Unit 2

Basic Concepts of Keynesian Economics

Q1) Explain principle of effective demand? 8 marks

A1)

Keynes’ theory of employment is based on the principle of effective demand. In other words, level of employment in a capitalist economy depends on the extent of effective demand. Thus, unemployment is attributed to the deficiency of effective demand and to cure it requires the increasing of the level of effective demand.

By ‘effective’ demand, Keynes meant the entire demand for goods and services in an economy at various levels of employment. Total demand for goods and services by the people is that the sum total of all demand meant for consumption and investment. In other words, the sum of consumption expenditures and investment expenditures constitute effective demand in a two-sector economy.

In order to satisfy such demand, people are employed to produce all types of goods, both consumption goods and investment goods. However, to finish our discussion on effective demand, we need another component of effective demand—the component of government expenditure. Thus, effective demand could also be defined as the total of all expenditures, i.e.,

C + 1 +G

Where C stands for consumption expenditure,

I stands for investment expenditure, and

G stands for government expenditure.

Here we ignore government expenditure as a component of effective demand. Consistent with Keynes, the level of employment is decided by the effective demand which, in turn, is decided by aggregate demand function or aggregate demand price and aggregate supply function or aggregate supply price. In Keynes’ words; “The value of D (Aggregate Demand) at the point of Aggregate Demand function, where it's intersected by the aggregate Supply function, are going to be called the effective demand.”

Aggregate Demand (AD):

“The aggregate demand price for the output of any given amount of employment is the total sum of money or proceeds, which is expected from the sale of the output produced when that amount of labour is employed.”

Thus the aggregate demand price is the amount of money which the entrepreneurs expect to get by selling the output produced by the number of men employed. In other words, it refers to the expected revenue from the sale of output produced at a particular level of employment. Different aggregate demand prices relate to different levels of employment in the economy.

A statement showing the various aggregate demand prices at different levels of employment is called the aggregate demand price schedule or aggregate demand function. “The aggregate demand function,” according to Keynes, “relates any given level of employment to the expected proceeds from that level of employment.” Table I shows the aggregate demand schedule.

Table 1

Level of employment (N) (in lakhs) | Aggregate demand price (D) (Rs crores) |

20 | 230 |

25 | 240 |

30 | 250 |

35 | 260 |

40 | 270 |

45 | 280 |

50 | 290 |

The table reveals that with the increase in the level of employment proceeds expected rise and at lower levels of employment decline. When 45 lakh people are provided employment the aggregate demand price is Rs 280 crores and when 25 lakh people are provided jobs, it is Rs 240 crores. According to Keynes, the aggregate demand function is an increasing function of the level of employment and is expressed as D = F (AO, where D is the proceeds which entrepreneurs expect from the employment of N men.

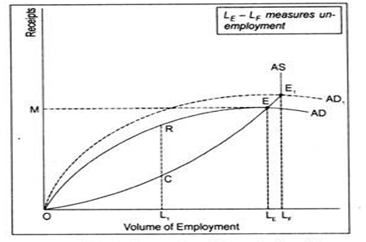

The aggregate demand curve can be drawn on the basis of the above schedule. It slopes upward from left to right because as the level of employment increases aggregate demand price also rises, shown as AD curve in bellow figure.

Aggregate Supply (AS):

When an entrepreneur gives employment to certain amount of labour, it requires certain quantities of co-operant factors like land, capital, raw materials, etc. which will be paid remuneration along with labour. Thus each level of employment involves certain money costs of production including normal profits which the entrepreneur must cover.

“At any given level of employment of labour aggregate supply price is the total amount of money which all the entrepreneurs in the economy, taken together, must expect to receive from the sale of the output produced by that given number of men, if it is to be just worth employing them.”

In brief, the aggregate supply price refers to the proceeds necessary from the sale of output at a particular level of employment. Thus each level of employment in the economy is related to a particular aggregate supply price and there are different aggregate supply prices for different levels of employment.

A statement showing the various aggregate supply prices at different levels of employment is called the aggregate supply price schedule or aggregate supply function. In the words of Prof. Dillard, “The aggregate supply function is a schedule of the minimum amounts of proceeds required to induce varying quantities of employment.” Table II shows the aggregate supply schedule

Level of employment (N) (in lakhs) | Aggregate supply price (D) (Rs crores) |

20 | 215 |

25 | 230 |

30 | 245 |

35 | 260 |

40 | 275 |

45 | 290 |

50 | 305 |

The above table reveals that the aggregate supply price rises with the increase in the level of employment. If entrepreneurs are to provide employment to 20 lakh workers, they must receive Rs 215 crores from the sale of the output produced by them.

It is only when they expect to receive the minimum amounts of proceeds (Rs 230 crores, Rs 245 crores and Rs 260 crores) that they will provide employment to more workers (25 lakhs, 30 lakhs and 35 lakhs respectively).

But when the economy reaches the level of full employment (at 40 lakh workers) the aggregate supply price (Rs 275,290 and 305 crores) continues to increase but there is no further increase in employment. According to Keynes, the aggregate supply function is an increasing function of the level of employment and is expressed as Z = фN, where Z is aggregate supply price of the output from employing N men.

The aggregate supply curve can be drawn on the basis of the schedule. It slopes upward from left to right because as the necessary expected proceeds increase, the level of employment also rises. But when the economy reaches the level of full employment, the aggregate supply curve becomes vertical. Even with the increase in the aggregate supply price, it is not possible to provide more employment as the economy has attained the level of full employment.

Equilibrium Level of Employment— the point of Effective Demand:

We have studied separately aggregate demand and aggregate supply as the two determinants of effective demand. Now we'll describe how equilibrium level of employment is determined in an economy by using the concept of effective demand.

The level of employment in an economy is determined at that point where the aggregate supply price equals the aggregate demand price. In other words, the intersection of the aggregate supply function with the aggregate demand function determines the volume of income and employment in an economy.

It is, thus, clear that so long as expected sales receipts of the entrepreneur (i.e., aggregate demand schedule) exceed costs (i.e., aggregate supply schedule), the level of employment should be increasing and therefore the process will continue until expected receipts equal costs or aggregate demand curve intersects aggregate supply curve.

Note that the AS curve starts from the origin. If aggregate receipts (i.e., GNP) are zero, entrepreneurs wouldn't hire workers. Likewise, AD curve also starts from the origin. The equilibrium level of employment is deter-mined by the intersection of the AS and AD curves. This is often the point of effective demand— point E in the below figure. Like this point, OLE workers are employed. At the OL1 level of employment, expected receipts exceed necessary costs by the quantity RC. Entrepreneurs will now go on hiring more labour till OLE level of employment is reached.

At this level of employment, entrepreneurs’ expectations of profits are maximised. Employment beyond OLE is unprofitable because costs exceed revenue. Thus, actual employment (OLE) falls short of full employment (OLF). Keynesian system shows two kinds of equilibrium—actual employment equilibrium determined by AD and AS curves and underemployment equilibrium.

Keynes made little emphasis to the aggregate supply function since its determinants (such as technology, supply or availability of raw materials, etc.,) don't change in the short run. Keynes was examining the possibility of unemployment in a capitalistic economy against the backdrop of Great Depression of the 1930s.

After diagnosing the matter, Keynes recommended policy prescription so on create more employment in the economy. Indeed, for curing unemployment problem, he did not subscribe the classical ideas—the supply-oriented policies. Keynes attached great importance to demand-stimulating policies to cure unemployment. In other words, Keynes paid emphasis on the aggregate demand function. That is why Keynes’ theory is known as a ‘theory of aggregate demand’.

Q2) Explain aggregate demand? 5 marks

A2)

Keynes’ theory of employment is based on the principle of effective demand. In other words, level of employment in a capitalist economy depends on the extent of effective demand. Thus, unemployment is attributed to the deficiency of effective demand and to cure it requires the increasing of the level of effective demand.

By ‘effective’ demand, Keynes meant the entire demand for goods and services in an economy at various levels of employment. Total demand for goods and services by the people is that the sum total of all demand meant for consumption and investment. In other words, the sum of consumption expenditures and investment expenditures constitute effective demand in a two-sector economy.

In order to satisfy such demand, people are employed to produce all types of goods, both consumption goods and investment goods. However, to finish our discussion on effective demand, we need another component of effective demand—the component of government expenditure. Thus, effective demand could also be defined as the total of all expenditures, i.e.,

C + 1 +G

Where C stands for consumption expenditure,

I stands for investment expenditure, and

G stands for government expenditure.

Here we ignore government expenditure as a component of effective demand. Consistent with Keynes, the level of employment is decided by the effective demand which, in turn, is decided by aggregate demand function or aggregate demand price and aggregate supply function or aggregate supply price. In Keynes’ words; “The value of D (Aggregate Demand) at the point of Aggregate Demand function, where it's intersected by the aggregate Supply function, are going to be called the effective demand.”

Aggregate Demand (AD):

“The aggregate demand price for the output of any given amount of employment is the total sum of money or proceeds, which is expected from the sale of the output produced when that amount of labour is employed.”

Thus the aggregate demand price is the amount of money which the entrepreneurs expect to get by selling the output produced by the number of men employed. In other words, it refers to the expected revenue from the sale of output produced at a particular level of employment. Different aggregate demand prices relate to different levels of employment in the economy.

A statement showing the various aggregate demand prices at different levels of employment is called the aggregate demand price schedule or aggregate demand function. “The aggregate demand function,” according to Keynes, “relates any given level of employment to the expected proceeds from that level of employment.” Table I shows the aggregate demand schedule.

Table 1

Level of employment (N) (in lakhs) | Aggregate demand price (D) (Rs crores) |

20 | 230 |

25 | 240 |

30 | 250 |

35 | 260 |

40 | 270 |

45 | 280 |

50 | 290 |

The table reveals that with the increase in the level of employment proceeds expected rise and at lower levels of employment decline. When 45 lakh people are provided employment the aggregate demand price is Rs 280 crores and when 25 lakh people are provided jobs, it is Rs 240 crores. According to Keynes, the aggregate demand function is an increasing function of the level of employment and is expressed as D = F (AO, where D is the proceeds which entrepreneurs expect from the employment of N men.

Q3) Explain aggregate supply? 5 marks

A3)

Keynes’ theory of employment is based on the principle of effective demand. In other words, level of employment in a capitalist economy depends on the extent of effective demand. Thus, unemployment is attributed to the deficiency of effective demand and to cure it requires the increasing of the level of effective demand.

By ‘effective’ demand, Keynes meant the entire demand for goods and services in an economy at various levels of employment. Total demand for goods and services by the people is that the sum total of all demand meant for consumption and investment. In other words, the sum of consumption expenditures and investment expenditures constitute effective demand in a two-sector economy.

In order to satisfy such demand, people are employed to produce all types of goods, both consumption goods and investment goods. However, to finish our discussion on effective demand, we need another component of effective demand—the component of government expenditure. Thus, effective demand could also be defined as the total of all expenditures, i.e.,

C + 1 +G

Where C stands for consumption expenditure,

I stands for investment expenditure, and

G stands for government expenditure.

Here we ignore government expenditure as a component of effective demand. Consistent with Keynes, the level of employment is decided by the effective demand which, in turn, is decided by aggregate demand function or aggregate demand price and aggregate supply function or aggregate supply price. In Keynes’ words; “The value of D (Aggregate Demand) at the point of Aggregate Demand function, where it's intersected by the aggregate Supply function, are going to be called the effective demand.”

Aggregate Supply (AS):

When an entrepreneur gives employment to certain amount of labour, it requires certain quantities of co-operant factors like land, capital, raw materials, etc. which will be paid remuneration along with labour. Thus each level of employment involves certain money costs of production including normal profits which the entrepreneur must cover.

“At any given level of employment of labour aggregate supply price is the total amount of money which all the entrepreneurs in the economy, taken together, must expect to receive from the sale of the output produced by that given number of men, if it is to be just worth employing them.”

In brief, the aggregate supply price refers to the proceeds necessary from the sale of output at a particular level of employment. Thus each level of employment in the economy is related to a particular aggregate supply price and there are different aggregate supply prices for different levels of employment.

A statement showing the various aggregate supply prices at different levels of employment is called the aggregate supply price schedule or aggregate supply function. In the words of Prof. Dillard, “The aggregate supply function is a schedule of the minimum amounts of proceeds required to induce varying quantities of employment.” Table II shows the aggregate supply schedule

Level of employment (N) (in lakhs) | Aggregate supply price (D) (Rs crores) |

20 | 215 |

25 | 230 |

30 | 245 |

35 | 260 |

40 | 275 |

45 | 290 |

50 | 305 |

The above table reveals that the aggregate supply price rises with the increase in the level of employment. If entrepreneurs are to provide employment to 20 lakh workers, they must receive Rs 215 crores from the sale of the output produced by them.

It is only when they expect to receive the minimum amounts of proceeds (Rs 230 crores, Rs 245 crores and Rs 260 crores) that they will provide employment to more workers (25 lakhs, 30 lakhs and 35 lakhs respectively).

But when the economy reaches the level of full employment (at 40 lakh workers) the aggregate supply price (Rs 275,290 and 305 crores) continues to increase but there is no further increase in employment. According to Keynes, the aggregate supply function is an increasing function of the level of employment and is expressed as Z = фN, where Z is aggregate supply price of the output from employing N men.

Q4) Explain consumption function? 5 marks

A4)

The consumption function or propensity to consume refers to income-consumption relationship. It is a “functional relationship between two aggregates, i.e., total consumption and gross national income.” Symbolically, the relationship is represented as C = f(Y), where C is consumption, Y is income, and f is the functional relationship. Thus the consumption function indicates a functional relationship between C and Y, where C is the dependent by Y is the independent variable, i.e., C is determined by Y.

This relationship is based on the ceteris paribus (other things being equal) assumption, as such only income-consumption relationship is considered and all possible influences on consumption are held constant. In fact, the propensity to consume or consumption function is a schedule of the various amounts of consumption expenditure corresponding to different levels of income. A hypothetical consumption schedule is given in table.

Income (Rs crores)(Y) | Consumption C = f(Y) |

0 | 20 |

60 | 70 |

120 | 120 |

180 | 170 |

240 | 220 |

300 | 270 |

360 | 320 |

Table shows that consumption is an increasing function of income because consumption expenditure increases with increase in income. Here it is shown that when income is zero during the depression, people spend out of their past savings on consumption because they must eat in order to live.

When income is generated in the economy to the extent of Rs 60 crores, it is not sufficient to meet the consumption expenditure of the community so that the consumption expenditure of Rs 70 crores is still above the income amounting to Rs 60 crores (Rs 10 crores are dis-saved).

When both consumption expenditure and income equal Rs 120 crores, it is the basic consumption level. After this, income is shown to increase by 60 crores and consumption by 50 crores. This implies a stable consumption function during the short-run as assumed by Keynes.

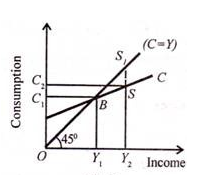

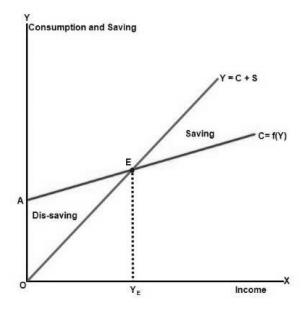

Figure illustrates the consumption function diagrammatically. In the diagram, income is measured horizontally and consumption is measured vertically. 45° is the unity-line where at all levels income and consumption are equal. The C curve is a linear consumption function based on the assumption that consumption changes by the same amount (Rs 50 crores).

Its upward slope to the right indicates that consumption is an increasing function of income. B is the break-even point where C=Y or OY1 = OC1. When income rises to OY1 consumption also increases to OC2, but the increase in consumption is less than the increase in income, C1C2 < Y1Y2.

The portion of income not consumed is saved as shown by the vertical distance between 45° line and C curve, i.e., SS1. “Thus the consumption function measures not only the amount spent on consumption but also the amount saved. This is because the propensity to save is merely the propensity not to consume. The 45° line may therefore be regarded as a zero-saving line, and the shape and position of the C curve indicate the division of income between consumption and saving.”

Q5) Explain properties of consumption function? 8 marks

A5)

Consumption function is based on two major properties i.e. Average Propensity to Consume and Marginal propensity to consume. These two properties are also known as technical attributes of consumption function. Both properties are important to study for better understanding of consumption function. Propensity to consume refers to that portion of total income which consumers tend to spend on goods and services. These properties are discussed in detail here:

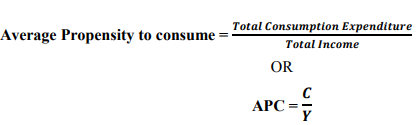

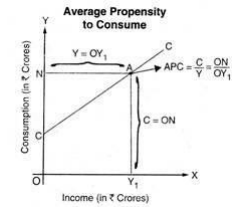

(I) Average Propensity to Consume

Average propensity to consume refers to the ratio between total consumption expenditure to total income. Or this may be defined as the ratio of consumption expenditure to personal disposable income. It can be shown as:

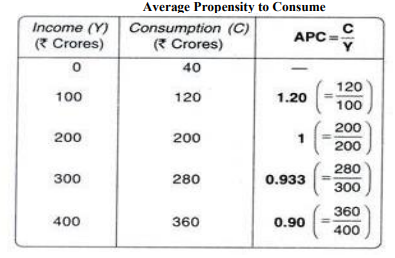

For example, if total consumption expenditure is 8,000 rupee and personal disposable income is 20,000 rupee, then APC =8000/20000= 0.4 or 40%. It means 40% of the total income is used for consumption purpose in an economy. This can be calculated for individual consumer using personal disposable income. APC can be presented through Table below.

This table represents that when income level is zero, consumption expenditure is 40 crores. This is due to expenditure on necessity goods even when national income is 0. When national income increases consumption expenditure will increase simultaneously. But APC starts declining from 1.20 to 0.90.

Further this can be presented through a diagram, where consumption is shown on OY axis and income is represented on OX axis. In Fig, CC is the consumption curve. At ON consumption level and OY1 income level, APC situated at point A which can be calculated by, APC = 𝑂𝑁/OY1

Some important points about APC:

(i) APC > 1, when consumption is more than national income.

(ii) APC < 1, when consumption is less than national income.

(iii) APC = 1, when consumption is equal to national income.

(iv) APC ≠ 0, because consumption cannot be zero at any level of income.

(v) APC falls continuously with the increase in national income because the portion spent on consumption starts declining

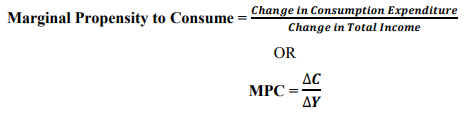

(II) Marginal Propensity to Consume

Marginal propensity to consume refers to change in total consumption to change in total income. It may be described as the ratio of change in consumption expenditure due to change in personal disposable income. It can be represented as,

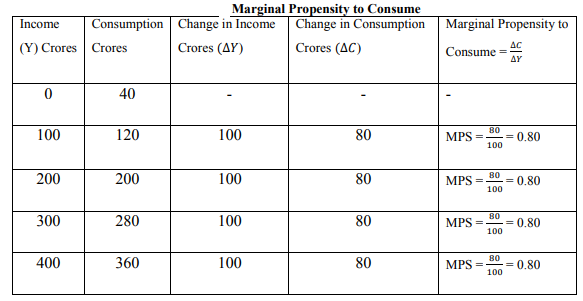

For example, if total consumption expenditure increases from 8,000 to 10,000 rupee and personal disposable income increases 30,000 rupee, then MPC =10000/30000= 0.33 or 33%. It means 33% of the total income is used for consumption purpose in an economy. This can be calculated as additional consumption out of additional income. MPC can be presented through Table

Table represents that when there is change in total income from 0 to 100 crores and consumption expenditure increases from 40 to 120 crores which lead to MPC at 0.80. Here, the consumption curve will be a straight line because MPC remains constant at different level of income and consumption.

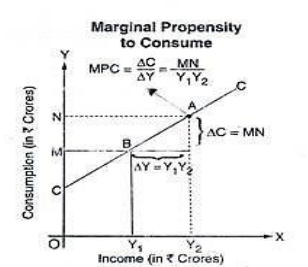

Further this can be shown through a figure which represents change in income from OY1 to OY2 and change in consumption expenditure from OM to ON. MPC is situated at point A where change in consumption and change in income is measured.

Some important points about MPC:

(i) MPC value ranges from 0 to 1. If all the additional income is consumed, then MPC will be equal to 1 and when all the additional income is saved then MPC will be 0.

(ii) Marginal Propensity to Consume of poor people will be more than rich people because a greater percentage of their increased income on consumption. But rich people spend a smaller portion of their income on consumption because they already enjoy high standard of living.

(iii) MPC starts declining with successive increase in income.

Q6) Explain Psychological Law of Consumption? 8 marks

A6)

Psychological law of consumption is propounded by economist Keynes which shows relationship among aggregate consumption and income. It is also known as Keynes’ Fundamental Law of Consumption. Keynes stated that with the increase in income there will be increase in consumption expenditure but this increase in consumption is less than increase in income. Keynes stated that, “The psychology of the community is such that when aggregate real income is increased, aggregate consumption is increased, but not by so much as income.”

Definition

According to Keynes, “The fundamental psychological law, upon which we are entitled to depend with great confidence both a priori from our knowledge of human nature and from the detailed facts of experience, is that men are disposed, as a rule, and on the average, to increase their consumption as their income increases, but not by as much as the increase in their income.” Further, it can be said that marginal propensity to consume is always positive but it is less than unity.

Assumption

I. This law is related to short period so it assumes that distribution of income, price level, population growth, fashion, taste, behaviour of consumer, spending habits, etc. will remain constant. Only one factor will affect the consumption i.e. Income.

II. Keynes assumes that there exists normal situation in the economy for applicability of this law. Normal condition means there is usual and ordinary conditions in the economy. There are no chances for the occurrence of war, revolution, hyperinflation, etc. in the economy.

III. One another assumption is about the free capitalistic economy exist in a country. Free capitalistic economy means the economy where the economy is free from government intervention in context of increase and decrease in income level. It is also known as laissez-faire capitalistic economy. Here, market is determined through demand and supply of goods and services.

Explanation of the law

This law can be explained with the help of a table and diagram:

Income (Y) | Consumption (C) | Savings (S) |

0 | 20 | -20 |

50 | 60 | -10 |

100 | 100 | 0 |

150 | 140 | 10 |

200 | 180 | 20 |

This table represents the relationship among income, saving and consumption. Table shows that there is increase in consumption with respect to increase in income but proportionate increase in consumption is less than proportionate increase in income. Further, income may be zero when there is no means of earning but consumption still exists because consumer can borrow money or used their past savings at this movement. At some point, income and consumption will equivalent to each other and saving will be zero. Onward this point, increase in income will leads to increase in consumption but total income is not used for consumption hence there will be increase in saving.

Similarly, this situation can be shown through fig. Which represents that from origin to OYE there will be increase in consumption and there is dis-saving because either people are not earning from any source or their income is less than their consumption expenditure. At point E, consumption and income are equal to each other. Onward point E, there will be saving because proportionate increase in income is greater than proportionate increase in consumption.

According to Keynes Law, if this gap between income and consumption continuously rise then there will be deficiency of aggregate demand in context of aggregate supply at full employment level. This will lead to low level equilibrium in the economy and this will adversely affect the economy. Due to this situation effective demand will decrease and this will lead to unemployment in the economy

Implication

Consumption function is not just a concept of discussion rather it has its own theoretical and practical implications. Every nation depends on economic policies for the economic development. These policies are formed after studying microeconomic and macroeconomic factors of a nation. Consumption function is an important macroeconomic factor and important to study. Importance of consumption function is explained below:

1. Invalidates Say’s Law:

Say’s Law states that supply creates its own demand. Therefore, there cannot be general overproduction or general unemployment. Keynes’s psychological law invalidates Say’s Law because as income increases, consumption also increases but by a smaller amount.

In other words, all that is produced (income) is not taken off the market (spent), as income increases. Thus supply fails to create its own demand. Rather it exceeds demand and leads to general overproduction and glut of commodities in the market. As a result, producers stop production and there is mass unemployment.

2. Need for State Intervention:

As a corollary to the above, the psychological law highlights the need for state intervention. Say’s Law is based on the existence of laissez-faire policy and its refutation implies that the economic system is not self-adjusting.

So when consumption does not increase by the full increment of income and consequently there is general overproduction and mass unemployment, the necessity of state intervention arises in the economy to avert general overproduction and unemployment through public policy.

3. Crucial Importance of Investment:

Keynes’s psychological law stresses the vital point that people fail to spend on consumption the full increment of income. This tendency creates a gap between income and consumption which can only be filled by either increased investment or consumption. If either of them fails to rise, output and employment will inevitably fall.

Since the consumption function is stable in the short-run, the gap between income and consumption can only be filled by an increase in investment. Thus the psychological law emphasises the crucial role of investment in Keynes’s theory. It is the inadequacy of investment which results in unemployment and logically, the remedy to overcome unemployment is increase in investment.

4. Existence of Underemployment Equilibrium:

Keynes’s notion of underemployment equilibrium is also based on the psychological law of consumption. The point of effective demand which determines the equilibrium level of employment is not of full employment but of underemployment because consumers do not spend the full increment of their income on consumption and there remains a deficiency in aggregate demand. Full employment equilibrium level can however, be reached if the state increases investment to match the gap between income and consumption.

5. Declining Tendency of the Marginal Efficiency of Capital:

The psychological law also points towards the tendency of declining marginal efficiency of capital in a laissez-faire economy. When income increases and consumption does not increase to the same extent, there is a fall in demand for consumer goods. This results in glut of commodities in the market.

The producers will reduce production which will, in turn, bring a decline in the demand for capital goods and hence in the expected rate of profit and business expectations. It implies a decline in the marginal efficiency of capital. It is not possible to arrest this process of declining tendency of marginal efficiency of capital unless the propensity to consume rises. But such a possibility can exist only in the long run when the psychological law of consumption does not hold good.

6. Danger of Permanent Over-saving or Under-investment Gap:

Keynes’s psychological law points out that there is always a danger of an over-saving or under-investment gap appearing in the capitalist economy because as people become rich the gap between income and consumption widens.

This long-run tendency of increase in saving and fall in investment is characterised as secular stagnation. When people are rich, their propensity to consume is low and they save more. This implies low demand which leads to decline in investment. Thus the tendency is for secular stagnation in the economy.

7. Unique Nature of Income Propagation:

The fact that the entire increased income is not spent on consumption explains the multiplier theory. The multiplier theory or the process of income propagation tells that when an initial injection of investment is made in the economy, it leads to smaller successive increments of income.

This is due to the fact that people do not spend their full increment of income on consumption. In fact, the value of multiplier is derived from the marginal propensity to consume, i.e., Multiplier = 1—1/MPC. The higher the MPC, the higher the value of the multiplier, and vice versa.

Q7) Explain investment function? 8 marks

A7)

An investment function is a concept or strategy within economics that helps to identify the connection between shifts in the national income and the investment patterns that take place within that particular national economy. In this type of situation, a function would be any variable within the framework of the economy that would motivate investors to change their typical buying and selling habits as a means of either taking advantage of the economic shift in a bid to increase their returns or to minimize the amount of loss incurred as a result of that shift. In weighing variables, the investor will consider the current level of gross domestic product (GDP) as well as the average interest rates that currently apply within the economy.

The investment function is a summary of the variables that influence the levels of aggregate investments. It can be formalized as follows: I=f(r, Y,q)

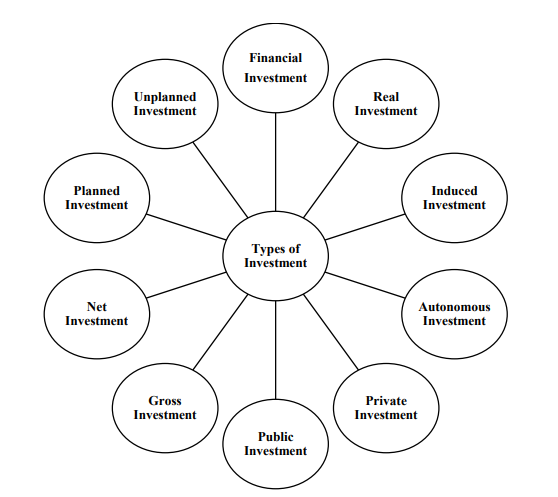

Types of investment

(a) Financial Investment

Financial investment refers to the amount of money invested for buying shares and stocks of existing companies. Or we can say that it is the expenditure made by investor on purchase of financial instruments. Financial investment leads to increase in total assets of an individual but it is not significant in economy as a whole unless it is undertaken by our residents in rest of the world.

According to Stonier and Hague, “By investment we do not mean the purchase of existing paper security, bonds, debentures or equity, but the purchase of new factories, machines and like.

(b) Real Investment

Real investment refers to the total expenditure on the purchase of the goods which results into increase in overall production capacity in the economy. This expenditure involves purchase of new machinery, plant, buildings for business purpose or construction of residential house. Real investment is can be called as net capital formation because it has a direct impact on the production, employment and national growth.

According to Mrs. Joan Robinson, “By investment is meant an addition to capital, such as occurs when a new house is build or a new factory is built. Investment means making an addition to the stock of goods in existence.”

(c) Induced Investment

Induce investment is based on two major factors i.e. income and profit and it is positively related with income level and profits. At high level of income and profit investors are Types of Investment Financial Investment Real Investment Induced Investment Autonomous Investment Private Investment Public Investment Gross Investment Net Investment Planned Investment Unplanned Investment induced to invest more and when income level and profits goes down, investment level also reduces. This type of investment may be known as profit or income elastic. According to Prof. Keiser, “When an increase in investment is due to increase in current level of income and production, it is known as induced investment”.

(d) Autonomous Investment

Autonomous investment is the investment which is independent of the level of the income and output. It means this investment is not induced by level of income. It is the investment which is made by government to enhance the level of effective demand in the economy during the period of depression and unemployment. It may include expenditure on construction of houses, roads, buildings and other infrastructure by government. According to Peterson, “The autonomous investment is generally associated with such factors as the introduction of new techniques or products, the development of new resources or the growth of population and labour force.”

(e) Private Investment

Private investment refers to the investment made by private individual or private player of the market with the merely motive to earn profit. This type of investment is dependent on two major factors i.e. Marginal efficiency of capital and Rate of interest. If Marginal efficiency of capital is greater than rate of interest, then there will more private investment in the economy. On the other hand, if marginal efficiency of capital is less than rate of interest then there will no private investment in the economy.

(f) Public Investment

Public investment refers to the investment made by central government, state government and local self-government of a country. This investment is not made for merely profits but it is made for social welfare and economic development of a country. This type of investment is encouraged so that higher rate of growth is achieved in the economy.

(g) Gross Investment

Gross investment is the total investment made on capital goods at any given point of time in an economy. Moreover, it may be defined as the total amount of money spent on capital assets like plant and machinery, factory building, etc. Gross investment includes net investment and replacement investment.

It may be shown as: Gross Investment = Net Investment + Replacement Investment

Here, replacement investment is the cost incurred on the maintenance of depreciating capital assets in the business. Whenever gross investment is more than replacement investment then there will be increase in capital stock.

(h) Net Investment

Net investment refers to the investment which arises out of increasing capital stock in the business. According to Peterson, “Net investment is investment that enlarges economy’s stock of real capital assets thereby, adding to productive capacity.” Net investment can be shown as: Net Investment = Gross Investment – Replacement Investment

(i) Planned Investment

When an entrepreneur makes a plan for investment in a systematic manner with a particular objective, is known as planned investment. It is also known as intended investment or Ex – ante investment or voluntary investment. As per the term planned investment, we can describe it as voluntary investment made by investors for achieving particular objectives. It is affected by two major factors i.e. anticipated increase in demand and anticipated cut in the cost of production due to new technology. So, it can be termed as cost-oriented investment because of the cost reduction technique.

(j) Unplanned Investment

Unplanned investment refers to the investment which is made without any concrete plan or it may be random investment. Unplanned investment is involuntary investment made by investors. Sometimes, there is sudden fall in demand and stock of goods is accumulated in the business without any plan or objective. Thus, it is also known as unintended investment, Ex – post investment and involuntary investment.

Q8) Explain factors affecting investment? 8 marks

A8)

An investment function is a concept or strategy within economics that helps to identify the connection between shifts in the national income and the investment patterns that take place within that particular national economy. In this type of situation, a function would be any variable within the framework of the economy that would motivate investors to change their typical buying and selling habits as a means of either taking advantage of the economic shift in a bid to increase their returns or to minimize the amount of loss incurred as a result of that shift. In weighing variables, the investor will consider the current level of gross domestic product (GDP) as well as the average interest rates that currently apply within the economy.

The investment function is a summary of the variables that influence the levels of aggregate investments. It can be formalized as follows: I=f(r, Y,q)

Investment function is the relationship among investment and its determinants. Investment decision is influenced by a large number of factors. These factors are explained below:

1) Technology Advancement and Innovation - As we had earlier discussed that investment is affected by technology and new research in the economy, same is supported by Prof. Norman F. Keiser. He believed that introduction of new labour-saving and capital-saving techniques leads to increase in investment in the agriculture as well as manufacturing industries. There are various changes occurred due to technology and investment which are proven beneficial to increase the volume of investment.

2) Discovery of Natural Resources - Invention of the natural resources like: petrol, oil, etc. will leads to increase in investment. Discovery of new sources of natural resources will attract investors to invest more in order to obtain the new resources. On the other hand, if production of natural resources decreases or destroyed then there will be decrease in investment level also.

3) Government Policies Investment is also affected through monetary and fiscal policy of the government in an economy. Whenever government wants to expands credit and use cheap money policy then investment will increase. On the other hand, when government wants to contract the credit and use dear money policy then investment will decrease. Similarly, taxation and expenditure policy of the government affects investment decision in the economy. If more taxes are imposed by government then expectations of profit will go down and new investment will be discouraged. On the contrary, if fewer taxes are imposed then investment will be encouraged.

4) Foreign Trade - Foreign trade has a positive impact on the level of investment. Whenever investor expects that foreign trade of a country will increase then he will investment more. On the contrary, if volume of foreign trade reduces then level of investment will also fall in the economy.

5) Political Environment - Political environment is an important factor that affects business as well as investors in a country. If there is peace and stability in the political environment of a country, then it will induce more investment. On the other hand, if there is political disturbance, danger of foreign aggression and instability in a country then it will adversely affect investment level and investment will fall.

6) Expectations - Business expectations are directly related with profits in the organisation. Businessman uses capital goods for the further production of products. So, the expectation of profit depends upon the sale of goods produced through capital goods. If business is in good condition and business community is positive about future growth, then there will be increase in investments. But, when business is going through depression and business community is pessimistic about its growth then there will be a decrease in investment.

7) Rate of Population Growth - If there is continuous increase in population in a country then it will require new houses, schools, hospitals, roads, transportation, consumer goods, public services, etc. Thus, increase in population leads to more investment for the above requirement of the population. Further, according to Norman F. Keiser growth in population will leads to increase in labour supply. So, wage rate will fall and prospective yield of invested capital will increase.

8) Territorial Expansion - Due to increase in population, there is requirement for new territories in the economy which require public and private investment. Thus, opening of new business houses also affects investment.

9) The Price Level - Price is a major factor which affects investment level in the economy. If price in the market starts increasing, then there will be increase in profits for investors and due to this investors will be attracted towards more investment. On the other hand, if price starts declining then it will discourage investment.

10) The Market Structure - Market structure refers to the nature of competition prevails in the market. If there is many producer of same commodity in the market and competing with each other then they will try to cut down their cost of production through use of new machines and technology. These will result into increase in investment. On the contrary, if there is low competition among producers then monopoly can be created and production will continue through old machinery and obsolete technology. It will adversely affect investment level in the economy.

11) Availability of Finance - Investment is also influenced through availability of finance. Two major source of finance for a firm is internal source and external source. If a firm had more internal source of finance like: undistributed profits and reserves, etc. then the firm is able to investment more. Similarly, when external source of finance is easily available to firm then they are able to invest more. However, unavailability of finance leads to decrease in investment by a firm.

12) Condition in the Labour Market - Labour market is an equally important factor to study as other factors affecting investment decision. If trained and skilled labourers are available in the labour market, investment will be favorably influenced. This is due to the cordial and peaceful relationship among labourers and employer.

13) The Present Stock of Capital Goods - If present stock of capital goods in the firm is in excess of need then there is excess capacity in the firm and very little investment is required. On the other hand, when there is deficiency of capital goods then the possibility for investment will be more in the firm.

14) Aggregate Demand - Aggregate demand is the total demand of all the individuals in the economy during an accounting year. Aggregate demand also affects investment level in the economy. Continuous increase in aggregate demand for goods and services will stimulate the investment.

15) Factors Influencing Investment in Public Sector - Investment in public sector is influenced through the objectives like: economic development, social welfare and defence of the country. Investment for this purposive is independent of income or profit. If we need defence products for the security in the country or social welfare of people, then we have to invest irrespective of profit and income. But, it does not mean that government does not concentrate on profit or income. Government also makes public investment to earn profits.

Q9) Explain marginal efficiency of capital? 5 marks

A9)

Marginal efficiency of capital may be defined as expected rate of return of a new project or investment in the business. Marginal efficiency of capital may be defined as the ratio between the potential return of supplementary capital and price of their supply.

According to Dillard, “the marginal efficiency of capital in general is the highest rate of return over cost expected from producing an additional or marginal unit of the most profitable of all types of capital assets.”

Marginal efficiency of capital may be determined through two major factors i.e.

(i) Prospective Yield

Prospective yield of an asset may be defined as the aggregate of expected revenue from the sale of output produced during its life time but excluded variable cost. Here, variable cost refers to the cost of raw materials, wages, advertisement, transportation, etc. Marginal efficiency of capital depends on the long term expectations of the entrepreneurs’ regarding the prospective yields of the capital assets. Inducement of investment depends on the profit and loss expectations of the entrepreneur. Whenever a new investment is made or a new project is decided then prospective yield from that project is considers first. Expected yield is difficult to compute as one can only estimate about the physical life of an asset but no one can predict about the economic life of that asset because of obsolesce or physical worn out. Thus, an entrepreneur has to critically examine all the factors while computation of flows of income or prospective yield from capital asset.

(ii) Supply Price

Supply price does mean the supply of an existing asset to others but it is the cost of producing a new asset in the business. Or whenever an entrepreneur wishes to buy the capital asset, then he has to pay some price for that asset, is known as supply price of the asset. Keynes has described supply price as the cost of acquisition or replacement cost of an asset. Supply price may be extended to a number of years in case of services like construction, etc. Supply price is considered as fixed in short period.

Factors which shift the Marginal Efficiency of Capital

1. The cost of capital. If capital is cheaper, then investment becomes more attractive. For example, the development of steel rails made railways cheaper and encouraged more investment.

2. Technological change. If there is an improvement in technology, it can make investment more worthwhile.

3. Expectations and business confidence. If people are optimistic about the future, they will be willing to invest because they expect higher profits. In a recession, people may become very pessimistic, so even lower interest rates don't encourage investment. (e.g. During recession 2008- 12, interest rates were zero, but investment low)

4. Supply of finance. If banks are more willing to lend money investment will be easier.

5. Demand for goods. Higher demand will increase profitability of capital investment.

6. Rate of Taxes. Higher taxes will discourage investment. Sometimes, governments offer tax breaks to encourage investment.

Q10) Explain investment multiplier? 8 marks

A10)

The concept of multiplier was introduced in the beginning of 1930s by F.A. Kahn an economist of Cambridge University. He defined multiplier in the context of increase in employment level due to increase in initial investment and employment. It is known as employment multiplier. Further, Keynes refined the concept of multiplier with reference to increase in total income due to increase in investment income. This multiplier defined by Keynes is known as investment multiplier or income multiplier. The spirit of multiplier is that total increase in income, output and employment is multiple of the increase in original increase in investment. For example, if investment of rupee 100 crores is made, then it does not mean that income will also rise by rupee 100 crores but a multiple of it. If national income increases by rupee 300 crores due to investment of rupee 100 crores then multiplier will be equal to 3.

According to Keynes, “Investment multiplier tells us that when there is an increment of an aggregate investment; income will increase by an amount which is ‘K’ times the increment of investment.” Thus, multiplier may be defined as the ratio of increase in income to the increase in investment. It may be shown as:

Here,

K stands for multiplier,

∆Y stands for change in Income,

∆I stands for change in Investment.

Thus, multiplier is simply associated with change in investment and size of multiplier depends upon the size of marginal propensity to consume. Further, the value of multiplier varies from unity to infinity.

Working of Multiplier and its Assumptions:

First, we have assumed that the marginal propensity to consume remains constant throughout as the income increases in various rounds of consumption expenditure. However, the marginal propensity to consume may differ in various rounds of consumption expenditure. But this constancy of marginal propensity to consume is a realistic assumption, since all available empirical evidence shows that marginal propensity to consume is very stable in the short run.

Secondly, we have assumed that there is a net increase in investment in a period and no further indirect effects on investment in that period occur or if they occur they have been taken into account so that there is a given net increase in investment.

Further, we have assumed that there is no any time-lag between the increase in investment and the resultant increment in income. That is, increment in income takes place instantaneously as a result of increment in investment. J.M. Keynes ignored the time-lag in the process of income generation and therefore his multiplier is also called instantaneous multiplier. In recent years, the importance of time-lag has been recognized and concept of dynamic multiplier has been developed on that basis.

Another important assumption in the theory of multiplier is that excess capacity exists in the consumer goods industries so that when the demand for them increases, more amounts of consumer goods can be produced to meet this demand. If there is no excess capacity in consumer goods industries, the increase in demand as a result of some original increase in investment will bring about rise in prices rather than increases in real income, output and employment.

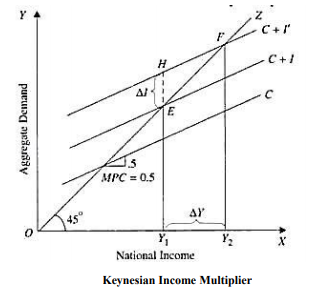

Diagrammatic representation of multiplier

Here, OX axis represents National Income and OY axis represents aggregate demand, C represents marginal propensity to consume. It is assumed that marginal propensity to consume is equal to 0.5 so that the curve C of MPC shown equals to 0.5. C + I represent the level of aggregate demand curve which intersects the 45° line at point E so that the level of income equal to OY1. If investment increases by the amount EH then aggregate demand curve shifts upward to the C + I’. Thus, new aggregate demand curve intersects at point F represents the equilibrium level of income which increases to OY2. So, the increase in investment leads to increase in income also. Through measurement we can conclude that Y1Y2 is twice the length of EH. This is expected because the marginal propensity to consume is equal to 0.5 here and therefore the size of multiplier will be equal to 2.

Q11) Explain leakages? 8marks

A11)

The concept of multiplier was introduced in the beginning of 1930s by F.A. Kahn an economist of Cambridge University. He defined multiplier in the context of increase in employment level due to increase in initial investment and employment. It is known as employment multiplier. Further, Keynes refined the concept of multiplier with reference to increase in total income due to increase in investment income. This multiplier defined by Keynes is known as investment multiplier or income multiplier. The spirit of multiplier is that total increase in income, output and employment is multiple of the increase in original increase in investment. For example, if investment of rupee 100 crores is made, then it does not mean that income will also rise by rupee 100 crores but a multiple of it. If national income increases by rupee 300 crores due to investment of rupee 100 crores then multiplier will be equal to 3.

According to Keynes, “Investment multiplier tells us that when there is an increment of an aggregate investment; income will increase by an amount which is ‘K’ times the increment of investment.” Thus, multiplier may be defined as the ratio of increase in income to the increase in investment. It may be shown as:

Here,

K stands for multiplier,

∆Y stands for change in Income,

∆I stands for change in Investment.

Thus, multiplier is simply associated with change in investment and size of multiplier depends upon the size of marginal propensity to consume. Further, the value of multiplier varies from unity to infinity.

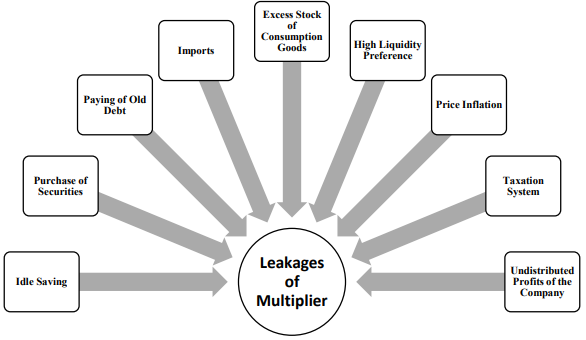

Marginal propensity to consume is generally less than the total income because whole income is not used for the consumption purpose. And the part of income which is not spent for consumption is known as leakages from total income. Forward action of multiplier does not exist for endlessly rather than the process of income circulation comes down. The reasons behind this decrease in income are known as leakages in the multiplier. Several reasons for leakages in multiplier are discussed below:

- Idle Saving - Idle savings are the part of increased income which is not used for consumption purpose and it goes out of the circulation. Idle savings results into equivalent fall in marginal propensity to consume and fall in marginal propensity to consume leads to fall in the value of multiplier. We can conclude that higher the marginal propensity to save will leads to leakages from the income circulation and it will also lower the value of multiplier.

- Purchase of Shares and Government Securities - Purchase of shares and government securities are one of the major reasons behind leakages of the multiplier. Income used for buying such old securities is cause of fall in the income streams. This part of income is not used for consumption purpose so; it will not generate further income for the future. Thus, there will be decrease in future income as well as decrease in multiplier.

- Paying of Old Debts - Whenever a person has to pay its old debt then he/she used money from increased income and this amount used for paying debt is not used for purpose. This will lead to another leakage of multiplier and it restricts the process of income generation through multiplier effect

- Imports - Import refers to the purchase of goods and services from the rest of the world or outside the boundaries of a country. When income goes out of the country it will adversely affects process of income generation. The money which goes out of the country will not generate further income in the boundaries of that country. Hence, imports will result into leakages in the multiplier.

- Excess Stock of Consumption Goods - Excess stock of consumption adversely affects the multiplier in the economy. Increase in income tends to increase the demand and this will lead to increase in consumption. If this increased demand is fulfilled by existing stock in the economy, then new goods will not be produced and as a result of this further production falls down as well as multiplier also goes down. This will reduce the income stream in the process of income generation.

- High Liquidity Preference - Liquidity refers to the cash position with a consumer. If people prefer high liquidity; means they want hold more cash with them, will negatively affects multiplier. As high liquidity preference leads to less expenditure and it will restrict the process of income generation. Thus, high liquidity preference leads to leakages in the multiplier.

- Price Inflation - Inflation is a situation of continuous increase in prices in the economy. If prices increase with the increase in income, then same amount of goods can be purchased with the increased income. Due to increased prices, people have to spend more income to buy the same amount goods and services as before. Thus, increase in price will nullify the effect of increase in income in the economy. Very few part of income will be left behind for the purchase of additional goods and services. There will be little effect on the consumption of goods and services. Thus, multiplier effect will be limited to price inflation.

- Taxation System - Whenever taxes on goods and progressive tax rate on income are increased then there will be no significant increase in consumption of goods and services even if income increases. Increases in taxes leads to slow down the process of income generation in the economy. Thus, taxes in the economy are considered as leakage in the multiplier.

- Undistributed Profits of the Companies - Undistributed profits are that part of company’s profit which is not divided among shareholders as dividend. Undistributed profits work same as the idle saving. Many companies do not distribute the whole profits of the company among its shareholders and kept some part of profit as reserve. This undistributed profit is not used for further consumption as well as it will not provide any future income in the economy. Thus, undistributed profits are leakages in the multiplier.

Q12) Explain importance of multiplier? 5 marks

A12)

The concept of multiplier was introduced in the beginning of 1930s by F.A. Kahn an economist of Cambridge University. He defined multiplier in the context of increase in employment level due to increase in initial investment and employment. It is known as employment multiplier. Further, Keynes refined the concept of multiplier with reference to increase in total income due to increase in investment income. This multiplier defined by Keynes is known as investment multiplier or income multiplier. The spirit of multiplier is that total increase in income, output and employment is multiple of the increase in original increase in investment. For example, if investment of rupee 100 crores is made, then it does not mean that income will also rise by rupee 100 crores but a multiple of it. If national income increases by rupee 300 crores due to investment of rupee 100 crores then multiplier will be equal to 3.

According to Keynes, “Investment multiplier tells us that when there is an increment of an aggregate investment; income will increase by an amount which is ‘K’ times the increment of investment.” Thus, multiplier may be defined as the ratio of increase in income to the increase in investment. It may be shown as:

Here,

K stands for multiplier,

∆Y stands for change in Income,

∆I stands for change in Investment.

Thus, multiplier is simply associated with change in investment and size of multiplier depends upon the size of marginal propensity to consume. Further, the value of multiplier varies from unity to infinity.

Various uses and importance of multiplier are discussed below:

- Concept of multiplier is helpful in understanding the income circulation process in the economy. It is helpful to determine that increase in employment, income and output is due to increase in investment.

- The concept of multiplier is helpful for the better understanding of trade cycles in the business. Trade cycles define the business fluctuations like: boom, depression, recession, etc. Multiplier explains that increase in investment leads to increase in income. Further, investments are increased during depression and decreased during inflations.

- Importance of investment in economic analysis can be better understood through the concept of multiplier. Investment is a dynamic factor which affects income as well as employment level in the economy.

- Multiplier is helpful for the determination of employment level in the economy. Increase in investments leads to increase in income and increase in income leads to increase in output and improving the employment level.

- Keynes define that equilibrium position is recognized when saving and investment are equal. Concept of multiplier is a helpful factor to achieve equilibrium in saving and investment. Whenever saving volume is low in the economy then marginal propensity to save is a tool to determine increase in income so that required saving volume can be obtained. Similarly, to determine the level of investment required for increase in income, coefficient of multiplier is used.

- Deficit financing is also highlighted through concept of multiplier. Some of the economists define that deficit financing is helpful to remove the bad effects of depression. Due to deficit financing, investment increases and this increase will lead to increase in income many more times due to multiplier effect.

- Keynes also used the concept of multiplier in introducing importance of public investment during depression. In this period, if public investment is raised then there will be increase in income many more times. Such an increase in investment tends to control the situation of depression and unemployment in the economy.

- Further, concept of multiplier is also helpful to decide that how much increase and decrease in investment is required for balancing the prices in the economy. It means multiplier is also helpful to control the situation of inflation and deflation.

- Government interference is a must according to Keynes and it is equally supported by concept of multiplier. By introducing a little investment in the economy, government can increase the income level many times under the impact of multiplier.

- At last, multiplier is also important to decide the level of additional investment required to achieve the desired rate of GDP in the economy

Q13) Explain limitation of multipliers? 8 marks

A13)

The concept of multiplier was introduced in the beginning of 1930s by F.A. Kahn an economist of Cambridge University. He defined multiplier in the context of increase in employment level due to increase in initial investment and employment. It is known as employment multiplier. Further, Keynes refined the concept of multiplier with reference to increase in total income due to increase in investment income. This multiplier defined by Keynes is known as investment multiplier or income multiplier. The spirit of multiplier is that total increase in income, output and employment is multiple of the increase in original increase in investment. For example, if investment of rupee 100 crores is made, then it does not mean that income will also rise by rupee 100 crores but a multiple of it. If national income increases by rupee 300 crores due to investment of rupee 100 crores then multiplier will be equal to 3.

According to Keynes, “Investment multiplier tells us that when there is an increment of an aggregate investment; income will increase by an amount which is ‘K’ times the increment of investment.” Thus, multiplier may be defined as the ratio of increase in income to the increase in investment. It may be shown as:

Here,

K stands for multiplier,

∆Y stands for change in Income,

∆I stands for change in Investment.

Thus, multiplier is simply associated with change in investment and size of multiplier depends upon the size of marginal propensity to consume. Further, the value of multiplier varies from unity to infinity.

Limitation of multiplier

- Availability of Consumer Goods - Income circulation is dependent on the availability of consumer goods in adequate quantity so that consumer can spend their increased income on these goods and income generation process goes on. If quantity of consumer goods is not adequate in the economy, then consumer will not be able to spend their increased income and this will restrict the multiplier effect. Thus, it will adversely affect the income generation process.

- Net Increase in Expenditure - Keynes define that spending may be known as expenditure which is used to increase the stock of goods and net increase in expenditure can be obtained through increase in expenditure of government on various projects and by reducing the taxes on goods. Further, net expenditure can also be increased through modifying the tax structure in such way that idle saving can be discouraged.

- Multiplier Period - We have earlier discussed that increase in investment will leads to increase in income due to multiplier effect but this multiplier effect does not work immediately rather than it needs a time lag for operation. Whenever consumer receive income they can’t spend all the income immediately and it takes a time lag between receipts of income again and its expenditure again. If we want to recognize the effect of increase in investment on the national income, then we have to study the effect of multiplier period. If multiplier period is greater than there will be small number of secondary expenditure on consumption and multiplier value will be small and vice-versa.

- Net increase in Investment - Direction of multiplier is very important for the determination of the value of multiplier. Value of multiplier is dependent on the net increase in investment. Here, net increase in investment does not mean that increase in public sector investment is supplemented by decrease in private sector investment. In this, situation multiplier will not work. It becomes necessary that the increase in investments should be at regular time intervals for obtaining a high value of multiplier. Thus, level of multiplier and national income can be raised, kept and maintained.

- Less than Full Employment Level - Multiplier is based on some assumptions and less than full employment level in the economy is one of these assumptions. We had earlier discussed that increase in investment leads to increase in income, output and employment and this is possible only when all the resources in the economy are not fully utilized. On the other hand, if there is full employment in the economy then there will be no increase in income and output and there will be no effect of multiplier on it.

- Autonomous Investment - There are two major types of investments i.e. autonomous investment and induced investment. Induced investment is affected by profits and income whereas autonomous investment is independent of profit motive. Moreover, value of multiplier is more than that of autonomous investment and less than that of induced investment.

- Steady Flow of Investment - As we had earlier discussed that net increase in investment is necessary for the determination of multiplier in the economy. It means there should be regular flow of income. If investment is not made on regular basis, then the multiplier effect will go down and initially income will raise but afterwards it stars declining and reached at its original position. Thus, for maintaining the effect of multiplier, it is necessary that there should be continuous increase in income.

- Closed Economy- Closed economy is another important factor to determine the value of multiplier in the economy. Multiplier works on the assumption that there is closed economy. There is absence of international trade in the closed economy. Open economy works adversely in the process of income generation through multiplier because imports over exports acts as a leakage. Further, any expenditure on imports will reduce the marginal propensity to consume and thus, it will adversely affect the value of multiplier.

- Acceleration effect ignored - Multiplier is related with the original investment on consumption and income only but it ignores the effect of increased or induced consumption on investment. But the value of multiplier will be affected by this increase in investment. This change in investment as a result of change in consumption is known as acceleration. This acceleration is helpful to increase the value of multiplier many times more than earlier increase but in multiplier, effect of acceleration is ignored.

- Constant Marginal Propensity to Consume- Assumption of multiplier becomes the limitations for multiplier and constant marginal propensity to consume is another limitation of multiplier which is assumed as constant. Any change in the value of MPC leads to change in value of multiplier. If value of MPC goes down, then value multiplier will also go down and vice-versa. Thus, constant value of marginal propensity of consume will tend to constant value of multiplier.

- No change in Prices- It is also assumed that there will be no change in the prices of commodities and any other material related to commodities. If there is any change in the prices, then consumption will be affected and change in consumption will affect the value of multiplier.

- Industrialised Economy- Multiplier is more effective in an industrialised economy rather than an agricultural economy. Elasticity of demand is higher in case of industrial products than agriculture products. Further, supply of industrial product is highly associated with its demand and fulfilled earlier than demand for agricultural products. Thus, industrial economy will lead to more effective for determination of multiplier.

- No change in Distribution of Income - Multiplier has another limitation due to its assumption of no change in distribution of income in the economy. It is due to the fact that change in income distribution tends to change in marginal propensity to consume. Thus, in case of change in distribution of income, it becomes difficult to determine the value of multiplier.

- Surplus Capacity in Consumer Goods Industries- We are known to the fact that increase in initial investment tends to increase in income and as a result of increase in income, consumption will also increase. But, consumption will increase only if there is surplus capacity in consumer goods industries. Due to this surplus capacity increased demand can be fulfilled. On the other hand, when there is no surplus capacity then consumption will not be increased and multiplier will be less effective.

- Availability of other Resources of Production - Availability of other resources of production like: raw material, capital equipment, etc., besides laborers is necessary for the smooth and better working of multiplier. When there is absence of these resources of production then multiplier will not be effective. Thus, we can conclude that multiplier is a helpful tool to determine the income, investment, output and employment. But, multiplier is also associated with different limitations. Multiplier would only work with different assumptions because without these assumptions multiplier will not be effective.

Q14) Explain paradox of thrift? 5 marks

A14)

The concept of “paradox of thrift” was first introduced by Bernard Mandeville in the Fable of the Bees in 1714. It had been later recognised by several classical economists and became an integral a part of the Keynesian economics.

Thriftiness is usually considered a virtue. An increase in thrift on the part of an individual leads to greater saving and wealth. It’s also regarded a public virtue because if people consume less, then more resources can be devoted to producing capital goods which cause increase in income, output and employment.

According to Keynes, thrift is a public virtue only if the propensity to invest is equally high. Otherwise, thrift may be a public vice if the rise in the propensity to save is unaccompanied by increase in the propensity to invest, i.e., (autonomous investment).

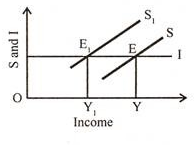

Suppose people become thrifty and decide to save more out of a given level of income, given the propensity to invest. This may lead to a lower equilibrium level of income. This example is illustrated in the below fig where S is that the saving curve and i is the income-inelastic investment curve.

The equilibrium level of income is E where the 2 curves are equal. Suppose people become thriftier. As a result, the saving curve shifts upward to five, with no change in the investment curve I. The new equilibrium point is E1 which results in a decline in the income level from Y to Y1.

Note that at the new equilibrium level Y1 saving is that the same as it was previously at E. (This is because both saving and investment are taken along the vertical axis). Thus people’s desire to save lots of more has been frustrated. This is often called the paradox of thrift.

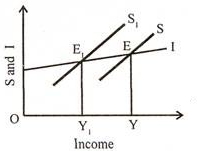

The paradox of thrift also can be explained if investment is induced instead of autonomous. This is illustrated in below fig. The investment curve I slopes upward and intersects the S curve at point E where T level of income is decided.

Suppose people increase their savings because of thriftiness. As a result, the S curve shifts upward to S1. It cuts the I curve at E1 and the new equilibrium level of income is Y1. The result's that there's reduction not only in the society’s rate of saving but also in the rate of investment with the fall in income from Y to Y1. People have tried to save more but they ended up saving less. This is the paradox of thrift.

Q15) Explain Keynesian theory tools to the developing countries? 8 marks

A15)

The Keynesian Tools and Underdeveloped Countries:

Effective Demand and Underdeveloped Economy:

According to Keynes, employment depends upon effective demand, which manifests itself in the spending of income.

No doubt, in underdeveloped economies, effective demand is low, but it is on account of low level of income and not on account of excess savings, as is the case in advanced economies.

A depressed developed economy has not only idle manpower but also excess industrial capacity and raw materials, while in underdeveloped countries the complementary resources like capital stock are lacking.

Thus, it is said that the theory of effective demand, as enunciated by Keynes, does not hold good in underdeveloped countries ; here the problem is more of increasing supplies and raising the surplus for capital formation rather than of generating demand which is already there in an unsatisfied form.

Consumption Function and Underdeveloped Economy:

Consumption function in underdeveloped economies presents interesting features. People have unusually high (near unity) average and marginal propensities to consume. Therefore, the marginal propensity to save is low, partly on account of low income levels and partly on account of high marginal propensity to consume.

In LDC’s the percentage of income saved decreases with the increase in income, while the tendency is just the opposite in advanced economics.

In advanced economics additional expenditure on consumption is primarily on industrial consumer goods and the percentage of expenditure on food is very low. In an underdeveloped economy; on account of low level of income, increases in income tend to be mostly spent on food grains and other protective food or in substituting superior quality of food for inferior types. In India, the income elasticity of demand for food has been found to be mostly near unity.

In an underdeveloped economy household enterprises predominate and production is more for self-consumption than for the market. Thus when income increases, the marginal propensity to consume leads to an increase in the demand for self-consumption rather than for purchases in the market.

The increased demand for self- consumption of food is met by a diversion of output from the market causing a reduction in the marketable surplus.

Thus, in an underdeveloped economy, an increase in income and hence in the propensity to consume would lead to a fall in the marketable surplus and rise in the level of prices. Keynesian’ remedy to remove unemployment in underdeveloped economy may actually plunge the economy into an inflationary spiral.

Hence one of the most important constituents of effective demand, namely, consumption function, has severe limitations for application in an underdeveloped economy.