Unit 3

Approaches to Equity Analysis

Q1) What is fundamental analysis? What are the parameters of fundamental analysis. 4+6

Q2) Write a brief note on fundamental analysis.

A) to Q1 & Q2. Fundamental analysis is one of the three approaches to security valuation. It is based on the premise that in the long run true or fair value of an equity share is equal to its intrinsic value. The intrinsic value of a share is the present value of all future expected cash inflows from the share. If the intrinsic value is greater than current price of the share, the share is under-priced and hence a good buy. Fundamental analysis is used primarily to identify securities that are mispriced i.e. that are undervalued or overvalued. There can be two approaches to fundamental analysis –

Fundamental analysis involves analysis of the following parameters-

- Balance sheet,

- Income statement,

- Cash flow statement,

- Notes to financial statements,

- Auditor’s report,

- Social and sustainability reports, if any,

- Corporate governance reports.

2. Earnings analysis or Profitability: Earnings analysis is an important component of company analysis because future cash inflows from an equity share depend to a great extent on the earnings of the company. A company’s overall profitability may be analysed using operating profit margin, return on capital employment (ROCE), Return on asset (ROA), Return on Investment ( ROI), net profit margin etc.

3. Return on Equity (ROE): Return on equity is that part of total earnings of the company which belongs to equity shareholders. It is calculated by dividing profit after tax and preference dividend by the amount of equity shareholders’ funds or net worth.

Return on Equity= PAT - Preference dividend*100/Equity shareholders funds

4. Earnings per share (EPS): Earnings per share is calculated by dividing the amount of profit after tax and preference dividends by the total number of outstanding equity shares of the company. Hence it shows how much amount is earned per equity share of the company. It is easy to understand than any other ratio and is widely reported in news and media. An increasing EPS shows the relative strength of the company.

Earning per share = PAT - Preference dividend/Number of equity shares

5. Price Earnings Ratio (P/E): Analysis of price earnings ratio or P/E ratio as we popularly call it is an important ingredient of company analysis. P/E ratio is calculated by dividing market price per share by the EPS.

Price Earnings Ratio = Market price per share/EPS

6. Book Equity to Market Equity Ratio (BE/ME): A related valuation ratio is Book equity to Market Equity ratio. It is calculated by dividing the Book Value of Equity share by the Market price.

BE/ME Ratio= Book Value per share/Market price per share.

Q3) What is technical analysis? What are the techniques of technical analysis? 10

Q4) Write a brief note on technical analysis.

A) to Q3 & Q4 Technical analysis is the study of financial market action. The technician looks at price changes that occur on a day-to-day or week-to-week basis or over any other constant time period displayed in graphic form, called charts. Technical analysts examine the price action of the financial markets instead of the fundamental factors that (seem to) effect market prices. Different techniques of technical analysis are-

The bar charts are:

One single bar shows the high and the low of the respective trading period. A vertical bar is used to connect the high and the low. Horizontal lines are used to show the opening price (left) of that specific trading period and the closing price (right) at the end of the period.

High High

High High

open

open

close

close

Low Low

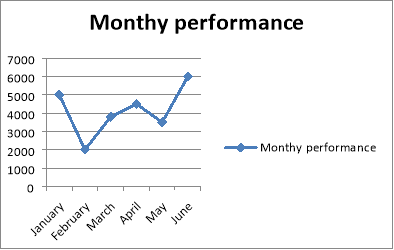

2. Line charts

A line chart is the simplest of all methods. It is constructed by joining together the closing price of each period, for example daily closings for the daily line chart, weekly closings for the weekly chart or monthly closings for the monthy line chart.

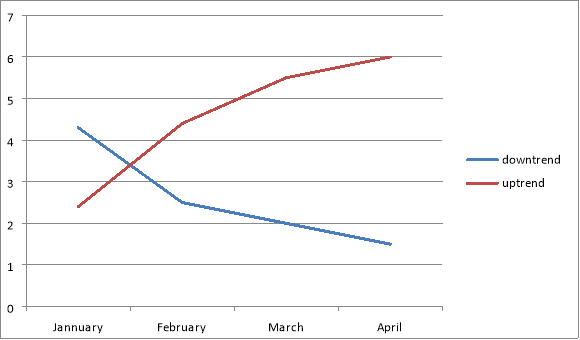

3. Trend lines

The trend line is nothing more than a straight line drawn between at least three points. In an up-move the low points are connected to form an uptrend line. For a downtrend the peaks are connected. The important point is that it should not be drawn over the price action. Trend-lines must encorporate all of the price data, i.e. connect the highs in a downtrend and the lows in an uptrend.

4. Investment horizons

The charts on the previous pages show that investors require perspective. It is imperative to differentiate between a short-term, a medium-term and a long-term trend.

5. Moving averages

Moving averages are popular and versatile for identifying price trends. They smooth out fluctuations in market prices, thereby making it easier t0 determine underlying trends. The simple moving average is the most widely used.

6. The simple moving average (SMA)

The simple moving average yields the mean of a data set for a given period. The moving average is usually plotted on the same chart as price movements, so a change in direction of trend can be indicated by the penetration/crossover of the SMA.

7. Momentum

In financial markets it is measured by the speed of the price trend, i.e. whether a trend is accelerating or decelerating, rather than the actual price level itself. While moving averages are lagging indicators, giving signals after the price trend has already turned, momentum indicators lead the price trend. They give signals before the price trend turns.

Q5) What is efficient market hypothesis?

Q6) Write a brief note on efficient market hypothesis? 8

A) to Q5 & Q6. An efficient capital market is one in which security prices adjust rapidly to the arrival of new information and, therefore, the current prices of securities reject all information about the security. The efficient market hypothesis (EMH) asserts that prices for assets are efficient with respect to available information. The hypothesis implies that no investment strategy based on current or historical information produces extraordinary large products. With thousands of investment advisory services, mountains of information, and millions of investors, the adjustment of prices to new information is almost instantaneous. Assumptions made for the requirements of an efficient market include:

Efficient market hypothesis could have some implications regarding the following:

Q7) Write a brief note on dividend capitalisation model.

Q8) Discuss the techniques of divided capitalisation model. 8

A) to Q7 & Q8

Myron Gordon used the dividend capitalization approach to study the effect of the firms’ dividend policy on the stock price.

Assumptions

The following are the assumptions based on which Gordon based the dividend policy model for firms: –

Gordon model assumes that the investors are rational and risk averse. They prefer certain returns to uncertain returns and thus put a premium to the certain returns and discount the uncertain returns. Thus, investors would prefer current dividends and avoid risk. Retained earnings involve risk and so the investor discounts the future dividends. This risk will also affect the stock value of the firm.

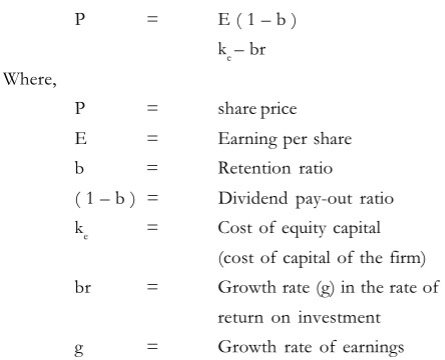

Gordon explains this preference for current income by the bird- in-hand argument. Since, a bird-in-hand is worth two in bush, the investors would prefer the income that they earn currently to that income in future which may be or may not be available. Thus, investors would prefer to pay a higher price for the stocks, which earn them current dividend income and would discount those stocks, which either postpones / reduce the current income. The discounting will differ depending on the retention rate (percentage of retained earnings) and the time. Gordon’s dividend capitalization model gave value of the stock as

So, Gordon correlated that the firm’s share value is positive with the payout ratio when re > ke and decreases with an increase in the pay-out ratio when r > ke. Thus, firms with rate of return greater than the cost of capital should have a higher retention ratio and those firms, which have a rate of return less than the cost of capital, should have a lower retention ratio.

The dividend policy of firms which have a rate of return equal to the cost of capital will however not have any impacts on its share value.

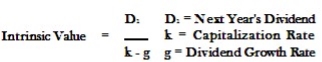

The constant-growth DDM (aka Gordon Growth model) assumes that dividends grow by a specific percentage each year, and is usually denoted as g, and the capitalization rate is denoted by k.

The constant-growth model is often used to value stocks of mature companies that have increased the dividend steadily over the years. Although the annual increase is not always the same, the constant-growth model can be used to approximate an intrinsic value of the stock using the average of the dividend growth and projecting that average to future dividend increases.