UNIT 3

Perfect Competition

Q1) Explain perfect competition?

A1)

Perfect competition refers to ‘A market structure in which there are large number of buyers and sellers with a single uniforms price for the product which is determined by the forces of demand & supply.’ The price prevailing in perfect competition market is equilibrium price.

Definition:

It is identified by the existence of the many firm; they all sell an identical products an equivalent way. The supplier is the one who accepts the price."- Vilas

Such market gains when the request for product of every producer is totally elastic. Mrs Joan Robinson.

It is a market condition with an outsized number of sellers and buyers, similar products, free entry of enterprises into the industry is ideal knowledge between buyers and sellers of existing market conditions and free mobility of production factors between alternative uses. Lim Chong-ya

Characteristic of perfect competition:-

1) Large number of seller / seller are price takers: There are many potential sellers selling their commodity in the market. Their number is so large that a single seller cannot influence the market price because each seller sells a small fraction of total market supply. The price of the product is determined on the basis of market demand and market supply of the commodity which is accepted by the firms, thus seller is a price taker and not a price maker.

2) Large number of buyers: There are many buyers in the market. A single buyer cannot influence the price of the commodity because individual demand is a small fraction of total market demand.

3) Homogeneous product: The product sold in the market is homogeneous, i.e. identical in quality and size. There is no difference between the products. The products are perfect substitutes for each other.

4) Free entry and exit: There is freedom for new firms or sellers to enter into the market or industry. There is no legal, economic or any type of restrictions. Similarly, the seller is free to leave the market on industry.

5) Perfect knowledge: The seller and buyers have perfect knowledge about the market such as price, demand and supply. This will prevent the buyer from paying higher price than the market price. Similarly, sellers cannot change a different price than the prevailing market price.

6) Perfect mobility of factors of production: Factors of production are freely mobile from one firm to another or from one place to another. This ensures freedom of entry and exit firms. This also ensure that the factors cost are the same for all firms.

7) No transport cost: It is assumed that there are no transport costs. As a result, there is no possibility of changing a higher price on the behalf of transport costs.

8) Non intervention by the government: It is assumed that government does not interfere in the working of the market economy. Price is determined freely according to demand and supply conditions of the market.

9) Single Price: In Perfect Competition all units of a commodity have uniforms or a single price. It is determined by the forces of demand and supply.

Q2) Explain characteristics of perfect competition?

A2)

Perfect competition refers to ‘A market structure in which there are large number of buyers and sellers with a single uniforms price for the product which is determined by the forces of demand & supply.’ The price prevailing in perfect competition market is equilibrium price.

Definition:

It is identified by the existence of the many firm; they all sell an identical products an equivalent way. The supplier is the one who accepts the price."- Vilas

Such market gains when the request for product of every producer is totally elastic. Mrs Joan Robinson.

It is a market condition with an outsized number of sellers and buyers, similar products, free entry of enterprises into the industry is ideal knowledge between buyers and sellers of existing market conditions and free mobility of production factors between alternative uses. Lim Chong-ya

Characteristic of perfect competition:-

1) Large number of seller / seller are price takers: There are many potential sellers selling their commodity in the market. Their number is so large that a single seller cannot influence the market price because each seller sells a small fraction of total market supply. The price of the product is determined on the basis of market demand and market supply of the commodity which is accepted by the firms, thus seller is a price taker and not a price maker.

2) Large number of buyers: There are many buyers in the market. A single buyer cannot influence the price of the commodity because individual demand is a small fraction of total market demand.

3) Homogeneous product: The product sold in the market is homogeneous, i.e. identical in quality and size. There is no difference between the products. The products are perfect substitutes for each other.

4) Free entry and exit: There is freedom for new firms or sellers to enter into the market or industry. There is no legal, economic or any type of restrictions. Similarly, the seller is free to leave the market on industry.

5) Perfect knowledge: The seller and buyers have perfect knowledge about the market such as price, demand and supply. This will prevent the buyer from paying higher price than the market price. Similarly, sellers cannot change a different price than the prevailing market price.

6) Perfect mobility of factors of production: Factors of production are freely mobile from one firm to another or from one place to another. This ensures freedom of entry and exit firms. This also ensure that the factors cost are the same for all firms.

7) No transport cost: It is assumed that there are no transport costs. As a result, there is no possibility of changing a higher price on the behalf of transport costs.

8) Non intervention by the government: It is assumed that government does not interfere in the working of the market economy. Price is determined freely according to demand and supply conditions of the market.

9) Single Price: In Perfect Competition all units of a commodity have uniforms or a single price. It is determined by the forces of demand and supply.

Q3) Explain equilibrium of firm under perfect competition?

A3)

Equilibrium of firm

Meaning:

A firm is in equilibrium when it has no tendency to change its level of output. It needs neither expansion nor contraction. It wants to earn maximum profits. In the words of A.W. Stonier and D.C. Hague, “A firm will be in equilibrium when it is earning maximum money profits.”

Equilibrium of the firm can be analysed in both short-run and long-run periods. A firm can earn the maximum profits in the short run or may incur the minimum loss. But in the long run, it can earn only normal profit.

Short-run Equilibrium of the Firm:

The short run is a period of time in which the firm can vary its output by changing the variable factors of production in order to earn maximum profits or to incur minimum losses. The number of firms in the industry is fixed because neither the existing firms can leave nor new firms can enter it.

It’s Conditions:

The firm is in equilibrium when it is earning maximum profits as the difference between its total revenue and total cost.

For this, it essential that it must satisfy two conditions:

(1) MC = MR, and (2) the MC curve must cut the MR curve from below at the point of equality and then rise upwards.

The price at which each firm sells its output is set by the market forces of demand and supply. Each firm will be able to sell as much as it chooses at that price. But due to competition, it will not be able to sell at all at a higher price than the market price. Thus the firm’s demand curve will be horizontal at that price so that P = AR = MR for the firm.

1. Marginal Revenue and Marginal Cost Approach:

The short-run equilibrium of the firm can be explained with the help of the marginal analysis as well as with total cost-total revenue analysis. We first take the marginal analysis under identical cost conditions.

This analysis is based on the following assumptions:

1. All firms in an industry use homogeneous factors of production.

2. Their costs are equal. Therefore, all cost curves are uniform.

3. They use homogeneous plants so that their SAC curves are equal.

4. All firms are of equal efficiency.

5. All firms sell their products at the same price determined by demand and supply of the industry so that the price of each firm is equal to AR = MR.

Determination of Equilibrium:

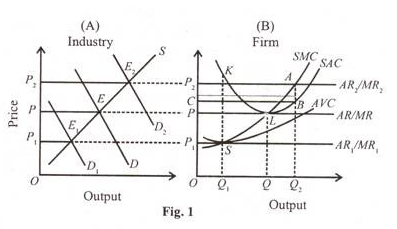

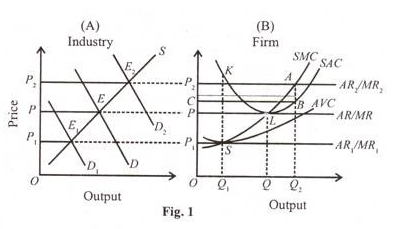

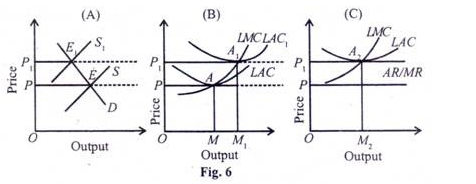

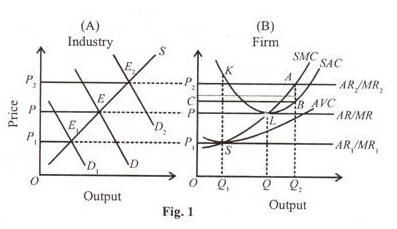

Given these assumptions, suppose that price OP in the competitive market for the product of all the firms in the industry is determined by the equality of demand curve D and the supply curve S at point E in Figure 1(A) so that their average revenue curve (AR) coincides with the marginal revenue curve (MR).

At this price, each firm is in equilibrium at point L in Panel (B) of the figure where (i) SMC equals MR and AR, and (ii) the SMC curve cuts the MR curve from below. Each firm would be producing OQ output and earning normal profits at the maximum average total costs QL. A firm earns normal profits when the MR curve is tangent to the SAC curve at its minimum point.

If the price is higher than these minimum average total costs, each firm will be earning supernormal profits. Suppose the price rises to 0Рг where the SMC curve cuts the new marginal revenue curve MR2 (=AR2) from below at point A which now becomes the equilibrium point. In this situation, each firm produces OQ2 output and earns supernormal profits equal to the area of the rectangle P2 ABC.

If the price falls below OP1the firm would make a loss because the SAC would be higher than the price. In the short-run, it would continue to produce and sell OQ1 output at OP1price so long as it covers its AVC. S is thus the shut-down point at which the firm is incurring the maximum loss equal to SK per unit of output. If the price falls below OP1 the firm will close down because it would fail to cover even the minimum average variable cost. OP1 is thus the shut-down price.

2. Total Cost Revenue Analysis:

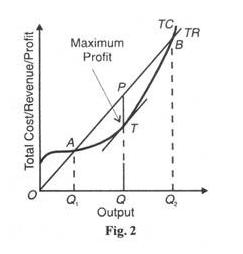

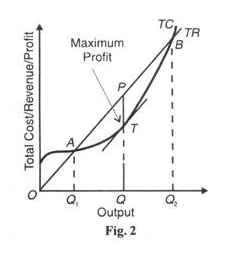

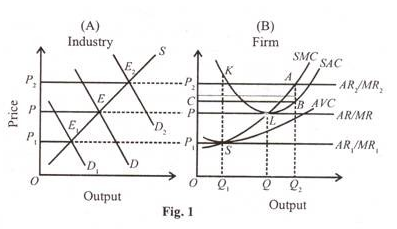

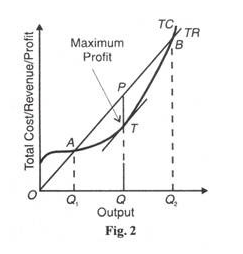

The short-run equilibrium of the firm can also be shown with the help of total cost and total revenue curves. The firm is able to maximize its profits at that level of output where the difference between total revenue and total cost is the maximum. This is shown in Figure 2 where TR is the total revenue curve and TC total cost curve.

The total revenue curve is an upward sloping straight line curve starting from O. This is because the firm sells small or large quantities of its product at a constant price under perfect competition. If the firm produces nothing, total revenue will be zero. The more it produces, the larger is the increase in total revenue. Hence the TR curve is linear and slopes upward.

The firm will maximize its profits at that level of output where the gap between the TR curve and the 1C curve is the maximum. Geometrically, it is that level at which the slope of a tangent drawn to the total cost curve equals the slope of the total revenue curve. In Figure 2, the maximum amount of profit is measured by TP at OQ output. At outputs smaller or larger than OQ between A and В points, the firm’s profits shrink. If the firm produces OQ1 output, its losses are the maximum because the TC curve is i above the TR curve. At Q1 its profits are zero. Similar situation prevails at Q2.

Since the marginal revenue equals the slope of the total о revenue curve and the marginal cost equals the slope of the tangent to the total cost curve, it follows that where the slopes of the total cost and revenue curves are equal as at P and T, the marginal cost equals the marginal revenue. It should be clear of that the point of maximum profits lies in the region of rising marginal cost (when TC is below TR) and of maximum loss in the falling marginal cost region (where TC is above TR).

The explanation of the equilibrium of the firm by using total cost-revenue curves does not throw more light than is provided by the marginal cost-marginal revenue analysis. It is useful only in the case of certain marginal decisions where the total cost curve is also linear over a certain range of output.

But it makes the equilibrium of the firm a cumbersome and difficult analysis particularly when one has to compare the change in cost and revenue resulting from a change in the volume of output. Further, maximum profits cannot be known at once. For this, a number of tangents are required to be drawn which is a real difficulty.

Long-run Equilibrium of the Firm:

In the long-run, it is possible to make more adjustments than in the short-run. The firm can adjust its plant capacity and scale of operations to the changed circumstances. Therefore, all costs are variable. Firms must earn only normal profits. In case the price is above the long-run AC curve firms will be earning supernormal profits.

Attracted by them, new firms will enter the industry and supernormal profits will be competed away. If the price is below the LAC curve firms will be incurring losses. As a result, some of the firms will leave the industry so that no firm earns more than normal profits. Thus “in the long-run firms are in equilibrium when they have adjusted their plant so as to produce at the minimum point of their long-run AC curve, which is tangent (at this point) to the demand (AR) curve defined by the market price” so that they earn normal profits.

It’s Assumptions:

This analysis is based on the following assumptions:

1. Firms are free to enter into or leave the industry.

2. All firms are of equal efficiency.

3. All factors are homogeneous. They can be obtained at constant and uniform prices.

4. Cost curves of firms are uniform.

5. The plants of firm: are equal having given technology.

6. All firms have perfect knowledge about price and output.

Determination:

Given these assumptions, each firm of the industry will be in the following two conditions.

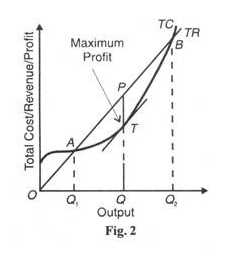

(1) In equilibrium, its short-run marginal cost (SMC) must equal to its long-run marginal cost (LMC) as well as its short-run average cost (SAC) and its long-run average cost (LAC) and both should be equal to MR=AR=P. Thus the first equilibrium condition is:

SMC = LMC = MR = AR = P = SAC = LAC at its minimum point, and

(2) LMC curve must cut MR curve from below.

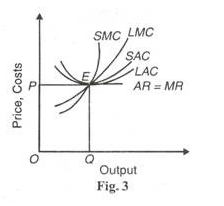

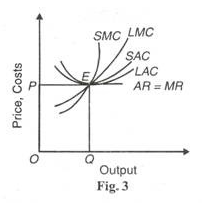

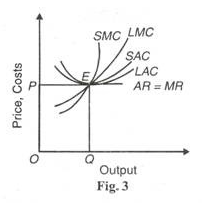

Both these conditions of equilibrium are satisfied at point E in Figure 3 where SMC and LMC curves cut from below SAC and LAC curves at their minimum point E and SMC and LMC curves cut AR = MR curve from below. All curves meet at this point E and the firm produces OQ optimum quantity and sell it at OP price.

Since we assume equal costs of all the firms of industry, all firms will be in equilibrium m the long-run. At OP price a firm will have neither a tendency to leave nor enter the industry and all firms will earn normal profit.

Q4) Explain equilibrium of industry under perfect competition?

A4)

Equilibrium of the Industry under Perfect Competition:

Conditions of Equilibrium of the Industry:

An industry is in equilibrium:

(i) When there is no tendency for the firms either to leave or enter the industry, and (ii) when each firm is also in equilibrium. The first condition implies that the average cost curves coincide with the average revenue curve of all the firms in the industry. They are earning only normal profits, which are supposed to be included in the average cost curves of the firms. The second condition implies the equality of MC and MR. Under a perfectly competitive industry, these two conditions must be satisfied at the point of equilibrium, i.e.,

SMC = MR

SAC = AR

P = AR = MR

SMC = SAC = AR = P

Such a situation represents full equilibrium of the industry.

Short-Run Equilibrium of the Industry:

An industry is in equilibrium in the short run when its total output remains steady, there being no tendency to expand or contract its output. If all firms are in equilibrium, the industry is also in equilibrium. For full equilibrium of the industry in the short run, all firms must be earning only normal profits. The condition for this is SMC = MR = AR = SAC. But full equilibrium of the industry is by sheer accident because in the short run some firms may be earning supernormal profits and some incurring losses.

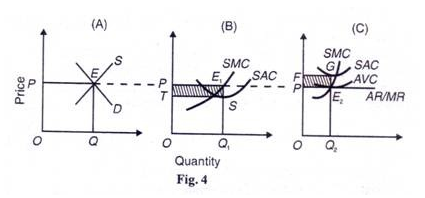

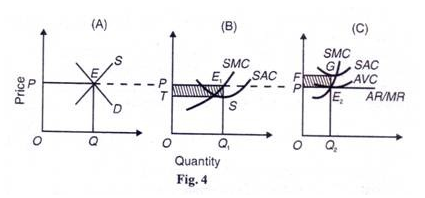

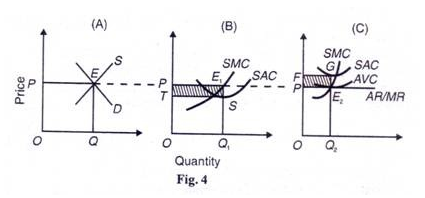

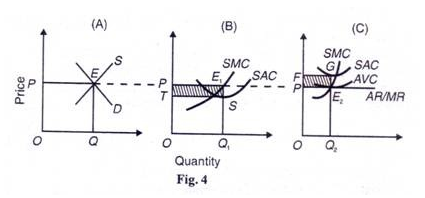

Even then, the industry is in short- run equilibrium when its quantity demanded and quantity supplied are equal at the price which clears the market. This is illustrated in Figure 4, where in Panel (A), the industry is in equilibrium at point E where its demand curve D and supply curve S intersect which determine OP price at which its total output OQ is cleared. But at the prevailing price OP some firms are earning supernormal profits PE1ST as shown in Panel (B), while some other firms are incurring FGE2P losses as shown in Panel (C) of the figure.

Long-Run Equilibrium of the Industry:

The industry is in equilibrium in the long run when all firms earn normal profits. There is no incentive for firms to leave the industry or for new firms to enter it. With all factors homogeneous and given their prices and the same technology, each firm and industry as a whole are in full equilibrium where LMC = MR =AR(=p) =LAC at its minimum. Such an equilibrium position is attained when the long-run price for the industry is determined by the equality of total demand and supply of the industry.

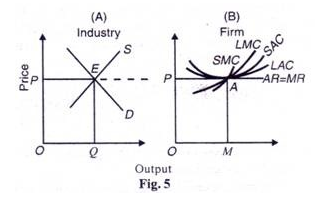

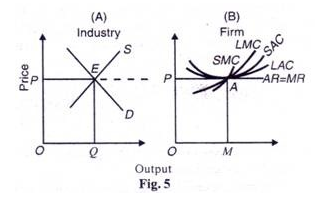

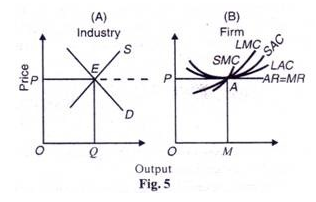

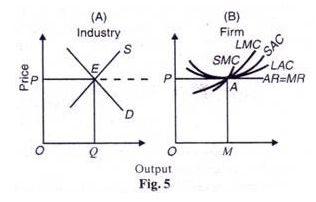

The long-run equilibrium of the industry is illustrated in Figure 5(A) where the long-run price op and OQ output are determined by the intersection of the demand curve d and the supply curve s at point E. At this price op, the firms are in equilibrium at point A in Panel (B) at OM level of output where LMC =SMC= MR= p (=AR) =SAC= LAC at its minimum. At this level, the firms are earning normal profits and have no incentive to enter or leave the industry. It follows that when the industry is in long-run equilibrium, each firm in the industry is also in long-run equilibrium. If both the industry and the firms are in long-run equilibrium, they are also in short-run equilibrium.

Even though all firms in a perfectly competitive industry in the long run have the same cost curves, the firms can be of different efficiency. Firms using superior resources or inputs such as superior management must pay them higher rewards, otherwise they will shift to new firms which offer them higher prices.

So the forces of competition will force the more efficient firms to pay superior resources higher prices at their opportunity cost. As a result, the lac curve of the more efficient firms will shift upwards and they will benefit in the form of higher output at the higher long-run equilibrium price set by the industry.

Unable to pay higher prices to resources or inputs, less efficient firms will be competed away. New firms which are able to pay more and attracted by the new higher market price will enter the industry. But at the new long-run equilibrium price of the industry, all firms will be producing at the minimum LAC.

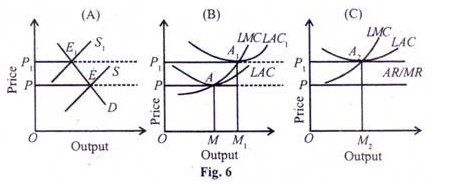

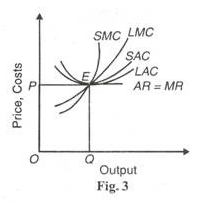

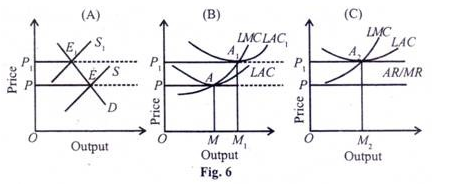

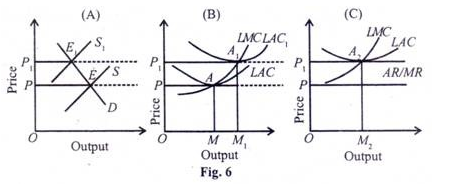

This is illustrated in Figure 6 where the industry is in initial equilibrium at point E with price OP m Panel (A) and the more efficient firms like all other firms are in equilibrium at point A in Panel (B). As the industry is in equilibrium, the new firms do not exist as they are not in a position to cover their costs at OP price.

When the more efficient firms pay higher prices to resources or inputs, their LAC curve rises to LAC1 At the new long-run equilibrium price of the industry set at OP 1 the more efficient firms are in equilibrium where P1 = LAC1 at its minimum point A1 in Panel (B). They are now producing larger output OM1 even though they earn normal profits. The new firms also earn normal profits at point A2, as shown in Panel (C). But they produce less output OM2 than OM1 produced by the more efficient firms.

Q5) Explain producer surplus?

A5)

Producer surplus:

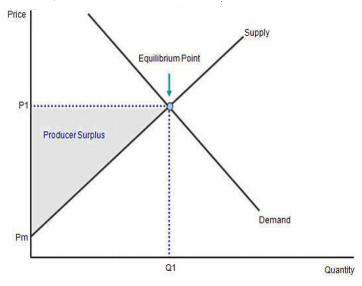

Producer surplus is defined as the difference between the amount the producer is willing to supply goods for and the actual amount received by him when he makes the trade. Producer surplus is a measure of producer welfare. It is shown graphically as the area above the supply curve and below the equilibrium price.

Here the producer surplus is shown in gray. As the price increases, the incentive for producing more good increases thereby increases the producer surplus.

A producer always tries to increase his producer surplus by trying to sell more and more at higher prices. However, it is simply not possible to increase the producer surplus indefinitely since at higher prices there might be very little or no demand for goods.

Q6) Explain short run equilibrium of firm.

A6)

Short-run Equilibrium of the Firm:

The short run is a period of time in which the firm can vary its output by changing the variable factors of production in order to earn maximum profits or to incur minimum losses. The number of firms in the industry is fixed because neither the existing firms can leave nor new firms can enter it.

It’s Conditions:

The firm is in equilibrium when it is earning maximum profits as the difference between its total revenue and total cost.

For this, it essential that it must satisfy two conditions:

(1) MC = MR, and (2) the MC curve must cut the MR curve from below at the point of equality and then rise upwards.

The price at which each firm sells its output is set by the market forces of demand and supply. Each firm will be able to sell as much as it chooses at that price. But due to competition, it will not be able to sell at all at a higher price than the market price. Thus the firm’s demand curve will be horizontal at that price so that P = AR = MR for the firm.

1. Marginal Revenue and Marginal Cost Approach:

The short-run equilibrium of the firm can be explained with the help of the marginal analysis as well as with total cost-total revenue analysis. We first take the marginal analysis under identical cost conditions.

This analysis is based on the following assumptions:

1. All firms in an industry use homogeneous factors of production.

2. Their costs are equal. Therefore, all cost curves are uniform.

3. They use homogeneous plants so that their SAC curves are equal.

4. All firms are of equal efficiency.

5. All firms sell their products at the same price determined by demand and supply of the industry so that the price of each firm is equal to AR = MR.

Determination of Equilibrium:

Given these assumptions, suppose that price OP in the competitive market for the product of all the firms in the industry is determined by the equality of demand curve D and the supply curve S at point E in Figure 1(A) so that their average revenue curve (AR) coincides with the marginal revenue curve (MR).

At this price, each firm is in equilibrium at point L in Panel (B) of the figure where (i) SMC equals MR and AR, and (ii) the SMC curve cuts the MR curve from below. Each firm would be producing OQ output and earning normal profits at the maximum average total costs QL. A firm earns normal profits when the MR curve is tangent to the SAC curve at its minimum point.

If the price is higher than these minimum average total costs, each firm will be earning supernormal profits. Suppose the price rises to 0Рг where the SMC curve cuts the new marginal revenue curve MR2 (=AR2) from below at point A which now becomes the equilibrium point. In this situation, each firm produces OQ2 output and earns supernormal profits equal to the area of the rectangle P2 ABC.

If the price falls below OP1the firm would make a loss because the SAC would be higher than the price. In the short-run, it would continue to produce and sell OQ1 output at OP1price so long as it covers its AVC. S is thus the shut-down point at which the firm is incurring the maximum loss equal to SK per unit of output. If the price falls below OP1 the firm will close down because it would fail to cover even the minimum average variable cost. OP1 is thus the shut-down price.

2. Total Cost Revenue Analysis:

The short-run equilibrium of the firm can also be shown with the help of total cost and total revenue curves. The firm is able to maximize its profits at that level of output where the difference between total revenue and total cost is the maximum. This is shown in Figure 2 where TR is the total revenue curve and TC total cost curve.

The total revenue curve is an upward sloping straight line curve starting from O. This is because the firm sells small or large quantities of its product at a constant price under perfect competition. If the firm produces nothing, total revenue will be zero. The more it produces, the larger is the increase in total revenue. Hence the TR curve is linear and slopes upward.

The firm will maximize its profits at that level of output where the gap between the TR curve and the 1C curve is the maximum. Geometrically, it is that level at which the slope of a tangent drawn to the total cost curve equals the slope of the total revenue curve. In Figure 2, the maximum amount of profit is measured by TP at OQ output. At outputs smaller or larger than OQ between A and В points, the firm’s profits shrink. If the firm produces OQ1 output, its losses are the maximum because the TC curve is i above the TR curve. At Q1 its profits are zero. Similar situation prevails at Q2.

Since the marginal revenue equals the slope of the total о revenue curve and the marginal cost equals the slope of the tangent to the total cost curve, it follows that where the slopes of the total cost and revenue curves are equal as at P and T, the marginal cost equals the marginal revenue. It should be clear of that the point of maximum profits lies in the region of rising marginal cost (when TC is below TR) and of maximum loss in the falling marginal cost region (where TC is above TR).

The explanation of the equilibrium of the firm by using total cost-revenue curves does not throw more light than is provided by the marginal cost-marginal revenue analysis. It is useful only in the case of certain marginal decisions where the total cost curve is also linear over a certain range of output.

But it makes the equilibrium of the firm a cumbersome and difficult analysis particularly when one has to compare the change in cost and revenue resulting from a change in the volume of output. Further, maximum profits cannot be known at once. For this, a number of tangents are required to be drawn which is a real difficulty.

Q7) Explain long run equilibrium of firm under perfect competition?

A7)

Long-run Equilibrium of the Firm:

In the long-run, it is possible to make more adjustments than in the short-run. The firm can adjust its plant capacity and scale of operations to the changed circumstances. Therefore, all costs are variable. Firms must earn only normal profits. In case the price is above the long-run AC curve firms will be earning supernormal profits.

Attracted by them, new firms will enter the industry and supernormal profits will be competed away. If the price is below the LAC curve firms will be incurring losses. As a result, some of the firms will leave the industry so that no firm earns more than normal profits. Thus “in the long-run firms are in equilibrium when they have adjusted their plant so as to produce at the minimum point of their long-run AC curve, which is tangent (at this point) to the demand (AR) curve defined by the market price” so that they earn normal profits.

It’s Assumptions:

This analysis is based on the following assumptions:

1. Firms are free to enter into or leave the industry.

2. All firms are of equal efficiency.

3. All factors are homogeneous. They can be obtained at constant and uniform prices.

4. Cost curves of firms are uniform.

5. The plants of firm: are equal having given technology.

6. All firms have perfect knowledge about price and output.

Determination:

Given these assumptions, each firm of the industry will be in the following two conditions.

(1) In equilibrium, its short-run marginal cost (SMC) must equal to its long-run marginal cost (LMC) as well as its short-run average cost (SAC) and its long-run average cost (LAC) and both should be equal to MR=AR=P. Thus the first equilibrium condition is:

SMC = LMC = MR = AR = P = SAC = LAC at its minimum point, and

(2) LMC curve must cut MR curve from below.

Both these conditions of equilibrium are satisfied at point E in Figure 3 where SMC and LMC curves cut from below SAC and LAC curves at their minimum point E and SMC and LMC curves cut AR = MR curve from below. All curves meet at this point E and the firm produces OQ optimum quantity and sell it at OP price.

Since we assume equal costs of all the firms of industry, all firms will be in equilibrium m the long-run. At OP price a firm will have neither a tendency to leave nor enter the industry and all firms will earn normal profit.

Q8) Explain conditions of equilibrium of industry under perfect competition?

A8)

Conditions of Equilibrium of the Industry:

An industry is in equilibrium:

(i) When there is no tendency for the firms either to leave or enter the industry, and (ii) when each firm is also in equilibrium. The first condition implies that the average cost curves coincide with the average revenue curve of all the firms in the industry. They are earning only normal profits, which are supposed to be included in the average cost curves of the firms. The second condition implies the equality of MC and MR. Under a perfectly competitive industry, these two conditions must be satisfied at the point of equilibrium, i.e.,

SMC = MR

SAC = AR

P = AR = MR

SMC = SAC = AR = P

Such a situation represents full equilibrium of the industry.

Short-Run Equilibrium of the Industry:

An industry is in equilibrium in the short run when its total output remains steady, there being no tendency to expand or contract its output. If all firms are in equilibrium, the industry is also in equilibrium. For full equilibrium of the industry in the short run, all firms must be earning only normal profits. The condition for this is SMC = MR = AR = SAC. But full equilibrium of the industry is by sheer accident because in the short run some firms may be earning supernormal profits and some incurring losses.

Even then, the industry is in short- run equilibrium when its quantity demanded and quantity supplied are equal at the price which clears the market. This is illustrated in Figure 4, where in Panel (A), the industry is in equilibrium at point E where its demand curve D and supply curve S intersect which determine OP price at which its total output OQ is cleared. But at the prevailing price OP some firms are earning supernormal profits PE1ST as shown in Panel (B), while some other firms are incurring FGE2P losses as shown in Panel (C) of the figure.

Long-Run Equilibrium of the Industry:

The industry is in equilibrium in the long run when all firms earn normal profits. There is no incentive for firms to leave the industry or for new firms to enter it. With all factors homogeneous and given their prices and the same technology, each firm and industry as a whole are in full equilibrium where LMC = MR =AR(=p) =LAC at its minimum. Such an equilibrium position is attained when the long-run price for the industry is determined by the equality of total demand and supply of the industry.

The long-run equilibrium of the industry is illustrated in Figure 5(A) where the long-run price op and OQ output are determined by the intersection of the demand curve d and the supply curve s at point E. At this price op, the firms are in equilibrium at point A in Panel (B) at OM level of output where LMC =SMC= MR= p (=AR) =SAC= LAC at its minimum. At this level, the firms are earning normal profits and have no incentive to enter or leave the industry. It follows that when the industry is in long-run equilibrium, each firm in the industry is also in long-run equilibrium. If both the industry and the firms are in long-run equilibrium, they are also in short-run equilibrium.

Even though all firms in a perfectly competitive industry in the long run have the same cost curves, the firms can be of different efficiency. Firms using superior resources or inputs such as superior management must pay them higher rewards, otherwise they will shift to new firms which offer them higher prices.

So the forces of competition will force the more efficient firms to pay superior resources higher prices at their opportunity cost. As a result, the lac curve of the more efficient firms will shift upwards and they will benefit in the form of higher output at the higher long-run equilibrium price set by the industry.

Unable to pay higher prices to resources or inputs, less efficient firms will be competed away. New firms which are able to pay more and attracted by the new higher market price will enter the industry. But at the new long-run equilibrium price of the industry, all firms will be producing at the minimum LAC.

This is illustrated in Figure 6 where the industry is in initial equilibrium at point E with price OP m Panel (A) and the more efficient firms like all other firms are in equilibrium at point A in Panel (B). As the industry is in equilibrium, the new firms do not exist as they are not in a position to cover their costs at OP price.

When the more efficient firms pay higher prices to resources or inputs, their LAC curve rises to LAC1 At the new long-run equilibrium price of the industry set at OP 1 the more efficient firms are in equilibrium where P1 = LAC1 at its minimum point A1 in Panel (B). They are now producing larger output OM1 even though they earn normal profits. The new firms also earn normal profits at point A2, as shown in Panel (C). But they produce less output OM2 than OM1 produced by the more efficient firms.

Q9) Explain Equilibrium of the firm and the industry in the short and the long-runs, including industry’s long run supply curve?

A9)

Equilibrium of firm

Meaning:

A firm is in equilibrium when it has no tendency to change its level of output. It needs neither expansion nor contraction. It wants to earn maximum profits. In the words of A.W. Stonier and D.C. Hague, “A firm will be in equilibrium when it is earning maximum money profits.”

Equilibrium of the firm can be analysed in both short-run and long-run periods. A firm can earn the maximum profits in the short run or may incur the minimum loss. But in the long run, it can earn only normal profit.

Short-run Equilibrium of the Firm:

The short run is a period of time in which the firm can vary its output by changing the variable factors of production in order to earn maximum profits or to incur minimum losses. The number of firms in the industry is fixed because neither the existing firms can leave nor new firms can enter it.

It’s Conditions:

The firm is in equilibrium when it is earning maximum profits as the difference between its total revenue and total cost.

For this, it essential that it must satisfy two conditions:

(1) MC = MR, and (2) the MC curve must cut the MR curve from below at the point of equality and then rise upwards.

The price at which each firm sells its output is set by the market forces of demand and supply. Each firm will be able to sell as much as it chooses at that price. But due to competition, it will not be able to sell at all at a higher price than the market price. Thus the firm’s demand curve will be horizontal at that price so that P = AR = MR for the firm.

1. Marginal Revenue and Marginal Cost Approach:

The short-run equilibrium of the firm can be explained with the help of the marginal analysis as well as with total cost-total revenue analysis. We first take the marginal analysis under identical cost conditions.

This analysis is based on the following assumptions:

1. All firms in an industry use homogeneous factors of production.

2. Their costs are equal. Therefore, all cost curves are uniform.

3. They use homogeneous plants so that their SAC curves are equal.

4. All firms are of equal efficiency.

5. All firms sell their products at the same price determined by demand and supply of the industry so that the price of each firm is equal to AR = MR.

Determination of Equilibrium:

Given these assumptions, suppose that price OP in the competitive market for the product of all the firms in the industry is determined by the equality of demand curve D and the supply curve S at point E in Figure 1(A) so that their average revenue curve (AR) coincides with the marginal revenue curve (MR).

At this price, each firm is in equilibrium at point L in Panel (B) of the figure where (i) SMC equals MR and AR, and (ii) the SMC curve cuts the MR curve from below. Each firm would be producing OQ output and earning normal profits at the maximum average total costs QL. A firm earns normal profits when the MR curve is tangent to the SAC curve at its minimum point.

If the price is higher than these minimum average total costs, each firm will be earning supernormal profits. Suppose the price rises to 0Рг where the SMC curve cuts the new marginal revenue curve MR2 (=AR2) from below at point A which now becomes the equilibrium point. In this situation, each firm produces OQ2 output and earns supernormal profits equal to the area of the rectangle P2 ABC.

If the price falls below OP1the firm would make a loss because the SAC would be higher than the price. In the short-run, it would continue to produce and sell OQ1 output at OP1price so long as it covers its AVC. S is thus the shut-down point at which the firm is incurring the maximum loss equal to SK per unit of output. If the price falls below OP1 the firm will close down because it would fail to cover even the minimum average variable cost. OP1 is thus the shut-down price.

2. Total Cost Revenue Analysis:

The short-run equilibrium of the firm can also be shown with the help of total cost and total revenue curves. The firm is able to maximize its profits at that level of output where the difference between total revenue and total cost is the maximum. This is shown in Figure 2 where TR is the total revenue curve and TC total cost curve.

The total revenue curve is an upward sloping straight line curve starting from O. This is because the firm sells small or large quantities of its product at a constant price under perfect competition. If the firm produces nothing, total revenue will be zero. The more it produces, the larger is the increase in total revenue. Hence the TR curve is linear and slopes upward.

The firm will maximize its profits at that level of output where the gap between the TR curve and the 1C curve is the maximum. Geometrically, it is that level at which the slope of a tangent drawn to the total cost curve equals the slope of the total revenue curve. In Figure 2, the maximum amount of profit is measured by TP at OQ output. At outputs smaller or larger than OQ between A and В points, the firm’s profits shrink. If the firm produces OQ1 output, its losses are the maximum because the TC curve is i above the TR curve. At Q1 its profits are zero. Similar situation prevails at Q2.

Since the marginal revenue equals the slope of the total о revenue curve and the marginal cost equals the slope of the tangent to the total cost curve, it follows that where the slopes of the total cost and revenue curves are equal as at P and T, the marginal cost equals the marginal revenue. It should be clear of that the point of maximum profits lies in the region of rising marginal cost (when TC is below TR) and of maximum loss in the falling marginal cost region (where TC is above TR).

The explanation of the equilibrium of the firm by using total cost-revenue curves does not throw more light than is provided by the marginal cost-marginal revenue analysis. It is useful only in the case of certain marginal decisions where the total cost curve is also linear over a certain range of output.

But it makes the equilibrium of the firm a cumbersome and difficult analysis particularly when one has to compare the change in cost and revenue resulting from a change in the volume of output. Further, maximum profits cannot be known at once. For this, a number of tangents are required to be drawn which is a real difficulty.

Long-run Equilibrium of the Firm:

In the long-run, it is possible to make more adjustments than in the short-run. The firm can adjust its plant capacity and scale of operations to the changed circumstances. Therefore, all costs are variable. Firms must earn only normal profits. In case the price is above the long-run AC curve firms will be earning supernormal profits.

Attracted by them, new firms will enter the industry and supernormal profits will be competed away. If the price is below the LAC curve firms will be incurring losses. As a result, some of the firms will leave the industry so that no firm earns more than normal profits. Thus “in the long-run firms are in equilibrium when they have adjusted their plant so as to produce at the minimum point of their long-run AC curve, which is tangent (at this point) to the demand (AR) curve defined by the market price” so that they earn normal profits.

It’s Assumptions:

This analysis is based on the following assumptions:

1. Firms are free to enter into or leave the industry.

2. All firms are of equal efficiency.

3. All factors are homogeneous. They can be obtained at constant and uniform prices.

4. Cost curves of firms are uniform.

5. The plants of firm: are equal having given technology.

6. All firms have perfect knowledge about price and output.

Determination:

Given these assumptions, each firm of the industry will be in the following two conditions.

(1) In equilibrium, its short-run marginal cost (SMC) must equal to its long-run marginal cost (LMC) as well as its short-run average cost (SAC) and its long-run average cost (LAC) and both should be equal to MR=AR=P. Thus the first equilibrium condition is:

SMC = LMC = MR = AR = P = SAC = LAC at its minimum point, and

(2) LMC curve must cut MR curve from below.

Both these conditions of equilibrium are satisfied at point E in Figure 3 where SMC and LMC curves cut from below SAC and LAC curves at their minimum point E and SMC and LMC curves cut AR = MR curve from below. All curves meet at this point E and the firm produces OQ optimum quantity and sell it at OP price.

Since we assume equal costs of all the firms of industry, all firms will be in equilibrium m the long-run. At OP price a firm will have neither a tendency to leave nor enter the industry and all firms will earn normal profit.

Equilibrium of the Industry under Perfect Competition:

Conditions of Equilibrium of the Industry:

An industry is in equilibrium:

(i) When there is no tendency for the firms either to leave or enter the industry, and (ii) when each firm is also in equilibrium. The first condition implies that the average cost curves coincide with the average revenue curve of all the firms in the industry. They are earning only normal profits, which are supposed to be included in the average cost curves of the firms. The second condition implies the equality of MC and MR. Under a perfectly competitive industry, these two conditions must be satisfied at the point of equilibrium, i.e.,

SMC = MR

SAC = AR

P = AR = MR

SMC = SAC = AR = P

Such a situation represents full equilibrium of the industry.

Short-Run Equilibrium of the Industry:

An industry is in equilibrium in the short run when its total output remains steady, there being no tendency to expand or contract its output. If all firms are in equilibrium, the industry is also in equilibrium. For full equilibrium of the industry in the short run, all firms must be earning only normal profits. The condition for this is SMC = MR = AR = SAC. But full equilibrium of the industry is by sheer accident because in the short run some firms may be earning supernormal profits and some incurring losses.

Even then, the industry is in short- run equilibrium when its quantity demanded and quantity supplied are equal at the price which clears the market. This is illustrated in Figure 4, where in Panel (A), the industry is in equilibrium at point E where its demand curve D and supply curve S intersect which determine OP price at which its total output OQ is cleared. But at the prevailing price OP some firms are earning supernormal profits PE1ST as shown in Panel (B), while some other firms are incurring FGE2P losses as shown in Panel (C) of the figure.

Long-Run Equilibrium of the Industry:

The industry is in equilibrium in the long run when all firms earn normal profits. There is no incentive for firms to leave the industry or for new firms to enter it. With all factors homogeneous and given their prices and the same technology, each firm and industry as a whole are in full equilibrium where LMC = MR =AR(=p) =LAC at its minimum. Such an equilibrium position is attained when the long-run price for the industry is determined by the equality of total demand and supply of the industry.

The long-run equilibrium of the industry is illustrated in Figure 5(A) where the long-run price op and OQ output are determined by the intersection of the demand curve d and the supply curve s at point E. At this price op, the firms are in equilibrium at point A in Panel (B) at OM level of output where LMC =SMC= MR= p (=AR) =SAC= LAC at its minimum. At this level, the firms are earning normal profits and have no incentive to enter or leave the industry. It follows that when the industry is in long-run equilibrium, each firm in the industry is also in long-run equilibrium. If both the industry and the firms are in long-run equilibrium, they are also in short-run equilibrium.

Even though all firms in a perfectly competitive industry in the long run have the same cost curves, the firms can be of different efficiency. Firms using superior resources or inputs such as superior management must pay them higher rewards, otherwise they will shift to new firms which offer them higher prices.

So the forces of competition will force the more efficient firms to pay superior resources higher prices at their opportunity cost. As a result, the lac curve of the more efficient firms will shift upwards and they will benefit in the form of higher output at the higher long-run equilibrium price set by the industry.

Unable to pay higher prices to resources or inputs, less efficient firms will be competed away. New firms which are able to pay more and attracted by the new higher market price will enter the industry. But at the new long-run equilibrium price of the industry, all firms will be producing at the minimum LAC.

This is illustrated in Figure 6 where the industry is in initial equilibrium at point E with price OP m Panel (A) and the more efficient firms like all other firms are in equilibrium at point A in Panel (B). As the industry is in equilibrium, the new firms do not exist as they are not in a position to cover their costs at OP price.

When the more efficient firms pay higher prices to resources or inputs, their LAC curve rises to LAC1 At the new long-run equilibrium price of the industry set at OP 1 the more efficient firms are in equilibrium where P1 = LAC1 at its minimum point A1 in Panel (B). They are now producing larger output OM1 even though they earn normal profits. The new firms also earn normal profits at point A2, as shown in Panel (C). But they produce less output OM2 than OM1 produced by the more efficient firms.

Q10) Explain short run and long run equilibrium of firm under perfect competition?

A10)

Equilibrium of firm

Meaning:

A firm is in equilibrium when it has no tendency to change its level of output. It needs neither expansion nor contraction. It wants to earn maximum profits. In the words of A.W. Stonier and D.C. Hague, “A firm will be in equilibrium when it is earning maximum money profits.”

Equilibrium of the firm can be analysed in both short-run and long-run periods. A firm can earn the maximum profits in the short run or may incur the minimum loss. But in the long run, it can earn only normal profit.

Short-run Equilibrium of the Firm:

The short run is a period of time in which the firm can vary its output by changing the variable factors of production in order to earn maximum profits or to incur minimum losses. The number of firms in the industry is fixed because neither the existing firms can leave nor new firms can enter it.

It’s Conditions:

The firm is in equilibrium when it is earning maximum profits as the difference between its total revenue and total cost.

For this, it essential that it must satisfy two conditions:

(1) MC = MR, and (2) the MC curve must cut the MR curve from below at the point of equality and then rise upwards.

The price at which each firm sells its output is set by the market forces of demand and supply. Each firm will be able to sell as much as it chooses at that price. But due to competition, it will not be able to sell at all at a higher price than the market price. Thus the firm’s demand curve will be horizontal at that price so that P = AR = MR for the firm.

1. Marginal Revenue and Marginal Cost Approach:

The short-run equilibrium of the firm can be explained with the help of the marginal analysis as well as with total cost-total revenue analysis. We first take the marginal analysis under identical cost conditions.

This analysis is based on the following assumptions:

1. All firms in an industry use homogeneous factors of production.

2. Their costs are equal. Therefore, all cost curves are uniform.

3. They use homogeneous plants so that their SAC curves are equal.

4. All firms are of equal efficiency.

5. All firms sell their products at the same price determined by demand and supply of the industry so that the price of each firm is equal to AR = MR.

Determination of Equilibrium:

Given these assumptions, suppose that price OP in the competitive market for the product of all the firms in the industry is determined by the equality of demand curve D and the supply curve S at point E in Figure 1(A) so that their average revenue curve (AR) coincides with the marginal revenue curve (MR).

At this price, each firm is in equilibrium at point L in Panel (B) of the figure where (i) SMC equals MR and AR, and (ii) the SMC curve cuts the MR curve from below. Each firm would be producing OQ output and earning normal profits at the maximum average total costs QL. A firm earns normal profits when the MR curve is tangent to the SAC curve at its minimum point.

If the price is higher than these minimum average total costs, each firm will be earning supernormal profits. Suppose the price rises to 0Рг where the SMC curve cuts the new marginal revenue curve MR2 (=AR2) from below at point A which now becomes the equilibrium point. In this situation, each firm produces OQ2 output and earns supernormal profits equal to the area of the rectangle P2 ABC.

If the price falls below OP1the firm would make a loss because the SAC would be higher than the price. In the short-run, it would continue to produce and sell OQ1 output at OP1price so long as it covers its AVC. S is thus the shut-down point at which the firm is incurring the maximum loss equal to SK per unit of output. If the price falls below OP1 the firm will close down because it would fail to cover even the minimum average variable cost. OP1 is thus the shut-down price.

2. Total Cost Revenue Analysis:

The short-run equilibrium of the firm can also be shown with the help of total cost and total revenue curves. The firm is able to maximize its profits at that level of output where the difference between total revenue and total cost is the maximum. This is shown in Figure 2 where TR is the total revenue curve and TC total cost curve.

The total revenue curve is an upward sloping straight line curve starting from O. This is because the firm sells small or large quantities of its product at a constant price under perfect competition. If the firm produces nothing, total revenue will be zero. The more it produces, the larger is the increase in total revenue. Hence the TR curve is linear and slopes upward.

The firm will maximize its profits at that level of output where the gap between the TR curve and the 1C curve is the maximum. Geometrically, it is that level at which the slope of a tangent drawn to the total cost curve equals the slope of the total revenue curve. In Figure 2, the maximum amount of profit is measured by TP at OQ output. At outputs smaller or larger than OQ between A and В points, the firm’s profits shrink. If the firm produces OQ1 output, its losses are the maximum because the TC curve is i above the TR curve. At Q1 its profits are zero. Similar situation prevails at Q2.

Since the marginal revenue equals the slope of the total о revenue curve and the marginal cost equals the slope of the tangent to the total cost curve, it follows that where the slopes of the total cost and revenue curves are equal as at P and T, the marginal cost equals the marginal revenue. It should be clear of that the point of maximum profits lies in the region of rising marginal cost (when TC is below TR) and of maximum loss in the falling marginal cost region (where TC is above TR).

The explanation of the equilibrium of the firm by using total cost-revenue curves does not throw more light than is provided by the marginal cost-marginal revenue analysis. It is useful only in the case of certain marginal decisions where the total cost curve is also linear over a certain range of output.

But it makes the equilibrium of the firm a cumbersome and difficult analysis particularly when one has to compare the change in cost and revenue resulting from a change in the volume of output. Further, maximum profits cannot be known at once. For this, a number of tangents are required to be drawn which is a real difficulty.

Long-run Equilibrium of the Firm:

In the long-run, it is possible to make more adjustments than in the short-run. The firm can adjust its plant capacity and scale of operations to the changed circumstances. Therefore, all costs are variable. Firms must earn only normal profits. In case the price is above the long-run AC curve firms will be earning supernormal profits.

Attracted by them, new firms will enter the industry and supernormal profits will be competed away. If the price is below the LAC curve firms will be incurring losses. As a result, some of the firms will leave the industry so that no firm earns more than normal profits. Thus “in the long-run firms are in equilibrium when they have adjusted their plant so as to produce at the minimum point of their long-run AC curve, which is tangent (at this point) to the demand (AR) curve defined by the market price” so that they earn normal profits.

It’s Assumptions:

This analysis is based on the following assumptions:

1. Firms are free to enter into or leave the industry.

2. All firms are of equal efficiency.

3. All factors are homogeneous. They can be obtained at constant and uniform prices.

4. Cost curves of firms are uniform.

5. The plants of firm: are equal having given technology.

6. All firms have perfect knowledge about price and output.

Determination:

Given these assumptions, each firm of the industry will be in the following two conditions.

(1) In equilibrium, its short-run marginal cost (SMC) must equal to its long-run marginal cost (LMC) as well as its short-run average cost (SAC) and its long-run average cost (LAC) and both should be equal to MR=AR=P. Thus the first equilibrium condition is:

SMC = LMC = MR = AR = P = SAC = LAC at its minimum point, and

(2) LMC curve must cut MR curve from below.

Both these conditions of equilibrium are satisfied at point E in Figure 3 where SMC and LMC curves cut from below SAC and LAC curves at their minimum point E and SMC and LMC curves cut AR = MR curve from below. All curves meet at this point E and the firm produces OQ optimum quantity and sell it at OP price.

Since we assume equal costs of all the firms of industry, all firms will be in equilibrium m the long-run. At OP price a firm will have neither a tendency to leave nor enter the industry and all firms will earn normal profit.

Q11) Explain short and long run equilibrium of industry?

A11)

Equilibrium of the Industry under Perfect Competition:

Conditions of Equilibrium of the Industry:

An industry is in equilibrium:

(i) When there is no tendency for the firms either to leave or enter the industry, and (ii) when each firm is also in equilibrium. The first condition implies that the average cost curves coincide with the average revenue curve of all the firms in the industry. They are earning only normal profits, which are supposed to be included in the average cost curves of the firms. The second condition implies the equality of MC and MR. Under a perfectly competitive industry, these two conditions must be satisfied at the point of equilibrium, i.e.,

SMC = MR

SAC = AR

P = AR = MR

SMC = SAC = AR = P

Such a situation represents full equilibrium of the industry.

Short-Run Equilibrium of the Industry:

An industry is in equilibrium in the short run when its total output remains steady, there being no tendency to expand or contract its output. If all firms are in equilibrium, the industry is also in equilibrium. For full equilibrium of the industry in the short run, all firms must be earning only normal profits. The condition for this is SMC = MR = AR = SAC. But full equilibrium of the industry is by sheer accident because in the short run some firms may be earning supernormal profits and some incurring losses.

Even then, the industry is in short- run equilibrium when its quantity demanded and quantity supplied are equal at the price which clears the market. This is illustrated in Figure 4, where in Panel (A), the industry is in equilibrium at point E where its demand curve D and supply curve S intersect which determine OP price at which its total output OQ is cleared. But at the prevailing price OP some firms are earning supernormal profits PE1ST as shown in Panel (B), while some other firms are incurring FGE2P losses as shown in Panel (C) of the figure.

Long-Run Equilibrium of the Industry:

The industry is in equilibrium in the long run when all firms earn normal profits. There is no incentive for firms to leave the industry or for new firms to enter it. With all factors homogeneous and given their prices and the same technology, each firm and industry as a whole are in full equilibrium where LMC = MR =AR(=p) =LAC at its minimum. Such an equilibrium position is attained when the long-run price for the industry is determined by the equality of total demand and supply of the industry.

The long-run equilibrium of the industry is illustrated in Figure 5(A) where the long-run price op and OQ output are determined by the intersection of the demand curve d and the supply curve s at point E. At this price op, the firms are in equilibrium at point A in Panel (B) at OM level of output where LMC =SMC= MR= p (=AR) =SAC= LAC at its minimum. At this level, the firms are earning normal profits and have no incentive to enter or leave the industry. It follows that when the industry is in long-run equilibrium, each firm in the industry is also in long-run equilibrium. If both the industry and the firms are in long-run equilibrium, they are also in short-run equilibrium.

Even though all firms in a perfectly competitive industry in the long run have the same cost curves, the firms can be of different efficiency. Firms using superior resources or inputs such as superior management must pay them higher rewards, otherwise they will shift to new firms which offer them higher prices.

So the forces of competition will force the more efficient firms to pay superior resources higher prices at their opportunity cost. As a result, the lac curve of the more efficient firms will shift upwards and they will benefit in the form of higher output at the higher long-run equilibrium price set by the industry.

Unable to pay higher prices to resources or inputs, less efficient firms will be competed away. New firms which are able to pay more and attracted by the new higher market price will enter the industry. But at the new long-run equilibrium price of the industry, all firms will be producing at the minimum LAC.

This is illustrated in Figure 6 where the industry is in initial equilibrium at point E with price OP m Panel (A) and the more efficient firms like all other firms are in equilibrium at point A in Panel (B). As the industry is in equilibrium, the new firms do not exist as they are not in a position to cover their costs at OP price.

When the more efficient firms pay higher prices to resources or inputs, their LAC curve rises to LAC1 At the new long-run equilibrium price of the industry set at OP 1 the more efficient firms are in equilibrium where P1 = LAC1 at its minimum point A1 in Panel (B). They are now producing larger output OM1 even though they earn normal profits. The new firms also earn normal profits at point A2, as shown in Panel (C). But they produce less output OM2 than OM1 produced by the more efficient firms.