Letters of credit are most frequently utilized in international trade, where they're governed by the Uniform Customs and Practice for Documentary Credits (or UCP), the principles of the International Chamber of Commerce. However, they will be utilized in other situations.

Q2) What is ORDER LETTER?A2) An order letter is typically written once you got to assign orders for goods. It's quite common and is written almost on a day to day basis. The language of the letter, however, must be formal and therefore the letter follows a typical format, since the knowledge is extremely specific.

An order letter must pen down the terms and conditions of the acquisition. These benefit both the involved parties. It generally contains details like product specifications, their quantities, a price that the parties have prescribed, the date of delivery, what to try to to just in case there occurs a late delivery, etc.

Now, I can tell you ways to write down an order letter, since you now know all that you simply needed to understand before writing one.

An order letter needs the subsequent things to be in check:o Contact information about yourself, the person/company which will supply to you and therefore the date.

o A subject line that helps the recipient to know your purpose directly.

o A salutation, like, if you recognize the name of the vendor, write, “Dear ……………”. If you do not know the name of your seller, simply write “Dear Seller”

o Information about your company; but this is often totally optional. However, this will ensure a long-term relationship. you'll also say a couple of words about your future plans associated with the sale.

o Order details, and by details I mean everything. The model number, color, size, number, etc. Be attentive since they'll send whatever you'll write. If possible, use bullet points or tables. If you're buying different items of various types, describe them in separate paragraphs.

o Mention your payment mode or if you've paid already, mention that next.

o Indicate your preferred delivery method and date.

o Include any special instructions as a neighborhood of the terms and conditions agreed between the parties.

o Tell them that you're going to enjoy future cooperation with them and encourage them to contact if needed.

o Close with “Sincerely”, your signature and name.

The quality of the delivered goods will depend upon your instructions. Not just that, it's literally a legal instrument between yourself and therefore the seller. So watch out for what goes in your order letter and pay an honest deal of attention while drafting one. Q3) Explain CREDIT LETTER.

A3) When you hear the phrase 'letter of credit,' it'd be natural to think it refers to a document verifying that you simply are creditworthy, but that may not the case. A letter of credit may be a document issued by a 3rd party that guarantees payment for goods or services when the vendor provides acceptable documentation. Letters of credit are usually issued by banks or other financial institutions, but some creditworthy financial services companies, like insurance companies or mutual funds, might issue letters of credit under certain circumstances.

A letter of credit generally has three participants. First, there's the beneficiary, the person or company who are going to be paid. Next, there's the customer or applicant of the products or services. this is often the one who needs the letter of credit. Finally, there's the issuing bank, the institution issuing the letter of credit. Additionally, the beneficiary may request payment to an advising bank, which may be a bank where the beneficiary may be a client, instead of on to the beneficiary. This could be done, for instance, if the advising bank financed the transaction for the beneficiary until payment was received.

Letters of credit are most frequently utilized in international trade, where they're governed by the Uniform Customs and Practice for Documentary Credits (or UCP), the principles of the International Chamber of Commerce. However, they will be utilized in other situations, as we shall see.

Most letters of credit are import/export letters of credit, which, because the name implies, are letters of credit that are utilized in international trade. an equivalent letter of credit would be termed an import letter of credit by the importer and an export letter of credit by the exporter. In most cases, the importer is that the buyer and therefore the exporter is that the beneficiary.

There also are other sorts of letters of credit. The revocable letter of credit are often changed at any time by either the customer or the issuing bank with no notification to the beneficiary. the foremost recent version of the UCP, UCP 600, did away with this type of letter of credit for any transaction under their jurisdiction. Conversely, the irrevocable letter of credit only allows change or cancellation of the letter of credit by the issuing bank after application by the customer and approval by the beneficiary. All letters of credit governed by the present UCP are irrevocable letters of credit.

A confirmed letter of credit is one where a second bank agrees to pay the letter of credit at the request of the issuing bank. While not usually required by law, an issuing bank could be required by writ to only issue confirmed letters of credit if they're in receivership. As you would possibly guess, an unconfirmed letter of credit is guaranteed only by the issuing bank. this is often the foremost common form with reference to confirmation.

A letter of credit can also be a transferrable letter of credit. These are commonly used when the beneficiary is just an intermediary for the important supplier of the products and services or is one among a gaggle of suppliers. It allows the named beneficiary to present its own documentation but transfer all or a part of the payment to the particular suppliers. As you would possibly guess, an un-transferrable letter of credit doesn't allow transfer of payments to 3rd parties.

A letter of credit can also be at sight, which is payable as soon because the documentation has been presented and verified, or payment could also be deferred. Deferred letters of credit also are called a nuisance letter of credit and should be postpone until a particular period of time has passed or the customer has had the chance to examine or maybe sell the related goods.

A red clause letter of credit allows the beneficiary to receive partial payment before shipping the products or performing the services. Originally, these terms were written in loss, hence the name. In practical use, issuing banks will rarely offer these terms unless the beneficiary is extremely creditworthy or an advising bank agrees to refund the cash if the shipment isn't made.

Finally, a back-to-back letter of credit is employed during a trade involving an intermediary, like a trading house. it's actually made from two letters of credit, one issued by the buyer's bank to the intermediary and therefore the other issued by the intermediary's bank to the vendor.

In order to receive payment, the beneficiary must present documentation of completion of their part within the transaction to the issuing bank. The documents that the issuing bank will accept are laid out in the letter of credit, but may often include:

• Bills of exchange• Invoices• Government documents, like licenses, certificates of origin, inspection certificates, embassy legalizations, and phytosanitary certificates• Shipping and transport documents, like bills of lading and airway bills• Insurance policies or certificates, except cover notesQ4) What is COLLECTION LETTER? A4) Letters written for realizing payments from the debtors are referred to as collection letters. the necessity for writing collection letters arises from credit sales. Selling on credit may be a traditional business policy that enhances volume of sales. Under the credit sales policy, the sellers allow the purchasers a particular period for payment of dues. However, sometimes the buyers make unexpected delay in paying their dues. Even, some custom stances, the sellers write letters reminding and requesting the purchasers to pay the due bills. rather than sending one letter or repeated copies of an equivalent letter, credit departments send a series of letters.

In the opinion of Kitty O. Locker, “Collection letters ask customers to buy the products and services they need already received.” Quibble et al. defined, “Collection letters are employed by a corporation to entice its charge customers to pay an impressive charge-account balance.”

Collection letters are written during a series. When collection letters are written during a series beginning with an easy reminder and end with a warning letter indication action the dues promptly by retaining the purchasers with the corporate. Q5) What are the different sorts of enquiry letters?

A5) Letter of inquiry is one among the foremost important sorts of business letters. When a buyer wishes to urge some information about the number, price, availability etc of products to be bought or about the terms of sale, payment etc he writes a letter of inquiry to the vendor.

Inquiry Letter ACCORDING TO MORRIS PHILIP et al., “THE LETTER THAT SEEKS INFORMATION CONCERNING THE PRODUCTS AND SERVICES FROM A business is named AN INQUIRY LETTER.”

QUIBLE et al. SAID, “LETTER OF INQUIRY MAY BE A SORT OF BUSINESS MESSAGE THAT ASKS THE RECIPIENT FOR INFORMATION OR ASSISTANCE.”

IN THE OPINION OF R. V. LESIKAR et al., “LETTERS THAT ASKS QUESTIONS OR INFORMATION ABOUT ANYTHING is named INQUIRY LETTER.” BUSINESS COMMUNICATION

ACCORDING TO GARTSIDE, “AN INQUIRY LETTER ASKS INFORMATION LIKE CATALOGUE, QUOTATION, SAMPLE and price OF A PRODUCT FORM A SELLER during a CONCISE AND CLEAR WAY.”

So, we will define the letter of inquiry as a letter sent to the vendor from the potential buyer asking information about the worth , quantity, availability etc of a product and therefore the terms of sale, terms of payment, service etc.

Every letter has some certain objectives or motives and inquiry letter isn't an exception. it's written on different occasions for various reason. Inquiry letter is written so as to hold out one among the subsequent objectives bellow-

• To get the worth quotation of specific commodities• To invite catalog• To know payment terms• To know the past records of job applicant• To know the credit worthiness of a firm or an individual• To invite folders• To get recommendation from former employer• To know the financial strength of a firm or an individual• To know the business reputation of a firm• To know the transportation facility provided by the firm• To obtain information about social station of an individual or a firm• To evaluate the performance of an individual or a firm• To study the standard of a product• To know the supply of an item• To make request for sample etc.

Inquiries could also be of various types supported the target, information sought and therefore the initiatives taken. There are generally four sorts of inquires letter-solicited inquiry, unsolicited inquiry, inquiry for a few favor and routine inquiry letter. These are discussed below-

• Solicited Inquiry: An inquiry made in response to the sellers’ advertisement and publicity is named a solicited inquiry. Actually it's a response by the customer to the advertisement or publicity of a seller.

• Unsolicited Inquiry: An inquiry made at the buyer’s own initiative is named unsolicited inquiry. this sort of inquiry is formed when a buyer wants to understand anything from the vendor.

• Inquiry for a few Favor: An inquiry made not about goods but another information like special price or favorable terms is named inquiry for a few favor.

• Routine Inquiry: An inquiry made by an old or regular buyer within the usual course of action is named routine inquiry. Most of the business inquires fall during this category.

So, we discover that there are differing types of inquires, regardless of the type is that the bottom line of success of an inquiry depends upon how it's written.

SAMPLE

To,

Robert Parkinson

Head of Advertising

Jones Advertising Company

D-45, ground floor , Henry tower, jack lane

Vanilla street-5th avenue

London, UK

Date: 19th April 2014

Subject: Business communication inquiry letter

Dear Mr. Parkinson,

I am Jack Parker, the senior marketing manager at Pablo International Company and that I am scripting this letter to you to form an inquiry about your previous couple of emails to us. I assume there has been confusion in business communication and that I wish to clear it out upfront.

As discussed in our meeting last week, you were alleged to create an advertising plan and proposal for advertising of our brand and its products. In response to the present discussion, you sent us an in depth plan but later, I received a totally new and different plan on email. I replied back to you asking about which one to think about but there was no response. Kindly check out the matter and let me know which decide to consider in order that I can plow ahead and review it.

I hope that you simply will reply soon because our product launch is arising soon,

Thanking you.

Regards,

Jack Parker

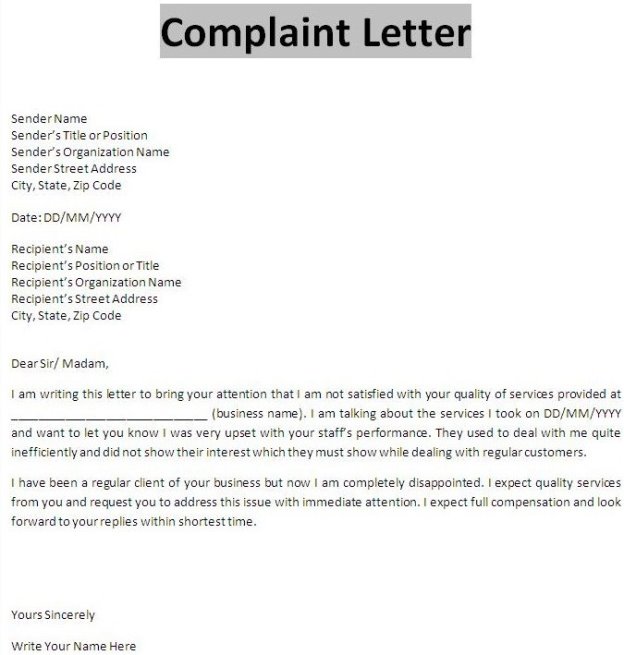

Q6) What is COMPLAINT LETTER?

A6) Definition of complaint letter, meaning of complaint letter, sorts of Complaints Letter. Letters which are written by the purchasers to the sellers about their inconveniences created by some unexpected situations are referred to as complaint letters. However efficient a corporation could also be in running a business, everything doesn't go all the time consistent with plan. there'll be some mistake and a few accidents. Important service are sometimes rendered unsatisfactorily; goods are consigned to wrong destinations, sometimes too late, sometimes in but the specified quantities, sometimes in damaged condition.

Complaint letter 1s..

Letter written to bring these mistakes to the notice of these who must own the responsibilities for them are called claim or complaint letters. So, when a letter is written to the vendor by the customer raising complaints or claims regarding mistakes taken place during the order to payment period is named a claim or complaint letter.

Business complaint letter is written by customers who aren't satisfied by the amount of consumer services provided. If you are feeling that your supplier is dishonest about the products they deliver to you, whether in terms of content or pricing, you'll write them a customer complaint letter to precise your grievances. don't forget to say that there'll be consequences should they fail to deal with the difficulty in question.

|

These letters are written to the purchasers in order that they will observe profits. It are often written to the prevailing customers to tell changes in rates, supplies, and new offers, etc. It is often associated with introducing a replacement product of the corporate to follow up together with your existing customers or new customers to take care of an honest account.

Your product or service could be top of the road. Your customer service could also be the simplest in school. you're still getting to get complaints. Client complaints or claim letters are often an enormous asset for your business then show you ways to harness those assets. When customers complain, they're actively teaching you ways to enhance your product. this sort of warm, helpful letter to take care of the business scent during the amount you're gathering all the specified information for the prospect.

Claim Letter Template

From,

_____________

_______________

Date:______________(date on which the letter is written)

To,

____________

_________

Subject: Claim letter

Dear Sir/ Madam,

I am ___________ (name) scripting this letter to you to declare the schemes and offers on behalf of our company that's ____________ (name of the company).On this Diwali, we've declared festive season offers. We are delighted to satisfy your needs and consider it a compliment whenever you place an order.

In appreciation for your business, we've included a coupon for 10 percent off any service for each product in your fleet. If you place an order between 01.11.2013 to 15.11.2013 then you'll avail these offers.

We will also sell regular products prices during this period. So if you would like to realize huge profits, then you'll place big orders during this period. you'll also buy larger quantities. These offers are for all our important customers, and you're one among them.

We encourage you to contact us regarding this special offer and to think about us your one-stop service center. At eBay, we are committed to providing superior care. Again, it's a privilege of servicing you. Hence you're requested to be benefited by these offers.

Hope to listen to soon from you.

Thanking You.

Yours Sincerely,

____________

Svetlana Singh,

Bhalla Enterprises,

Delhi.

6th December 2014

To,

Shivaay Singh Oberoi,

Oberoi Industries,

Delhi.

Subject: sample credit letter

Dear Sir,

Warm wishes.

Doing business with you for the past five years has truly been a pleasure, and that we hope to continue this rewarding relationship for years to return. We are pleased that we will provide you with flawless products annually, and that we are indebted to you for recommending us to your professional and private associates. Because your support means such a lot to us, we would like to mention many thanks for this. We feel excellent to announce various schemes and offers for our honored customers such as you. we've arranged special festive season cent percent discount & concessions for all the orders for a replacement and old range of products.

Kindly note that this is often not stock clearance offers but we'll present you with fresh stock. The offers are Diwali special, and hence they're for a limited period of 01.11.2013 to 1511.2013. we propose you place your order between these periods in order that you'll avail such offer and make a profit. Moreover, for a limited period, we are reducing the costs for all items in our catalog.

Hence you're requested to require advantage of an equivalent. you'll order for larger quantities or heavy consignments in order that you'll observe profits. As you recognize, your satisfaction with our company products is that the top priority. expecting an enormous response from your side. Hope to ascertain you soon regarding this.

Thanking You.

Yours Sincerely,Shvetlana Singh.

Q8) What is an ADJUSTMENT LETTER?

A8) Adjustment Letter is response letter to customer complaint or claim. it's official in nature and explains the relevancy of the complaint or claim and the way it are often resolved.

Adjustment Letter Definition

• A sort of letter addressed in response to a customer's claim or complaint letter, written by a representative of an organisation or a gaggle

Because of the client-vendor relation, a letter of adjustment also acts as a legal instrument demonstrating the small print of the correspondence and therefore the resolution or dissolution the between the 2 parties. A letter of adjustment doesn’t mean that your complaint or claim are going to be accepted. It notifies the sender that their claim or complaint letter has been received. It depends upon the validity of your claim that a letter of adjustment will contain conformity of its mistake and its rectification.

Adjustment letters are meant to resolve a conflict that's why they're referred to as such. Letters of adjustment also are referred as Claim Adjustment Letters, Complaint Response Letters, Customer Complaint Reply, Letter of Complaint Response, Letter of response to Complaint and similar other terms. A letter of adjustment deals with all kinds of claims and complaints; defective product, poor service, goods not delivered, shipment arriving late, salary not received et al.

Bangladesh Textiles Mills Ltd. Narayangong, Dhaka 10th Feb. 04 Marketing Manger Bexi-Clothes Corner South Plaza, Dhaka-1215. Ref: Your letter dated 5th Feb. 04. Dear Sir, We thank you. for your letter of 5th Feb. 04 along with/ sample of cloth for examination. The report that we have received just today shows that the consignment forwarded to you was the wrong one full of defective clothes. It was a mistake because of our dispatch section and we regret this mistake which has caused you both embarrassment and inconvenience. We have already sent the replacement by passenger train. You can be sure of the quality of cloth now sent. You can, of course, return the clothes to us and debit our account for the loss caused to you. We again regret the inconvenience to you and assure you that such mistakes will be avoided in future. Yours faithfully

M. Ashraf Sales Manager Banagladesh Textile Mills Ltd. |

Emporium Tea Ltd. Golf Club Road, Tongi, Gazipur 25th July, 04, Manger 25, Dhanmondi, Dhaka-1211 Ref: Your letter dated July 21, 2015 Dear Sir, We have received your letter of complaint dated July 21, 04 regarding shortage of quantity. It is probably first time that we get such complaint from a customer regarding shortage of quantity. Where as you are our valued customer, we cannot deny any human error made by our dispatch workers. As a large concern in the country, we have to deal with large quantity each day and therefore a sudden error is possible. We therefore, are dispatching the shortage quantity as per your order. We expect your co-ordination as before. With thanks. Yours faithfully Salam Ahmed Sales Manager Emporium Tea Ltd. |

LIGHTING WORLD LTD Tongi, Gazipur 10th March, 04 Sales Manager TRANS-WORLD LIGHTING Mohakhali C/A, Dhaka-1212 Ref: Reply to your letter dated 5th March, 2015 Dear Sir, We feel extremely sorry to hear that 100 cartoons of Tube lights received by you in a 4amaged condition. Our dispatch section has a pre-packing inspection which allows the packing of goods maintaining satisfactory quality. Damage, such as in your case, occurs very rarely when the packages are roughly handled in transit. As the contract involves replacement of damaged goods we are ensuring the supply of 100 cartoons of Tube lights with more extra packaging. Will you kindly sign the enclosed “Damage Report” So that we can submit our claim to Insurance Company? The attached Business Reply Envelope is for your convenience in returning the report. Our authorized representative will collect the damaged goods before 15th March, 04. Please confirm the arrival of goods. Yours faithfully S. Alam Manager, Sales & Service LIGHTING WORLD LTD |

A9) Sales Correspondence may be a written language between two parties with the motive of sales. A sales letter may be a sort of sale correspondence. it's a letter that tries to sell a product. Sales letters are an efficient thanks to communicate with clients.It may target a selected group to grab their attention. it's sort of a salesman discussing the aim but within the sort of a letter. A sales letter are often general or particular in nature.

• A sales letter aims at reaching the reader to get the merchandise.• Introduction and marketing of latest products and services.• To reach potential customers.• Expansion of the market.

Writing Tips for Writing Sales Letter

• Introduce the ideas during a way that compels the reader to require a positive action.• Introduce yourself and therefore the product well.• Be clear in what you're offering.• Choose your words as per the targeted audience.• Always use a headline.• Make the primary sentence of every paragraph count.• Use of font styles, font sizes, bullets, and numbering etc.• Use relevant statement showing the credibility of the merchandise.• Suitable closing sentences.• Correct use of salutation.• Proper and complete details of the merchandise and availability.• Always invite attention, build interest, desire, and call of action.• Have an easy and convincing tone.• Avoid creating confusion and uncertainty.• Avoid being clever and funny.• Include your name, signature, and other contact details.• Do not use fancy words or slangs.• Always revise and edit the letter.

A sales letter features a specific purpose to satisfy. the varied purposes are often the introduction of a replacement product or service, availing new offers, selling incentive etc. allow us to discuss a number of them here.

This type of letter is written to a customer or a consumer to introduce to the corporate or a product. It also explains how readers will get enjoy the merchandise or the service. It must grab people’s attention, build their interest and call to action. 2. Product Update

As the name suggests, this sort of letter is to explain the advantages of latest products over older ones. Other details sort of a limited period to get and discount also can be included.

3. Selling Incentive It promotes existing products among current customers. this sort of letter must build some excitement among the reader to shop for the merchandise.

4. Thank You A sender writes this letter to thank the purchasers to be a neighborhood of the business. It shows the worth of the customer. a quick mention is given on the supply of product for the customer.

5. Holiday Celebration This letter gives an opportunity to supply a product as a present for patrons. It also shows the discounts and therefore the offers limited to the vacation celebration.

6. Invitation It is a call for participation to the purchasers for any celebration. This helps the purchasers to feel important.

7. Lost Customer This type of letter is for the purchasers who haven't been too active recently. It helps the organization to bind with them and offers them good deals.

Q10) Write a note on RTI.

A10) RTI or Right to Information is an act gone by the Govt of India in 2005. As per the RTI Act, any citizen of India may request information from any “Public Authority”. the general public Authority then has got to provide the requested information or a reply within 30 days of receiving the RTI application. The Act covers all of India except Jammu & Kashmir, where a modified J&K Right to Information Act is applicable.

A “Public Authority” is defined as a body or authority established or constituted by order or notification of appropriate government including bodies “owned, controlled or substantially financed” by government. Non-Government organizations “substantially financed, directly or indirectly by funds” provided by the Govt. also are covered within the Act.

It is important to notice that the above explanation may be a very basic summary of the RTI Act.

What is the RTI Act?

The Right to Information Act (RTI), 2015 is an Act of the Parliament of India “to provide for beginning the sensible regime of right to information for citizens.” Simply put, it allows citizens of the country to request information from any public authority about its work, actions, etc.

Why is RTI important?

The Right to Information Act is taken into account to be one among the strongest pieces of legislation at the disposal of the commoner. It gives citizens the facility to question public authorities and their activities, thereby not only promoting transparency, but demanding accountability also. The Act is taken into account a landmark legislation within the fight against corruption.

Who all are covered under the Act?In the spirit of promoting transparency and accountability within the Govt., the RTI Act covers various departments. While most the departments and bodies controlled or funded by the Central Government (even at the state level) are covered under the Act, departments funded by the State Governments are accessible only in those States which have State RTIs.

Departments handling defence and national security, however, don't fall into the purview of RTI. This includes bodies like National watchman, the Intelligence Bureau, and Border private security force, etc. The state of Jammu and Kashmir is additionally exempt from the RTI Act.

Where do I file an RTI application?

An RTI application are often filed in one among three ways:

1. Online: Visit rtionline.gov.in and login to file an RTI.2. Via post: send your application to the concerned department via speed post or registered mail.3. In person: Visit the general public Information Officer of the concerned department and he/she will guide you extra.

For instance, if you reside in Bengaluru and have queries about the water system in your area, you'll approach the municipal body responsible of supplying water to your area (in this case, the Bangalore water system and Sewerage Board), either at their office or through their website.

The procedure to file for an RTI is fairly simple.

1. Determine which department your query concerns and who is that the Public Information Officer there.For Central Public Authorities, inspect this website. For State Public Information Officers, go here.

2. Write an easy, to-the-point form detailing your questions clearly.

3. Pay the fee of Rs. 10. The payment are often made via Demand Draft or Indian money order or can even be submitted to the treasury. Proof of payment (such as challans and receipts) must be enclosed with the appliance. Online options for the payment also are available here.

4. Submit the appliance either via post, online or face to face.

When am I able to expect a response to my RTI request?By law, RTIs must be replied to within 30 days. In fact, in life and death cases, RTIs must be skilled within 48 hours.

Date: ………..

Place: …………….

From,

…………..

………………………..

ToThe Public Information Officer…………….

Letter under Sec.6 of the proper to Information Act, 2005

Under the provisions of Right to information Act, we wish to hunt the subsequent information from your office:

1. A……… 2. B………

3. C………

A money order for Rs.10/- is shipped herewith towards fee as per the provisions of Right to information Act, 2005.

You are requested to supply the specified information at the earliest.

Thanking you,

Yours faithfully

…………………..

Encl: