FRD

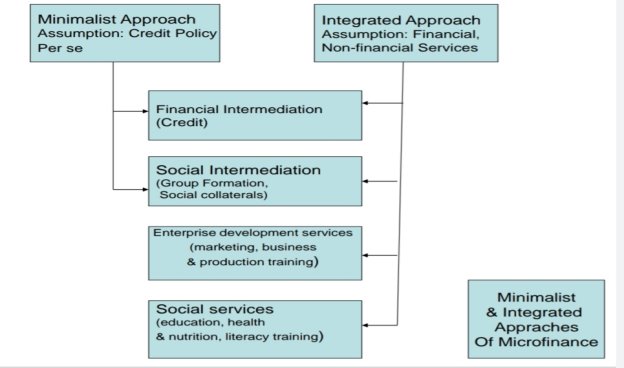

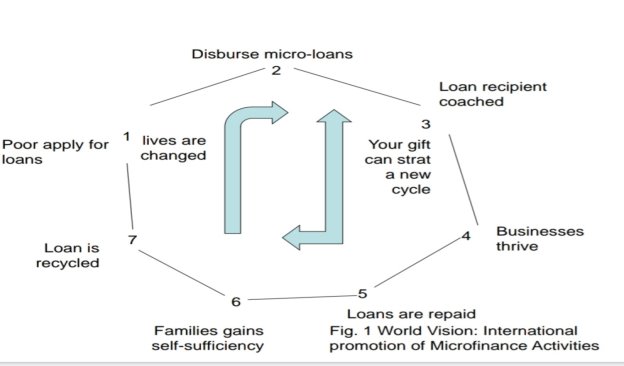

UNIT-2MICRO FINANCE Q1) Define Microfinance. Write the Scope of Micro Finance.A1) According to Kofi Annan (Sec. General of UN) “Microfinance recognizes that poor people are remarkable reservoirs of energy and knowledge and while the lack of financial services is not just a sign of poverty. Today it is looked as an untapped opportunity to create markets, bring people in from the margins and give them the tools to help themselves.”According to Laureate Milton Friedman, "The Poor stay poor, not because they are lazy but because they have no access to capital.” Micro finance includes the following subject areas:Micro-loans:Microfinance loans are significant as these are provided to borrowers with no collateral. The end result of microloans should be to have its recipient outgrow smaller loans and be ready for traditional bank loans.The importance of Micro loans is that it is provided with no collateral. The borrower is not bound to pledge something as a security for repayment of the loans. It offers a better overall loan repayment rate than traditional banking product.it enhance the possibility of future investments as it is a sustainable process. Most importantly it gives people a soothing and non stressful life. Micro-savings:Micro savings accounts allow entrepreneurs operate savings account with no minimum balance. These accounts help users inculcate financial discipline and develop an interest in saving for future.The importance of micro savings are that the poor people and small businessman with low income can operate their account with no minimum balance. These accounts do not bound people to maintain their accounts with certain amount of money in it. Micro-insurance:Microinsurance is a type of coverage provided to borrowers of microloans. These insurance plans have lower premiums than traditional insurance policies.The importance of microinsurance is that it is the machinery to protect the poor people from all the mishap that might take place in furture, example : Acidents, chronic disease etc. It addresses to all kind of risks that people of low income group or poor people face globally. Q2) Why microfinance is Important? How does it help Rural People.A2) The area of microfinance has been highlighted since 1970s with an aim to uplift the poor section of the society and to enhance economic growth. Its importance has been amplified amidst global financial crisis when trust into formal banking system is shaken. Microfinance in India performs a very important role in the development of its nation. It act as an anti-poverty vaccine for the people living in rural areas. It aims at assisting communities of the economically excluded to achieve greater level of asset creation and income security at the household and community level. The utmost significance of microfinance in India is that it dispenses the access to the capital to small entrepreneurs. As it has been discussed above that microfinance in India is providing loans, insurance, access to savings accounts. The concept of microfinance focuses on women also by granting them loans. It act as a tool for the empowerment of poor women as women are becoming independent, they are able to contribute directly to the well beings of their families and are able to confront all the gender inequalities. The major targets of microfinance are the poor rural and urban households and women too. The Reserve Bank Of India imparts no ceiling with respect to minimum and maximum amounts to be given as loan. Credit is important to the poor people for maintaining the common imbalance in between the income and their expenditure. It is also vital to the poor people for the income generating activities like investing in marginal farms and other small scale self employment ventures. Their access to formal banking channels are low due to the lack of resources an nature of formal credit institutions. Consequently in India, Microfinance institutions and self help groups are leading to other traditional banking channels as they are catering the need of credit to poor people. It has contribute a lot in enhancing the quality of life of the poor people. Therefore microfinance is not a financial system but a tool to allievate poverty from the country and bring social change and especially to uplift the status of women in our country so they can become self reliance. There is a public interest the interest of microfinance and this is what makes it acceptable as valid goal for public policy. Q3) Explain the models of Microfinance around the world.A3) Associations ModelThis is where the target community forms an 'association' through which various microfinance (and other) activities are initiated. Such activities may include savings. Associations or groups can be composed of youth, women; can form around political/religious/cultural issues; can create support structures for microenterprises and other work-based issues.In some countries, an 'association' can be a legal body that has certain advantages such as collection of fees, insurance, tax breaks and other protective measures. Distinction is made between associations, community groups, peoples organizations, etc. on one hand (which are mass, community based) and NGOs, etc. which are essentially external organizations. Bank Guarantees ModelAs the name suggests, a bank guarantee is used to obtain a loan from a commercial bank. This guarantee may be arranged externally (through a donor/donation, government agency etc.) or internally (using member savings). Loans obtained may be given directly to an individual, or they may be given to a self-formed group.Bank Guarantee is a form of capital guarantee scheme. Guaranteed funds may be used for various purposes, including loan recovery and insurance claims. Several international and UN organizations have been creating international guarantee funds that banks and NGOs can subscribe to, to on lend or start microcredit programmes. Community Banking ModelCommunity Banking model essentially treats the whole community as one unit, and establishes semi-formal or formal institutions through which microfinance is dispensed. Such institutions are usually formed by extensive help from NGOs and other organizations, who also train the community members in various financial activities of the community bank.These institutions may have savings components and other income-generating projects included in their structure. In many cases, community banks are also part of larger community development programmes which use finance as an inducement for action. Cooperatives ModelA co-operative is an autonomous association of persons united voluntarily to meet their common economic, social, and cultural needs and aspirations through a jointly-owned and democratically-controlled enterprise. Some cooperatives include member-financing and savings activities in their mandate. Credit Unions ModelA credit union is a unique member-driven, self-help financial institution. It is organized by and comprised of members of a particular group or organization, who agree to save their money together and to make loans to each other at reasonable rates of interest. Grameen ModelThe Grameen model emerged from the poor-focussed grassroots institution, Grameen Bank, started by Prof. Mohammed Yunus in Bangladesh. It essentially adopts the following methodology: A bank unit is set up with a Field Manager and a number of bank workers, covering an area of about 15 to 22 villages. The manager and workers start by visiting villages to familiarize themselves with the local milieu in which they will be operating and identify prospective clientele, as well as explain the purpose, functions, and mode of operation of the bank to the local population. Q4) Write a short note on portfolio Securitization.A4) Securitisation is a process under which a lender bundles loans together and sell them to another financial institution, freeing up capital. The risk of the loan is transferred to the buyer in the process. Financial institutions such as banks buy these portfolios in order to meet their priority sector lending norms.Loan pools can be securitized two ways—direct assignment or through issuing pass-through certificates (PTC). Direct assignment involves directly transferring a bunch of loans to the buyer. In a PTC, the certificates are issued through a special purpose vehicle (SPV) and could carry an implicit guarantee by the SPV.“Securitisation volumes have reduced for microfinance segment on account of the impact of demonetisation. We are already seeing a pickup in Direct Assignments. PTC volumes may take some more time to pick up as investors (like mutual funds) wait for collections trends to stabilize," said Krishnan Sitaraman, senior director, financial sector ratings and structured finance ratings, at Crisil Ratings.Housing and loan against property, commercial finance, small business loans form major part of securitization volume apart from microfinance. Total securitisation portfolio of microfinance industry for the financial year 2016 stood at Rs11,500 crore, according to Crisil estimates.Demonetisation disrupted the microfinance business in the months of November and December. Local leaders in parts of Maharashtra, Uttar Pradesh, Madhya Pradesh and Kerala were telling people that their loans have been waived, taking benefit of the situation. Repayment rates dropped to 30-40% in many areas in November.“Since there was no customer acquisition in latter half of the quarter, securitized portfolio was nil. On an average we do securitisation worth Rs.50 crore every quarter. In the coming quarter too, we will not do any securitisation because demand is not there," said Anup Kumar Singh, director of Sonata Finance Pvt. Ltd, an Uttar Pradesh-based microfinance lender.Portfolio at risk for 30 days has increased considerably from 0.5% in the previous quarters to 7.52% in the quarter three of the current financial year, according to Microfinance Institutions Network (MFIN) report. Q5) What is NRLM? What are its guidelines and mission?A5) National Rural Livelihoods Mission (NRLM) was launched by the Ministry of Rural Development (MoRD), Government of India in June 2011. Aided in part through investment support by the World Bank, the Mission aims at creating efficient and effective institutional platforms of the rural poor, enabling them to increase household income through sustainable livelihood enhancements and improved access to financial services. National Rural Livelihood Mission (NRLM) is a poverty alleviation project implemented by Ministry of Rural Development, Government of India. This scheme is focused on promoting self-employment and organization of rural poor. The basic idea behind this programme is to organize the poor into SHG (Self Help Groups) groups and make them capable for self-employment. In 1999 after restructuring Integrated Rural Development Programme(IRDP), Ministry of Rural Development (MoRD) launched Swarnajayanti Grameen Swarojgar Yojana (SGSY) to focus on promoting self-employment among rural poor. SGSY is now remodeled to form NRLM thereby plugging the shortfalls of SGSY programme.This scheme was launched in 2011 with a budget of $5.1 billion and is one of the flagship programmes of Ministry of Rural Development. This is one of the world's largest initiatives to improve the livelihood of poor. This programme is supported by the World Bank with a credit of $1 Billion. The scheme was succeeded by Deen Dayal Antyodaya Yojana on 25 September 2015. Mission"To reduce poverty by enabling the poor households to access gainful self- employment and skilled wage employment opportunities resulting in appreciable improvement in their livelihoods on a sustainable basis, through building strong and sustainable grassroots institutions of the poor." Guiding PrinciplesPoor have a strong desire to come out of poverty, and they have innate capabilities .An external dedicated and sensitive support structure is required to induce the social mobilization, institution building and empowerment process.Facilitating knowledge dissemination, skill building, access to credit, access to marketing, and access to other livelihoods services enables them to enjoy a portfolio of sustainable livelihoods. ValuesThe core values which guide all the activities under NRLM are as follows:Inclusion of the poorest, and meaningful role to the poorest in all the processesTransparency and accountability of all processes and institutions.Ownership and key role of the poor and their institutions in all stages – planning, implementation, and, monitoring.NRLM will be implemented in a mission mode. This enables:(a) shift from the present allocation based strategy to a demand driven strategy, enabling the states to formulate their own livelihoods-based poverty reduction action plans.(b) focus on targets, outcomes and time bound delivery.(c) continuous capacity building, imparting requisite skills and creating linkages with livelihoods opportunities for the poor, including those emerging in the organized sector.(d) monitoring against targets of poverty outcomes.As NRLM follows a demand driven strategy, the States have the flexibility to develop their own livelihoods-based perspective plans and annual action plans for poverty reduction. The overall plans would be within the allocation for the state based on inter-se poverty ratios.The second dimension of demand driven strategy implies that the ultimate objective is that the poor will drive the agenda, through participatory planning at grassroots level, implementation of their own plans, reviewing and generating further plans based on their experiences. The plans will not only be demand driven, they will also be dynamic. Q6) Why microfinance is Important? Explain its impact.A6) Impact is about understanding how financial services affect the lives of poor people. To date, most impact assessments have focused on microcredit programs rather than looking at a range of financial services.Impact considers income growth, asset building, and reduction of vulnerability. Impact indicators extend beyond enterprise measures (assets, employment, revenues) to include multiple dimensions of poverty, including overall household income, social improvements in health and education, and empowerment (in terms of increased self-esteem and control of household resources among women The impact of microfinance is important because of the following reasonsOutreach is important.-Financial institutions must reach poor clients to have an impact. As we know most microfinance clients today fall in a band around the poverty line. The extreme poor are rarely reached by microfinance. (Social safety net programs are often more appropriate for the destitute and extreme poor.) Product characteristics count- Specific characteristics of financial products, such as loan terms and transaction size, affect impact. Shortterm working-capital loans may work well for traders wanting to purchase inventory. For producers who need to make one-time investments in equipment purchases, however, they work less well. These clients may require other services like term savings or longer-term loans. The asset base of clients is relevant- The initial resource base of a client affects impact. The impact of financial services on clients who begin with more resources (financial, physical, or social) tends to be greater than on clients who start from a very low resource base. Sustainability matters- The length of time that an individual has been a client of an institution has a positive correlation with impact. Sustainable institutions ensure ongoing impact by providing permanent access to services. Country context is a factor- The macroeconomic, legal, and policy environments seriously affect impact. Poor economic conditions, weak social and physical infrastructure (education, health, roads), corruption, and lack of security adversely influence the ability of clients to benefit from financial services. Q7) Write the guidelines of Impact assessment and monitoring of Micro finance.A7) There are some guidelines for Impact assessment and monitoring of MicrofinanceThese guidelines have been formulated to:Offer relevant information that will help users make informed and effective decisions in order to design IM and IA suited to prevailing contextual factors and objectives; Build on and improve existing M&E procedures, and help users understand and appraise the impact of projects on human well-being (current M&E mainly focuses on performance indicators such as financial and institutional sustainability criteria); Measure the effectiveness of microfinance programmes according to key concepts in poverty reduction: strengthening physical, human and social capital; increasing the standard of living; improving access to and control over productive resources; and enhancing knowledge about and participation in individual rights and power; Help to design a less-costly, application-orientated M&E process that is con-text specific and with which it is possible to reach a high level of data reliability; Provide information for decision making, project design and mid-term corrections by proving impact (accountability) and improving intervention (project management); Help users avoid undesirable or negative programme impact; Identify various MFI stakeholders and make them more aware of their ownership; Help to indicate necessary changes in microfinance policies to ensure that efficient dissemination and transparency exist between the project, the MFI and the donor; Show donors the effectiveness of their input in response to their goal to alleviate poverty. Q8) Distinguish between Minimalist and Integrated approach of Microfinance.A8)The minimalist approach considers the access by low-income individuals to credit as the only piece missing for income generation and, therefore, sees the providing of microcredit loans as a development strategy per se. On the other hand, the integrated approach emphasizes the importance of providing not only credit but a range of development-oriented services to the poor in order to attack the structural causes of poverty. Minimalist ApproachTypically, these non-financial services should include educational programs, community-based development programs, business and capabilityenhancing training, and so on. In terms of economic sustainability, operating costs incurred in the minimalist approach are obviously much lower than those of integrated microcredit programs.

Minimalist programs often adopt specific risk-managing and credit analysis methods that demand some degree of social intermediation through the use of loan officers, but avoid the costs of additional development-oriented services or policies. This approach is based on the premise that there is a single “missing piece” for economic growth among the poor, i.e. affordable, accessible short-term credit (Ledgerwood 1999). Minimalist programmes are implemented by microfinance institutions such as agriculture/farming banks or credit unions. Minimalist approaches normally offer only financial intermediation, i.e. savings, credit, insurance, credit cards, and payment systems. Minimalist programmes will acknowledge that the poor may need other development and social services, but they have to assume that other agencies will provide these, because provision of such services is not their corporate business. This approach offers the great advantage of having a single focus, which becomes more cost effective with time, so that subsidies that might have been necessary to establish the programme, can gradually be eliminated (Ledgerwood 1999).

Integrated Approach This strategy, which lies somewhere near the centre of the microfinance spectrum, takes a rather more wholistic view of the poor in its design of poverty reductionprogrammes (Ledgerwood 1999).It offers not only a range of financial and social intermediations, but adds to these enterprise development services, such as marketing, marketing analysis, business and production training, and social services, like health and nutrition, education, adult literacy training awareness raising on civil and human rights matters, and so forth.

World Vision explains how this model fits into its wholistic, integrated development programmes, in which the poor are engaged in activities addressing multiple inter-related needs, such as potable water supply, health care, basic education, food security and economic growth. The programme offers community banking as the solution for the poorest, using a group-based, joint liability model that includes compulsory savings, member training in loan management and business training skills. Q9) Distinguish between financial and non- financial services.A9) Financial services are the economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, accountancy companies, consumer-finance companies, stock brokerages, investment funds, individual managers and some government-sponsored enterprises.The financial sector is traditionally among those to receive government support in times of widespread economic crisis. Such bailouts, however, enjoy less public support than those for other industries. Banking ServicesA commercial bank is what is commonly referred to as simply a bank. The term "commercial" is used to distinguish it from an investment bank, a type of financial services entity which instead of lending money directly to a business, helps businesses raise money from other firms in the form of bonds (debt) or stock (equity). The primary operations of commercial banks include:Keeping money safe while also allowing withdrawals when neededIssuance of cheque books so that bills can be paid and other kinds of payments can be delivered by the postProvide personal loans, commercial loans, and mortgage loans (typically loans to purchase a home, property or business) etc Investment banking servicesUnderwriting debt and equity for the private and public sector in order for such entities to raise capital.Mergers and acquisitions - Work to underwrite and advise companies on mergers or takeovers. Structured finance - Develop intricate (typically derivative) products for high net worth individuals and institutions with more intricate financial needs.Restructuring - Assist in financially reorganizing companiesMarket maker - Provide liquidity to the markets by both buying and selling financial instruments with their own account in hopes of profiting off the Bid–ask spread. Foreign exchange servicesForeign Exchange machineForeign exchange services are provided by many banks and specialist foreign exchange brokers around the world. Foreign exchange services include:Currency exchange - where clients can purchase and sell foreign currency banknotes.Wire transfer - where clients can send funds to international banks abroad. Non- Financial ServicesThe non-financial Non- financial services include information, education, networking/access to markets and recognition. They should complement the financial offerings of a bank. They are not a marketing effort, not part of CSR and not one-size-fits-all; they require a business strategy in order to ensure sustainability; services sector includes economic activities, such as computer services, real estate, research and development, legal services and accounting. Q10) How Microfinance alleviates Poverty?A10) The microfinance industry promotes the dual objectives of sustainability of services and outreach to the very poor. When deciding to fund specific microfinance institutions (MFIs), donors and other social investors in the sector consider both objectives, but their relative importance varies among funders. Furthermore, many practitioners, donors, and experts perceive a trade-off between financial sustainability and depth of outreach, although the exact nature of this trade-off is not well understood. In recent years, several tools have emerged to assist donors in their assessment of the institutional performance of MFIs. One example is the CGAP Format for Appraisal of Microfinance Institutions (hereafter, CGAP Appraisal Format), which contains practical guidelines and indicators for measuring MFI performance on a range of issues, including governance, management and leadership, mission and plans, systems, operations, human resource management, products, portfolio quality, and financial analysis. Analysis of these institutional features allows an appraisal to consider an institution’s potential for viability and/or sustainability. At the same time, the proliferation of tools such as the CGAP Appraisal Format has encouraged transparency and the development of standards for financial sustainability in microfinance. Currently, no rigorous tool exists to measure the poverty level of MFI clients. In order to gain more transparency on the depth of poverty outreach, CGAP collaborated with the International Food Policy Research Institute (IFPRI) to design and test a simple, low-cost operational tool to measure the poverty level of MFI clients relative to non clients. This tool is a companion piece to the CGAP Appraisal Format; donors should not use the poverty assessment tool without also conducting a larger institutional appraisal. The concept of poverty is complex and strongly influenced by local cultural and socioeconomic conditions. The poverty assessment approach presented in this manual supports a flexible definition of poverty that can be adapted to fit local perceptions and conditions of poverty. The tool is intended neither as a means to target new clients nor to assess the impact of microfinance services on the lives of existing clients. It may provide a useful means to verify—both for the donor and the MFI—the extent to which an existing strategy results in poor clients joining the MFI. The tool assesses the poverty levels of MFI clients compared to non clients within the operational area of an MFI. Using available data or expert opinion, the tool also relates local poverty levels to poverty measured at larger regional and national levels. IFPRI developed a survey-based method of assessment and tested it with case studies using random samples of client and non client households from the operational areas of four MFI partners of CGAP. Not only did these institutions operate in significantly different geographic and socio economic settings, they also had different objectives and institutional designs. A sample of 500 households—200 client households and 300 non client households—was drawn in each of the case studies.Results from these case studies helped refine the final product, a practical operational manual. This manual explains in detail the process for conducting a comparative poverty assessment between MFI clients and non clients.

|

|

0 matching results found