Unit II

Business Income

Q1) A company has a practice of valuing inventory as per FIFO. In the current year the company changed the valuation method to weighted average method. Value of inventory as per FIFO is Rs. 2 lakhs and as per weighted average method is Rs. 1.8 lakhs. How will the company disclose such matter in the financial statements as per AS 1-Disclosure of Accounting Policies?

A1) A simple disclosure that an accounting policy has been changed is not of much use for a reader of a financial statement. The effect of change should therefore be disclosed wherever ascertainable. The company has switched over to weighted average formula for ascertaining cost of inventory, from the earlier practice of using FIFO. If the closing inventory by FIFO is Rs. 2 lakhs and that by weighted average formula is Rs. 1.8 lakhs, the change in accounting policy pulls down profit and value of inventory by Rs. 20,000. The company may disclose the change in accounting policy in the following manner:

‘The company values its inventory at lower of cost and net realizable value. Since net realisable value of all items of inventory in the current year was greater than respective costs, the company valued its inventory at cost. In the present year the company has changed to weighted average formula, which better reflects the consumption pattern of inventory, for ascertaining inventory costs from the earlier practice of using FIFO for the purpose. The change in policy has reduced profit and value of inventory by Rs. 20,000’.

A change in accounting policy is to be disclosed if the change is reasonably expected to have material effect in future accounting periods, even if the change has no material effect in the current accounting period.

Q2) In the books of M/s Sagar Ltd., closing inventory as on 31.03.2015 amounts to Rs. 1,63,000 (on the basis of FIFO method).

The company decides to change from FIFO method to weighted average method for ascertaining the cost of inventory from the year 2014-15. On the basis of weighted average method, closing inventory as on 31.03.2015 amounts to Rs. 1,47,000. Realisable value of the inventory as on 31.03.2015 amounts to Rs. 1,95,000.

Discuss disclosure requirement of change in accounting policy as per AS-1.

A2) As per AS 1 “Disclosure of Accounting Policies”, any change in an accounting policy which has a material effect should be disclosed in the financial statements. The amount by which any item in the financial statements is affected by such change should also be disclosed to the extent ascertainable. Where such amount is not ascertainable, wholly or in part, the fact should be indicated. Thus Sagar Ltd. Should disclose the change in valuation method of inventory and its effect on financial statements. The company may disclose the change in accounting policy in the following manner:

‘The company values its inventory at lower of cost and net realisable value. Since net realisable value of all items of inventory in the current year was greater than respective costs, the company valued its inventory at cost. In the present year i.e. 2014-15, the company has changed to weighted average method, which better reflects the consumption pattern of inventory, for ascertaining inventory costs from the earlier practice of using FIFO for the purpose. The change in policy has reduced current profit and value of inventory by Rs. 16,000.

Q3) ABC Ltd. Was making provision for non-moving inventories based on issues for the last 12 months up to 31.3.2016. The company wants to provide during the year ending 31.3.2017 based on technical evaluation:

Total value of inventory Rs. 100 lakhs

Provision required based on 12 months issue Rs. 3.5 lakhs

Provision required based on technical evaluation Rs. 2.5 lakhs

Does this amount to change in Accounting Policy? Can the company change the method of provision?

A3) The decision of making provision for non-moving inventories on the basis of technical evaluation does not amount to change in accounting policy. Accounting policy of a company may require that provision for non-moving inventories should be made. The method of estimating the amount of provision may be changed in case a more prudent estimate can be made.

In the given case, considering the total value of inventory, the change in the amount of required provision of non-moving inventory from Rs. 3.5 lakhs to Rs. 2.5 lakhs is also not material. The disclosure can be made for such change in the following lines by way of notes to the accounts in the annual accounts of ABC Ltd. For the year 2016-17:

“The company has provided for non-moving inventories on the basis of technical evaluation unlike preceding years. Had the same method been followed as in the previous year, the profit for the year and the corresponding effect on the year end net assets would have been lower by Rs. 1 lakh.”

Q4) The company deals in three products, A, B and C, which are neither similar nor interchangeable. At the time of closing of its account for the year 2016-17, the Historical Cost and Net Realisable Value of the items of closing stock are determined as follows:

Items | Historical Cost (Rs. in lakhs) | Net Realisable Value (Rs. in lakhs) |

A | 40 | 28 |

B | 32 | 32 |

C | 16 | 24 |

Calculate the value of closing stock.

A4) As per AS 2 (Revised) on ‘Valuation of Inventories’, inventories should be valued at the lower of cost and net realisable value. Inventories should be written down to net realisable value on an item-by-item basis in the given case.

Items | Historical Cost (Rs. in lakhs) | Net Realisable Value (Rs. in lakhs) | Valuation of closing stock (Rs. in lakhs) |

A | 40 | 28 | 28 |

B | 32 | 32 | 32 |

C | 16 | 24 | 16 |

| 88 | 84 | 76 |

Hence, closing stock will be valued at Rs. 76 lakhs.

Q5) X Co. Limited purchased goods at the cost of Rs. 40 lakhs in October, 2016. Till March, 2017, 75% of the stocks were sold. The company wants to disclose closing stock at Rs. 10 lakhs. The expected sale value is Rs. 11 lakhs and a commission at 10% on sale is payable to the agent. The company needs your advise on the correct value of closing stock to be disclosed as at 31.3.2017.

A5) As per AS 2 (Revised) “Valuation of Inventories”, the inventories are to be valued at lower of cost or net realisable value.

In this case, the cost of inventory is Rs. 10 lakhs. The net realisable value is 11,00,000 x 90% = Rs. 9,90,000. So, the stock should be valued at Rs. 9,90,000.

Q6) In a production process, normal waste is 5% of input. 5,000 mtr of input were put in process resulting in wastage of 300 mtr. Cost per mtr of input is Rs. 1,000. The entire quantity of waste is on stock at the year end. State with reference to Accounting Standard, how will you value the inventories in this case?

A6) As per AS 2 (Revised), abnormal amounts of wasted materials, labour and other production costs are excluded from cost of inventories and such costs are recognised as expenses in the period in which they are incurred.

In this case, normal waste is 250 mtr and abnormal waste is 50 mtr. The cost of 250 mtr will be included in determining the cost of inventories (finished goods) at the year end. The cost of abnormal waste (50 mtr x 1,052.6315 = Rs. 52,632) will be charged to the profit and loss statement.

Cost per mtr (Normal Quantity of 4,750 mtr) = 50,00,000 / 4,750 = Rs. 1,052.6315

Total value of inventory = 4,700 mtr x Rs. 1,052.6315 = Rs. 49,47,368.

Q7) The Board of Directors decided on 31.3.2017 to increase the sale price of certain items retrospectively from 1st January, 2017. In view of this price revision with effect from 1st January 2017, the company has to receive Rs. 15 lakhs from its customers in respect of sales made from 1st January, 2017 to 31st March, 2017. Accountant cannot make up his mind whether to include Rs. 15 lakhs in the sales for 2016-2017.Advise.

A7) Price revision was effected during the current accounting period 2016-2017. As a result, the company stands to receive Rs. 15 lakhs from its customers in respect of sales made from 1st January, 2017 to 31st March, 2017. If the company is able to assess the ultimate collection with reasonable certainty, then additional revenue arising out of the said price revision may be recognised in 2016-2017.

Q8) Y Ltd., used certain resources of X Ltd. In return X Ltd. Received Rs. 10 lakhs and Rs. 15 lakhs as interest and royalties respective from Y Ltd. During the year 2016-17. You are required to state whether and on what basis these revenues can be recognised by X Ltd.

A8) As per AS 9 on Revenue Recognition, revenue arising from the use by others of enterprise resources yielding interest and royalties should only be recognised when no significant uncertainty as to measurability or collectability exists. These revenues are recognised on the following bases:

(i) Interest: on a time proportion basis taking into account the amount outstanding and the rate applicable.

(ii) Royalties: on an accrual basis in accordance with the terms of the relevant agreement.

Q9) A claim lodged with the Railways in March, 2015 for loss of goods of Rs. 2,00,000 had been passed for payment in March, 2017 for Rs. 1,50,000. No entry was passed in the books of the Company, when the claim was lodged. Advise P Co. Ltd. About the treatment of the following in the Final Statement of Accounts for the year ended 31st March, 2017.

A9) AS 9 on ‘Revenue Recognition’ states that where the ability to assess the ultimate collection with reasonable certainty is lacking at the time of raising any claim, revenue recognition is postponed to the extent of uncertainty involved. When recognition of revenue is postponed due to the effect of uncertainties, it is considered as revenue of the period in which it is properly recognised. In this case it may be assumed that collectability of claim was not certain in the earlier periods. This is supposed from the fact that only Rs. 1,50,000 were collected against a claim of Rs. 2,00,000. So this transaction can not be taken as a Prior Period Item.

In the light of AS 5, it will not be treated as extraordinary item. However, AS 5 states that when items of income and expense within profit or loss from ordinary activities are of such size, nature, or incidence that their disclosure is relevant to explain the performance of the enterprise for the period, the nature and amount of such items should be disclosed separately. Accordingly, the nature and amount of this item should be disclosed separately.

Q10) Prepare a statement showing the pricing of issues, on the basis of

(a) FIFO and

(b) Weighted Average methods from the following information pertaining to Material-D

2016 March 1 Purchased 100 units @ Rs 10 each

2 Purchased 200 units @ Rs 10.2 each.

5 Issued 250 units to Job X vide M.R.No.12

7 Purchased 200 units @ Rs 10.50 each

10 Purchased 300 units @ Rs 10.80 each

13 Issued 200 units to Job Y vide M.R.No.15

18 Issued 200 units to Job Z vide M.R.No.17

20 Purchased 100 units @ Rs 11 each

25 Issued 150 units to Job K vide M.R.No.25

A10)

- FIFO Method

Stores Ledger

Date | Receipts | Issues | Balance | ||||||

Qty. | Price Rs | Value Rs | Qty. | Price Rs | Value Rs | Qty. | Price Rs | Value Rs | |

2016 March 1 |

100 |

10 |

1000 |

-- |

-- |

-- |

100 |

|

1000 |

March 2 | 200 | 10.20 | 2040 |

|

|

| 100 | 10 | 1000 |

|

|

|

|

|

|

| 200 | 10.20 | 2040 |

March 5 | -- | -- | -- | 100 | 10 | 1000 |

|

|

|

|

|

|

| 150 | 10.20 | 1530 | 50 | 10.20 | 510 |

March 7 | 200 | 10.50 | 2100 | -- | -- | -- | 50 | 10.20 | 510 |

|

|

|

|

|

|

| 200 | 10.50 | 2100 |

March 10 | 300 | 10.80 | 3240 | -- | -- | -- | 50 | 10.20 | 510 |

|

|

|

|

|

|

| 200 | 10.50 | 2100 |

|

|

|

|

|

|

| 300 | 10.80 | 3240 |

March 13 | -- | -- | -- | 50 | 10.20 | 510 |

|

|

|

|

|

|

| 150 | 10.50 | 1575 | 50 | 10.50 | 525 |

|

|

|

|

|

|

| 300 | 10.80 | 3240 |

March 18 | -- | -- | -- | 50 | 10.50 | 525 |

|

|

|

|

|

|

| 150 | 10.80 | 1620 | 150 | 10.80 | 1620 |

March 20 | 100 | 11 | 1100 | -- | -- | -- | 150 | 10.80 | 1620 |

|

|

|

|

|

|

| 100 | 11 | 1100 |

March 25 | -- | -- | -- | 150 | 10.80 | 1620 | 100 | 11 | 1100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Weighted Average Method

Stores Ledger

Date | Receipts | Issue | Balance | |||||

Qty. | Price Rs | Value Rs | Qty. | Price Rs | Value Rs | Qty. | Value Rs | |

2016 March 1 |

100 |

10 |

1000 |

-- |

-- |

-- |

100 |

1000 |

March 2 | 200 | 10.2 | 2040 | -- | -- | -- | 300 | 3040 |

March 5 | -- | -- | -- | 250 | 10.13 | 2533 | 50 | 507 |

March 7 | 200 | 10.5 | 2100 | -- | -- | -- | 250 | 2607 |

March 10 | 300 | 10.8 | 3240 | -- | -- | -- | 550 | 5847 |

March 13 | -- | -- | -- | 200 | 10.63 | 2126 | 350 | 3721 |

March 18 | -- | -- | -- | 200 | 10.63 | 2126 | 150 | 1595 |

March 20 | 100 | 11 | 1100 | -- | -- | -- | 250 | 2695 |

March 25 | -- | -- | -- | 150 | 10.78 | 1617 | 100 | 1078 |

Working Notes:

Calculation of price for Issue on March 5th

= 3040/300 = Rs 10.13

Calculation of price for Issue on March 13th

= 5847/550 = Rs 10.63

Calculation of price for Issue on March 18th

= 3721/350 = Rs 10.63

Calculation of price for Issue on March 25th

= 2695/250 = Rs 10.78

Q11) The stock of material held on 1-4-2015 was 400 units @ 50 per unit. The following receipts and issues were recorded. You are required to prepare the Stores Ledger Account, showing how the values of issues would be calculated under Base Stock Method, through FIFO base being 100 units.

2-4-2015 | Purchased 100 units @Rs. 55 per unit |

|

6-4-2015 | Issued 400 units |

|

10-4-2015 | Purchased 600 units @ Rs. 55 per unit |

|

13-4-2015 | Issued 400 units |

|

20-4-2015 | Purchased 500 units @ Rs. 65 per unit. |

|

25-4-2015 | Issued 600 units |

|

10-5-2015 | Purchased 800 units @ Rs. 70 per unit |

|

12-5-2015 | Issued 500 units |

|

13-5-2015 | Issued 200 units |

|

15-5-2015 | Purchased 500 units @ Rs. 75 per unit |

|

12-6-2015 | Issued 400 units |

|

15-6-2015 | Purchased 300 units @ Rs. 80 per unit

|

|

A11)

Stores Ledger Account [under Base Stock through FIFO Method]

Date | Receipts | Issues | Balance | ||||||

Qty. | Price Rs | Value Rs | Qty. | Price Rs | Value Rs | Qty. | Price Rs | Value Rs | |

1-4-2015 | -- | -- | -- | -- | -- | -- | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 300 | 50 | 15,000 |

2-4-2015 | 100 | 55 | 5,500 | -- | -- | -- | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 300 | 50 | 15,000 |

|

|

|

|

|

|

| 100 | 55 | 5,500 |

6-4-2015 | -- | -- | -- | 300 | 50 | 15,000 |

|

|

|

|

|

|

| 100 | 55 | 5,500 | 100 | 50 | 5,000 |

10-4-2015 | 600 | 55 | 33,000 | -- | -- | -- | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 600 | 55 | 33,000 |

13-4-2015 | -- | -- | -- | 400 | 55 | 22,000 | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 200 | 55 | 11,000 |

20-4-2015 | 500 | 65 | 32,500 | -- | -- | -- | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 200 | 55 | 11,000 |

|

|

|

|

|

|

| 500 | 65 | 32,500 |

25-4-2015 | -- | -- | -- | 200 | 55 | 11,000 | 100 | 50 | 5,000 |

|

|

|

| 400 | 65 | 26,000 | 100 | 65 | 6,500 |

10-5-2015 | 800 | 70 | 56,000 | -- | -- | -- | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 100 | 65 | 6,500 |

|

|

|

|

|

|

| 800 | 70 | 56,000 |

12-5-2015 | -- | -- | -- | 100 | 65 | 6,500 | 100 | 50 | 5,000 |

|

|

|

| 400 | 70 | 28,000 | 400 | 70 | 28,000 |

13-5-2012 | -- | -- | -- | 200 | 70 | 14,000 | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 200 | 70 | 14,000 |

15-5-2015 | 500 | 75 | 37,500 | -- | -- | -- | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 200 | 70 | 14,000 |

|

|

|

|

|

|

| 500 | 75 | 37,500 |

12-6-2015 | -- | -- | -- | 200 | 70 | 14,000 | 100 | 50 | 5,000 |

|

|

|

| 200 | 75 | 15,000 | 300 | 75 | 22,500 |

15-6-2015 | 300 | 80 | 24,000 | -- | -- | -- | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 300 | 75 | 22,500 |

|

|

|

|

|

|

| 300 | 80 | 24,000 |

Q12) Adnan Naeem Imports, Ltd has the following information about the inventory of electronic components for October 2016.

Date | Quantity | Cost per item (Rs) |

Opening Inventory | 150 | 32 |

5 October Purchase | 200 | 32 |

17 October Purchase | 450 | 31 |

28 October Purchase | 100 | 33 |

As at the end of October, 220 components remained in inventory.

Required:

- If the company uses FIFO method of allocating inventory, what would is the cost of goods sold for October?

- If the company uses FIFO method of allocating inventory costs, what would be the ending inventory?

- If the company uses average cost method of allocating inventory costs, what would is the ending inventory for October?

A12)

- Cost of Goods Sold

Units | @ | Amount |

150 | 32 | 4,800 |

200 | 32 | 6,400 |

330 | 31 | 10,230 |

680 |

| Rs. 21,430 |

b. Cost of Closing Inventory

Units | @ | Amount |

120 | 31 | 3,720 |

100 | 33 | 3,300 |

220 |

| 7,020 |

c. Cost of Closing Inventory

Units | @ | Amount |

220 | 31.61 | 6954.20 |

Average rate = 28450/900 = Rs 31.61 per unit

Q13) The stock of material held on 1-4-2015 was 400 units @ 50 per unit. The following receipts and issues were recorded. You are required to prepare the Stores Ledger Account, showing how the values of issues would be calculated under Base Stock Method, through FIFO base being 100 units.

2-4-2015 | Purchased 100 units @Rs. 55 per unit |

|

6-4-2015 | Issued 400 units @ Rs. 65 |

|

10-4-2015 | Purchased 600 units @ Rs. 55 per unit |

|

13-4-2015 | Issued 400 units @ Rs. 67 |

|

20-4-2015 | Purchased 500 units @ Rs. 65 per unit. |

|

25-4-2015 | Issued 600 units @ Rs. 73 |

|

10-5-2015 | Purchased 800 units @ Rs. 70 per unit |

|

12-5-2015 | Issued 500 units @ Rs. 70 |

|

13-5-2015 | Issued 200 units @ Rs. 75 |

|

15-5-2015 | Purchased 500 units @ Rs. 75 per unit |

|

12-6-2015 | Issued 400 units @ Rs. 80 |

|

15-6-2015 | Purchased 300 units @ Rs. 80 per unit |

|

Also calculate the Cost of Goods Sold and the Gross Profit.

A13)

Stores Ledger Account [under Base Stock through FIFO Method]

Date | Receipts | Issues | Balance | ||||||

Qty. | Price Rs | Value Rs | Qty. | Price Rs | Value Rs | Qty. | Price Rs | Value Rs | |

1-4-2015 | -- | -- | -- | -- | -- | -- | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 300 | 50 | 15,000 |

2-4-2015 | 100 | 55 | 5,500 | -- | -- | -- | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 300 | 50 | 15,000 |

|

|

|

|

|

|

| 100 | 55 | 5,500 |

6-4-2015 | -- | -- | -- | 300 | 50 | 15,000 |

|

|

|

|

|

|

| 100 | 55 | 5,500 | 100 | 50 | 5,000 |

10-4-2015 | 600 | 55 | 33,000 | -- | -- | -- | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 600 | 55 | 33,000 |

13-4-2015 | -- | -- | -- | 400 | 55 | 22,000 | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 200 | 55 | 11,000 |

20-4-2015 | 500 | 65 | 32,500 | -- | -- | -- | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 200 | 55 | 11,000 |

|

|

|

|

|

|

| 500 | 65 | 32,500 |

25-4-2015 | -- | -- | -- | 200 | 55 | 11,000 | 100 | 50 | 5,000 |

|

|

|

| 400 | 65 | 26,000 | 100 | 65 | 6,500 |

10-5-2015 | 800 | 70 | 56,000 | -- | -- | -- | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 100 | 65 | 6,500 |

|

|

|

|

|

|

| 800 | 70 | 56,000 |

12-5-2015 | -- | -- | -- | 100 | 65 | 6,500 | 100 | 50 | 5,000 |

|

|

|

| 400 | 70 | 28,000 | 400 | 70 | 28,000 |

13-5-2012 | -- | -- | -- | 200 | 70 | 14,000 | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 200 | 70 | 14,000 |

15-5-2015 | 500 | 75 | 37,500 | -- | -- | -- | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 200 | 70 | 14,000 |

|

|

|

|

|

|

| 500 | 75 | 37,500 |

12-6-2015 | -- | -- | -- | 200 | 70 | 14,000 | 100 | 50 | 5,000 |

|

|

|

| 200 | 75 | 15,000 | 300 | 75 | 22,500 |

15-6-2015 | 300 | 80 | 24,000 | -- | -- | -- | 100 | 50 | 5,000 |

|

|

|

|

|

|

| 300 | 75 | 22,500 |

| 2,800 |

| 1,88,500 |

|

|

| 300 | 80 | 24,000 |

Calculation of Cost of Goods Sold

COGS = Opening Inventory + Purchases – Closing Inventory

= 5,000 + 1,88,500 – 24,000

= Rs. 1,69,500

Calculation of Gross Profit

Particulars | Amount (Rs) |

Sales: Qty x Selling price |

|

6-4: 400 x 65 | 26,000 |

13-4: 400 x 67 | 26,800 |

25-4: 600 x 73 | 43,800 |

12-5: 500 x 70 | 35,000 |

13-5: 200 x 75 | 15,000 |

12-6: 400 x 80 | 32,000 |

Total Sales | 1,78,600 |

Less: COGS | 1,69,500 |

Gross Profit | 9,100 |

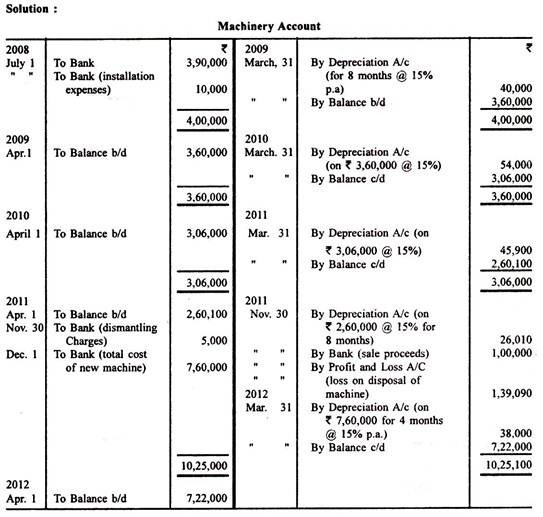

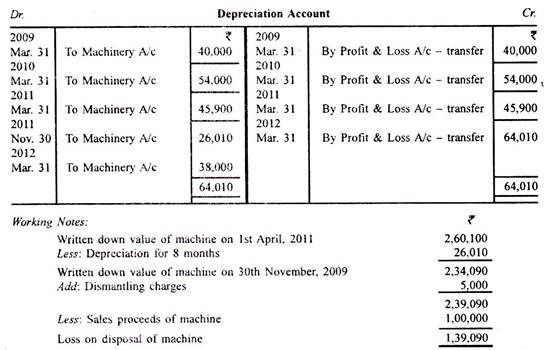

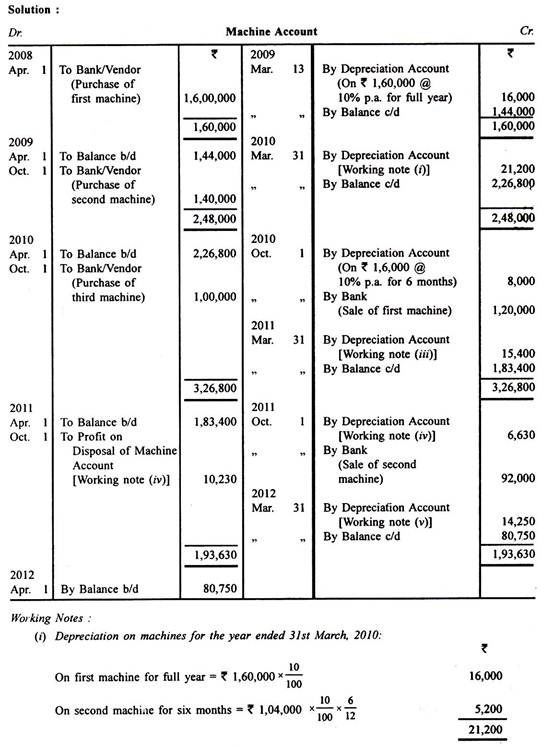

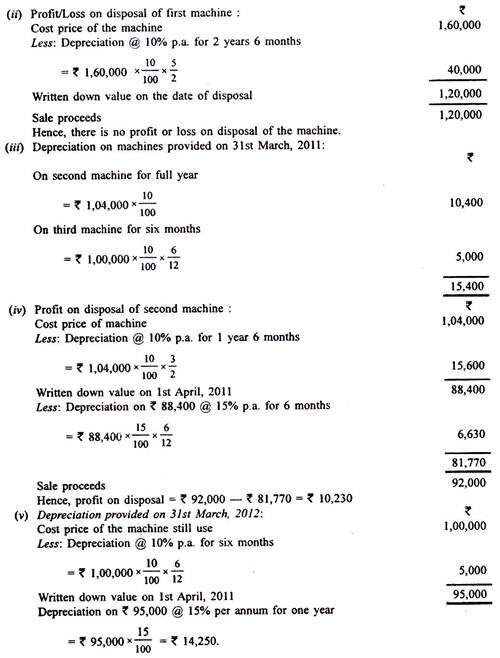

Q14) On July 1, 2008, a company bought a machine for Rs 3,90,000 and spent Rs 10,000 on its installation. We have decided to provide depreciation at 15% per year using the write-down method. On November 30, 2011, the machine was dismantled at a cost of 5,000 rupees and then sold for 1,00,000 rupees.

On December 1, 2011, the company acquired a new machine and put it into operation at a total cost of Rs 7,60,000. The new machine was depreciated on the same basis as the previous machine. The company closes its books on March 31st each year.

A14)

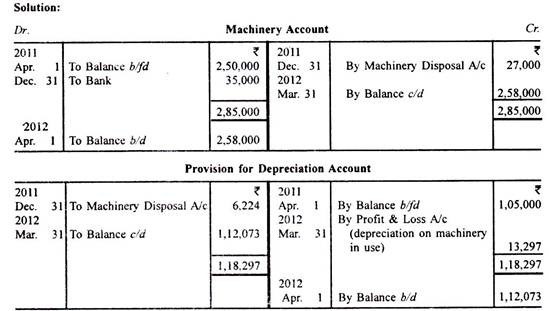

Q15) The cost of the machine used by the company on April 1, 2011 was Rs 250,000, while the depreciation cost for that day was Rs 1,05,000. The company provided depreciation at 10% of the reduced value.

Two machines purchased on December 31, 2011 and October 1, 2008, Rs. 15,000 and Rs. 12,000, respectively, were discarded due to damage and replaced with two new machines, Rs. 20,000 and Rs. 15,000, respectively. I had to.

One of the discarded machines sold for Rs 8,000. On the other hand, the Rs 3,000 was expected to be feasible.

Shows the accounts related to the company's ledger for the year ended March 31, 2012.

A15)

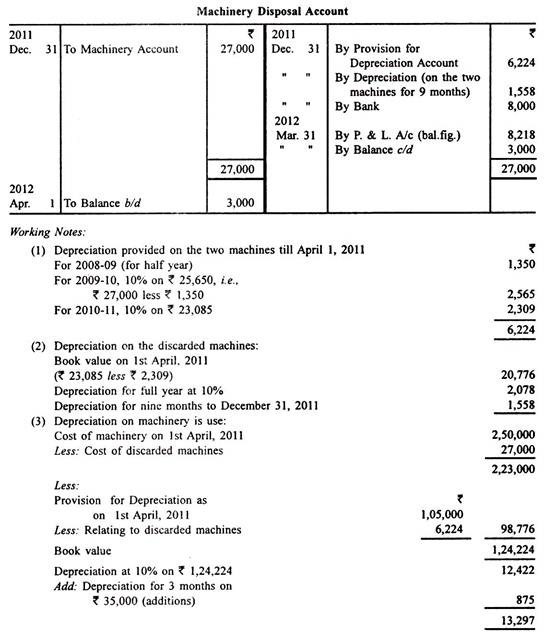

Q16) Metropol Ltd. Purchased the machine on April 1, 2009 for Rs 5,40,000. Depreciation is billed at an annual rate of 20% on a straight-line basis.

On October 1, 2011, a change was made to improve technical efficiency at a cost of 50,000 rupees, which was expected to extend the useful life of the machine by two years. At the same time, important components of the machine were replaced at a cost of 10,000 rupees due to excessive wear.

The cost of regular maintenance during the fiscal year ending March 31, 2012 is Rs 7,500.

Shows for the year ending March 31, 2012:

(I) Machine account

(II) Reserve for depreciation account and

(III) The relevant part of the income statement showing the revenue and expense associated with the machine.

A16)

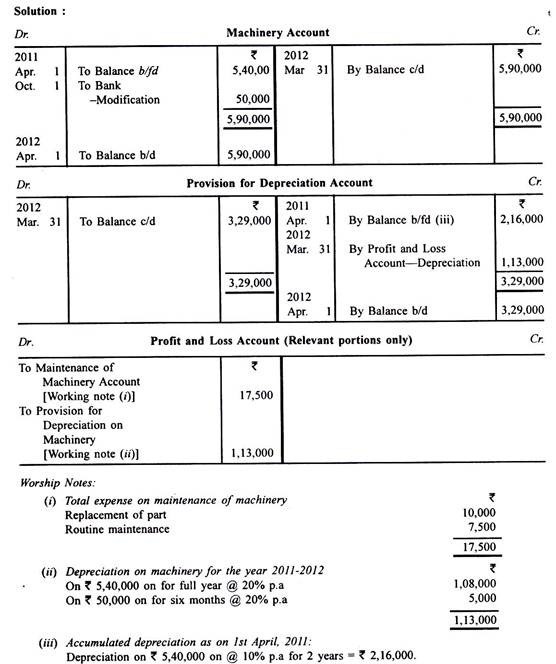

Q17) X Co. Ltd. Purchased the machine on April 1, 2008 for Rs 1,60,000. On October 1, 2009, another machine was acquired. For Rs 1,40,000. On October 1, 2010, the first machine sold for Rs 1,20,000. On the same day, another machine was purchased for Rs 1,00,000. On October 1, 2011, the second machine sold for Rs 92,000.

The depreciation rate on March 31 was 10% of the original cost. On March 31, 2011, the depreciation billing method was changed to the depreciation method, with a rate of 15%.

Prepare machine accounts for the years ending March 31, 2009, 2010, 2011, and 2012.

A17)

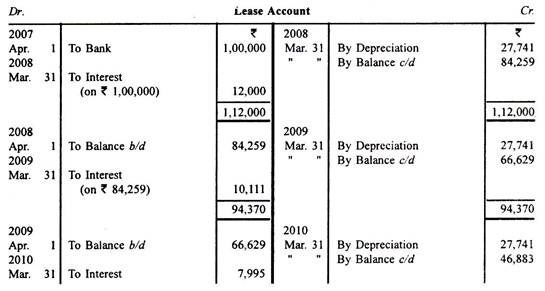

Q18) The lease will be purchased on April 1, 2007 for 5 years at a cost of Rs 1,00,000. It is proposed to depreciate the lease by the pension law, which charges 12% interest. Shows the 5-year lease account and related entries in the P & L account.

A18) A reference to the pension table indicates that Re will be depreciated. Under the 15-year pension law, you must claim 12% interest and amortize the total of Re. 0.277410. To amortize Rs 1,00,000, you need to amortize Rs 1,00,000 x 0.277410, or Rs 27,741 each year.

From the Q above, you can see that the amount depreciated as depreciation is higher than in the straight-line or instalment payments, but because of the interest, it does not ultimately affect the income statement. Assets that are debited are credited to the income statement. Therefore, the pension law only pays attention to the amount of money spent on the use of assets: lost costs and interest.

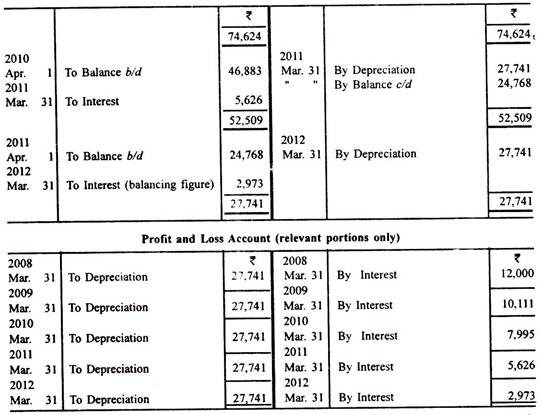

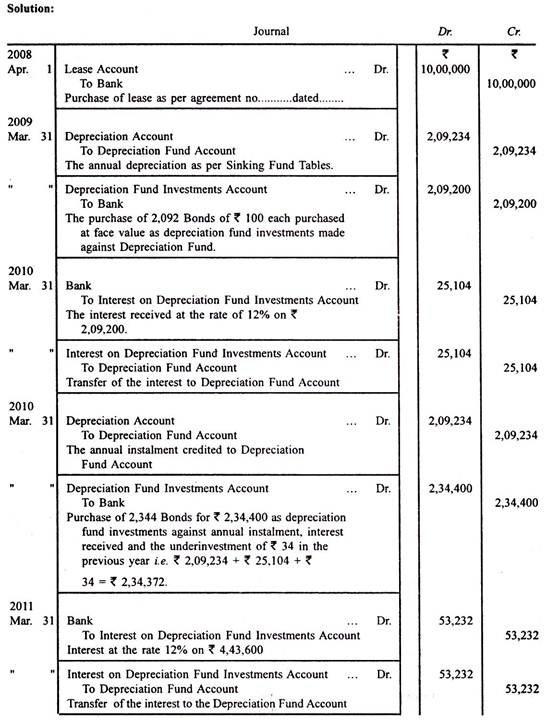

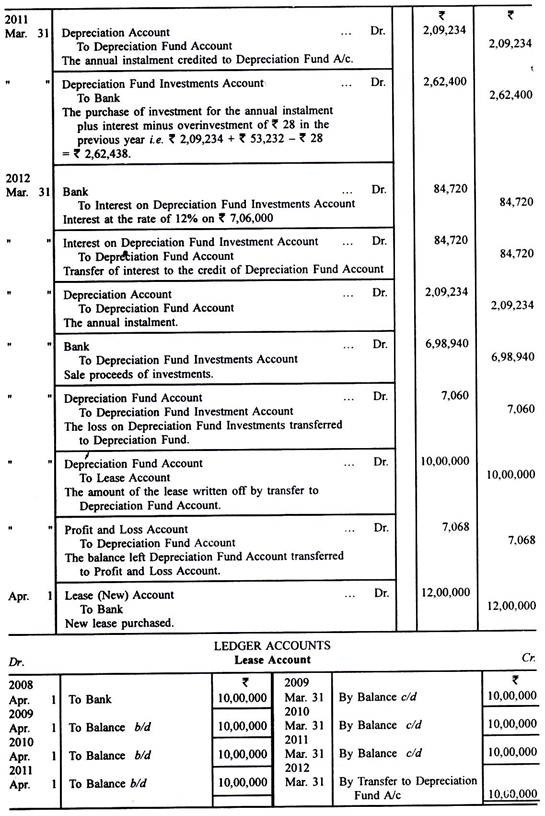

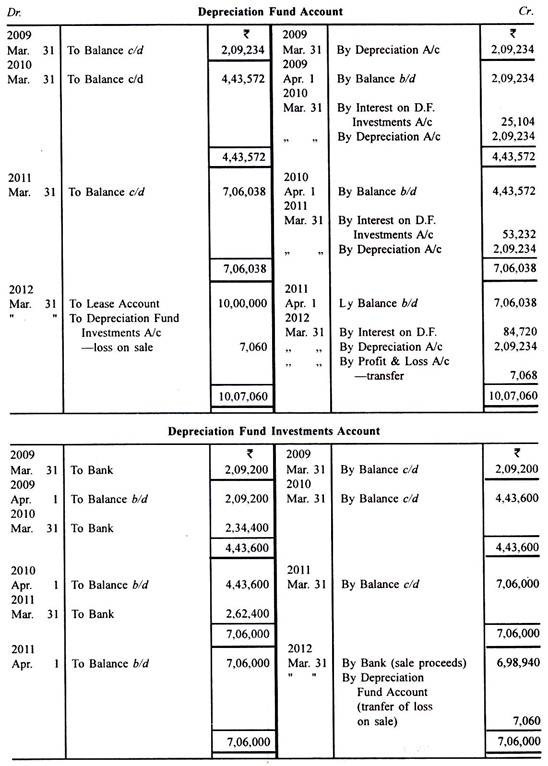

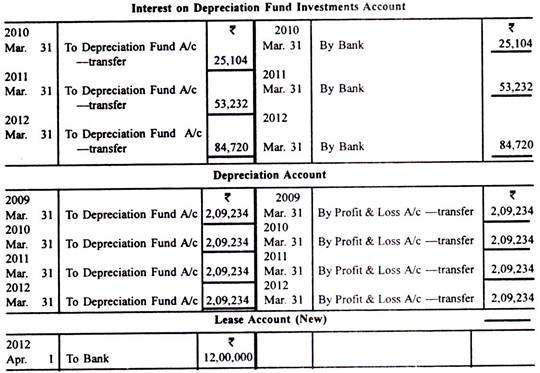

Q19) A company purchased a four-year lease for Rs 10,00,000 on April 1, 2008. By establishing a depreciation fund, it has been decided to offer a lease exchange at the end of four years. The investment is expected to be of interest at 12%. The table of the sinking fund is Re. Investing 0.209234 each year will generate Re. 12% per year at the end of 4 years 1. The investment was made in a 12% bond of Rs 100 available at par. Interest was received on March 31st of each year.

On March 31, 2012, the investment was sold for Rs 6,98,940. On April 1, 2012, the same lease was renewed for another four years with a payment of Rs 12,00,000.

View journals and specify important ledger accounts to record the above.

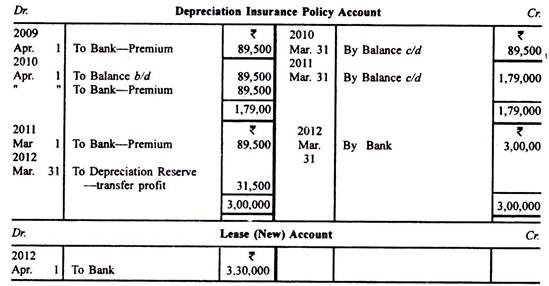

A19)

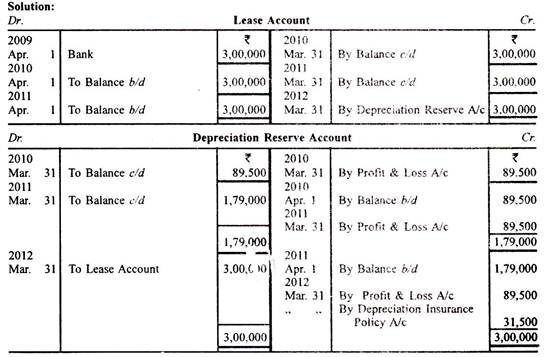

Q 20) A company bought a three-year lease on April 1 for Rs 3,000,000. In 2009, we decided to offer a replacement under an insurance policy of Rs 3,000,000. The annual premium is 89,500 rupees.

On April 1, 2012, the lease will be renewed for another 3 years at Rs 330,000. Display the required ledger accounts.

A20)

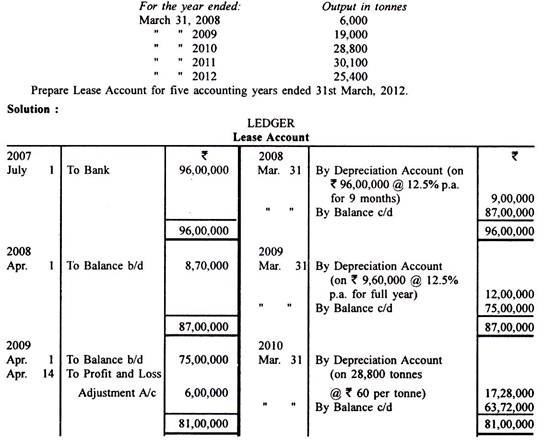

Q20) Experts estimated that the mine contained a total of 160,000 tonnes of minerals. On July 1, 2007, P leased the mine for eight years and paid the owner Rs 96,00,000 with the above estimate in mind.

P has decided to offer depreciation at an annual rate of 12.5% on a straight-line basis. However, in April 2009, we decided to switch to the depreciation method because we thought it would be more appropriate. He passed the required adjustment entry on April 14, 2009.

The output for the first five fiscal years of the lease is as follows:

A21)

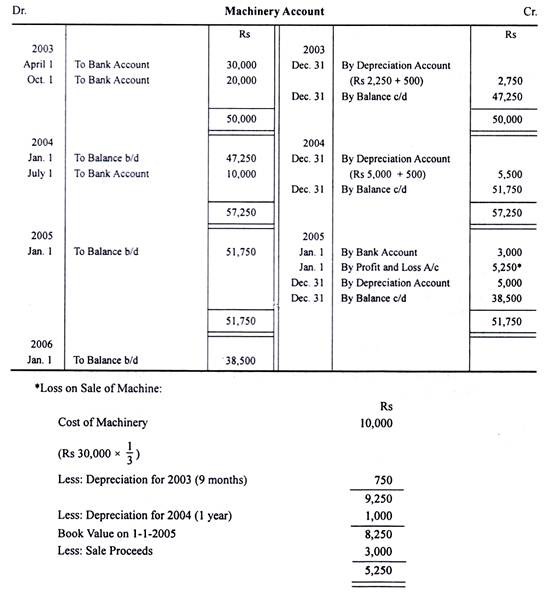

Q21) Companies whose financial year purchased on April 1, 2003 may be a civil year. The worth of the machine is 30,000 rupees.

I bought another machine for 20,000 rupees on October 1, 2003 and 10,000 rupees on Dominion Day, 2004.

One-third of the machines installed on January 1, 2005 and April 1, 2003 were abolished and sold for Rs 3,000.

Shows how machine accounts appear within the company's books. The machine may be a fixed instalment method @ 10% p.a. Depreciated by.

A22)

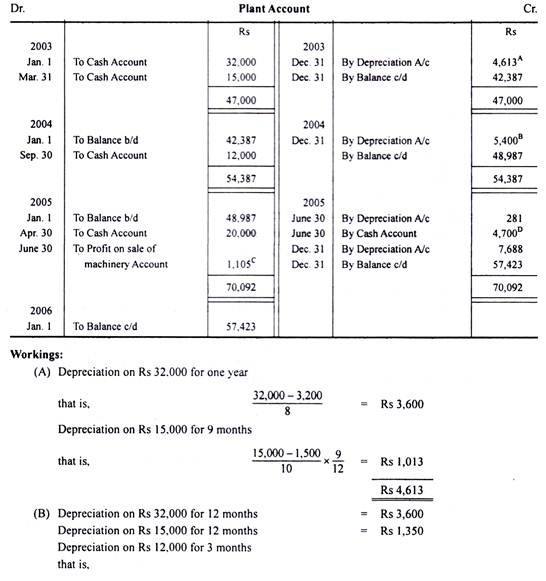

Q22) The 32,000-rupee plant purchased on January 1, 2003 has an estimated lifespan of 8 years.

Further purchases of plants are:

1. As of March 31, 2003, the value of the plant is 15,000 rupees and therefore the estimated life is 10 years.

2. On September 30, 2004, the factory cost is 12,000 rupees and therefore the estimated life is 6 years.

3. On April 30, 2005, the factory cost is 20,000 rupees and therefore the estimated life is 8 years.

Of the first plant acquired on January 1, 2003, one machine of Rs 5,000 was sold for Rs 4,700 on June 30, 2005.

The residual value of every asset is 10% of the first cost.

Prepare a plant account for the primary three years.

A23)

Q23) The balance of the plant and machinery accounts on New Year's Eve , 2003 was Rs 19,515 after depreciation for the year. (The total cost of the plant was 35,800 rupees and eight ,900 rupees including the plant purchased in 1995.)

In January 2004, a substitute factory was purchased at a price of Rs 2,950, and in 1980 a machine costing Rs 550 was sold as scrap of Rs 35.

In January 2005, there was an addition of 1,800 rupees, and in 2001 a 700-rupee machine was sold for 350 rupees.

You need to make machine accounts for 2004 and 2005. All calculations are displayed.

On January 1, 2003, the machine was purchased for Rs 80,000. On January 1, 2004, a machine of 40,000 rupees was added. On March 31, 2005, a machine of Rs 12,000 purchased on January 1, 2004 was sold for Rs 11,000 and 32,000 purchased on June 30, 2005 on January 1, 2003. The rupee machine was sold for 26,700 rupees. On October 1, 2005, an amount of Rs 20,000 was added. Depreciation was provided at an annual rate of 10%. About the reduction balance method.

Shows machine accounts for the three years from 2003 to New Year's Eve, 2005.

A24)

Q24)

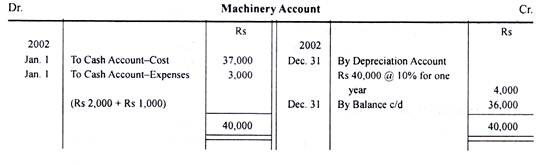

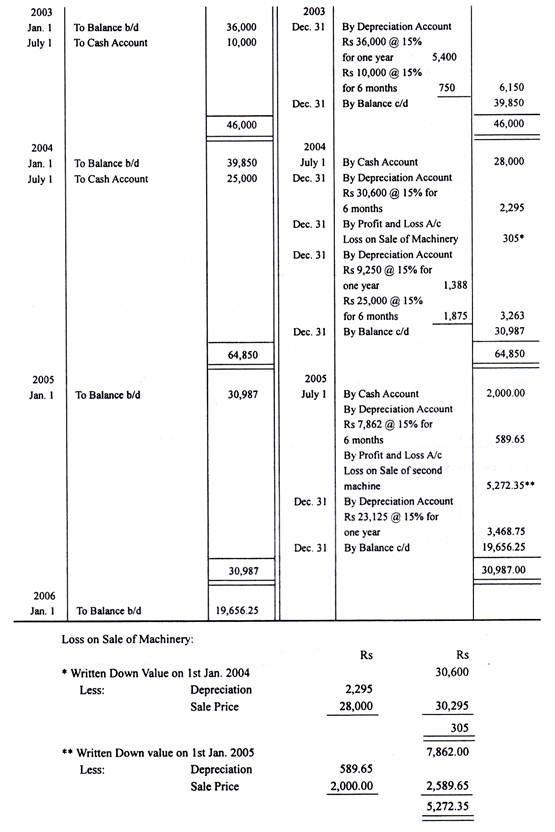

A company bought a second hand machine for Rs 37,000 on January 1, 2002 and immediately spent Rs 2,000 for repairs and Rs 1,000 for construction. I bought another machine for Rs 10.000 on Dominion Day, 2003 and sold the primary machine I bought in 2002 on Dominion Day, 2004 for Rs 28,000. On an equivalent day, I bought the machine for 25,000 rupees. The second machine, which was purchased for 10,000 rupees, was also sold for 2,000 rupees on Dominion Day, 2005.

Depreciation was provided to the machine on December 31st annually at a rate of 10% of the first cost. However, in 2003, we changed the depreciation method and adopted a depreciation method with a rate of depreciation of 15%.

We will offer you a machine account for 4 years from January 1, 2002.

A25)