IF

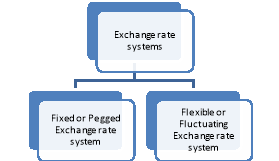

Unit – 1Fundamentals of International Finance Q1) Define International Finance. Discuss the Scope of International Finance.A1) International finance (also referred to as international monetary economics or international macroeconomics) is the branch of financial economics broadly concerned with monetary and macroeconomic interrelations between two or more countries. International finance examines the dynamics of the global financial system, international monetary systems, balance of payments, exchange rates, foreign direct investment, and how these topics relate to international trade. Scope of international finance:Foreign Exchange Market: The foreign exchange market is the market where foreign exchange or foreign exchange currencies are bought and sold. The foreign exchange market places at the disposal of buyers and sellers of foreign currencies the specialized services of intermediaries. It implies that the buyers and sellers of claims on foreign money and intermediaries constitute the structure of foreign exchange market. In the words of Kindelberger, “…The foreign exchange market is the market for a national currency (foreign money) anywhere in the world, as the financial centre of the world is united in a single market.” Exchange Rates: Another aspect covered in the international finance is the Exchange rate and its determination. The foreign exchange rates are classified into two broad categories:

In case of the fixed exchange rate or pegged exchange rate system, all the international transactions take place at the rate of exchange fixed by the monetary authority. The exchange rate is fixed by the government through legislation or it comes into existence through the intervention in the foreign exchange market by the authorities. While the flexible or fluctuating exchange rates are determined by the free working of the market forces. If there is an excess demand for foreign currency over its supply, the foreign currency appreciates whereas the home currency depreciates. Risk management: An understanding of foreign exchange risk is essential for managers and investors in the modern day environment of unforeseen changes in foreign exchange rates. In a domestic economy this risk is generally ignored because a single national currency serves as the main medium of exchange within a country. When different national currencies are exchanged for each other, there is a definite risk of volatility in foreign exchange rates. The present International Monetary System set up is characterised by a mix of floating and managed exchange rate policies adopted by each nation keeping in view its interests. In fact, this variability of exchange rates is widely regarded as the most serious international financial problem facing corporate managers and policy makers. Managing MNCs: International financial management is related to managing finance of MNCs. There are five methods by which firms conduct international business activities– licensing, franchising, joint ventures, management contracts and establishing new foreign subsidiaries. Q2) How does Globalization Affects The world Economy?A2) Economic globalization refers to the increasing interdependence of world economies as a result of the growing scale of cross-border trade of commodities and services, flow of international capital and wide and rapid spread of technologies. It reflects the continuing expansion and mutual integration of market frontiers, and is an irreversible trend for the economic development in the whole world at the turn of the millennium. The rapid growing significance of information in all types of productive activities and marketization are the two major driving forces for economic globalization. In other words, the fast globalization of the world’s economies in recent years is largely based on the rapid development of science and technologies, has resulted from the environment in which market economic system has been fast spreading throughout the world, and has developed on the basis of increasing cross-border division of labor that has been penetrating down to the level of production chains within enterprises of different countries. The advancement of science and technologies has greatly reduced the cost of transportation and communication, making economic globalization possible. Today’s ocean shipping cost is only a half of that in the year 1930, the current airfreight 1/6, and telecommunication cost 1%. The price level of computers in 1990 was only about 1/125 of that in 1960, and this price level in 1998 reduced again by about 80%. This kind of ‘time and space compression effect’ of technological advancement greatly reduced the cost of international trade and investment, thus making it possible to organize and coordinate global production. For example, Ford’s Lyman car is designed in Germany, its gearing system produced in Korea, pump in USA, and engine in Australia. It is exactly the technological advancement that has made this type of global production possible. Globalization of the financial sector has become the most rapidly developing and most influential aspect of economic globalization. International finance came into being to serve the needs of international trade and investment activities. However, along with the development of economic globalization, it has become more and more independent. Compared with commodity and labor markets, the financial market is the only one that has realized globalization in the true sense of ‘globalization’. Since 1970’s, cross-border flow of capital has been rapidly expanding. In 1980, the total volume of cross-border transactions of stocks and bonds of major developed countries was still less than 10% of their GDP. However, this figure had far surpassed 100% in 1995. The value of the average daily transactions of foreign exchanges has grown from US$ 200 billion in the middle of E c o n o m i c G l o b a l i z a t i o n : Tr e n d s , R i s k s a n d P r e v e n t i o n 3 1980’s to the present US$ 1,200 billion, which is 85% of the foreign exchange reserves of all the countries in the world and 70 times as large as the value of the daily export of commodities and services. Q3) What are the various challenges that has faced by International Finance.A3) 1. Challenge of Protection of Natural Resources

When there is more international finance; its growth will affect the natural resources. For example, after increasing the number of banks in India, ACs is used at large scale due to this, there is increasing the temperature of India. Who is responsible for this. Surely international banks are responsible who are opening the branches in India. Every increase in the number of bank branch means, 5 new installation of ACs which increases open environmental temperature. So, this is big challenge of international finance. It has to reduce by planting the tree and not to use ACs in office.

2. Terrorism

Terrorism is also main challenge of International Finance. If any country will increase the terrorism in other country, its international finance will affected. Motherland is first and then, there is any international finance. India should ban all international finance and business relating to the countries which are promoting terrorism in India. Other countries which have the problem of terrorism, should strict ban on it if it has to increase its international finance with other countries.

3. Culture

International finance has also challenge of culture of each country. Culture is most often viewed as the language or religion of a country, but there is obviously more to culture than these two component. A successful international business manager must know what cultural matters may affect developing relationships and the impact they have financially on a business venture.Financial issues are very much affected by language. Negotiations between a buyer and seller include price, delivery dates, shipping methods, and methods of payment. If either party is not completely fluent in the other party’s language, misunderstandings may arise which could lead to late payment or no payment at all.

4. Follow the Political Policies and Law of Nation

If business people have to grow international finance in any country, they have to make their policy according to the law and political policy of same country. Issues such as ill-defined or unstable policies and corrupt practices can be hugely problematic in emerging market. Changes in governments can bring changes in policy, regulations, and interest rates that can prove damaging to foreign business and investment.

5. International Currencies

International finance also affects from international currencies. You have some foreign currency if you have to deal with foreign country. At the time of dealing, you know what the current market rate of forex is.. Foreign investments are complicated by currency fluctuations and conversions between countries. A high-quality investment in another nation may lose money because that country's currency declined. Foreign-denominated debt used to purchase domestic assets has also led to bankruptcies in many emerging market economies. Movements in currencies can have a substantial impact on the returns from foreign investments. Investing in securities that are denominated in an appreciating currency can boost total returns. However, investing in securities denominated in a depreciating currency can reduce profits. 6. Trade Restrictions: Countries in order to protect their economies apply methods of restrictions such as tariffs, quotas, subsidies and exchange controls. By applying protectionism a country can gain from it in such as protecting infant industries, dumping and protecting manufacturing industries, but on the other hand can also have problems such as firms remaining inefficient, retaliation, and misallocation of resources, and related directly to international trade countries benefit on comparative and absolute advantage, and economies of scales it affects the international trade and finance. Q4) What do you mean by a Country’s BOP? Why it is important? A4) BOP statement of a country indicates whether the country has a surplus or a deficit of funds i.e when a country’s export is more than its import, its BOP is said to be in surplus. On the other hand, BOP deficit indicates that a country’s imports are more than its exports. Tracking the transactions under BOP is something similar to the double entry system of accounting. This means, all the transaction will have a debit entry and a corresponding credit entry. A country’s BOP is vital for the following reasons:BOP of a country reveals its financial and economic status. BOP statement can be used as an indicator to determine whether the country’s currency value is appreciating or depreciating. BOP statement helps the Government to decide on fiscal and trade policies. It provides important information to analyze and understand the economic dealings of a country with other countries. By studying its BOP statement and its components closely, one would be able to identify trends that may be beneficial or harmful to the economy of the county and thus, then take appropriate measures. Q5) Explain the structure and composition of a Country’s BOP.A5) There are three components of balance of payment viz current account, capital account, and financial account. The total of the current account must balance with the total of capital and financial accounts in ideal situations.

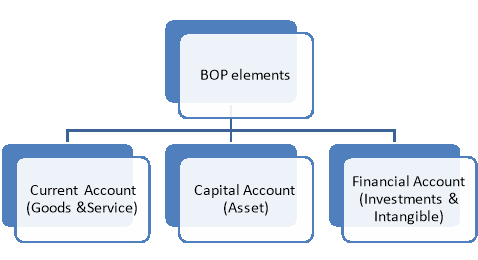

Current AccountThe current account is used to monitor the inflow and outflow of goods and services between countries. This account covers all the receipts and payments made with respect to raw materials and manufactured goods. It also includes receipts from engineering, tourism, transportation, business services, stocks, and royalties from patents and copyrights. When all the goods and services are combined, together they make up to a country’s Balance Of Trade (BOT).There are various categories of trade and transfers which happen across countries. It could be visible or invisible trading, unilateral transfers or other payments/receipts. Trading in goods between countries are referred to as visible items and import/export of services (banking, information technology etc) are referred to as invisible items. Unilateral transfers refer to money sent as gifts or donations to residents of foreign countries. This can also be personal transfers like – money sent by relatives to their family located in another country. Capital AccountAll capital transactions between the countries are monitored through the capital account. Capital transactions include the purchase and sale of assets (non-financial) like land and properties. The capital account also includes the flow of taxes, purchase and sale of fixed assets etc by migrants moving out/in to a different country. The deficit or surplus in the current account is managed through the finance from capital account and vice versa. There are 3 major elements of capital account:Loans & borrowings – It includes all types of loans from both the private and public sectors located in foreign countries. Investments – These are funds invested in the corporate stocks by non-residents. Foreign exchange reserves – Foreign exchange reserves held by the central bank of a country to monitor and control the exchange rate does impact the capital account.

Financial AccountThe flow of funds from and to foreign countries through various investments in real estates, business ventures, foreign direct investments etc is monitored through the financial account. This account measures the changes in the foreign ownership of domestic assets and domestic ownership of foreign assets. Q6) Distinguish between Fixed and Flexible Exchange Rate Systems.A6) Fixed Exchange Rate System:Fixed exchange rate is the rate which is officially fixed by the government or monetary authority and not determined by market forces. Only a very small deviation from this fixed value is possible. In this system, foreign central banks stand ready to buy and sell their currencies at a fixed price. A typical kind of this system was used under Gold Standard System in which each country committed itself to convert freely its currency into gold at a fixed price.In other words, value of each currency was defined in terms of gold and, therefore, exchange rate was fixed according to the gold value of currencies that have to be exchanged. This was called mint par value of exchange. Later on Fixed Exchange Rate System prevailed in the world under an agreement reached in July 1994. Merits:(i) It ensures stability in exchange rate which encourages foreign trade, (ii) It contributes to the coordination of macro policies of countries in an interdependent world economy, (iii) Fixed exchange rate ensures that major economic disturbances in the member countries do not occur, (iv) It prevents capital outflow, Flexible (Floating) Exchange Rate System:The system of exchange rate in which rate of exchange is determined by forces of demand and supply of foreign exchange market is called Flexible Exchange Rate System. Here, value of currency is allowed to fluctuate or adjust freely according to change in demand and supply of foreign exchange.There is no official intervention in foreign exchange market. Under this system, the central bank, without intervention, allows the exchange rate to adjust so as to equate the supply and demand for foreign currency In India, it is flexible exchange rate which is being determined. The foreign exchange market is busy at all times by changes in the exchange rate. Advantages and disadvantages of this system are listed below: Merits:(i) Deficit or surplus in BOP is automatically corrected, (ii) There is no need for government to hold any foreign exchange reserve, (iii) It helps in optimum resource allocation, Q7) How the European Monetary System Had Formed?A7) European Monetary System (1979–1998) In March 1979, the European Union or EU (then called the European Economic Community or EEC) announced the formation of the European Monetary System (EMS) as part of its aim toward greater monetary integration among its members, including the ultimate goal of creating a common currency and a Community-wide central bank. The main features of the EMS were (1) the European Currency Unit (ECU), defined as the weighted average of the currencies of the member nations, was created. (2) The currency of each EU member was allowed to fluctuate by a maximum of 2.25 percent on either side of its central rate or parity (6 percent for the British pound and the Spanish peseta; Greece and Portugal joined later). The EMS was thus created as a fixed but adjustable exchange rate system and with the currencies of member countries floating jointly against the dollar. Starting in September 1992, however, the system came under attack, and in August 1993 the range of allowed fluctuation was increased from 2.25 percent to 15 percent (see Case Study 20-2). (3) The European Monetary Cooperation Fund (EMCF) was established to provide shortand medium-term balance-of-payments assistance to its members. When the fluctuation of a member nation’s currency reached 75 percent of its allowed range, a threshold of divergence was reached, and the nation was expected to take a number of corrective steps to prevent its currency from fluctuating outside the allowed range. If the exchange rate did reach the limit of its range, intervention burdens were to be shared symmetrically by the weak- and the strong-currency member. For example, if the French franc depreciated to its upper limit against the German mark, then the French central bank had to sell Deutsche mark (DM) reserves and the German central bank (the Bundesbank) had to lend the necessary DM to France. Member nations were assigned a quota in the EMCF, 20 percent to be paid in gold (valued at the market price) and the remainder in dollars, in exchange for ECUs. The amount of ECUs grew rapidly as member nations converted more and more of their dollars and gold into ECUs. Indeed, ECUs became an important international asset and intervention currency. One advantage of the ECU was its greater stability in value with respect to any one national currency. It was anticipated that the EMCF would eventually evolve into an EU central bank. By the beginning of 1998, the total reserve pool of the EMCF was over $50 billion and the value of the ECU was $1.1042. From March 1979 to September 1992, there was a total of 11 currency realignments of the EMS. In general, high-inflation countries such as Italy and France (until 1987) needed to periodically devalue their currency with respect to the ECU in order to maintain competitiveness in relation to a low-inflation country such as Germany. This points to the fundamental weakness of the EMS in attempting to keep exchange rates among member nations within narrowly defined limits without at the same time integrating their monetary, fiscal, tax, and other policies. As pointed out by Fratianni and von Hagen (1992), inflation in Italy and France during the 1979–1987 period was restrained by the presence of Germany in the EMS, and this reduced the need for higher real appreciations of the Deutsche mark. France and Italy, however, paid a price in terms of greater unemployment for the gradual convergence toward Germany’s low inflation rate. The EU’s desire to stabilize exchange rates was understandable in view of the large exchange rate fluctuations since 1973 (see Case Study 20-2). Empirical evidence (see Giavazzi and Giovannini, 1989, and MacDonald and Taylor, 1991) indicates that variations in nominal and real exchange rates and money supplies among EMS members were smaller than among nonmembers, at least until September 1992. Q8) What is Foreign Bank Note Market? Give a brief description about Spot exchange market.A8) A banknote (often known as a bill (in the US and Canada), paper money, or simply a note) is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand. Historically, the banknotes were issued by the commercial banks but now, the production and distribution of new banknotes, and destruction of the unfit banknotes is the responsibility of the central bank of the respective countries. One of the crucial responsibilities of the national banks is to ensure the adequate confidence of the citizens in their nations currency. A country’s monetary policy serves the purpose of designing strategies related to money supply in the economy. A key component of the foreign exchange market is the spot market. The spot market facilitates foreign exchange transactions that involve the immediate exchange of currencies. The prevailing exchange rate at which one currency can be immediately exchanged for another currency is referred to as the spot exchange rate (or spot rate). For example, the Canadian dollar's value has ranged between $0.60 and $0.80 in recent years. When U.S. firms purchase foreign supplies or acquire a firm in another country, and when U.S. investors invest in foreign securities, they commonly use the spot market to obtain the currency needed for the transaction. During the so-called Bretton Woods era from 1944 to 1971, exchange rates were virtually fixed. They could change by only 1 percent from an initially established rate. Central banks of countries intervened by exchanging their currency on reserve for other currencies in the foreign exchange market to maintain stable exchange rates. By 1971 the boundaries of exchange rates were expanded to be 2.25 percent from the specified value, but this still restricted exchange rates from changing substantially over time.In 1973 the boundaries were eliminated. This came as a result of pressure on some currencies to adjust their values because of large differences between the demand for a specific currency and the supply of that currency for sale. As the flow of trade and investing between the United States and a given country changes, so does the U.S. demand for that foreign currency and the supply of that foreign currency for sale (exchanged for dollars).Because the demand and supply conditions for a given currency change continuously, so do the spot rates of most currencies. Thus most firms and investors that will need or receive foreign currencies in the future are exposed to exchange rate fluctuations. Q9) How many ways Exchange rate quotation can be quoted? Distinguish between Direct Quotation and Indirect Quotation.A9) Exchange rate quotations can be quoted in two ways – Direct quotation and Indirect quotation. Direct quotation is when the one unit of foreign currency is expressed in terms of domestic currency. Similarly, the indirect quotation is when one unit of domestic currency us expressed in terms of foreign currency. Since the US dollar (USD) is the most dominant currency, usually, the exchange rates are expressed against the US dollar. However, the exchange rates can also be quoted against other countries’ currencies, which is called as cross currency.Now, a lower exchange rate in a direct quote implies that the domestic currency is appreciating in value. Whereas, a lower exchange rate in an indirect quote indicates that the domestic currency is depreciating in value as it is worth a smaller amount of foreign currency.Every quote could potentially be a direct one, or an indirect one at the same time. This generally depends on your geographical location, and your domestic currency. To simplify, a direct quote is a foreign exchange price quotation that can be easily understood, even by a person who doesn't necessarily know the exchange rate of their domestic currency in relation to the foreign one. Let's look at this with an example: Assuming you are from the United States, your domestic currency is the US dollar.In this case, a USD/GBP quote of 0.66 will be a direct quote for you, and it will mean that one US dollar can be used to purchase 0.66 GB pounds. Conversely, if you were not from the US, and instead from the UK, you would see a USD/GBP quote of 0.66 as an indirect one, whereby one US dollar could be bought for 0.66 GBP, yet you would not be provided with the knowledge of how many US dollars can be bought with one unit of your domestic currency, without calculating it.In other words, a Forex direct quote shows how many foreign currency units could be bought for a single unit of your domestic currency. This is rather simple and useful for people that want to easily transfer foreign prices into the currency that is more common for them.Indirect quotes show the exact opposite of direct quotes. Instead of displaying the value of a foreign currency in the domestic one, it shows the value of the domestic currency in a foreign one. Here's an example of an indirect Forex quote: Assume you are from a European country, where the local currency is EUR, and you can see a quote like this: USD/EUR 0.8765. This means that one US dollar is sold for 0.8765 euros. However, you have to note that if you were an American, this quote would be a direct one for you. Q10) Discuss the various factors which affects the international exchange rate.A10) The exchange rate is defined as "the rate at which one country's currency may be converted into another." It may fluctuate daily with the changing market forces of supply and demand of currencies from one country to another. For these reasons; when sending or receiving money internationally, it is important to understand what determines exchange rates. 1. Inflation RatesChanges in market inflation cause changes in currency exchange rates. A country with a lower inflation rate than another's will see an appreciation in the value of its currency. The prices of goods and services increase at a slower rate where the inflation is low. A country with a consistently lower inflation rate exhibits a rising currency value while a country with higher inflation typically sees depreciation in its currency and is usually accompanied by higher interest rates

2. Interest RatesChanges in interest rate affect currency value and dollar exchange rate. Forex rates, interest rates, and inflation are all correlated. Increases in interest rates cause a country's currency to appreciate because higher interest rates provide higher rates to lenders, thereby attracting more foreign capital, which causes a rise in exchange rates

3. Country’s Current Account / Balance of PaymentsA country’s current account reflects balance of trade and earnings on foreign investment. It consists of total number of transactions including its exports, imports, debt, etc. A deficit in current account due to spending more of its currency on importing products than it is earning through sale of exports causes depreciation. Balance of payments fluctuates exchange rate of its domestic currency.

4. Government DebtGovernment debt is public debt or national debt owned by the central government. A country with government debt is less likely to acquire foreign capital, leading to inflation. Foreign investors will sell their bonds in the open market if the market predicts government debt within a certain country. As a result, a decrease in the value of its exchange rate will follow.

5. Terms of TradeRelated to current accounts and balance of payments, the terms of trade is the ratio of export prices to import prices. A country's terms of trade improves if its exports prices rise at a greater rate than its imports prices. This results in higher revenue, which causes a higher demand for the country's currency and an increase in its currency's value. This results in an appreciation of exchange rate.

6. Political Stability & PerformanceA country's political state and economic performance can affect its currency strength. A country with less risk for political turmoil is more attractive to foreign investors, as a result, drawing investment away from other countries with more political and economic stability. Increase in foreign capital, in turn, leads to an appreciation in the value of its domestic currency. A country with sound financial and trade policy does not give any room for uncertainty in value of its currency. But, a country prone to political confusions may see a depreciation in exchange rates.

7. RecessionWhen a country experiences a recession, its interest rates are likely to fall, decreasing its chances to acquire foreign capital. As a result, its currency weakens in comparison to that of other countries, therefore lowering the exchange rate.

|

When there is more international finance; its growth will affect the natural resources. For example, after increasing the number of banks in India, ACs is used at large scale due to this, there is increasing the temperature of India. Who is responsible for this. Surely international banks are responsible who are opening the branches in India. Every increase in the number of bank branch means, 5 new installation of ACs which increases open environmental temperature. So, this is big challenge of international finance. It has to reduce by planting the tree and not to use ACs in office.

2. Terrorism

Terrorism is also main challenge of International Finance. If any country will increase the terrorism in other country, its international finance will affected. Motherland is first and then, there is any international finance. India should ban all international finance and business relating to the countries which are promoting terrorism in India. Other countries which have the problem of terrorism, should strict ban on it if it has to increase its international finance with other countries.

3. Culture

International finance has also challenge of culture of each country. Culture is most often viewed as the language or religion of a country, but there is obviously more to culture than these two component. A successful international business manager must know what cultural matters may affect developing relationships and the impact they have financially on a business venture.Financial issues are very much affected by language. Negotiations between a buyer and seller include price, delivery dates, shipping methods, and methods of payment. If either party is not completely fluent in the other party’s language, misunderstandings may arise which could lead to late payment or no payment at all.

4. Follow the Political Policies and Law of Nation

If business people have to grow international finance in any country, they have to make their policy according to the law and political policy of same country. Issues such as ill-defined or unstable policies and corrupt practices can be hugely problematic in emerging market. Changes in governments can bring changes in policy, regulations, and interest rates that can prove damaging to foreign business and investment.

5. International Currencies

International finance also affects from international currencies. You have some foreign currency if you have to deal with foreign country. At the time of dealing, you know what the current market rate of forex is.. Foreign investments are complicated by currency fluctuations and conversions between countries. A high-quality investment in another nation may lose money because that country's currency declined. Foreign-denominated debt used to purchase domestic assets has also led to bankruptcies in many emerging market economies. Movements in currencies can have a substantial impact on the returns from foreign investments. Investing in securities that are denominated in an appreciating currency can boost total returns. However, investing in securities denominated in a depreciating currency can reduce profits. 6. Trade Restrictions: Countries in order to protect their economies apply methods of restrictions such as tariffs, quotas, subsidies and exchange controls. By applying protectionism a country can gain from it in such as protecting infant industries, dumping and protecting manufacturing industries, but on the other hand can also have problems such as firms remaining inefficient, retaliation, and misallocation of resources, and related directly to international trade countries benefit on comparative and absolute advantage, and economies of scales it affects the international trade and finance. Q4) What do you mean by a Country’s BOP? Why it is important? A4) BOP statement of a country indicates whether the country has a surplus or a deficit of funds i.e when a country’s export is more than its import, its BOP is said to be in surplus. On the other hand, BOP deficit indicates that a country’s imports are more than its exports. Tracking the transactions under BOP is something similar to the double entry system of accounting. This means, all the transaction will have a debit entry and a corresponding credit entry. A country’s BOP is vital for the following reasons:

|

2. Interest RatesChanges in interest rate affect currency value and dollar exchange rate. Forex rates, interest rates, and inflation are all correlated. Increases in interest rates cause a country's currency to appreciate because higher interest rates provide higher rates to lenders, thereby attracting more foreign capital, which causes a rise in exchange rates

3. Country’s Current Account / Balance of PaymentsA country’s current account reflects balance of trade and earnings on foreign investment. It consists of total number of transactions including its exports, imports, debt, etc. A deficit in current account due to spending more of its currency on importing products than it is earning through sale of exports causes depreciation. Balance of payments fluctuates exchange rate of its domestic currency.

4. Government DebtGovernment debt is public debt or national debt owned by the central government. A country with government debt is less likely to acquire foreign capital, leading to inflation. Foreign investors will sell their bonds in the open market if the market predicts government debt within a certain country. As a result, a decrease in the value of its exchange rate will follow.

5. Terms of TradeRelated to current accounts and balance of payments, the terms of trade is the ratio of export prices to import prices. A country's terms of trade improves if its exports prices rise at a greater rate than its imports prices. This results in higher revenue, which causes a higher demand for the country's currency and an increase in its currency's value. This results in an appreciation of exchange rate.

6. Political Stability & PerformanceA country's political state and economic performance can affect its currency strength. A country with less risk for political turmoil is more attractive to foreign investors, as a result, drawing investment away from other countries with more political and economic stability. Increase in foreign capital, in turn, leads to an appreciation in the value of its domestic currency. A country with sound financial and trade policy does not give any room for uncertainty in value of its currency. But, a country prone to political confusions may see a depreciation in exchange rates.

7. RecessionWhen a country experiences a recession, its interest rates are likely to fall, decreasing its chances to acquire foreign capital. As a result, its currency weakens in comparison to that of other countries, therefore lowering the exchange rate.

0 matching results found