Unit 1

Introduction to Management Accounting

Q1) Define management accounting. State the nature of management accounting. 8

A1) Management accounting is a new approach to accounting. The term management accounting is composed of two words — management and accounting. It refers to accounting for the management. Management Accounting is a modern tool to management. Management accounting provides the techniques for interpretation of accounting data. Management is concerned with decision-making. So, the role of management accounting is to facilitate the process of decision-making by the management. Management accounting is that field of accounting, which deals with providing information including financial accounting information to managers for their use in planning, decision-making, performance evaluation, control, management of costs and cost determination for financial reporting.

The following aspects are considered as the nature of management accounting:

(i) Management accounting is a decision making system:

Management accounting provides accounting information in such a way as to assist management in the creation of policy and in the day-to-day operations. Though management accountant is not taking any decision but provides data which is helpful to management in decision making. It communicates a great variety of facts in a systematic and meaningful manner.

(ii) Management accounting is futuristic:

Management accounting unlike the financial accounting, deals with the future. It helps in planning the future-because decisions are always taken for the future course of action. In the decision making process management accounting provides selective and fruitful information out of the data collected.

(iii) Management accounting is a technique of selective nature:

Management accountant takes into account only those data from the financial statement and communicates to the management which is useful for taking decisions.

(iv) Management accounting analyses different variables:

Management accounting helps in analysing the reasons for variations in profit as compared to the past period. It analyses the effects of different variables on the profits and profitability of the concern.

(v) Management accounting does not set particular formats for information:

It provides necessary information to the management in the form which may be more useful to the management in taking various decisions on different aspects of the business.

Q2) Discuss the scope and significance of management accounting. 5

A2) Management accounting includes financial accounting and extends to the operation of a system of cost accountancy, budgetary control and statistical data. The scope of management accounting, inter alia includes:

- Formation, installation and operation of accounting, cost accounting, tax accounting and information systems. Management accountant has to construct and reconstruct these systems to meet the changing needs of management functions.

- The compilation and preservation of vital data for management planning. The accounts and the document files are repository of vast quantities of details about the past progress of the enterprise, without which forecasts of the future is very hazardous for the enterprise. The management accountant presents the past data in such a way as to reflect the trends of events to the management. He is supposed to give his assessment of anticipated changes in relevant areas. Such information provides effective assistance in the planning process. At times the management accountant may be called upon to associate with and even supervise the actual planning process along with other members of the management team.

- Providing means of communicating management plans to the various levels of organisation. This, on the one hand ensures the coordination of various segments of the enterprise plans and on the other defines the role of individual segments in the whole plan and assists the management in directing their activities.

4. Providing and installing an effective system of feed-back reports. This would enable the management in its controlling function. By pin-pointing the significant deviations between actual and expected activities, and by adhering to the principles of selectivity and relevance, such reports help in the installation and operation of the system of ‘management by exceptions’. The management accountant is expected to analyse the deviation by reasons and responsibility and to suggest appropriate corrective measures in deserving cases.

5. Analysing and interpreting accounting and other data to make it understandable and usable to the management. It is only through such analysis and clarification that the management is enabled to place the various data and figures in proper perspective in the performance of its functions. Such analysis assists management in the location of responsibilities and to effect necessary changes in the organisational set up to achieve the objectives of the enterprise in a more efficient manner.

6. Assisting management in decision-making by (a) providing relevant accounting, other data and (b) analysing the effect of alternative proposals on the profits and position of the enterprise. Management accountant helps the management in a proper understanding and analysis of the problem in hand and presentation of factual information obviously in financial terms.

7. Providing methods and techniques for evaluating the performance of the management in the light of the objectives of the enterprises, thus assisting in the implementation of the principle of management by objectives.

8. Improving, modifying and sharpening the effectiveness of co-existing techniques of analysis. The management accountant should always think of increasing the practicability of existing techniques. He should be on the lookout for the development of new techniques as well.

Q3) Discuss the functions of management accounting. 5

A3) The primary objective of Management Accounting is to maximize profits or minimize losses. This is done through the presentation of statements in such a way that the management is able to take corrective policy or decision. The functions of management accounting are-

- Storehouse of Reliable Data:

Management accounting collects the data from various sources and stores the information for appropriate use, as and when needed. Though the main source of data is financial statements, Management Accounting is not restricted to the use of monetary data only. While preparing a sales budget, the management accountant uses the past data of the products sold from the financial records and makes projections based on the consumer surveys, population figures and other reliable information to estimate the sales budget.

2. Modification and Presentation of Data:

Data collected from financial statements and other sources is not readily understandable to the management. The data is modified and presented to the management in such a way that it is useful to the management. If sales data is required, it can be classified according to product, geographical area, season-wise, type of customers and time taken by them for making payments. Similarly, if production figures are needed, these can be classified according to product, quality, and time taken for manufacturing process.

3. Communication and Coordination:

Targets are communicated to the different departments for their achievement. Coordination among the different departments is essential for the success of the organisation. The targets and performances of different departments are communicated to the concerned departments to increase the efficiency of the various sections, thereby increasing the profitability of the firm. Variance analysis is an important tool to bring the necessary matters to the attention of the concerned to exercise control and achieve the desired results.

4. Financial Analysis and Interpretation:

Management accounting helps in strategic decision making. Top managerial executives may lack technical knowledge. Management accounting for Managers Accountant gives facts and figures about various policies and evaluates them in monetary terms. He interprets the data and gives his opinion about various alternative courses of action so that it becomes easier to the management to take a decision.

5. Control:

It is absolutely essential that there should be a system of monitoring the performance of all divisions and departments so that deviations from the desired path are brought to light, without delay and are corrected then and there. This process is termed as control. The aim of this function control is to facilitate accomplishment of the goals in an efficient manner. For the discharge of this important function, management accounting provides meaningful information in a systematic and effective manner.

6. Supplying Information to Various Levels of Management:

Every level of management requires information for decision-making and policy execution. Top-level management takes broad policy decisions, leaving day-to-day decisions to lower management for execution. Supply of right information, at proper time, increases efficiency at all levels.

7. Reporting to Management:

Reporting is an important function of management accounting to achieve the targets. The reports are presented in the form of graphs, diagrams and other statistical techniques so as to make them easily understandable. These reports may be monthly, quarterly, and half-yearly. These reports are helpful in giving constant review of the working of the business.

Figure: Functions of management accounting

Q4) Write a note on decision making process of management accounting. 5

A4) Management accounting helps the management in decision making through the techniques of marginal costing, differential costing, capital budgeting, cash flow analysis, discounted cash flow etc. to select the best alternative which will maximise the profits of the business. The process of making decisions is generally considered to involve the following steps:

1 Identify the various alternatives for a given type of decision.

2. Obtain the necessary data necessary to evaluate the various alternatives.

3. Analyze and determine the consequences of each alternative.

4. Select the alternative that appears to best achieve the desired goals or objectives.

5. Implement the chosen alternative.

6. At an appropriate time, evaluate the results of the decisions against standards or other desired results.

The concept of decision‑making is a complex subject with a vast amount of management literature behind it. How businessmen make decisions has been intensively studied. In management accounting, it is useful to classify decisions as:

1. Strategic and tactical.

2. Short‑run and long-run.

Strategic and Tactical Decisions

Strategic decisions are broad‑based, qualitative type of decisions which include or reflect goals and objectives. Strategic decisions are non-quantitative in nature. Strategic decisions are based on the subjective thinking of management concerning goals and objectives. Tactical decisions are quantitative executable decisions which result directly from

The strategic decisions. The distinction between strategic and tactical is important in management accounting because the techniques of management accounting pertain primarily to tactical decisions. Management accounting does not typically provide techniques for assisting in making strategic decisions.

Short‑run Versus Long-run Decision‑making

The decision‑making process is complicated somewhat by the fact that the horizon for making decisions may be for the short‑run or long‑run. The choice between the short‑run or the long‑run is particularly critical concerning the setting of profitability objectives.

Q5) Discuss the techniques involved in decision making process. 5

A5)

- Marginal costing

Marginal costing is ―the ascertainment of marginal costs and of the effect on profit of changes in volume or type of output by differentiating between fixed costs and variable costs. Several other terms in use like direct costing, contributory costing, variable costing, comparative costing, differential costing and incremental costing are used more or less synonymously with marginal costing. It is a process whereby costs are classified into fixed and variable and with such a division so many managerial decisions are taken. The essential feature of marginal costing is division of total costs into fixed and variable, without which this could not have existed. Variable costs vary with volume of production or output, whereas fixed costs remains unchanged irrespective of changes in the volume of output.

2. Differential costing

Differential Cost is the change in the costs which results from the adoption of an alternative course of action. The alternative actions may arise due to change in sales volume, price, product mix (by increasing, reducing or stopping the production of certain items), or methods of production, sales, or sales promotion, or they may be due to make or buy or take or refuse decisions. When the change in costs occurs due to change in the activity from one level to another, differential cost is referred to as incremental cost or decremental cost, if a decrease in output is being considered, i.e. total increase in cost divided by the total increase in output.

3. Capital budgeting

Capital Budgeting is defined as the firm‘s decision to invest its current funds most efficiently in long term activities in anticipation of an expected flow of future benefits over a series of years. Capital budgeting decision may be defined as ―Firms decisions to invest its current funds most efficiently in long term activities in anticipation of an expected flow of future benefits over a series of year. The firm‘s capital budgeting decisions will include addition, disposition, modification and replacement of fixed assets.

4. Cash flow analysis

A cash flow analysis determines a company’s working capital—the amount of money available to run business operations and complete transactions. That is calculated as current assets (cash or near-cash assets, like notes receivable) minus current liabilities (liabilities due during the upcoming accounting period).

5. Discounted cash flow

Discounted cash flow (DCF) is a valuation method used to estimate the value of an investment based on its expected future cash flows. DCF analysis attempts to figure out the value of an investment today, based on projections of how much money it will generate in the future. This applies to the decisions of investors in companies or securities, such as acquiring a company, investing in a technology start-up, or buying a stock, and for business owners and managers looking to make capital budgeting or operating expenditures decisions such as opening a new factory or purchasing or leasing new equipment.

Q6) Distinguish between financial accounting and management accounting. 8

A6) Financial accounting and management accounting both are branches of accounting. Some of the differences between them are-

Sl no. | Financial accounting | Management accounting |

1. | Financial accounting deals with the business transactions and events for the enterprise as a whole. | Management accounting, in addition to the study of events in relation to the enterprise as a whole takes organisation in its various units and segments and attempts to trace the impact and effect of the business transactions and events through its various divisions and sub-divisions. |

2. | It reveals the overall performance and position of the enterprise. | It emphasise on the details of operational costs, inventories, products, process and jobs. It traces the effect and impact of the business transactions and events on costs, inventories, processes, jobs and products |

3. | Financial accounting is attached more with reporting the results and position of the business to Persons and authorities other than management - Government, creditors, investors, owners, etc. | Management accounting is concerned more with generating information for the use of internal management and hence the information reflects the real or really expected position. |

4. | It records and analyses business events long after they have taken place. | It analyses the events as they take place and also anticipates such events for the future. |

5. | The periodicity in reporting financial accounts is much wider than in case of management accounting. In financial accounting, generally, results are reported on year to year basis. | In management accounting, weekly, fortnightly and even monthly reporting is used. |

6. | Financial accounting has to be governed by the “generally accepted principles”. | The form and content of management accounting information differs according to the needs and purpose. |

7. | Financial accounting is a must in case of joint stock companies to meet the statutory provisions of company law and tax laws. | It is entirely optional and its forms and contents depend upon the outlook of the management. |

8. | Financial accounting provides monetary information only. | Management accounting statements in addition to monetary information also consist non-monetary information, viz., quantities of materials consumed, number of workers, quantities produced and sold and so on. |

9. | Financial statements are required to be published and audited by statutory auditors. | Management accounting statements are for internal use and thus neither published nor audited. |

10. | It is more precise than the management accounting data. | It is less precise than the financial accounting data. |

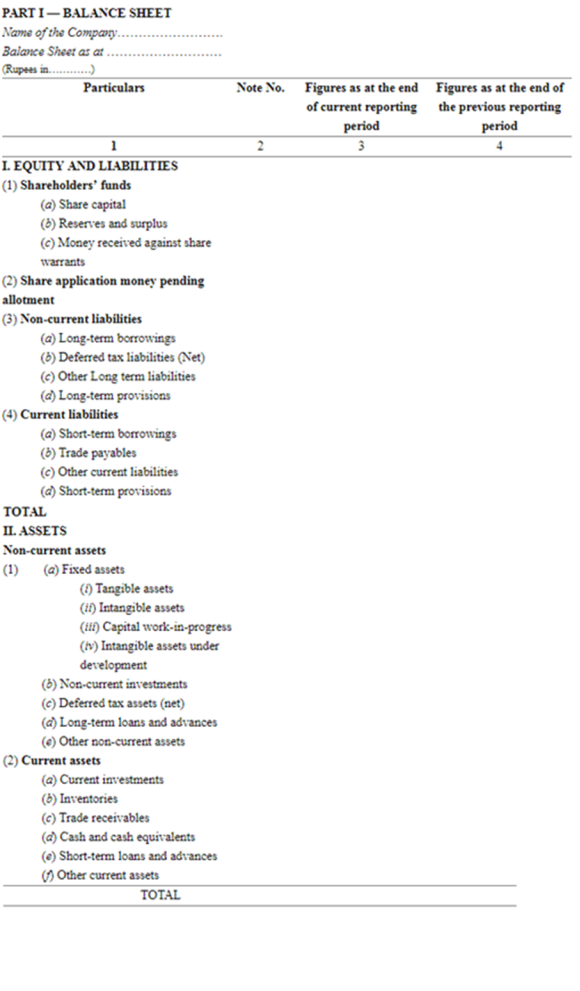

Q7) Define balance sheet. Highlight the specimen of balance sheet. 5

A7) Balance sheet is a financial statement prepared at the end of the accounting period to know the financial position of the company. The balance provides information about the nature and quality of assets and liabilities of the company. Schedule III of the Companies Act, 2013 deal with the Balance sheet and profit and loss account. The specimen format of the balance sheet is depicted below-

Q8) State briefly about the following balance sheet items 8

- Share capital.

- Reserves and surplus.

- Long term borrowings.

- Tangible and intangible assets.

A8)

Share capital:

a. The number and amount of shares authorized.

b. The number of shares issued, subscribed and fully paid, and subscribed but not fully paid.

c. Par value per share.

d. A reconciliation of the number of shares outstanding at the beginning and at the end of the reporting period.

e. The rights, preferences and restrictions attaching to each class of shares including restrictions on the distribution of dividends and the repayment of capital.

f. Shares in respect of each class in the company held by its holding company or its ultimate holding company including shares held by or by subsidiaries or associates of the holding company or the ultimate holding company in aggregate.

g. Shares in the company held by each shareholder holding more than 5 per cent, shares specifying the number of shares held.

h. Shares reserved for issue under options and contracts/commitments for the sale of shares/disinvestment, including the terms and amounts.

i. For the period of five years immediately preceding the date as at which the Balance Sheet is prepared.

a) Aggregate number and class of shares allotted as fully paid-up pursuant to contract(s) without payment being received in cash.

b) Aggregate number and class of shares allotted as fully paid-up by way of bonus shares.

c) Aggregate number and class of shares bought back.

j. Terms of any securities convertible into equity/preference shares issued along with the earliest date of conversion in descending order starting from the farthest such date.

k. Calls unpaid (showing aggregate value of calls unpaid by directors and officers).

Reserves and Surplus

i) Capital Reserves;

Ii) Capital Redemption Reserve;

Iii) Securities Premium Reserve;

Iv)Debenture Redemption Reserve;

v) Revaluation Reserve;

Vi) Share Options Outstanding Account;

Vii) Other Reserves (specify the nature and purpose of each reserve and the amount in respect thereof);

Viii) Surplus i.e., balance in Statement of Profit and Loss disclosing allocations and appropriations such as dividend, bonus snares and transfer to/from reserves, etc.

Long-Term Borrowings

i) Bonds/debentures,

Ii) Term loans:

(a) from banks.

(b) from other parties

Iii) Deferred payment liabilities;

Iv) Deposits;

v) Loans and advances from related parties;

Vi) Long term maturities of finance lease obligations;

Vii) Other loans and advances (specify nature)

Tangible assets

i) Land,

Ii) Buildings;

Iii) Plant and Equipment;

Iv) Furniture and Fixtures;

v) Vehicles;

Vi) Office equipment;

Vii) Others (specify nature).

Intangible assets

i) Goodwill,

Ii) Brands /trademarks;

Iii) Computer software;

Iv) Mastheads and publishing titles;

v) Mining rights;

Vi) Copyrights, and patents and other intellectual property rights, services and operating rights;

Vii) Recipes, formulae, models, designs and prototypes;

Vii) Licences and franchise;

Viii) Others (specify nature).

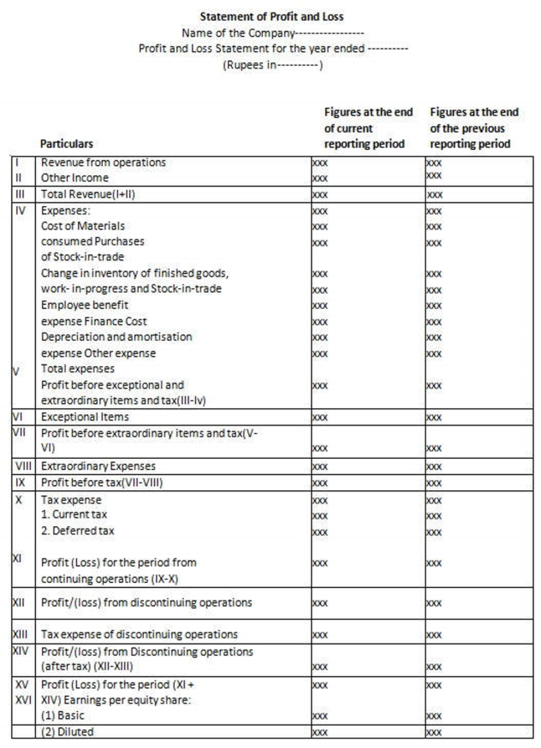

Q9) What is income statement? Draw the specimen of income statement. 5

A9) Income statement is a financial statement of the company that shows profits/loss of the company for an accounting period. It is also known as profit and loss account which records sales, purchase and all direct and indirect expenses related to the respective accounting period. The specimen format of income statement is depicted below-

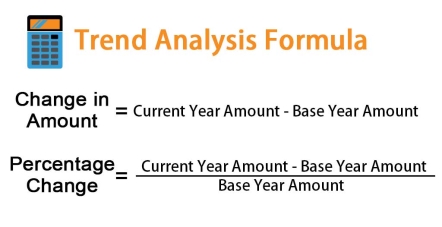

Q10) Write a note on trend analysis, common size statement and comparative statement. 12

A10) Trend analysis

Trend analysis is a financial statement analysis technique that shows changes in the amounts of corresponding financial statement items over a period of time. It is a useful tool to evaluate the trend situations. The statements for two or more periods are used in horizontal analysis. The earliest period is usually used as the base period and the items on the statements for all later periods are compared with items on the statements of the base period. It evaluates an organization’s financial information over a period of time. Periods may be measured in months, quarters, or years, depending on the circumstances. The goal is to calculate and analyze the amount change and percent change from one period to the next.

Importance of trend analysis-

- Trend analysis identifies current and future movements of an investment or group of investments.

- It is comparing past and current financial ratios as they related to various institutions to project how long the current trend will continue.

- It is helpful to investors who wish to make the most of their investments.

- The process of a trend analysis begins with identifying the category of the investments that are under consideration.

- It is possible to determine if all or most of those factors are still exerting an influence.

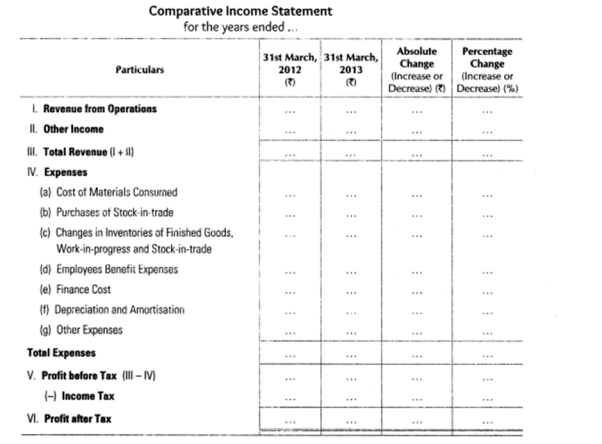

Comparative Statement

Comparative financial statements are one of the most commonly used tools for undertaking the financial analysis of the statements generated by the business. Comparative statements or comparative financial statements are statements of financial position of a business at different periods. These statements help in determining the profitability of the business by comparing financial data from two or more accounting periods. There are two types of comparative statements which are as follows

- Comparative income statement: Income statements provide the details about the results of the operations of the business, and comparative income statements provide the progress made by the business over a period of a few years. This statement also helps in ascertaining the changes that occur in each line item of the income statement over different periods. The comparative income statement not only shows the operational efficiency of the business but also helps in comparing the results with the competitors, over different time periods. This is possible by comparing the operational data spanning multiple periods of accounting. The steps in preparing a comparative income statement are-

- Specify absolute figures of all the items related to the accounting period under consideration.

- Determine the absolute change that has occurred in the items of the income statement. It can be achieved by finding the difference between previous year values with the current year values.

- Calculate the percentage change in the items present in the current statement with respect to previous year statements.

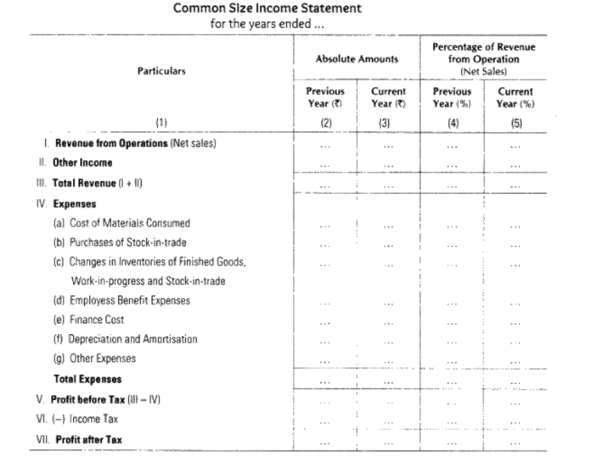

Common Size Statement

Common size statement is a form of analysis and interpretation of the financial statement. It is also known as vertical analysis. This method analyses financial statements by taking into consideration each of the line items as a percentage of the base amount for that particular accounting period. Common size statements are not any kind of financial ratios but are a rather easy way to express financial statements, which makes it easier to analyse those statements. Common size statements are always expressed in the form of percentages. Therefore, such statements are also called 100 per cent statements or component percentage statements as all the individual items are taken as a percentage of 100. There are two types of common size statements:

- Common size income statement: This is one type of common size statement where the sales is taken as the base for all calculations. Therefore, the calculation of each line item will take into account the sales as a base, and each item will be expressed as a percentage of the sales. It helps the business owner in understanding the following points-

- Whether profits are showing an increase or decrease in relation to the sales obtained.

- Percentage change in cost of goods that were sold during the accounting period.

- Variation that might have occurred in expense.

- If the increase in retained earnings is in proportion to the increase in profit of the business.

- Helps to compare income statements of two or more periods.

- Recognises the changes happening in the financial statements of the organisation, which will help investors in making decisions about investing in the business.

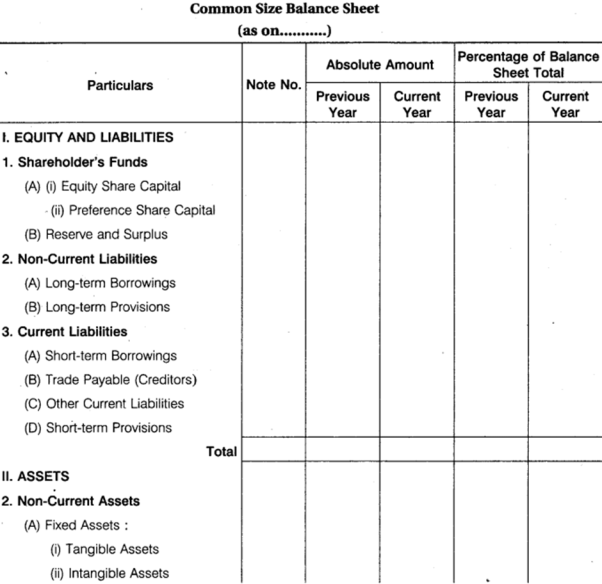

2. Common size balance sheet: A common size balance sheet is a statement in which balance sheet items are being calculated as the ratio of each asset in relation to the total assets. For the liabilities, each liability is being calculated as a ratio of the total liabilities. Common size balance sheets can be used for comparing companies that differ in size. The comparison of such figures for the different periods is not found to be that useful because the total figures seem to be affected by a number of factors.

Q11) Draw the specimen of common size statement with imaginary figures. 8

A11) Common size statement is a form of analysis and interpretation of the financial statement. There are two types of common size statements:

- Common size income statement.

- Common size balance sheet.

Specimen common size income statement

Specimen of common size balance sheet

Q12) Discuss the items of income statement. 8

A12) The items of statement of profit and loss are discussed as follows:

- Revenue from operations

This includes: (i) Sale of products

(ii) Sale of services ,

(iii) Other operating revenues.

In respect to a finance company, revenue from operational shall include revenue from interest, dividend and income from other financial services. It may be noted that under each of the above heads shall be disclosed separately by way of notes to accounts to the extent applicable.

2. Other income

(i) Interest income (in case of a company other than a finance company),

(ii) Dividend income,

(iii)Net gain/loss on sale of investments,

(iv) Other non-operating income (net of expenses directly attributable to such income).

- Expense :

Expenses incurred to earn the income shown under various heads as discussed below:

(a) Cost of Materials: It applies to manufacturing companies. It consists of raw materials and other materials consumed in manufacturing of goods.

(b) Purchase of Stock-in-trade: It means purchases of goods for the purpose of trading.

(c) Changes in inventories: It is the difference between opening inventory (stock) finished goods, WIP and of finished goods, WIP and stock-in-trade and closing stock-in-trade inventory.

(d) Employees benefit expenses: Expenses incurred on employees towards salary, wages, leave encashment, staff welfare, etc., are shown under this head. Employees benefit expenses may be further categorised into direct and indirect expenses.

(e) Finance cost: It is the expenses towards interest charges during the year on the borrowings. Only the interest cost is to be shown under this head. Other financial expenses such as bank charges are shown under “Other Expenses”.

(f) Depreciation: Depreciation is the diminution in the value of fixed assets whereas amortisation is writing off the amount relating to intangible assets.

(g) Other expenses: All other expenses which do not fall in the above categories are shown under other expenses. Other expenses may further be categorised into direct expenses, indirect expenses and non-operating expenses.

Q13) Write a note on relationship between balance sheet and income statement. 5

A13) The relationship between balance sheet and income statement are discussed below-

a) The income statement communicates the inflows and outflows of assets, where inflows are the revenues generated and outflows are the expenses. An excess of inflows over outflows is called net income, and an excess of outflows over inflows is called a net loss.

b) The balance sheet communicates what the entity owns in terms of assets, what it owes in terms of liabilities, and the difference between those two which represents what the owners of the company are entitled to. The owner’s portion is called equity.

c) The income statement and balance sheet of a company are linked through the net income for a period and the subsequent increase, or decrease, in equity that results. The income that an entity earns over a period of time is transcribed to the equity portion of the balance sheet. The income represents an increase in the owners’ claim against the assets: Income is NOT a cash asset. It is through the income and equity accounts that the balance sheet and income statement reflect the total financial picture of the entity.

Q14) Explain about the balance sheet items. 12

A14) Description of balance sheet items-

- Share capital:

a. The number and amount of shares authorized.

b. The number of shares issued, subscribed and fully paid, and subscribed but not fully paid.

c. Par value per share.

d. A reconciliation of the number of shares outstanding at the beginning and at the end of the reporting period.

e. The rights, preferences and restrictions attaching to each class of shares including restrictions on the distribution of dividends and the repayment of capital.

f. Shares in respect of each class in the company held by its holding company or its ultimate holding company including shares held by or by subsidiaries or associates of the holding company or the ultimate holding company in aggregate.

g. Shares in the company held by each shareholder holding more than 5 per cent, shares specifying the number of shares held.

h. Shares reserved for issue under options and contracts/commitments for the sale of shares/disinvestment, including the terms and amounts.

i. For the period of five years immediately preceding the date as at which the Balance Sheet is prepared.

a) Aggregate number and class of shares allotted as fully paid-up pursuant to contract(s) without payment being received in cash.

b) Aggregate number and class of shares allotted as fully paid-up by way of bonus shares.

c) Aggregate number and class of shares bought back.

j. Terms of any securities convertible into equity/preference shares issued along with the earliest date of conversion in descending order starting from the farthest such date.

k. Calls unpaid (showing aggregate value of calls unpaid by directors and officers).

l. Forfeited shares (amount originally paid-up).

2. Reserves and Surplus

i) Capital Reserves;

Ii) Capital Redemption Reserve;

Iii) Securities Premium Reserve;

Iv)Debenture Redemption Reserve;

v) Revaluation Reserve;

Vi)Share Options Outstanding Account;

Vii) Other Reserves (specify the nature and purpose of each reserve and the amount in respect thereof);

Viii) Surplus i.e., balance in Statement of Profit and Loss disclosing allocations and appropriations such as dividend, bonus snares and transfer to/from reserves, etc.

3. Long-Term Borrowings

i) Bonds/debentures

Ii) Term loans:

(a) from banks.

(b) from other parties

Iii) Deferred payment liabilities;

Iv) Deposits;

v) Loans and advances from related parties;

Vi) Long term maturities of finance lease obligations;

Vii) Other loans and advances (specify nature)

4. Other Long-term Liabilities

(i) Trade payables

(ii) Others.

5. Long-term provisions

i) Provision for employee benefits

Ii) Others (specify nature).

6. Short-term borrowings

i) Loans repayable on demand

(a) from banks

(b) from other parties

(c) Loans and advances from related parties

(d) Deposits

(e) Other loans and advances (specify nature).

7. Other current liabilities

i) Current maturities of long-term debt;

Ii) Current maturities of finance lease obligations;

Iii) Interest accrued but not due on borrowings;

Iv) Interest accrued and due on borrowings;

v) Income received in advance;

Vi) Unpaid dividends;

Vii) Application money received for allotment of securities and due for refund and interest accrued thereon. Share application money includes advances towards allotment of share capital. The terms and conditions including the number of shares proposed to be issued, the amount of premium, if any, and the period before which shares shall be allotted shall be disclosed. It shall also be disclosed whether the company has sufficient authorised capital to cover the share capital amount resulting from allotment of shares out of such share application money. Further, the period for which the share application money has been pending beyond the period for allotment as mentioned in the document inviting application for shares along with the reason for such share application money being pending shall be disclosed. Share application money not exceeding the issued capital and to the extent not refundable shall be shown under the head Equity and share application money to the extent refundable, i.e., the amount in excess of subscription or in case the requirements of minimum subscription are not met, shall be separately shown under “Other current liabilities”;

Viii) Unpaid matured deposits and interest accrued thereon;

Ix) Unpaid matured debentures and interest accrued thereon;

x) Other payables (specify nature).

8. Short-term provisions

i) Provision for employee benefits

Ii) Others (specify nature).

9. Tangible assets

i) Land

Ii) Buildings;

Iii) Plant and Equipment;

Iv) Furniture and Fixtures;

v) Vehicles;

Vi) Office equipment;

Vii) Others (specify nature).

10. Intangible assets

i) Goodwill

Ii) Brands /trademarks;

Iii) Computer software;

Iv) Mastheads and publishing titles;

v) Mining rights;

Vi) Copyrights, and patents and other intellectual property rights, services and operating rights;

Vii) Recipes, formulae, models, designs and prototypes;

Vii) Licences and franchise;

Viii) Others (specify nature).

11. Non-current investments

i) Investment property;

Ii) Investments in Equity Instruments;

Iii) Investments in preference shares;

Iv) Investments in Government or trust securities;

v) Investments in debentures or bonds;

Vi) Investments in Mutual Funds;

Vii) Investments in partnership firms;

Viii) Other non-current investments (specify nature). Under each classification, details shall be given of names of the bodies corporate indicating separately whether such bodies are

(a) subsidiaries,

(b) associates,

(c) joint ventures, or

(d) controlled special purpose entities in whom investments have been made and the nature and extent of the investment so made in each such body corporate (showing separately investments which are partly-paid). In regard to investments in the capital of partnership firms, the names of the firms (with the names of all their partners, total capital and the shares of each partner) shall be given.

12. Long-term loans and advances

i) Capital Advances;

Ii) Security Deposits;

Iii) Loans and advances to related parties (giving details thereof);

Iv) Other loans and advances (specify nature).

13.Other non-current assets

i) Long-term Trade Receivables (including trade receivables on deferred credit terms);

Ii) Others (specify nature);

Iii) Long term Trade Receivables, shall be sub-classified as:

(a) Secured, considered good;(b) Unsecured, considered good;

(c) Doubtful

14. Current Investments

i) Investments in Equity Instruments;

Ii) Investment in Preference Shares;

Iii) Investments in Government or trust securities:

Iv) Investments in debentures or bonds;

v) Investments in Mutual Funds;

Vi) Investments in partnership firms;

Vii) Other investments (specify nature).

15. Inventories

i) Raw materials;

Ii) Work-in-progress;

Iii) Finished goods;

Iv) Stock-in-trade (in respect of goods acquired for trading);

v) Stores and spares;

Vi) Loose tools;

Vii) Others (specify nature)

16. Trade Receivables

Aggregate amount of Trade Receivables outstanding for a period exceeding six months from the date they are due for payment

i) Secured, considered good;

Ii) Unsecured, considered good;

Iii) Doubtful.

17. Cash and cash equivalents

i) Balances with banks;

Ii) Cheques, drafts on hand;

Iii) Cash on hand;

Iv) Others (specify nature)

18. Short-term loans and advances

i) Loans and advances to related parties (giving details thereof);

Ii) Others (specify nature).

Sub-categorised as a) Secured, considered good; b) Unsecured, considered good; c) Doubtful.

19. Other current assets (specify nature)

Which incorporates current assets that do not fit into any other asset categories

20. Contingent liabilities

i) Claims against the company not acknowledged as debt

Ii) Guarantees;

Iii) Other money for which the company is contingently liable.

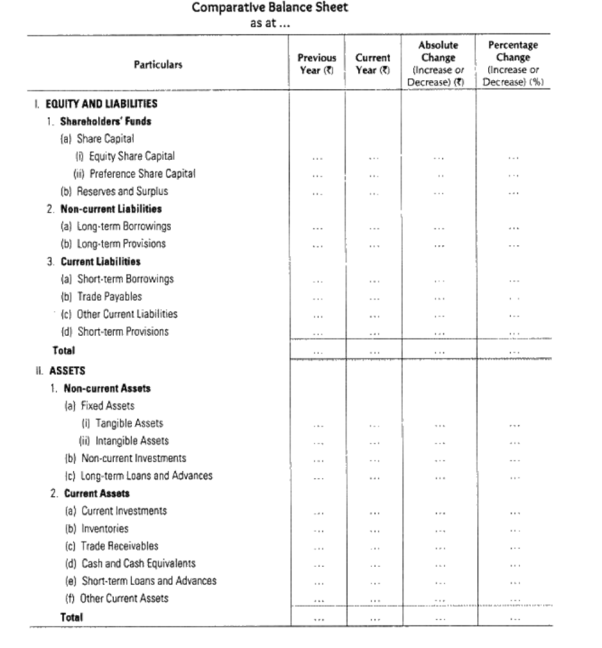

Q15) Draw the specimen of comparative statement. 8

A15) There are two types of comparative statements-

- Specimen of comparative income statement

2. Specimen of comparative balance sheet