Unit 1

Introduction

Q1) Define the meaning, objectives and advantages of cost accounting.

A1) Cost accounting is a formal mechanism of cost control. It is the process of accounting for cost which begins with the recording of expenditure and ends with the preparation of periodical statements and reports for ascertaining and controlling cost. According to Charles T. Horngren “Cost accounting is often a way by that info consists, apportion summed up and understood for three main purposes: (in) elaboration and operational management, (ii) specific decision; and (iii) product Decision. ".

Objectives of cost accounting

The main objectives of cost accounting are-

a) Post costing: It analyses the actual information as recorded in financial books.

b) Continuous costing: It aims at collecting information about cost as and when it takes place.

2. Determination of selling price: It provides information about the cost of production and selling price of product/provided service.

3. Cost control: To exercise cost control it clearly defines objective of cost, measure the actual performance, investigate into the causes of failure to perform according to plan, institute corrective action.

4. Cost reduction: It implies permanent and genuine savings in the cost of manufacturing, administration, distribution and selling by eliminating wasteful and unnecessary wastage.

5. Ascertain the profit of each activity: The profit of any activity is ascertained by matching cost with the revenue of that activity.

Advantages of cost accounting

A good system of costing is a way to manage spending and help bring the economy. Since it is a production product, it meets the needs of many people as follows.

(A) Benefits to management: The information revealed by costing is primarily for support purposes. Management is decision-making and profit optimization. In addition to this, there are certain benefits. The impact of costing on management is price fixing and profitability, to eliminate unprofitable activities, idle capacity, cost control and inventory control.

(B) Benefits to employees: In cost accounting, wage structure, efficient bonuses,. Sincere employees increase productivity, profitability and reduce costs.

(C) Benefits to creditors: Improving financial management through cost accounting leads to timely Debt repayment by the company in the form of loan repayments and interest payments. Stay to grow in competition and judge the health and cost of current and future borrowers. The report gives a better overview of efficiency benefits and capacity.

(D) Benefits to Government: Costing enables government. Prepare a plan for the economy. To develop policies on national development, taxation, excise tax, exports, prices and caps, Granting subsidies, etc.

(E) Consumer / Public Benefits: Costing helps consumers get better products Quality at a reasonable price.

Q2) Distinguish between cost accounting v/s financial accounting.

A2)

Basis of difference | Cost Accounting | Financial Accounting |

1) Definition | Costing, called the form of management accounting that companies use to classify, summarize, and analyze different costs, helps management make better decisions for cost control and cost savings. | Financial accounting is the accounting department involved in summarizing, recording, and reporting financial transactions that arise from business concerns over a period of time. |

2) Information | Document data related to the workforce and materials used in the manufacturing process | Document financial data |

3) Estimation of stock | Stock value is estimated at cost | Stock value is estimated based on the net realizable value or the smaller value between costs |

4) Analysis of profit | Profit is usually investigated for a particular job, batch, product, or procedure | Profit, income and expenses are investigated together for a particular period of time across trading concerns. |

5) Analysis of profit | Cost management and reduction | To maintain a complete record of financial transactions |

6) Deals | This deals with estimates and this only deals with real values. Both actual data’s. | With financial transactions It's a number, not an estimate |

7) Scope | It is related to a particular one It includes all commercials product or service. | Organizational translation specific period . |

8) Type of transactions | This deals with the inside transactions within the department. | Inter-party and external translation |

9) Financial statement | Only one statement is created. P & L A / c and balance. That is, a statement of cost | Both sheets are available. |

10) Valuation of stock | Stocks are valued at cost. | Market value or cost Whichever is lower is considered to be the value of stock. |

Q3) Discuss different cost concepts and its classification.

A3) There are six basic cost concepts that underlie cost classification and various cost conditions as follows:

1. Objectivity concept: This concept helps to direct an operation called cost. Discovery, cost analysis, cost recording, cost reporting. This concept requires a match of goals. In short, cost exercises should be in harmony with your goals. Goals affect cost processing. Cost strategies that may include operational, external, and internal reports for certain non-repetitive decisions.

2. Concept of Importance: Enforcing Accuracy This concept must be softened by good judgment. When there is no possibility of misrepresentation of product costs. For example, the overhead may include some direct cost item. It may not be important enough to justify tracking down to a particular unit. Manufacturing Certain decisions may help, but the benefits may not be practically sufficient implement it. Importance is determined by referring to the nature of the company's business and management policy and competitor practices.

3. Period concept: All assumptions related to various cost exercises are valid only during the next period. The fixed cost statement depends on the period under consideration. Costs don't stay fixed forever. The period chosen by the company should be more sufficient. Allow procedures to record relevant costs, production, working hours, and other necessary factors .Interpretation or analyst. If the period is too short, it can delay the recording of cost data. It's quite annoying. When costs associated with activities in a particular period are recorded in another period activity, cost results can turn out to be quite wrong

4. Related activity range concept: The related activity range reveals the volume range. In the meantime, cost behaviour is expected to remain valid. Various cost activities depend on specific assumptions related to cost behaviour patterns that are valid only within the relevant interior scope of cost exercise. Fixed costs are fixed only in relation to the relevant scope of activity during the period.

5. Related Cost and Benefit Concepts: This concept is for decision-making purposes. When assessing alternative behavioural policies, management should only consider those that are relevant to the costs involved. Benefits associated with the alternatives under consideration. Unrelated costs and benefits are ignored. The impact of this concept on determining the capacity of the operation or connection range is as follows:

(A) Costs and benefits associated with operational decisions: Concentration in operational decisions. Incremental analysis based on differential cost revenue differences are directly based on the associated cost and profit concepts.

(B) Costs and benefits associated with capacity determination: Costs and benefits associated with capacity. Decisions differ from the costs and benefits associated with operational decisions. In the long run the concept of fixed and variable costs is meaningless. In long-term decision making, costs and benefits, it was evaluated in relation to its cost impact. In the long-term decision, money, investment timing and cost recovery.

6. Normal and abnormal cost concept: The term normal refers to cost or situation. This is consistent with normal or normal typical. The term anomaly costs or situations that is usually expected or different from normal. Various costs Accounting and strategy are tailored to normal and unusual costs and circumstances. These terms are commonly used in connection with normal or unusual work conditions in costing.

Q4) Discuss different elements of cost.

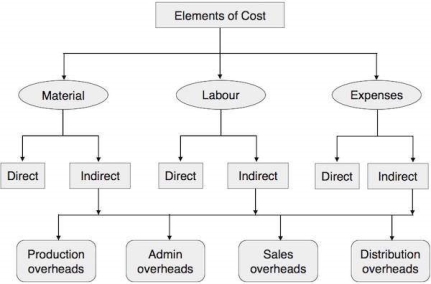

A4) The cost element consists of:-

[a] Materials;

[b] Labour; and

[c] Expenses.

Elements can again be divided into direct and overhead costs. The above cost factors are analyzed in the chart below:

Chart 1: Elements of cost

[A] Materials: The substances that make up a product are known as materials. They can be raw or manufactured. It can be direct or indirect.

[a] Direct material: A direct material is a material that can be identified as follows. It is a product that can be conveniently and economically measured and charged directly Product.

Example,

I. Wood used to make furniture.

ii. A cloth used to make ready-made clothes.

iii. Bricks used to build a house.

Cotton, leather, cloth, brick, jute all materials are entered directly in manufacturing it is known as the raw material (or) direct material

[b] Indirect materials: Indirect materials are materials that cannot normally be used. Form part of the finished product. You can't specify and allocate that cost, Assigned to a specific product. For example, Lubricant, waste cotton, grease, oil, etc.

Example:

I. Materials used for plant and machine maintenance such as lubricants and cotton scraps, grease, oil, fixing, etc.

ii. A small tool for general use.

iii. The cost of dress making thread

iv. The cost of shoe making and furniture nails

[B] Labor: It takes human effort to convert materials into finished products. Remuneration is paid for such human efforts, which are called labor costs or wages. Labor can be direct or indirect.

Example:

(I) Personnel expenses such as idle time, overtime, and holidays.

(II) Wages and salaries of clerical staff, managers, salesmen, etc.

[C] Expenses: Expenses other than material and labor costs are called expenses. It can be direct or indirect.

[a] Direct or billable costs: These are costs that may be incurred directly. Conveniently and fully assigned to a cost center or cost unit. This is part of the prime cost. For example: Excise tax, royalties for production, special drawing and design costs, etc.

[b] Overhead: These costs are indirect materials and non-indirect. It cannot be directly identified and assigned, but it can only be assigned to or. It is absorbed by the cost center or cost unit.

For example:

(I) Rent and insurance.

(I) Electricity and lighting.

(III) Depreciation and repair of fixed assets.

(Iv) Bank charges.

(V) Advertising.

(Vi) Employee benefits and medical expenses.

(Vii) Service department costs.

All costs except direct material costs, direct labor costs and direct costs are known as overhead costs or overhead costs. The overhead classifications are-

[a] Production overhead or work overhead or factory overhead or manufacturing Overhead: It refers to all overhead costs incurred in processes and operations starting from receipt to completion of work instructions, to the customer or the finished product store. For example indirect labour, direct factory costs, rent, electricity, depression, repairs, lighting, heating occurred at the factory, welfare and medical expenses for factory employees.

[b] Administrative Overhead / Office Overhead: This consists of all expenses incurred in develop policies, direct the organization business. For example, office expenses including rent, taxes, lighting, printing, stationery, insurance, shipping, telegrams, phone calls, bank charges

[c] Overhead sales: Costs to create and stimulate demand, securing orders. In other words, all costs to secure and retain customers. The product is sold, as it is spent on creating and maintaining Product demand. For example: Sales manager salary, commission, travel expenses, Showroom costs, promotional costs, gifts and samples, etc.

[d] Distribution overhead: These are the costs associated with delivery. Shipping of finished products to customers. In other words, it's the spending that comes in time, the product will be completed until it arrives at the destination. For example, salesmen, salaries, commissions, bonuses, advertising, warehouse rent, light, staff salary, delivery vans, costs, depreciation, etc.

Q5) Discuss material control concept and techniques.

A5) Material control refers to a systemic control over purchasing, storing and consumption of materials to ensure a regular and timely supply of materials at same time, avoiding overstocking.

Techniques of material control

It is found that in most inventories some items have a much higher annual usage value than others. ABC analysis separates inventories into A,B and C items. In order to make such an ABC analysis, the list of all the stored items and their annual consumption in value is tabulated on the basis of the latest available records. Each individual item in its annual consumption value is listed separately and then this list is rearranged in a descending order, beginning with the items of highest value and ending with the items of lowest value. When such an analysis is made, it is usually seen that the 1st 10 per cent of the items (A) approximately account for 70-80 per cent of the value. Next 20 per cent of items (B) 20-25 per cent and the last 70 per cent of items (C) only 5-10 per cent of the value. The analysis can be used as a guide for economizing purchases and controlling stores by having concentrated attention on the inventory control of A and B items. The ABC concept tries to isolate the vital few and concentrate on them.

2. VED analysis

VED analysis is used for medical stores, spare parts inventory etc. those item, the absence of which even for very short duration will stop production/work, are known as vital products e.g. life-saving drugs. Essential items are those, the absence of which cannot be tolerated for more than a day or so. The desirable items are those which are definitely needed, but with their absence, the work can continue.

Vital: The spares, stock-out of which even for a short time will stop the production for quite some time, and where in the stock-out cost is very high are known as Vital spares. For a car Assembly Company, Engine is a vital part, without the engine the assembly activity will not be started.

Essential: The spares or material absence of which cannot be tolerated for more than few hours or a day and the cost of lost production is high and which is essential for production to continue are known as Essential items. For a car assembly company ‘Tyres’ is an essential item, without fixing the tyres the assembly of car will not be completed.

Desirable: The Desirable spares are those parts which are needed, but their absence for even a week or more also will not lead to stoppage of production.

3. FSN Analysis

FSN analysis is the process of classifying the materials based on their movement from inventory for a specified period. All the items are classified in to F-Fast moving, S- Slow moving and N-Non-moving items based on consumption and average stay in the inventory. Higher the stay of item in the inventory, the slower would be the movement of the material. This analysis helps the store keeper / purchase department to keep the fast moving items always available & take necessary steps to dispose off the non-moving inventory.

4. Just-in-Time

Just in time (JIT) is a production strategy that strives to improve a business return on investment by reducing in-process inventory and associated carrying costs. Inventory is seen as incurring costs, or waste, instead of adding and storing value, contrary to traditional accounting. In short, the Just-in-Time inventory system focuses on “the right material, at the right time, at the right place, and in the exact amount” without the safety net of inventory.

5. Inventory Turnover Ratio

Inventory Turnover signifies a ratio of the value of materials consumed during a given period to the average level of inventory held during that period. The ratio is worked out on the basis of the following formula:

Inventory Turnover Ratio = Value of average stock held during the period/Value of material consumed during the period.

6. First-In First-Out (FIFO) Method:

A method of pricing the issue of material using, the purchase price of the oldest unit in the stock. Under this method materials are issued out of stock in the order in which they were first received into stock. It is assumed that the first material to come into stores will be the first material to be used. This method is more suitable where the size of the raw materials is large and bulky and its price is high and can be easily identified in the stores separately. This method is useful when the frequency of material receipts is less and the market price of the material are stable.

7. Last-In First-Out (LIFO) Method:

Under this method most recent purchase will be the first to be issued. The issues are priced out at the most recent batch received and continue to be charged until a new batch received is arrived into stock. It is a method of pricing the issue of material using the purchase price of the latest unit in the stock.

8. Base Stock Method

A minimum quantity of stock under this method is always held at a fixed price as reserve in the stock, to meet a state of emergency, if arises. This minimum stock is known as Base Stock and is valued at a price at which the first lot of materials is received and remains unaffected by subsequent price fluctuations. The quantity in excess of the base stock may be valued either on the LIFO basis or FIFO basis. This method is not an independent method as it uses FIFO or LIFO. Its advantages and disadvantages therefore will depend upon the use of the other method.

9. Simple Average Price Method

Under this method materials issued are valued at average price, which is computed by dividing the total of all units rate by the number of units. Material Issue Price = Total of unit prices of each purchase / Total No of Units. This method is useful, when the materials are received in uniform lots of similar quantity and prices do not fluctuate considerably.

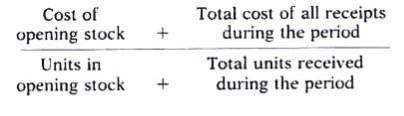

10. Weighted Average Price Method

This method removes the limitation of Simple Average Method in that it also takes into account the quantities which are used as weights in order to find the issue price. This method uses total cost of material available for issue divided by the quantity available for issue.

Issue Price = Total Cost of Materials in stock / Total Quantity of Materials in stock

Q6) Discuss inventory control concept and techniques.

A6) Inventory management and control refers to the planning for optimum quantities of materials at all stages in the production cycle and evolving techniques which would ensure the availability of planned inventories.

Inventory control techniques

1) ABC Analysis: ABC analysis is a business term used to define an inventory categorization technique often used in materials management. It is also known as ‘Selective Inventory Control.’ ABC analysis provides a mechanism for identifying items which will have a significant impact on overall inventory cost whilst also providing a mechanism for identifying different categories of stock that will require different management and controls.

ABC CODES

"A class" inventory will typically contain items that account for 80% of total value, or 20% of total items.

"B class" inventory will have around 15% of total value, or 30% of total items.

"C class" inventory will account for the remaining 5%, or 50% of total items.

2) High, Medium and Low Classification: The High, medium and Low (HML) classification follows the same procedure as is adopted in ABC classification. Only difference is that in HML, the classification unit value is the criterion and not the annual consumption value. The items of inventory should be listed in the descending order of unit value and it is up to the management to fix limits for three categories. The HML analysis is useful for keeping control over consumption at departmental levels, for deciding the frequency of physical verification, and for controlling purchases.

3) VED classification: The VED analysis is done to determine the criticality of an item and its effect on production and other services. It is specially used for classification of spare parts.

4) SDE Classification: The SDE analysis is based upon the availability of items and is very useful in the context of scarcity of supply. In this analysis, items, generally imported, and those which are in short supply. It refers to difficult items which are available indigenously but are difficult items to procure. Items which have to come from distant places or for which reliable suppliers are difficult to come by fall into category. It also refers to items which are easy to acquire and which are available in the local markets.

5) FSN Classification: FSN stands for fast moving, slow moving and non-moving. Here, classification is based on the pattern of issues from stores and is useful in controlling obsolescence. To carry out an FSN analysis, the date of receipt or the last date of issue, whichever is later, is taken to determine the number of months, which have lapsed since the last transaction. The items are usually grouped in periods of 12 months.

6) SOS Analysis: ‘S’ stands for Seasonal items and ‘OS’ stands for off-seasonal items. It may be advantageous to buy seasonal items at low prices and keep inventory or buy at high price during off seasons. Based on the fluctuation in prices and availability, suitable decision has to be taken regarding how much to purchase and at what prices.

7) XYZ Analysis: XYZ analysis is calculated by dividing an item's current stock value by the total stock value of the stores. The items are first sorted on descending order of their current stock value. The values are then accumulated till values reach say 60% of the total stock value. These items are grouped as 'X'. Similarly, other items are grouped as 'Y' and 'Z' items based on their accumulated value reaching another 30% & 10% respectively. The XYZ analysis gives an immediate view of which items are expensive to hold. Through this analysis, firm can reduce its money locked up by keeping as little as possible of these expensive items.

8) GOLF Analysis: This stands for Government, Open market, Local or Foreign source of supply. For many items imports are canalized through government agencies such as State Trading Corporations, Mineral and Metals Trading Corporations, Indian Drugs and Pharmaceuticals etc.

9) Economic Order Quantity: Economic order quantity is the level of inventory that minimizes the total inventory holding costs and ordering costs. It is one of the oldest classical production scheduling models. The framework used to determine this order quantity is also known as Wilson EOQ Model or Wilson Formula.

Q7) Write a note on storage of materials.

A7) Once the material is received, it is the responsibility of the stores-in-charge, to ensure that material movements in and out of stores are done only against the authorized documents. Stores-in-charge is responsible for proper utilization of storage space & exercise better control over the material in the stores to ensure that the material is well protected against all losses such as theft, pilferage, fire, misappropriation etc.

The duties of store-keeper are as follows:-

(a) To exercise general control over all activities in stores department

(b) To ensure safe storage of the materials

(c) To maintain proper records

(d) To initiate purchase requisitions for the replacement of stock of all regular materials, whenever the stock level of any item in the store reaches the Minimum Level

(e) To initiate the action for stoppage of further purchasing when the stock level approaches the Maximum Level

(f) To issue materials only in required quantities against authorized requisition documents

(g) To check and receive purchased materials forwarded by the receiving department and to arrange for storage in appropriate places

Different classes of stores

1. Centralised stores: The usual practice in most of the concerns is to have a central store. Separate store to meet the requirements of each production department are not popular because of the heavy expenditure involved. In case of centralised stores materials are received by and issued from one stores department. All materials are kept at one central store.

2. Decentralised stores: Under this type of stores, independent stores are situated in various departments. Handling of stores is undertaken by the store keeper in each department. The departments requiring stores can draw them from their respective stores situated in their departments. The disadvantages of centralised stores can be eliminated, if there are decentralised stores. But these types of stores are uncommon because of heavy expenditure involved.

Q8) What are the issues involved in material.

A8)

A) Issues related to material control

B) Issues relating to purchasing

Companies with multiple plants face issues related to purchasing of materials. The company should take a balanced centralised and decentralised decisions regarding purchase. The measures for purchase decisions are-

C) Issues related to storage and material handling

Q9) Write a note on FIFO, LIFO and average.

Q10) Discuss any three methods of pricing of materials issue.

A) to Q 9 & 10

A method of pricing the issue of material using, the purchase price of the oldest unit in the stock. Under this method materials are issued out of stock in the order in which they were first received into stock. It is assumed that the first material to come into stores will be the first material to be used. This method is more suitable where the size of the raw materials is large and bulky and its price is high and can be easily identified in the stores separately. This method is useful when the frequency of material receipts is less and the market price of the material are stable.

Advantages:

(a) It is easy to understand and simple to price the issues.

(b) It is a good store keeping practice which ensures that raw material leaves the stores in a chronological order based on their age.

(c) It is a straight forward method which involves less clerical cost than other methods of pricing.

(d) This method of inventory valuation is acceptable under standard accounting practice.

(e) It is a consistent and realistic practice in valuation of inventory and finished stock.

(f) The inventory is valued at the most recent market prices and it is near to the valuation based on replacement cost.

Disadvantages:

a) There is no certainty that materials which have been in stock longest will be used, if they are mixed up with other materials purchased at a later date at different price.

(b) If the price of the materials purchased fluctuates considerably, it involves more clerical work and there is possibility of errors.

(c) In a situation of rising prices, production cost is understated.

(d) In inflationary market, there is a tendency to under-price material issues. In deflationary market, there is a tendency to overprice such issues.

(e) Usually more than one price has to be adopted for a single issue of materials.

(f) The method makes cost comparison difficult of different jobs when they are charged with varying prices for the same materials.

2. Last-In First-Out (LIFO) Method:

Under this method most recent purchase will be the first to be issued. The issues are priced out at the most recent batch received and continue to be charged until a new batch received is arrived into stock. It is a method of pricing the issue of material using the purchase price of the latest unit in the stock.

Advantages:

(a) Stocks issued at more recent price represent the current market value based on the replacement cost.

(b) It is simple to understand and easy to apply.

(c) Product cost will tend to be more realistic since material cost is charged at more recent price.

(d) In times of rising prices, the pricing of issues will be at a more recent current market price.

(e) It minimizes unrealized inventory gains and tends to show the conservative profit figure by valuation of inventory at value before price rise and provides a hedge against inflation.

Disadvantages:

(a) Valuation of inventory under this method is not acceptable in preparation of financial accounts.

(b) It is an assumption of a cash flow pattern and is not intended to represent the true physical flow of materials from the stores.

(c) More than one price may have to be adopted for an issue.

(d) It renders cost comparison between jobs difficult.

(e) It involves more clerical work and sometimes valuation may go wrong.

(f) In times of inflation, valuation of inventory under this method will not represent the current market prices.

3. Simple Average Cost Method:

Under this method all the materials received are merged into existing stock of materials, their identity being lost. The simple average price is calculated without any regard to the quantities involved. The simple average cost is arrived at by adding the different prices paid during the period for the batches purchased by dividing the number of batches. For example, three batches of materials received at Rs. 10, Rs. 12 and Rs. 14 per unit respectively.

The simple average price is calculated as follows:

Rs. 10 + Rs. 12 + Rs. 14/3 batches = Rs. 36/3 batches = Rs 12 per unit

This method is not popular because it takes into consideration the prices of different batches but not the quantities purchased in different batches. This method is used when prices do not fluctuate very much and the stock values are small in value.

4. Weighted Average Cost Method:

It is a perpetual weighted average system where the issue price is recalculated every time after each receipt taking into consideration both the total quantities and total cost while calculating weighted average price.

This method tends to smooth out the fluctuations in price and reduces the number of calculations to be made, as each issue is charged at the same price until a fresh batch of material is received. This method is easier as compared to FIFO and LIFO, as there is no necessity to identify each batch separately. But this method increases the clerical work in calculation of new average price every time a new batch is received. The issue price calculated rarely represents the actual purchase price

For example, three batches of material received in quantities of 1,000 units @ Rs. 15, 1,300 units @ Rs. 16 and 800 units @ Rs. 14.

The weighted average price is calculated as follows:

(1,000 units x Rs. 15) + (1,300 units x Rs. 16) + (800 units x Rs. 14)/1,000 units + 1,300 units + 800 units

= Rs. 15,000 + Rs. 20,800 + Rs. 11,200/3,100 units = Rs. 47,000/3,100 units = Rs. 15.16 per unit

5. Periodic Average Cost Method:

Under this method, instead or recalculating the simple or weighted average cost every time there is a receipt, an average for the accounting period as a whole is computed.

The average price for all the materials issued during the period is computed as follows: