IF

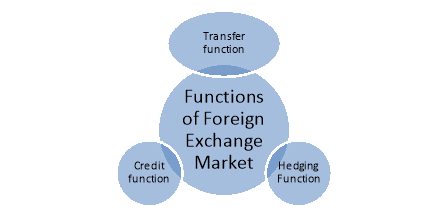

Unit - 2Foreign Exchange Markets, Exchange Rate Determination & Currency Derivatives Q1) Define Foreign Exchange market. Discuss the primary functions of foreign exchange market.A1) The foreign exchange market is the market in which individuals, firms, and banks buy and sell foreign currencies or foreign exchange. The foreign exchange market for any currency— say, the U.S. dollar—is comprised of all the locations (such asLondon, Paris, Zurich, Frankfurt, Singapore, Hong Kong, Tokyo, and New York) where dollars are bought and sold for other currencies. These different monetarycenters are connected electronically and are in constant contact with one another,thus forming a single international foreign exchange market. Functions of Foreign Exchange Market

1. Transfer Function The primary function of the foreign exchange market is the transfer of funds from one country to the other. It facilitates the conversion of one currency into another. This accomplishes the transfer of purchasing power between two different countries. This is the primary function of the foreign exchange market. The funds can be transferred through telegraphic transfers, bills of exchange, foreign bills and bank drafts. The foreign exchange market determines the price of one country’s currency relative to another country’s currency. 2. Credit FunctionThe foreign exchange market performs another function of the financing of trade. It is called as the credit function. Credit is usually required when goods are in transit and also to allow the buyer to resell the goods and make the payment. In general, the exporters allow 90 days to importers to pay. The former generally gets the importers obligations to pay discounted through the commercial banks. This permits the payment to the exporters right away but the commercial banks will eventually collect the payment from the importers when due. Thus the foreign exchange market permits time to the importers in making payment, on the one hand, and permits instant payment to exporters through discounting facility, on the other. 3. Hedging FunctionAnother function of the foreign exchange market is to furnish facilities for hedging exchange risks. In a free exchange market, the variations in exchange rates result in a gain or loss to the concerned parties. If there is rise in the exchange value of the foreign currency between the time at which obligation arises and the time at which it is discharged, the importer is faced with a risk of loss. To protect himself from such an exchange risk, the importer can avail himself of the hedging facility. Hedging means covering of an exchange risk, which can be avoided or reduced through a forward contract. It is a contract to buy or sell foreign exchange against another currency at some fixed date in the future at a price agreed upon presently. No money passes at the time of contract. The contract enables the importer to ignore any likely change in exchange rate in during the intervening period which is usually of the duration of 90 days. The existence of a forward market permits hedging against any possible exchange risk. Q2) Explain the structural components of Foreign exchange market .A2) Structure Of Foreign Exchange Markets

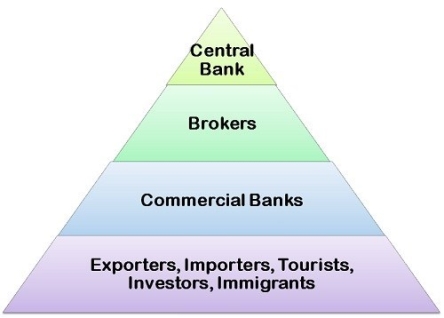

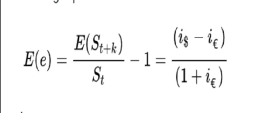

The foreign exchange market consist of Buyers, Commercial banks, Brokers and Central Bank. These are the main players of foreign exchange market. Let us explain the various participants of foreign exchange marketAt the bottom of the pyramid are the actual buyers and sellers of foreign currencies- exporters, importers, tourists and investors. They are the prime users of the currencies and approaches to commercial banks to buy them. Commercial banksNext player is the commercial banks .The commercial banks account for by far the largest proportion of all trading of both a commercial and speculative nature and operate within what is known as the interbank market. This is essentially a market composed solely of commercial and investments which buy and sell currencies from each other. Strict trading relationships exist between the member banks and lines of credit are established between these banks before they are permitted to trade.Commercial and investment banks are a fundamental part of the foreign exchange market as they not only trade on their own behalf and for their customers, but also provide the channel through which all other participants must trade. They are in essence the principal sellers within the Forex market BrokersForeign exchange intermediaries are firms that provide an exchanging platform to the currency traders so that they can sell and buy foreign currencies. The brokers who trades in currencies are also known as foreign exchange agent or retail foreign exchange brokers. They handle a little part of the volume of the overall foreign exchange market. They are used to access the 24/7 currency market, by money trader. Central banksCentral banks have a unique place in foreign exchange markets. First, unlike the other groups involved in foreign exchange markets, the central banks’ involvement in foreign exchange markets doesn’t have a profit motive.Second, central banks’ decisions regarding monetary policy are extremely influential on exchange rate determination. Central banks indirectly affect exchange rates through their monetary policy decisions. In every country, central banks are responsible for conducting monetary policy, among their other roles. The main goals of monetary policy are to promote price stability and economic growth.Basically, a central bank addresses the domestic economy’s problems by changing the quantity of money and interest rates, which leads to changes in the exchange rate as well.Third, central banks can directly affect exchange rates through interventions into foreign exchange markets. A central bank can use its domestic currency and foreign currency reserves to buy or sell foreign currencies directly in the foreign exchange market. Q3) Distinguish between Spot Transactions and Forward Transactions.A3) Spot transactionA foreign exchange spot transaction, also known as FX spot, is an agreement between two parties to buy one currency against selling another currency at an agreed price for settlement on the spot date. The exchange rate at which the transaction is done is called the spot exchange rate. As of 2010, the average daily turnover of global FX spot transactions reached nearly 1.5 trillion USD, counting 37.4% of all foreign exchange transactions.The standard settlement timeframe for foreign exchange spot transactions is T+2; i.e., two business days from the trade date. Notable exceptions are USD/CAD, USD/TRY, USD/PHP, USD/RUB, and offshore USD/KZT and USD/PKR currency pairs, which settle at T+1. Majority of SME FX payments are made through Spot FX, partially because businesses aren't aware of alternatives. Forward transactionsA forward transaction is a future transaction where the buyer and seller enter into an agreement of sale and purchase of currency after 90 days of the deal at a fixed exchange rate on a definite date in the future. The rate at which the currency is exchanged is called a Forward Exchange Rate. The market in which the deals for the sale and purchase of currency at some future date are made is called a Forward Market.Forward contracts have one settlement date—they all settle at the end of the contract. These contracts are private agreements between two parties, so they do not trade on an exchange. Q4) Explain the concept of Forward Quotations with the help of forward premium and Forward discount.A4) Forward is a transaction where two different currencies are exchanged between accounts on the prefixed future value date. The exchange of currencies takes place on the prefixed accounts, on the same value date. The Client is protected from adverse movements in future FX rates, but he also does not benefit from favourable movements. Foreign Exchange forwards avoid uncertainty and are therefore valid instruments for Clients to mitigate the foreign exchange risk for future transactions denominated in a foreign currency. The points on a forward rate quote are the differences between the spot exchange rate quote and the forward exchange rate quote. These points are scaled such that they can have a relation to the last decimal in the spot quote. It is of great importance to note that forward quotations are displayed as the number of forward points at each maturity. Swap points also express forward points.When the forward rate is higher than the spot rate, the points are positive and thus the base currency is said to be trading at a forward premium. Otherwise, the points are negative and said to be trading at a forward discount. A forward premium denotesthat the currency under consideration is more expensive (of course in terms offoreign currency) for future delivery than for immediate delivery, that is, it is moreexpensive forward than spot. A forward discount denotes the opposite situation, i.e. the currency is cheaper forward than spot. The higher or lower value of the currency forward than spot is usually measured in terms of the (absolute or proportional) deviation of the forward exchange rate with respect to the spot exchange rate. We observe, incidentally, that in the foreign exchange quotations the forwardexchange rates are usually quoted implicitly, that is, by quoting the premium ordiscount, either absolute or proportional. When the forward exchange rate is quoted If the price quotation system is used, the higher value of the currency forward than spot means that the forward exchange rate is lower than the spot exchange rate, and the lower value of a currency forward than spot means that the forward exchange rate is higher than the spot rate. But if the volume quotation system is used the opposite is true: the higher (lower) value of a currency on the forward than on the spot foreign exchange market means that the forward exchange rate is higher (lower, respectively) than the spot rate. If, say, the $ in New York is more expensive forward than spot with respect to the euro, this means that fewer dollars are required to buy the same amount of euros (or, to put it the other way round, that more euros can be bought with the same amount of dollars) on the forward than on the spot exchange market, so that if the USA uses the price quotation system, in New York the $=euro forward exchange rate will be lower than the spot rate, whereas if the USA used the other system, the opposite will be true. Therefore in the case of the price quotation system the forward premium willbe measured by a negative number (the difference forward minus spot exchangerate is, in fact, negative) and the forward discount by a positive number. Thisapparently counterintuitive numerical definition (intuitively it would seem morenatural to associate premium with a positive number and discount with a negativeone) is presumably due to the fact that this terminology seems to have originatedin England, where the volume quotation system is used, so that by subtracting thespot from the forward exchange rate one obtains a positive (negative) number in thecase of a premium (discount). Q5) State the relationship between Interest rate parity and Fisher’s Parity.A5) Interest rate parity is a no-arbitrage condition representing an equilibrium state under which investors interest rates available on bank deposits in two countries. The fact that this condition does not always hold allows for potential opportunities to earn riskless profits from covered interest arbitrage. Two assumptions central to interest rate parity are capital mobility and perfect substitutability of domestic and foreign assets. Given foreign exchange market equilibrium, the interest rate parity condition implies that the expected return on domestic assets will equal the exchange rate-adjusted expected return on foreign currency assets. Investors then cannot earn arbitrage profits by borrowing in a country with a lower interest rate, exchanging for foreign currency, and investing in a foreign country with a higher interest rate, due to gains or losses from exchanging back to their domestic currency at maturity. Interest rate parity takes on two distinctive forms: uncovered interest rate parity refers to the parity condition in which exposure to foreign exchange risk (unanticipated changes in exchange rates) is uninhibited, whereas covered interest rate parity refers to the condition in which a forward contract has been used to cover (eliminate exposure to) exchange rate risk. Each form of the parity condition demonstrates a unique relationship with implications for the forecasting of future exchange rates: the forward exchange rate and the future spot exchange rate.The international Fisher effect (sometimes referred to as Fisher's open hypothesis) is a hypothesis in international finance that suggests differences in nominal interest rates reflect expected changes in the spot exchange rate between countries. The hypothesis specifically states that a spot exchange rate is expected to change equally in the opposite direction of the interest rate differential; thus, the currency of the country with the higher nominal interest rate is expected to depreciate against the currency of the country with the lower nominal interest rate, as higher nominal interest rates reflect an expectation of inflation. Relation to interest rate parityCombining the international Fisher effect with uncovered interest rate parity yields the following equation:

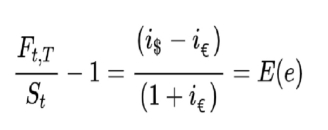

Where E (St+k) is the expected future spot exchange rateSt is the spot exchange rateCombining the International Fisher effect with covered interest rate parity yields the equation for unbiasedness hypothesis, where the forward exchange rate is an unbiased predictor of the future spot exchange rate.

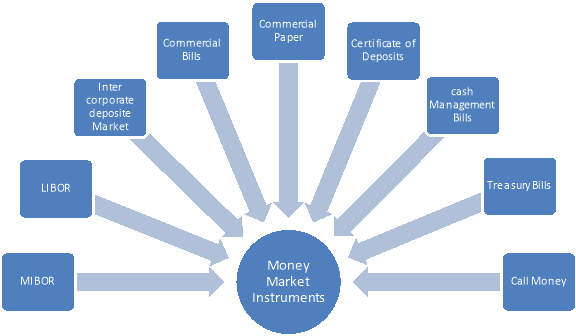

whereFt,T is the forward exchange rate. Q6) Why Exchange rate forecasting is important? What are the various approaches of forecasting are used by a forecaster?A6) The Importance of Exchange Rate Forecasting Exchange rate forecasts plays a fundamental role in nearly all aspects of international financial management. - Short-term hedging or cash management decisions often rely on a forecast of expected exchange rate movements. – To evaluate foreign borrowing or investment opportunities, forecasts of future spot exchange rates are necessary to convert expected foreign currency cash flows into their expected domestic currencies. - For long-term strategic decisions, such as whether to build or acquire productive resources in a particular country, the firm needs forecasts of exchange rates to measure the competitiveness of alternative location choices. Exchange rate forecasts also enter into the firm’s operating and strategic decisions, such as where in the world to source inputs and sell final products. Based on the information set used by the forecaster, there are two pure approaches to forecasting foreign exchange rates: (1) The fundamental approach. (2) The technical approach. Fundamental ApproachThe fundamental approach is based on a wide range of data regarded as fundamental economic variables that determine exchange rates. These fundamental economic variables are taken from economic models. Usually included variables are GNP, consumption, trade balance, inflation rates, interest rates, unemployment, productivity indexes, etc. In general, the fundamental forecast is based on structural (equilibrium) models. These structural models are then modified to take into account statistical characteristics of the data and the experience of the forecasters. Advantages of Fundamental ApproachFundamental Forecasting is based on the fundamental relationships between economic variables and exchange rates A forecast may arise simply from a subjective assessment of the factors that affect exchange rates. A forecast may be based on quantitative measurements using the regression models and sensitivity analysis. Technical ApproachThe technical approach (TA) focuses on a smaller subset of the available data. In general, it is based on price information. The analysis is "technical" in the sense that it does not rely on a fundamental analysis of the underlying economic determinants of exchange rates or asset prices, but only on extrapolations of past price trends. Technical analysis looks for the repetition of specific price patterns. Computer models attempt to detect both major trends and critical, or turning, points. These turning points are used to generate trading signals: buy or sell signals. The most popular TA models are simple and rely on moving averages (MA), filters, or momentum indicators. Advantages Of Technical ApproachTechnical forecasting involves the use of historical data to predict future values. It includes statistical analysis and time series models. Speculators may find the models useful for predicting day-to-day movements. Limited use of MNCs. Q7) What is Offshore market? Write the characteristics of Offshore Market.A7) The offshore market is a market where funds are moved actively by market participants (surplus and deficits units) in an offshore financial centre having specific and unique characteristics. Generally, an offshore financial center is a location or jurisdiction where financial products and services are offered by offshore companies that meet the needs of financial market participants in a low tax regime and moderately or lightly regulated jurisdictions. Some of the general characteristics, and benefits, of an offshore financial center are as follows:Low tax environment that give opportunities for offshore companies, including offshore banks to generate higher profits and a stable operating base Minimum exchange control requirements that enable the offshore banks to mobilize funds among market participants with a greater degree of flexibility even in a volatile market conditions Large number of financial institutions offering numerous products and services to meet the specific needs of the market Maximum confidentiality through the appointment of nominee owners and directors that provides high degree of secrecy on information of the banking clients Excellent physical infrastructure and communication networks that enable providers and users of the products and services to enjoy excellent services In the case of the Malaysian financial system the activities of offshore financial markets are based in Labuan. Labuan has all of the above features and besides that companies operating in Labuan (offshore companies) are able to operate in a competitive cost and politically and economically stable environment. Q8) List the various instruments of Money Market and state their uses.A8) Money market is a tool that manage the lending of short term funds (less than one year). It is a subdivision of the financial market in which financial instrument with high liquidity and very short maturities are traded.There are several money market instruments---

Call MoneyInter bank market where funds are borrowed and lent for 1 day or less. If >1 day and up to 14 days, it is called notice money. Mutual funds, scheduled commercial & cooperative banks act as both borrowers and lenders. LIC, GIC, NABARD, IDBI act only as lenders. Treasury BillsIssued by RBI on behalf of govt. Govt uses them to meet their short-term liquidity crunch. T-bills are sovereign zero risk instruments. At present, 3 types of T-bills are there : 91-day, 182-day, 364-day. State govt can not issue T-bills. They are issued by Market Stabilization Scheme (MSS). Available for a minimum amount of Rs 25000 or in multiples of that. Cash Management Bills (CMBs)It's a comparatively new short-term instrument issued by RBI on behalf of Govt. Issued to meet temporary mismatches in cash flow of Govt. They resemble T-bills in character but are issued for less than 91 days only. Certificate of Deposit (CDs)Issued by scheduled commercial banks and other financial institutions. RRBs and local area banks can not issue CDs. Issued at a discount to face value, the discount rate is negotiated between issuer and investor. Minimum amount to be Rs 1 lac. CDs issued by banks have a maturity period: 15 days to 1 year. CDs issued by selected FIs have maturity period: 1 year to 3 years. Can be issued to individuals or firms. Commercial Paper (CP)These are unsecured promissory* notes issued by large corporates, primary dealers, satellite dealers and all India FIs. Maturity period is between 7 days up to 1 year from date of issue. Minimum amount to be invested is Rs 5 lacs or multiples of that. The net worth for a corporate to be able to issue it is 4 crore. CPs need to have a credit rating from a credit rating agency. Commercial Bills (CBs)Negotiable instruments which are issued by all India FIs, NBFCs, SCBs, Merchant banks & Mutual funds. Drawn by seller on the buyer (buyer gives seller), hence also called trade bills. Q9) Explain the concept of trading interest rate futures.A9) A futures market is an auction market in which participants buy and sell commodity and futures contracts for delivery on a specified future date. Futures are exchange-traded derivatives contracts that lock in future delivery of a commodity or security at a price set today. Futures contracts are derivative financial instruments that have their value determined by an underlying asset. Each futures contract is an agreement between 2 parties to buy or sell an asset at a certain price by a set future date. Futures are commonly traded on assets like stock indices, currency pairs and commodities like grains and precious metals. While futures contracts imply a forthcoming transaction will take place, most futures trades are for hedging and speculation and are rarely used to take delivery of an asset. The majority of futures contracts are either offset in the market before the delivery date or rolled into later months. Trading in Futures

Futures contracts are traded by a system of open outcry on the trading floor (also called the trading pit) of a centralised and regulated exchange. Increasingly, trading with electronic screens is becoming the preferred mode in many exchanges around the world. All traders represent exchange members.Those who trade for their own account are called floor traders while those who trade on behalf of others are floor brokers. Some do both and are called dual traders .The variables to be negotiated in any deal are the price and the number of contracts. A buyer of futures acquires a long position while the seller acquires a short position. As we know, when two traders agree on a deal, it is entered as a short and a long both vis-à-vis the clearinghouse.Simple steps to trade in futures Step 1: Learn about Commodities and Futures. Step 2: Get a Reliable Internet Connection.Step 3: Choose a Reputable Futures Broker.Step 4: Open and Fund a Live Account. Q10) What are the strategies used by an investor to minimize its risks in foreign exchange market?A10) Hedging with Interest Rate FuturesIn an environment of volatile interest rates, both borrowers and investors may wish to reduce or completely eliminate interest rate risk. Borrowers may wish to ensure that their borrowing cost does not exceed some ceiling rate while investors may want to lock-in a minimum rate of return on their investments. Banks may wish to reduce the risk arising out of maturity mismatch – borrowing short term and lending long term – and hedge their positions in OTC products like FRAs.Interest rate futures can be used to reduce the risk though not eliminate it except in rare cases. Speculation with Interest Rate FuturesLike currency futures, interest futures can be used to speculate on absolute and relative interest rate movements. Strategies used by speculatorsLong position; purchase futures contractsStrategy to use if speculator anticipates interest rates will decrease and bond prices will increase. Buy a futures contract and if rates drop the contract’s price rises above what it cost to purchase and exchange adds gain with daily settlement to investor’s account. If interest rates rise instead of fall, futures contract price drops and investor’s account is reduced by daily lossShort position: sell futures contracts Strategy to use if speculator anticipates interest rates will rise and contract prices drop. Sell (short) a futures contract and close the position by buying a contract to offset short. If rates rise, the price to buy the contract and close the position is less than the price received for the initial sale of the contract. Speculator loses money if rates drop SPECULATION WITH INTEREST RATE FUTURES

Open Position Trading -On September 1, December eurodollar futures on the IMM is trading at A trader believes that short term interest rates are going to fall very soon. He buys a December contract at On subsequent days, the prices and consequent losses/gains are :Day 1: (+$250) Day 2: (-$75)Day 3: (+$325) Day 4: (+$50)Day 5: (-$50) Day 6: (+$125) Liquidates positionTotal gain: $625 minus brokerage commissions.

|

|

|

|

|

|

Open Position Trading -On September 1, December eurodollar futures on the IMM is trading at A trader believes that short term interest rates are going to fall very soon. He buys a December contract at On subsequent days, the prices and consequent losses/gains are :Day 1: (+$250) Day 2: (-$75)Day 3: (+$325) Day 4: (+$50)Day 5: (-$50) Day 6: (+$125) Liquidates positionTotal gain: $625 minus brokerage commissions.

0 matching results found