Unit 5

Marginal Costing

Q1) Distinguish between absorption v/s variable costing.

Q2) How absorption costing is different from variable costing?

A2) to Q1 &Q2

Sl no. | Absorption Costing | Marginal costing/variable costing |

1. | All costs are charged to the cost of production | Only variable cost is charged to cost of production. Fixed costs are recovered from contribution. |

2. 2.

3. | 3. Stock of work in-progress and finished goods are valued at full or total cost. Fixed cost is carried over from one period to another period which distorts cost comparison. The difference between sales and total cost constitute profit. | 2. Stock of work in progress and finished goods are valued at marginal cost. This facilitates cost comparison.

3. The excess of sales revenue over variable cost is known as contribution when fixed cost is deducted from contribution, it results in profit. |

4. | The apportionment of fixed costs on an arbitrary basis gives rise to under or over absorption of overheads. | As only variable costs are charged to products, it does not give rise to over or under absorption of overheads |

5. | Costs are classified according to functional basis such as production cost, administration cost, selling and distribution cost. | Costs are classified according to variability. |

Q3) Write distinctive features of absorption and variable costing.

A3) Features of absorption costing

1. The cost of a product is determined on the basis of full cost, i.e. variable cost and manufacturing cost.

2. The cost of inventory will be higher.

3. It is a conventional costing where profit is determined by subtracting the cost of goods sold from sales and net profit is determined by subtracting all commercial expenses from the gross profit.

4. Under or fixed allocation of fixed factory overhead is required to be adjusted in absorption costing as it is included in the cost of production.

Features of marginal costing

Costs are divided into two categories, i.e. fixed costs and variable costs.

Q4) Discuss the limitations of absorption and variable costing.

A4) Absorption costing suffers from the following limitations-

1. In practice this method employs highly arbitrary method of apportionment of overhead. This reduces the practical utility of cost data for control purposes.

2. Under absorption costing, fixed cost relating to closing stock is carried forward to the next year. Similarly, fixed cost relating to opening stock is charged to current year instead of previous year. Thus under this method, all the fixed cost is not charged against the revenue of the year in which they are incurred. It is unsound practice.

3. Under absorption costing collection and presentation of cost data is not very useful for decision making, because process of assigning product cost a reasonable share of fixed overhead obscures cost volume profit relationship.

4. Under absorption costing, behavioural pattern of costs is not highlighted and thus many situations, which can be utilized under marginal costing, are likely to go unnoticed in absorption costing.

5. The complaint is sometimes made that absorption costing often deals only with production costs and ignores selling and administration costs.

6. The decision maker needs to know the costs that will vary as a result of his decision, and the costs that will remain unchanged. Absorption costing does not provide a convenient basis for making such calculations. Its main purpose is to provide cost information for stock valuation and the measurement of reported profits

Limitations of marginal costing

1. The segregation of semi variable costs often poses a problem

2. Closing stock of work in progress and finished goods are understated which is not acceptable to tax authorities.

3. With the change technology and owing to automation of industries, it results in more fixed cost. Marginal costing fails to reflect the exact change because of adoption of new technology.

4. It does not provide any yardstick to exercise control. So an effective means of control cannot be exercised.

5. The technique is not suitable under cost plus contract because of technique ignores fixed cost in calculating total cost.

6. Variable cost per unit remains constant only in the short run but not in the long run.

7. Cost comparison of two jobs will be difficult.

8. When sales are based on marginal cost or marginal cost with some.

Q5) Write a brief note on cost, volume and profit analysis.

A5) Cost volume profit analysis defined as a managerial tool showing the relationship between various ingredients of profit planning viz, cost selling price and volume of activity etc. It is an important tool of profit planning. It provides information about the following matters:

Profit –Volume (P/V) Ratio a)= Contribution Sales

b)=Difference in Profits

Difference in sales

i) P/V Ratio= Contribution x 100

Sales

ii) P/V Ratio =100%--Marginal Cost%

Profit at a given sales volume Contribution

= Sales x P/V Ratio Profit

= Contribution- Fixed Cost

Profit at a given sales level = (Sales Revenue x P/v Ratio) - Fixed cost.

Breakeven Point:

The point which breaks the total cost and the selling price evenly to show the level of output or sales at which there shall be neither profit nor loss, is regarded as break-even point. At this point, the income of the business exactly equals its expenditure. If production is enhanced beyond this level, profit shall accrue to the business, and it is decreased from this level, loss shall be suffered by the business.

Breakeven point (in units)= Fixed cost

Contribution per unit

Break–even Point (in Rs.) = Fixed Cost x sales

Graphic method

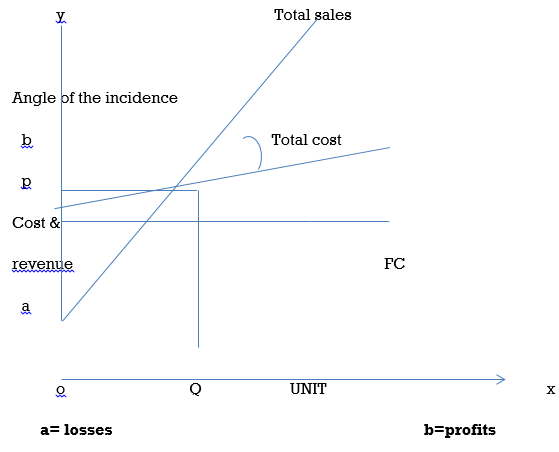

The formal break even chart is as follows:

When no. of units are expressed on X-axis and costs and revenues are expressed on Y-axis, three lines are drawn i.e., fixed cost line, total cost line and total sales line. In the above graph we find there is an intersection point of the total sales line and total cost line and from that intersection point if a perpendicular is drawn to X-axis, we find break even units. Similarly, from the same intersection point a parallel line is drawn to X-axis so that it cuts Y-axis, where we find Break Even point in terms of value. QP is the beak even point. Producing more than this level is profitable for the company because TR is more than TC and producing less than QP point is loss for the company because TC is more than TR. This is how, the formal pictorial representation of the Break Even chart. At the intersection point of the total cost line and total sales line, an angle is formed called Angle of Incidence, which is explained as follows:

Angle of Incidence:

Angle of Incidence is an angle formed at the intersection point of total sales line and total cost line in a formal break even chart. If the angle is larger, the rate of growth of profit is higher and if the angle is lower, the rate of growth of profit is lower. So, growth of profit or profitability rate is depicted by Angle of Incidence.

Algebric method

The equation for break-even analysis is

Π = TR-TC

TR= P*Q

TC= TVC+TFC

TC= AVC*Q+TFC

Q6) Write short notes on contribution, margin of safety and angle of incidence.

A6) Contribution:

In common parlance, contribution is the reward for the efforts of the entrepreneur or owner of a business concern. From this, one can get in his mind that contribution means profit. But it is not so. Technically or in Costing terminology, contribution means not only profit but also fixed cost. That is why; it is defined as the amount recovered towards fixed cost and profit. Contribution can be computed by subtracting variable cost from sales or by adding fixed costs and profit.

Symbolically, C = S – V

Where C = Contribution

S = Selling Price

V = Variable Cost

Also C = F + P

Where F = Fixed Cost

P = Profit

S-V=F+P

Contribution is helpful in determination of profitability of the products and / or priorities for profitability of the products. When there are two or more products, the product having more contribution is more profitable.

Margin of safety

Total sales minus the sales at breakeven point is known as the margin of safety

Thus, the formula is:

Margin of Safety = Total Sales - Break even sales

Margin of Safety can also be computed according to the following formula:

Margin of safety = Net profit

P/V Ratio

Margin of safety can also be expressed as a percentage of sales:

= Margin of Safety x100 Total Sales

Angle of intelligence

Angle of Incidence is an angle formed at the intersection point of total sales line and total cost line in a formal break even chart. If the angle is larger, the rate of growth of profit is higher and if the angle is lower, the rate of growth of profit is lower. So, growth of profit or profitability rate is depicted by Angle of Incidence.

Q7. Prepare Income statements under Absorption Costing and under Marginal costing from the following information relating to the year 2001-02:

Opening Stock = 1,000 units valued at Rs. 70,000 including variable cost of Rs. 50 per unit.

Fixed cost = Rs. 1, 20,000

Variable cost = Rs. 60 per unit

Production units = 10,000

Sales = 7,000 units @ Rs. 100/unit

Stock is valued on the basis of FIFO

A7) INCOME STATEMENT (Under Absorption Costing)

|

| Rs. | Rs. |

| Sales (7,000 units @ Rs. 100 per unit) |

| 7,00,000 |

Less: | Cost of Goods Manufactured: |

|

|

| Variable cost (10,000 unit @ Rs. 60 per unit) | 6,00,000 |

|

| Fixed cost (10,000 units = Rs. 12 per unit) | 1,20,000 |

|

|

| 7,20,000 |

|

Add: | Value of Opening Stock | 70,000 |

|

|

| 7,90,000 |

|

Less: | Value of Closing Stock (4,000 units @ Rs. 72 per unit) | 2,88,000 | 5,02,000 |

| Profit |

| 1,98,000 |

INCOME STATEMENT (Under Marginal Costing)

|

| Rs. | Rs. |

| Sales |

| 7,00,000 |

| Variable cost | 6,00,000 |

|

Add: | Value of Opening Stock (1,000 units @ Rs. 50 per unit) | 50,000 |

|

|

| 6,50,000 |

|

Less: | Value of Closing Stock (4,000 units @ Rs. 60 per unit) | 2,40,000 |

|

|

|

| 4,10,000 |

| Contribution |

| 2,90,000 |

Less: | Fixed Cost |

| 1,20,000 |

| Profit |

| 1,70,000 |

Q8. Your Company has a production capacity of 12,500 units and normal capacity utilisation is 80%. Opening inventory of finished goods on 1-1-1999 was 1,000 units. During the year ending 31-12-1999, it produced 11,000 units while it sold only 10,000 units.

Standard variable cost per unit is Rs, 6.50 and standard fixed factory cost per unit is Rs. 1.50. Total fixed selling and administration overhead amounted to Rs. 10,000. The company sells its product at Rs. 10 per unit.

Prepare Income Statements under Absorption Costing and Marginal Costing. Explain the reasons for difference in profit, if any.

A8)

INCOME STATEMENT (Absorption Costing)

|

| Rs. | Rs. |

| Sales (10,000 units @ Rs. 10) |

| 1,00,000 |

| Variable factory cost (11,000 units @ Rs. 6.50) | 71,500 |

|

| Fixed factory cost (11,000 units @ Rs. 1.50) | 16,500 |

|

|

| 88,000 |

|

|

| 8,000 |

|

Add: | Opening stock (1,000 units @ Rs. 8) | 96,000 |

|

|

| 16,000 |

|

Less: | Closing stock (2,000 units @ Rs. 8) | 80,000 |

|

Less: | Over-absorption (1,000 units @ Rs. 1.50) | 1,500 |

|

|

| 78,500 |

|

Add: | Selling and administration overhead | 10,000 |

|

| Total cost |

| 88,500 |

| Profit |

| 11,500 |

INCOME STATEMENT (Marginal Costing)

|

| Rs. | Rs. |

| Sales (10,000 units @ Rs. 10) |

| 1,00,000 |

| Variable cost (11,000 units @ Rs. 6.50) | 71,500 |

|

Add: | Opening Stock (1,000 units @ Rs. 6.50) | 6,500 |

|

|

| 78,000 |

|

Less: | Closing Stock (2,000 units @ Rs. 6.50) | (13,000) |

|

| Variable cost of Manufacture |

| 65,000 |

| Contribution |

| 35,000 |

Less: | Fixed cost – Factory (10,000 x Rs. 1.50) | 15,000 |

|

| Selling and Administration | 10,000 |

|

|

|

| 25,000 |

| Profit |

| 10,000 |

The difference in profits Rs. 1,500 (i.e. Rs. 11,500 – Rs. 10,000) as arrived at under absorption costing and marginal costing is due to the element of fixed factory cost included in the valuation of opening stock and closing stock as shown below:

| Opening Stock (Rs.) | Closing Stock (Rs.) |

Absorption Costing | 8,000 | 16,000 |

Marginal Costing | 6,500 | 13,000 |

| 1,500 | 3,000 |

Net Difference = Rs. 3,000 – Rs. 1,500 =Rs. 1,500

Q9. If the Budgeted output is 80,000 units, Fixed cost is Rs. 4,00,000, Selling price per unit is Rs. 20 and variable cost per unit is Rs. 10, find out BEP sales, BEP in units, P/V ratio and indicate the margin of safety.

A9)

PARTICULARS | Rs. PER UNIT |

Selling Price | 20 |

Less: Variable Cost | (10) |

Contribution | 10 |

P. V. Ratio =Contribution / Sales

=10 / 20

=0.5

BEP in Volume = Fixed Cost / P. V. Ratio

= 4,00,000 / 0.5

=8,00,000

BEP in Units = BEP in Volume / Selling Price

=8,00,000 / 20

=40,000

Margin of Safety in Volume = Budgeted Sales – BEP in Volume

= (80,000 x 20) – 8,00,000

= 16,00,000 – 8,00,000

= 8,00,000

Margin of Safety in Units = Budgeted Sales in units – BEP in Units

= 80,000 – 40,000

= 40,000

Q10) From the following information calculate:

Information:

A10)

| Activity Level | ||

Particulars | 75% Rs. | 80% Rs. | 100% Rs. |

Sales | 1,87,500 | 2,00,000 | 2,50,000 |

Less: Variable Cost: |

|

|

|

Direct Material (30%) | 56,250 | 60,000 | 75,000 |

Direct Labour (20%) | 37,500 | 40,000 | 50,000 |

Factory Overheads (10%) | 18,750 | 20,000 | 25,000 |

Administration Overheads (15%) | 28,125 | 30,000 | 37,500 |

Total Variable Expenses | 1,40,625 | 1,50,000 | 1,87,500 |

Contribution | 46,875 | 50,000 | 62,500 |

Less: Fixed Cost | 30,000 | 30,000 | 30,000 |

(3) Profit | 16,875 | 20,000 | 32,500 |

(1) BEP Fixed Cost | 30,000 | 30,000 | 30,000 |

(in Rs.) P/V Ratio | 0.25 | 0.25 | 0.25 |

| 1,20,000 | 1,20,000 | 1,20,000 |

Contribution | 46,875 | 50,000 | 62,500 |

(2) P/V Ratio Sales | 1,87,500 | 2,00,000 | 2,50,000 |

| = 0.25 | = 0.25 | = 0.25 |

Q11) Company X and Company Y, both under the same management, makes and sells the same type of product. This budgeted Profit and Loss Accounts for January – June, 2005, are as under:

| Company X’ |

| Company Y’ |

|

Particulars | Rs. | Rs. | Rs. | Rs. |

Sales |

| 6,00,000 |

| 6,00,000 |

Less: Variable Cost | 4,80,000 |

| 4,00,000 |

|

Fixed Cost | 60,000 | 5,40,000 | 1,40,000 | 5,40,000 |

Profit |

| 60,000 |

| 60,000 |

You are required to:

A11)

1) P/V Ratio =Contribution

Sales

X Y

1,20,000 2,00,000

6,00,000 6,00,000

= 0.2 = 0.33

BEP (Rs.)=Fixed Cost

P/V Ratio

X Y

60,000 1,40,000

0.2 0.33

= Rs. 3,00,000 = Rs. 4,20,000

2) Sales required to earn a desired profit = Fixed Cost + Desired Profit

P / V Ratio

X Y

60,000 + 20,000 1,40,000 + 20,000

0.2 0.33

= Rs. 4,00,000 = Rs. 4,80,000

3) MOS (Rs.) = Profit

P/V Ratio

X Y

60,000 60,000

0.2 0.33

= Rs. 3,00,000 = Rs. 1,80,000