A/C....................................Dr.

Equity share in purchasing Co...........Dr.

Preference share in purchasing Co....Dr.

Debentures share in purchasing Co...Dr.

To purchasing Co.

Step 8: Transfer all accumulated reserves/profits/losses to the capital accounts of partners in profit sharing ratio.

Reserve A/C.................Dr.

Profit and loss A/C.......Dr.

To partners' capital A/C

Partners' capital A/C.............Dr.

To profit and loss A/C

Step 9: Transfer the current account, if any, in the books, to the capital accounts of the partners.

Partners' current Account................Dr.

To partners' capital Account

Step 10: Pay off the partner's loan if any.

Partner's loan A/C ..............Dr.

To bank A/C

Step 11: Make final settlement by paying off balances in capital accounts. In the absence of an agreement as to the division of shares(from purchasing company) among partners, such shares are distributed in the ratio of their final claims(i.e. in the ratio of capitals after all the adjustments).

Partners' capital A/C ...........Dr.

To equity shares in purchasing Co.

To preference shares in purchasing Co.

To bank A/C

Entries in the books of purchasing company

Assets Account...........................Dr.

Goodwill Account........................Dr.

To liabilities

To share capital

To share premium

(Being assets and liabilities taken over)

Note: In case debit higher than credit, capital reserve is credited.

Q7) Write short note on Net Assets Method of Purchase Consideration. (8 marks)

A8) As per this method, the purchase consideration is calculated by finding out the difference between the assets and liabilities of the company. The sum of liabilities is deducted out of the sum of assets to find out the purchase consideration.

Under this method:

- All the assets agreed to be taken over by the transferee company includes the cash and bank balances.

- The assets like goodwill and prepaid expenses are also included in the assets to be taken over by the transferee company.

- The liabilities taken over by the transferee company includes all third party liabilities.

- The accumulated profits and reserves never form the part of the purchase consideration.

Example: X Ltd. Agrees to take over the Y Ltd. Which has following assets and liabilities:

Fixed assets: 6,50,000; Current Assets: 1,40,000; Goodwill: 10,000; Debentures: 1,00,000; Current Liabilities: 1,00,000.

As per this method, the purchase considerations will be calculated as follows:

Fixed Assets :6,50,000

Current Assets :1,40,000

Goodwill :10,000

Less: Debentures :(1,00,000)

Less: Current Liabilities :(1,00,000)

Purchase Considerations :6,00,000

On the basis of value of shares exchanged

Under this method, purchase consideration is calculated on the basis of the value of shares of the two companies involved.

Example: The Y Ltd. Has Rs. 20,000 share capital. X Ltd. Wants to take over the business of Y Ltd. By paying shares of Rs. 20 each. The purchase consideration will be calculated by calculating the number of shares to be issued.

20,000/20=1,000 shares

Q8) What does Transfer of Assets mean? (5 marks)

A9) The various asset accounts shown in the balance sheet on the date of takeover are transferred as follows:

1. All the Real Assets, whether taken over by the company or not, are transferred to the Realisation A/c. The Journal entry is:

Realisation A/c Dr. Total

To Various Assets A/cs Balance as per B/S

Notes:

(1) If the cash or bank balance is taken over by the company, it is also transferred to the Realisation A/c.

(2) If the cash or bank balance is not taken over by the company, it is not transferred to the Realisation A/c. It appears as the opening balance on the debit side of the Cash/Bank Account opened in step No. (2) above.

(3) Gross Value of Debtors is transferred to the debit of the Realisation A/c. Amount of Reserve/Provision for Doubtful Debts is transferred separately to the credit of the Realisation A/c.

(4) If Goodwill A/c appears in the balance sheet, it too is transferred along with other assets.

2. Fictitious Assets like Profit & Loss A/c (Debit) balance which indicates the accumulated losses and Deferred Revenue Expenditure not written off are transferred, not to the Realisation A/c, but to the partners’ capital accounts in their profit-sharing ratio. The Journal Entry is:

Partners’ Capital Accounts | Dr. | Profit Sharing Ratio |

To Profit & Loss A/c (Debit) |

| Balance as per B/S |

To Deferred Revenue Exp. A/c |

| Balance as per B/S |

Q9) Write short note on Liabilities in conversion. (5 marks)

A10) Liabilities Not Taken Over by Company: The liabilities not taken over by the company may be

(a) paid in cash or (b) taken over by a partner at an agreed value or (c) settled by giving an asset in exchange.

(a) Paid in Cash:

Realisation A/c Dr. Amount

Realisation A/c Dr. Amount

To Cash A/c

(b) Taken over by Partner:

Realisation A/c Dr. Agreed

Realisation A/c Dr. Agreed

To Partner’s Capital A/c

(c) Asset given Against Liability: If an asset is given in full settlement of a liability, no entry is passed. If an asset is given in part settlement of a liability, the agreed amount of asset is deducted from the liability. The balance paid in cash is accounted an in a) above.

Unrecorded Liabilities: There may be an unrecorded liability e.g. a contingent liability now becoming an actual liability, which does not appear in the balance sheet. If such unrecorded liabilities are settled (paid in cash or taken over by a partner on an asset is given in exchange) the same entries as in (9) above are passed. Thus, the amount paid or agreed value of such unrecorded liabilities is directly debited to the Realisation A/c.

Part B

Q10) Amit and Asit were in partnership sharing profit and losses: Amit two-thirds; Asit one-third. The summarized partnership balance sheet as on 31st December, 2014 was as under;

Liabilities | Assets | ||

Fixed Capital Accounts: Amit 50,000 Asit 40,000 Current Accounts: Amit 20,000 Less: Asit (Dr.) 10,000 Loan: Asit Creditors |

90,000

10,000 30,000 55,000 | Fixed Assets Current Assets Stock 35,000 Debtors 65,000 Balance at Bank 15,000 | 70,000

1,15,000 |

| 1,85,000 |

| 1,85,000 |

The fixed assets included two cars having book values of 8,000 and 6,000 respectively.

The partners desiring to retire from business, accepted the offer of Western India Limited to acquire stock and fixed assets, other than motor cars at an agreed purchase price of 1,60,000/-.

The purchase consideration was to be satisfied by a cash payment of 56,000, the allotment by the company of the partners of 400, 5% preference shares of 100 each, and the balance by the allotment by the allotment by the company to the partners of 900 equity shares of 100 each.

The Debtors realized 61,000/- and Creditors are settled for 51,000/-.

The partners agreed that the following should be the basis of distribution on dissolution of the partnership.

- Amit to take over one car at a valuation of 12,000 and Asit the other at 8,000.

- Asit to be allotted preference shares to the value of his loan, the remainder to be allotted to Amit.

- The equity shares to be allotted in proportion of fised capitals.

- Both the preference and equity shares to be valued at 80 per share.

- The balance to be settled in cash.

You are required to prepare:

(a) The realization account;

(b) The bank account; and

(c) The partners, capital accounts showing the final settlement between them. (8 marks)

A1) Calculation of Purchase Consideration

Lumpsum given = 1,60000

To be discharged as

(i) | Cash/Bank | 56,000 |

(ii) | Preference Shares (400× 80) | 32,000 |

(iii) | Equity Shares (900× 80) | 72,000 |

|

| 1,60000 |

Creditors A/c

|

| ||

To Cash/Bank To Realisation A/c. (Profit) | 51,000 4,000 | By Balance b/d | 55,000 |

| 55,000 |

| 55,000 |

Asits Loan A/c

|

| ||

To preference Share of Western India Ltd. | 30,000 | By Balance b/d | 30,000 |

| 30,000 |

| 30,000 |

Partners’ Capital A/c

| Amit | Asit |

| Amit | Asit |

To Current A/c | - | 10,000 | By Balance b/d | 50,000 | 40,000 |

To Realisation A/c. (M.Car) | 12,000 | 8,000 | By Current a/c | 20,000 | - |

To Preference share of Western |

| - | By Realisation A/c (Profit) | 50,000 | 25,000 |

India Co. | 2,000 |

|

|

|

|

To Equity Share of Western india |

|

|

|

|

|

Co. | 40,000 | 32,000 |

|

|

|

To Cash/Bank (final payment) (Bal. Fig.) |

66,000 |

15,000 |

|

|

|

| 1,20,000 | 65,000 |

| 1,20,000 | 65,000 |

Realisation A/c

|

| |||

To Fixed Assets |

| 70,000 | By Western India Ltd.(PC) | 1,60,000 |

To Stock |

| 35,000 | By Cash/Bank (D) | 61,000 |

To Debtors |

| 65,000 | By Creditors (Profit) | 4,000 |

To Net Profit transfer to |

|

| By Amit’s A/c. | 12,000 |

Amit | 50,000 |

| By Asits A/c. | 8,000 |

Asit | 25,000 | 75,000 |

|

|

| 2,45,000 |

| 2,45,000 | |

Cash/Bank A/c

|

| ||

To Balance b/d | 15,000 | By Creditors | 51,000 |

To Western India Ltd | 56,000 | By Amit’s Capita A/c | 66,000 |

To Realisation (Debtors) | 61,000 | By Ashits Capital A/c | 15,000 |

| 1,32,000 |

| 1,32,000 |

Western India Ltd. A/c

|

| ||

To Realisation A/c. | 1,60,000 | By Equity Share of W.I.Ltd | 72,000 |

|

| By Preference Share of Western India Ltd. | 32,000 |

|

| By Cash/bank | 56,000 |

| 1,60,000 |

| 1,60,000 |

Equity Share of Purchasing Co.A/c

|

| ||

To Western India Ltd. | 72,000 | By Amits Capital By Asits Capital (5:4) | 40,000 32,000 |

| 72,000 |

| 72,000 |

Preference Share of Purchasing Co, A/c

|

| ||

To Western India Ltd. | 32,000 | By Asits loan By Amit’s Capital (Bal.fig.) | 30,000 2,000 |

| 32,000 |

| 32,000 |

Q11) Ram and Sham sharing profits equally wanted to convert their partnership into limited company. Their Balance Sheet on 31st Dec., 1914 was as under:

Liabilities | Assets | ||

Sundry Creditors | 27,000 | Sundry debtors | 50,000 |

Loan | 25,000 | Bill’s receivable | 7,000 |

Bank overdraft | 10,000 | Stock in trade | 20,000 |

Reserve | 15,000 | Patents | 5,000 |

Ram’s Capital | 25,000 | Plant and Machinery | 10,000 |

Sham’s Capita | 25,000 | Land and Building | 35,000 |

| 1,27,000 |

| 1,27,000 |

(a) The goodwill of the firm was to be valued on the basis of twice the average profits calculated on the prevous three years’ profits which were in 2012 20,000, in 2013 23,000 and in 2014

26,000 after setting aside 5,000 to reserve each year and charging 1,500, 1,800 and

2,100 respectively in respect of income tax.

(b) The land and buildings and plant & machinery, were taken over at a revaluation of 75,000/- and

15,000 respectively.

(c) 10% Debentures of 1,00,000 were issued at a discount of 5%.

(d) Partners were issued 15,000 equity shares of 10 each towards purchase consideration and paid cash for the balance. Shares are to be distributed in the profit-sharing ratio.

(e) The purchasing company immediately pays off sundry creditors, and bank overdraft and issues 10% preference shares of 100 each to loan creditor for 25,000.

You are required to give:

- The statement showing how the purchase consideration was arrived at.

- The realization Account, and partner’s capital accounts.

Opening Balance Sheet of the new company.

A2) Calculation of Purchase Consideration (Net Assets Method)

Revised value of assets taken over:

Goodwill | 59,600 |

| ||

Land & Building | 75,00 |

| ||

Plant & Machinery | 15,000 |

| ||

Debtors | 50,000 |

| ||

Bills Receivable | 7,000 |

| ||

Stock | 20,000 |

| ||

Patents | 5,000 | 2,31,600 | ||

Less: Revised value of Liabilities | ||||

Creditors | 27,000 |

| ||

Loans | 25,000 |

| ||

Bank overdraft | 10,000 | 62,000 | ||

Net Assets/PC |

| 1,69,600 | ||

To be discharged as | ||||

(i) Equity Shares (15,000×10) |

| 1,50,000 | ||

(ii) Cash/Bank (Bal fig) |

| 19,600 | ||

|

| 1,69,600 | ||

Partner’s Capital A/c’s

| R | S |

| R | S |

To Equity Share of purchasing co. | 75,000 9,800 | 75,000 9,800 | By Balance b/d By Reserve (1:1) | 25,000 7,500 | 25,000 7,500 |

To Cash/Bank |

|

| By Realisation A/c. | 52,300 | 52,300 |

| 84,800 | 84,800 |

| 84,800 | 84,800 |

Realisation A/c

|

| ||

To Sundry Assets To Net Profit transfer to (1:1) R 52,300 S 52,300 | 1,27,000

1,04,600 | By Creditor By Loans By Bank O/D By Purchasing Co. ) (P.C.) | 27,000 25,000 10,000 1,69,600 |

| 2,31,600 |

| 2,31,600 |

Calculation of Goodwill

Year | Net Profit |

|

2012 | 26,500 (20,000+5,000+1,500) | Average 89,400 29,800 3 |

2013 | 29,800 (23,000+5,000+1,800) |

|

2014 | 33,100 (26,000+5,000+2,100) | Goodwill = 29,800 × 2 = 59,600 |

| 89,400 | 59,600 |

In the Books of Purchasing Co.

Particulars |

| Debit | Credit | ||

(i) | For Purchase of Business Business purchase A/c..... To Ram & Sham A/c. For Assets & Liabilities taken over Goodwill A/c...... Land & Building A/c..... Plant & Machinery A/c.. Debtors A/c..... Bills Receivable A/c..... Stock A/c..... Patents A/c..... To Creditors A/c To Loans A/c To Bank O/D A/c To Business Purchase A/c. For Discharge of P/C. Ram & Sham A/c..... To Equity Share Capital A/c. To Cash/Bank A/c For Issue of Debentures Cash/Bank/A/c..... Discount on Issue A/c..... To 10% Debenture A/c. For Payment to Creditors & Bank O/D Creditors A/c..... Bank O/D A/c..... To Cash/Bank A/c. For discharge of Loan creditor Loan Creditor, A/c..... To 10% Preference Share Capital A/c. |

|

|

|

|

| Dr | 1,69,600 |

| ||

|

|

| 1,69,600 | ||

(ii) |

|

|

| ||

| Dr | 59,600 |

| ||

| Dr | 75,000 |

| ||

| Dr | 15,000 |

| ||

| Dr | 50,000 |

| ||

| Dr | 7,000 |

| ||

| Dr | 20,000 |

| ||

| Dr | 5,000 |

| ||

|

|

| 27,000 | ||

|

|

| 25,000 | ||

|

|

| 10,000 | ||

|

|

| 1,69,600 | ||

(iii) |

|

|

| ||

| Dr. | 1,69,600 |

| ||

|

|

| 1,50,000 | ||

|

|

| 19,600 | ||

(iv) |

|

|

| ||

| Dr. | 95,000 |

| ||

| Dr. | 5,000 |

| ||

|

|

| 1,00,000 | ||

(v) |

|

|

| ||

| Dr. | 27,000 |

| ||

| Dr. | 10,000 |

| ||

|

|

| 37,000 | ||

(vi) |

|

|

| ||

| Dr. | 25,000 |

| ||

|

|

| 25,000 | ||

Balance Sheet as on...

| Particulars | |||

I | Equity and Liabilities

(a) Share Capital Equity Share Capital 10% Preference Share Capital (b) Reserves & Surplus 2. Non-current Liabilities (a) Secured Loan: 10% Debentures 3. Current Liabilities

Assets

(a) Fixed Assets |

|

1,50,000 25,000 Nil |

|

|

|

1,75,000 | ||

|

|

|

1,00,000 Nil | |

| Total | 2,75,000 | ||

II |

|

| ||

| (i) Tangible: Land $ Building Plant & Machinery (ii) Intangible: Goodwill Patents (b) Non-current Investments (c) Other Non-current Assets: Discount on Debentures 2. Current Assets (a) Inventory (b) Trade Receivables: Debtors Bills Receivable (c) Cash & Cash Equivalents (95,000 – 19,600 – 37,000) (d) Other Current Assets |

Total | 75,000 |

|

15,000 |

| |||

59,600 |

| |||

5,000 |

| |||

Nil |

| |||

5,000 | 1,59,600 | |||

20,000 |

| |||

50,000 |

| |||

7,000 |

| |||

38,400 |

| |||

Nil | 1,15,400 | |||

| 2,75,000 |

Q12) Amar, Akbar and Anthony carry on business in partnership under the style of M/s. ‘A’ & Co. Sharing profits and losses in the ratio of 5:3:2. They have floated ‘A’ Pvt. Ltd. For the purpose of take over of their business. The following is the Balance sheet of the firm as on 30th September, 2014.

M/s. A & Co. Balance Sheet as on 30.9.1983

|

| ||||

Creditors |

| 50,000 | Cash |

| 6,000 |

Capitals: |

|

| Bank |

| 14,000 |

Amar | 1,01,000 |

| Debtors | 60,000 |

|

Akbar | 1,51,000 |

| Less: Provision for doubtful debts | 2,000 | 58,000 |

Anthony | 1,33,000 | 3,85,000 | Stock |

| 42,000 |

|

|

| Fixed Assets |

|

|

|

|

| Written down value |

| 3,00,000 |

|

|

| Expenditure in relation to |

|

|

|

|

| ‘A’ Pvt. Ltd.: |

|

|

|

|

| Formation exp. | 12,000 |

|

|

|

| Bank A/c. In opened in |

|

|

|

|

| The name of ‘A’ Pvt. Ltd. |

|

|

|

|

| Representing deposit of |

|

|

|

|

| Par value of 300 equity |

|

|

|

|

| Shares of 10 each |

|

|

|

|

| Subscribed equallay by |

|

|

|

|

| Amar, Akbar and |

|

|

|

|

| Anthony as subscribers |

|

|

|

|

| To the MoA & AoA | 3,000 | 15,000 |

| 4,35,000 |

| 4,35,000 | ||

On that day ‘A’ Pvt. Ltd. Took over the business for a total consideration of 5,00,000. The purchase consideration was to be discharged by the allotment of equity shares of 10 each at par in the profit sharing ration and 15% debentures of 100/- each at par for surplus capital.

The directors of ‘A’ Pvt. Ltd. Revalued the fixed assets of ‘A’ Co. At 4,00,000. You are asked to

(a) State the number of equity shares & debentures allotted by ‘A’ Pvt. Ltd. To Amar, Akbar and Anthony by showing your workings.

(b) Show journal entries in connection with the above transactions in the book of ‘A’ Pvt. Ltd. (8 marks)

A3) Partners’ Capital A/c

To Equity Share of A Ltd. (Purchasing Co.) | 1,000 | 1,000 | 1,000 | By Balance b/d By Realisation A/c. | 1,01,000 59,000 | 1,51,000 35,400 | 1,33,000 23,600 |

To Deb. Of Purchase Co. To Eq. Share of purchase of | -- 1,59,000 | 90,000 95,400 | 92,000 63,6000 | (Net Profit) |

|

|

|

| 1,60,000 | 1,84,400 | 1,56,6000 |

| 1,60,000 | 1,86,400 | 1,56,600 |

Realisation A/c

|

| ||

To Cash | 6,000 | By Creditors | 50,000 |

To Bank | 14,000 | By R.B.D | 2,000 |

To Debtors | 60,000 | By Purchasing Co. (P.C) | 5,00,000 |

To stock | 42,000 |

|

|

To Fixed Assets | 3,00,000 |

|

|

To Preliminary Expenses of A of ‘A’ Ltd. |

|

|

|

To Net Profit transfer to (5:3:2) | 12,000 |

|

|

Amar 59,000 |

|

|

|

Akbar 35,400 |

|

|

|

Anthony 23,600 | 1,18,000 |

|

|

| 5,52,000 |

| 5,52,000 |

Purchasing Co. A/c

|

| ||

To Realisation A/c. (P.C) | 5,00,000 | By Debenture of Purchasing co. By Equity Share of Purchasing Company | 1,82,000 3,18,000 |

| 5,00,000 |

| 5,00,000 |

Equity Share of Purchasing Co A/c

|

| ||

To Purchasing Co. | 3,18,000 | By Amar’s Capital A/c. | 1,59,000 |

|

| By Akbar’s Capital A/c. | 95,400 |

|

| By Anthony’s Capital A/c. | 63,600 |

| 3,18,000 |

| 3,18,000 |

15% Debenture of Purchasing Co. A/c

|

| ||

To Purchasing Co. | 1,82,000 | By Akbar’s Capital A/c By Anthony’s Capital A/c | 90,000 92,000 |

| 1,82,000 |

| 1,82,000 |

Working Note:

Statement of Surplus Capital

| 5 | 3 | 2 |

Amar (1,60,000 – 1,0000) | Akbar (1,86,400 – 1,000) | Anthony (1,56,600 – 1,000) | |

Final Balance | 1,59,000 | 1,85,400 | 1,55,600 |

Capital in profit sharing ratio taking Amar’s Capital as base | 1,59,000 | 95,400 | 63,600 |

Excess Capital | — | 90,000 | 92,000 |

To be discharged as debentures | |||

5 : 1,59,000 |

|

|

|

3 : (?)= 95,400 |

|

|

|

5 : 1,59,000 |

|

|

|

2 : (?) = 63,600 | 1,59,000  5 | 1,85,400  3 | 1,55,600  2 |

One Share | 31,800 | 61,800 | 77,800 |

In the Books of M/s A & Co.

Particulars |

| Debit | Credit | ||

(i) | For Purchase of Business Purchase A/c.... To M/s A & Co. For Assets & Liabilities taken over Fixed Assets A/c..... Cash A/c..... Bank A/c. Debtors A/c Stock A/c. Preliminary Expenses A/c..... Goodwill A/c..... To R.B.D A/c. To Creditors A/c. To Business Purchase A/c For Discharge of P.C M/s A & Co. A/c..... To Equity Share A/c. To 15% Debenture A/c. For issue of Shares for subscriber of MoA & AoA Cash/Bank/A/c..... To Equity Share Capital A/c. |

|

|

|

|

| Dr | 5,00,000 |

| ||

|

|

| 5,00,000 | ||

(ii) |

|

|

| ||

| Dr | 4,00,000 |

| ||

| Dr | 6,000 |

| ||

| Dr | 14,000 |

| ||

| Dr | 60,000 |

| ||

| Dr | 42,000 |

| ||

| Dr | 12,000 |

| ||

| Dr | 18,000 |

| ||

|

|

| 2,000 | ||

|

|

| 50,000 | ||

|

|

| 5,00,000 | ||

(iii) |

|

|

| ||

| Dr | 5,00,000 |

| ||

|

|

| 3,18,00 | ||

|

|

| 1,80,000 | ||

(iv) |

|

|

| ||

| Dr | 3,000 |

| ||

|

|

| 3,000 | ||

Q13) John, James and Jack are partners of Jill and Co. Sharing profits and losses in the ration of 2:2:1. On 30th June 2014, their Balance sheet was as under:

|

| |||

Creditors |

| 60,000 | Building | 25,000 |

Capitals |

|

| Machinery | 30,000 |

John | 1,10,000 |

| Stock | 1,00,000 |

James 90,000 Jack 50,000 |

2,50,000 | Debtors Bank | 1,50,000 5,000 | |

| 3,10,000 |

| 3,10,000 | |

On that day they floated Jill & Co. Pvt. Ltd. Which took over the working capital at 2,00,000 and the goodwill of the firm at 50,000. It discharged the purchase consideration in the form of 9% debentures in respect of ultimate surplus capital, 10% redeemable preference shares in respect of the balance of initial surplus capital and equity shares for the balance, all issued at par. John took over the building at an agreed valuation of 40,000. James took over the machinery at an agreed valuation of 50,000. Jill & Co. (P) Ltd. Agreed to pay monthly rent of 40,000. James took over the machinery at an agreed valuation of 50,000. Jill & Co. (P) Ltd. Agreed to pay monthly rent of 1,000 to John for the occupation of the building and monthly compensation of 2,000 to James for the use of machinery.

The formation expenses of Jill & Co. Pvt. Ltd. Amounted to 6,000 which were agreed to be paid by the new company to Jack, the partner who was in charge of promotion, by 30th September, 2014.

You are required to:

(a) Close the books of partnership;

(b) Prepare a statement showing the allotment of various types of capital amongst the partner;

(c) Pass the opening journal entries in the books of Jill & Co. Pvt. Ltd. As on 1.7.2014. (8 marks)

A4) Calculation of Purchase Consideration (Net Assets Method)

Revised Value of Assets Taken Over

Working Capital | 2,00,000 |

Goodwill | 50,000 |

Net Assets/P.C | 2,50,000 |

To be Discharged as |

|

(i) Equity Shares | 1,90,000 |

(ii) Preference Shares | 45,000 |

(iii) 9% Debentures | 15,000 |

| 2,50000 |

In the Books of Jill & Co. Pvt. Ltd.

Particulars |

| Debit | Credit | ||

(i) | For Purchase of Business Purchase A/c..... To John James & Jack A/c. For Assets & Liabilities taken over Working Capital A/c...... Goodwill A/c..... To Business purchase A/c. For Discharge of P.C. John, James & Jack A/c...... To Equity Shares A/c. To Preference Shares A/c. To 9% Debentures A/c. For Preliminary Expenses A/c... To Mr. Jack A/c. |

|

|

|

|

| Dr | 2,50,000 |

| ||

|

|

| 2,50,000 | ||

(ii) |

|

|

| ||

| Dr. | 2,00,000 |

| ||

| Dr. | 50,000 |

| ||

|

|

| 2,50,000 | ||

(iii) |

|

|

| ||

| Dr. | 2,50,000 |

| ||

|

|

| 1,90,000 | ||

|

|

| 45,000 | ||

|

|

| 15,000 | ||

(iv) | Dr. | 6,000 |

| ||

|

|

| 6,000 | ||

Working Notes: Statement of Excess Capital

| 2 | 2 | 1 |

| John | James | Jack |

Final Balance | 1,06,000 | 76,000 | 68,000 |

Adjustment of partners capital in P S R taking James Capital as base (2:2:1) | 76,000 | 76,000 | 38,000 (2:2:1) |

Excess capital | 30,000 | -- | 30,000 |

Taking John’s Capital as abse. Extra Excess Capital 15,000 in 9% Debenture to Jack 45,000 in 10% preference share to John & Jack (30,000+15,000) 1,90,000 in Equity Share in 2:2:1 | 30,000 -- | -- -- | 15,000 15,000 |

One share | 106,000 | 76,000 | 68,000 |

|  2 |  2 |  1 |

| = 53,000 | 38,000 | 68,000 |

| 30,000 | 30,000 |

|

|  2 |  1 |

|

| 15,000 | 30,000 |

|

Partners’ Capital A/c’s

| John | James | Jack |

| John | James | Jack |

To Realisation A/c. (Building) |

40,000 |

– |

– | By Balance b/d |

1,10,000 |

90,000 |

50,000 |

To Realisation A/c |

|

|

| By Realisation A/c |

|

|

|

(Machinery) | – | 50,000 |

| (Net profit) | 36,000 | 36,000 |

|

To 9% Debentures of |

|

|

|

|

|

|

|

Purchase Co. |

|

| 15,000 |

|

|

|

|

To 10% Preference Share of Pur. Co. |

30,000 |

– |

15,000 |

|

|

|

|

To Equity Share of |

|

|

|

|

|

|

|

Purchase Co. | 76,000 | 76,000 | 38,000 |

|

|

|

|

| 1,46,000 | 1,26,000 | 68,000 |

| 1,46,000 | 1,26,000 | 68,000 |

Realisation A/c

|

| ||

To Building | 25,000 | By Creditors | 60,000 |

To Machinery | 30,000 | By Purchasing Co. (PC) | 2,50,.000 |

To Stock | 1,00,000 | By John’s Capital A/c. (Building) | 40,000 |

To Debtors | 1,50,000 | By James Capital A/c. (Machinery) | 50,000 |

To Bank | 5,000 |

|

|

To Net Profit transfer to |

|

|

|

John 36,000 |

|

|

|

James 36,000 |

|

|

|

Jack (2:2:1) 18,000 | 90,000 |

|

|

| 4,00,000 |

| 4,00,000 |

Purchasing Co. Ac

|

| ||

To Realisation | 2,50,000 | By 9% Debentures of purchase co. | 15,000 |

|

| By 10% Pref. Shares of Purchase Co. | 45,000 |

|

| By Equity Shares of purchasing co. | 1,90,000 |

| 2,50,000 |

| 2,50,000 |

Q14) M, B and G were in partnership sharing profits and losses equally. Their balance sheet on 31st Dec., 2014 was as follows:

Liabilities | Assets | |||

Bills payable |

| 12,075 | Goodwill | 5,000 |

Creditors |

| 20,625 | Machinery | 22,500 |

Capital Accounts: |

|

| Furniture | 2,625 |

M | 28,125 |

| Investments | 1,500 |

B | 9,375 |

| Stock | 17,550 |

G | 3,750 | 41,250 | Debtors | 22,625 |

|

|

| Cash | 2,150 |

| 73,950 |

| 73,950 | |

They decided to sell their business to MBG Ltd. As G who was the working partner, was found to be mismanaging the affairs of the firm. A sum of 5,000 reveived from the firm’s debtors was not credited to their accounts but was misapropriated by him. Stocks were overstated by 3,750.

Repairs to machinery amounting to 3,000 had been wrongly capitalised, during 2012 the rate of 10% of the diminishing balance.

MBG Ltd. Acquired all the partnership assets except the investments, which B agreed to take at

1,250. For the purpose of sale, the assets were valued as follows:

Goodwill 1,250, Furniture 1,625, Stock 12,500 Machinery at book value Debtors at book value less 5% M agreed to discharge the creditors. For the purpose of paying the bills payable, M and B introduced cash in their profit-sharing proportion.

G being insolvent, is unable to meet an deficiency that may arise.

The purchase consideration was settled by the allotment at a premium of 10 per share, of sufficient fully paid equity shares of Face value of 100 each in MBG Ltd., B agreed to take 200 shares and the balance was to be given to M.

Prepare necessary ledger accounts in the books of Partnership Firm.

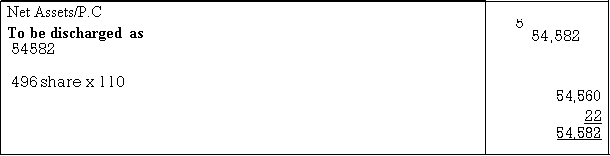

A5) Calculation of P.C.

(Net assets method) Revised Value of Assets

Goodwill |

| 1,250 |

Furniture |

| 1,625 |

Stock |

| 12,500 |

Machinery (22,500-2,187) |

| 20,313 |

Debtors (22,625 - 5,000 = 17,625- 5%) |

|

|

Bad Debts@ 5% | 17,625 |

|

| (–) 881 | 16,744 |

Cash |

| 2,150 |

|

| 54,582 |

Less: Liabilities at revised value |

| Nil |

Partners’ Capital A/c.

Partners’ Capital A/c.

| M | B | G |

| M | B | G |

To Profit/Loss Adj. | 1979 | 1979 | 1979 | By Balance b/d | 28,125 | 9,375 | 3,750 |

To Drs. | - | - | 5,000 |

|

|

|

|

To Balance c/d | 26,146 | 7,396 | - | By Balance b/d | - | - | 3,229 |

| 28,125 | 9,375 | 6,979 |

| 28,125 | 9,375 | 6,979 |

| M | B | G |

| M | B | G |

To Balance b/d | - | - | 3229 | By Balance b/d | 26,146 | 7,396 | - |

To Equity Share | 32,560 | 22,000 | - | By Creditors | 20625 | - | - |

To Real (Invt.) | - | 1,250 | - | By Cash/Bank (B/P) | 6,037 | 6,038 | - |

To Real A/c (Loss) | 2,394 | 2,394 | 2,393 | By Cash/Bk. (Real Loss) | 2,394 | 2,394 | - |

To G’s Cap, (Capital Ad.) | 4,382 | 1,240 | - | By M & B’s Capital | - | - | 5,622 |

To Cash/Bank (final pay) | 15,866 | - | - | By Cash/Bank | - | 11,056 | - |

| 55,202 | 26,884 | 5,622 |

| 55,202 | 26,884 | 5,622 |

Profit/Loss Adj. A/c.

|

| ||

To Stock To Machinery | 3,750 2,187 | By Loss Transfer to M 1,979 B 1,979 G (1:1:1) 1,979 |

5,937 |

| 5,937 |

| 5,937 |

Journal Entries for Rectification

| Particulars |

| Debit | Credit |

(1) | G’s A/c..... Dr. To Debtors A/c Profit/Loss A/c... Dr. To Stock A/c. Machinery (cost) 3,000 2012 (-) 10% Depreciation 2012 300 WDV 31/12/2012 2,700 (-) 10% Depreciation 2013 270 WDV 31/12/2013 2,430 (-) 10% Depreciation 2014 243 WDV 31/12/2014 2,187 (Balance to Today) (To be removed from Machinery A/c.) Profit/Loss (ADJ.) A/c...... Dr. To Machinery a/c. |

| 5,000 |

|

|

| 5,000 | ||

(2) | 3,750 |

| ||

|

| 3,750 | ||

(3) |

|

| ||

(4) |

2,187 |

| ||

|

| 2,187 |

Realisation A/c

|

| |||

To Sunday Assets |

| By Purchasing Co. (PC) |

| 54,582 |

Cash/Bank | 2,150 | By B’s Capital (Inv.) |

| 1,250 |

Goodwill | 5,000 | By Loss transfer to |

|

|

Machinery (22,500 – 2,187) | 20,313 | M | 2,394 |

|

Furniture | 2,625 | B | 2,394 |

|

Investments | 1,500 | G (1:1:1) | 2,393 | 7,181 |

Stock (17,550 – 3,750) | 13,800 |

|

|

|

Debtors (22,625 – 5,000) | 17,625 |

|

|

|

| 63,013 |

| 63,013 | |

Creditors A/c.

|

| ||

To M’s Capital | 20,625 | By Balance b/d | 20,625 |

| 20,625 |

| 20,625 |

Bills Payable A/c.

|

| ||

To Cash/Bank | 12,075 | By Balance b/d | 12,075 |

| 12,075 |

| 12,075 |

Cash/Bank A/c.

|

| ||

To purchasing Co. | 22 | By Bills Payable | 12,0758 |

To M’s Capital | 6.037 | By M’s Capital | 15,866 |

To B’s Capital | 6,038 |

|

|

To M’s Capital | 2,394 |

|

|

To B’s Capital | 2,394 |

|

|

To B’s Capital | 11,056 |

|

|

| 27,941 |

| 27,941 |

Purchasing Co.

|

| ||

To Realisation | 54,582 | By Equity Share By Cash | 54,560 22 |

| 54,582 |

| 54,582 |

Equity Share of P. Co.

|

| ||

To Purchasing Co. | 54,560 | By B’s Capital (200×110) By M’s Capital (296×110) | 22,000 32,560 |

| 54,560 |

| 54,560 |

|

|

|

|

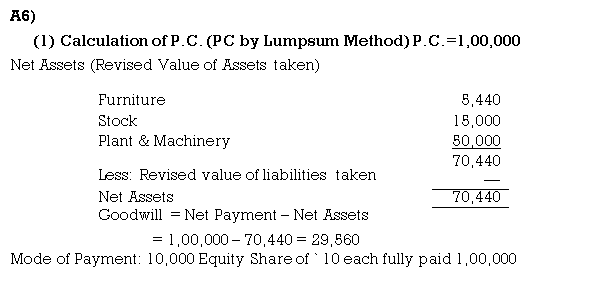

Liabilities | Assets | ||

Sundry Creditors | 20,000 | Cash in hand | 4,560 |

M/s Capital A/c. | 40,000 | Furniture | 5,440 |

N’s Capital A/C. | 30,000 | Sundry Debtors | 25,000 |

O’s Capital A/c. | 10,000 | Stock | 15,000 |

|

| Plant and Machinery | 50,000 |

| 1,00,000 |

| 1,00,000 |

Particulars |

| Debit | Credit | |||

(1) | For Business Purchase Business Purchase A/c..... To M.N & O A/c (vendor firm) |

Dr. |

|

1,00,000 |

1,00,000 | |

(2) | For Net Assets Taken over |

|

|

|

| |

| Furniture A/c..... | Dr. | 5,440 | |||

| Stock A/c..... | Dr. | 15,000 | |||

| Plant & Machinery A/c..... | Dr. | 50,000 | |||

| Goodwill A/c..... | Dr. | 29,560 | |||

| To Business Purchase A/c. |

|

| 1,00,000 | ||

(3) | For Net Payments Made M,N & O A/c.... Dr. To Equity Share Capital A/c. For Commission Adjusted out of net collection & balance cash paid Cash A/c..... Dr. To Vendor Suspense A/c. (Collection from Debtors) Vendor Suspense A/c.... Dr. To Cash A/c. (Payment to Creditors) Vendor suspense A/c..... Dr. To Commission A/c. (3% on 23,000+2% on 18,500) (690+370 = 1,060) Vendor Suspense A/c..... Dr. To Cash A/c. |

|

|

| ||

| 1,00,000 |

| ||||

|

| 1,00,000 | ||||

(4) |

|

| ||||

| 23,000 |

| ||||

|

| 23,000 | ||||

| 18,500 |

| ||||

|

| 18,500 | ||||

| 1,060 |

| ||||

|

| 1,060 | ||||

|

3,440 |

| ||||

|

| 3,440 | ||||

Q15) Asha and Bina are in partnership and share profits losses in equal proportion. On 30th September, 2014, they sold their assets to Ashawadi Ltd.

Balance Sheet as on 30.9.14 Stood as Under

Liabilities | Assets | |||

Creditors |

| 49,000 | Sundry Assets | 1,63,500 |

Capital |

|

| Cash in hand | 4,700 |

Asha | 47,800 |

|

|

|

Bina | 50,400 | 98,200 |

|

|

Loan from Sagar |

| 21,000 |

|

|

| 1,68,200 |

| 1,68,200 | |

The buyer, Ashwadi Ltd. Agree as follows:

(i) To pay 1,59,300 for sundry assets and 30,000 as goodwill.

(ii) To deposit 50,000 immediately to enable payments to creditors and the balance on completion of all formalities on 31.12.14. They agree to pay interest at 5% p.a. On the balance of purchase price.

Asha and Bina are to be allowed interest at 10% p.a. On their opening capital. Sagar loan account is to be credited with interest at 12% p.a.

Show necessary ledger accounts in the books of vendors, ignore fractions. (8 marks)

A7)

(1) Calculation of P.C. (Net Assets Method) Revised value of Assets taken Sundry Assets 1,59,300

Goodwill 30,000

Less: Revised value of Liab. Taken P.C. 1,89,300

Realisation A/c

|

| ||

To Sundry Assets | 1,63,500 | By Creditors | 49,000 |

To Cash/Bank (Creditors Paid) | 49,000 | By Ashawadi Ltd. (P.C.) | 1,89,300 |

To Interest |

| By Ashawadi Ltd. (Interest on PC) | 1,741 |

Asha’s Capital 1,195 Bina’s Capital 1,260 Sagar’s Loan 630 To Profit transfer to capital Asha 12,228 Bina 12,228 |

3,085

24,456 |

(1,39,300×5/100×3/12) |

|

| 2,40,041 |

| 2,40,041 |

Partner’s Capital A/c

Particulars | Asha | Bina | Particulars | Asha | Bina |

To Cash/Bank | 61,223 | 63,888 | By Balance | 47,800 | 50,400 |

|

|

| By Realisation (Interest) | 1,195 | 1,260 |

|

|

| By Realisation (Profit) | 12,228 | 12,228 |

| 61,223 | 63,888 |

| 61,223 | 63,888 |

Sagar’s Loan A/c

|

| ||

To Cash/Bank | 21,630 | By Balance By Realisation (Interest) | 21,000 630 |

| 21,630 |

| 21,630 |

Ashawadi Ltd.

|

| ||

To Realisation A/c. (PC) To Realisation A/c. (Interest on P.C.) | 1,89,300 1,741 | By Cash/Bank A/c By Cash/Bank A/c | 50,000 1,41,041 |

| 1,91,041 |

| 1,91,041 |

Cash/Bank A/c

|

| ||

To Balance b/f | 4,700 | By Realisation A/c. | 49,000 |

To Ashawadi Ltd A/c. | 50,000 | By Sagar’s Loan A/c. | 21,630 |

To Ashawadi Ltd A/c. | 1,41,041 | By Asha’s Capital a/c | 61,223 |

|

| By Bina Capital A/c. | 63,888 |

| 1,95,741 |

| 1,95,741 |

Q16) A and B were equal partners in a firm. Their Balance Sheet as on 31st December, 2014 was as under:

Liabilities | Assets | |||

Sundry Creditors | 25,000 | Cash |

| 7,000 |

Loan on Mortgage | 10,000 | Sundry Debtors | 16,000 |

|

Capital Accounts |

| Less:R.D.D | 1,000 | 15,000 |

A |

| Stock |

| 18,000 |

B | 55,000 | Furniture |

| 6,000 |

| 20,000 | Buildings |

| 64,000 |

| 1,10,000 |

| 1,10,000 | |

On the above date, A.B. Ltd. Took over the business of the firm. The company agreed

- To take over Sundry Debtors at 14,000; Stock at 22,000; Furniture at 4,000; Buildings at

70,000 and Goodwill at 22,000.

2. To take over Sundry Creditors from whom a discount of 29i,000 would be earned.

3. To take over Mortgage Loan with outstanding but unrecorded interest of 1,000.

4. To pay the expenses of realisatim which amounted to 2,000.

5. To pay the purchase price of Buildings in its shares of 100 each and the balance of purchase consideration in cash. The partners agreed to divide the shares as A3/5 and B 2/5. Show the Ledger Accounts to close the books. (8 marks)

A8) Calculation of P.C.

Net Assets Method |

|

|

Assets taken over at revised values |

|

|

Sundry Debtors | 14,000 |

|

Stock | 22,000 |

|

Furniture | 4,000 |

|

Buildings | 70,000 |

|

Goodwill | 22,000 | 132,000 |

Less: Liabilities taken over at revised values |

|

|

Sundry Creditors | 23,000 |

|

Mortgage loan | 11,000 | 34,000 |

|

| 98,000 |

Add: For Realisation Expenses |

| 2,000 |

P.C. |

| 1,00,000 |

Discharge of P.C. |

|

|

(1) Equity Shares of 100/-each | 70,000 | |

(2) Cash | 30,000 | |

P.C. | 1,00,000 |

In the Books of A & B Realisation A/c

|

| |||

To Sundry Debtors |

| 16,000 | By R.D.D | 1,000 |

To Stock |

| 18,000 | By Sundry Creditors | 25,000 |

To Furniture |

| 6,000 | By Loan on Mortgage | 10,000 |

To Buildings |

| 64,000 | By AB Ltd. (PC) | 1,00,000 |

To Cash/Bank (Exp.) |

| 2,000 |

|

|

To Real Profit |

|

|

|

|

A 15,000 |

|

|

|

|

B | 15,000 | 30,000 |

|

|

| 1,36,000 |

| 1,36,000 | |

AB Ltd. A/c

|

| ||

To Realisation A/c. | 1,00,000 | By Cash/Bank A/c. By Equity Shares of AB Ltd. | 30,000 70,000 |

| 1,00,000 |

| 1,00,000 |

Partners’ Capital A/c.

| A | B |

| A | B |

To Equity Shares of AB Ltd. To Cash/Bank A/c. | 42,000 28,000 | 28,000 7,000 | By Balance b/d By Realisation Profit | 55,000 15,000 | 20,000 15,000 |

| 70,000 | 35,000 |

| 70,000 | 35,000 |

Cash/Bank A/c

|

| ||

To Balance b/d | 7,000 | By Realisation (Exp.) | 2,000 |

To AB Ltd. | 30,000 | By A’s Capital A/c. | 28,000 |

|

| By B’s Capital A/c. | 7,000 |

| 37,000 |

| 37,000 |

Equity Shares of AB Ltd.

|

| ||

To AB Ltd. | 70,000 | By A’s Capital A/c. By B’s Capital A/c. | 42,000 28,000 |

| 70,000 |

| 70,000 |

Q17) A, B and C share profits and losses of a business as 1/2, 1/3 and 1/6 respectively.

Their Balance sheet as on 31st March, 2014 was as follows:

Liabilities | Assets | |||

Capital A/c.A | 70,000 | Goodwill |

| 10,000 |

B | 80,000 | Land |

| 20,000 |

C | 10,000 | Building |

| 1,10,000 |

General Reserve | 18,000 | Machinery |

| 50,000 |

Investment Fluctuation Fund | 4,000 | Motor Car |

| 28,000 |

|

| Furniture |

| 12,000 |

C’s Loan | 33,000 | Investment |

| 18,000 |

Mrs. A’s Loan | 15,000 | Loose Tools |

| 7,000 |

Creditors (trade) | 76,000 | Stock |

| 18,000 |

Creditors (Expenses) | 20,000 | Bills Receivable |

| 20,000 |

Bills Payable | 14,000 | Debtors | 40,000 |

|

|

|

|

|

|

Bank overdraft | 60,000 | Less: Provision | 2,000 | 38,000 |

|

| Cash at Bank |

| 1,000 |

|

| C’s Current A/c. |

| 56,000 |

|

| Profit and Loss A/c. |

| 12,000 |

| 4,00,000 |

| 4,00,000 | |

The partners decided to convert the firm into a Ltd. Company ABC Ltd. With an authorized capital of

10,00,000 divide into 100 equity shares.

The Terms were:

(i) Motor Car, Furniture, Investment, Loose Tools, Debtors, and Cash are not to be taken over by the company.

(ii) Bills payable, and Bank Overdraft are to be taken over.

(iii) The purchase price is settled at 1,95,000 payable as to 75,000 in cash and the balance in company’s fully paid shares of 100 each.

The remaining assets and liabilities were disposed as follows:

Investment was taken over by A for 13,000; Debtors realized 20,000; Motor car, Furniture, and Loose Tools fetch 24,000; 40,000 and 1,000 respectively. An agreed to pay his wife’s loan and the creditors were paid 74,000 in full settlement. Creditors for expenses were paid in full. The Realisation expenses amounted to 500.

The equity shares were distributed in profit sharing ratio amongst the partners.

You are required to show the necessary ledger accounts, assuming that the liabilities even if not taken over are transferred to the Realisation A/c. (8 marks)

A9) Calculation P.C. (Lumpsum Method)

Given 1,95,000

Discharge (1) Cash 75,000 Equity Shares 1,20,000 P.C. 1,95,000

Realisation A/c

|

| |||

To Goodwill | 10,000 | By R.B.D |

| 2,000 |

To Land | 20,000 | By C’s Loan |

| 35,000 |

To Building | 1,10,000 | By Mrs. A Loan |

| 15,000 |

To Machinery | 50,000 | By Creditors (Exp.) |

| 76,000 |

To Motor Car | 28,000 | By Bills Payable |

| 20,000 |

To Furniture | 12,000 | By Bank overdraft |

| 14,000 |

To investments | 18,000 | By ABC Ltd. (PC) |

| 60,000 |

To Loose Tools | 7,000 | By A’s Capital A/c. (Inv.) |

| 1,95,000 |

To Stock | 18,000 | By Cash/Bank A/c |

| 13,000 |

To Bills Receivable | 20,000 | Debtors | 20,000 |

|

To Debtors | 40,000 | Motor Car | 24,000 |

|

To A’s Capital A/c (Mrs. A loan) | 15,000 | Furniture | 40,000 |

|

To Cash/Bank |

| Loose Tools | 1,000 | 85,000 |

Trade Creditors 74,000 |

|

|

|

|

Creditors for Exp. 20,000 |

|

|

|

|

C’s Loan 33,000 | 1,27,000 |

|

|

|

To Cash/Bank (Expenses) | 500 |

|

|

|

To Real Profit: |

|

|

|

|

A 18,750 |

|

|

|

|

B 12,500 |

|

|

|

|

C 6,250 | 37,500 |

|

|

|

| 5,13,000 |

| 5,13,000 | |

Partners’ Capital A/c

| A | B | C |

| A | B | C |

To C’s Current | - | - | 56,000 | By Balance b/d | 70,000 | 80,000 | 10,000 |

To P&L A/c. | 6,000 | 4,000 | 2,000 | By General Res. | 9,000 | 6,000 | 3,000 |

To Real A/c. | 13,000 | - | - | By Invest Fl.Fund | 2,000 | 1,333 | 667 |

To Equity Share of ABC |

|

|

| By Real A/c. | 15,000 | - | - |

Ltd | 60,000 | 40,000 | 20,000 | By Real Profit | 18,750 | 12,5000 | 6,250 |

To Cash/Bank | 35,750 | 55,833 | - | By Cash/Bank | - | - | 58,083 |

| 1,14,750 | 99,833 | 78,000 |

| 1,14,750 | 99,833 | 78,000 |

Cash/Bank A/c

|

| ||

To Balance b/d | 1,000 | By Real (Liab.paid) | 1,27,000 |

To ABC Ltd. | 75,000 | By Real (Exp.) | 500 |

To Real(Assets sold) | 85,000 | By A’s Capital A/c. | 35,750 |

To C’s Capital A/c. | 58,083 | By B’s Capital A/c. | 55,833 |

| 2,19,083 |

| 2,19,083 |

ABC Ltd.

|

| ||

To Realisation | 1,95,000 | By Cash/Bank By Equity Share of ABC Ltd. | 75,000 1,20,000 |

1,95,000 | 1,95,000 |

Equity Share of ABC Ltd.

|

| ||

To ABC Ltd. | 1,20,000 | By A’s Capital A/c. By B’s Capital A/c. By C’s Capital A/c. | 60,000 40,000 20,000 |

1,20,000 | 1,20,000 |