Unit III

Non Banking Financial Institutions

Q1) Write a short note on evolution of NBFC. 5

A1) NBFC commenced humbly in India within side the Nineteen Sixties as an opportunity to savers and buyers whose present banking device does now no longer completely meet their monetary needs. Initially, NBFC operated on a restrained scale with out notably impacting the monetary industry. They invited constant deposits from buyers and signed condominium contracts with main business corporations.

In the early ranges of development, company regulation regulated financing. However, the precise and complicated nature of the enterprise and the reality that monetary corporations act as monetary intermediaries have required separate regulatory mechanisms.

Therefore, Chapter III B turned into blanketed within side the Reserve Bank of India Act of 1934 and had restrained authority to adjust deposit managing corporations. Since then, the RBI has taken steps to adjust the NBFC sector.

The RBI has customary and applied the cap potential of employment buy and leasing corporations to simply accept deposits inside their internet holdings, according with the important thing suggestions of the James S. Raj Study Group, shaped in 1975. Undisturbed authorized shape of presidency securities.

From the Eighties to the 1990s, the customer-pleasant recognition of NBFC commenced to draw a large range of buyers. The range of NBFCs extended swiftly from simply 7,000 in 1981 to approximately 30,000 in 1992, and the RBI felt the want to adjust the industry. In 1992, the RBI installed a committee chaired through former Bank of Baroda Chairman A. C. Shah to endorse measures for powerful law of the industry. The Shah Commission's suggestions blanketed most, from obligatory registration to soundness standards.

In January 1997, there have been main adjustments to the RBI Act of 1934, specially Chapters III-B, III-C, and V of the Act, which protects pursuits and allows the clean functioning of NBFC.

After the 1997 revision of the regulation, NBFC has grown notably in phrases of operations, gadget and variety of merchandise at the market, technological advances and more.

Over the closing decades, NBFC has received interest and introduced intensity to the monetary sector. In August 2016, the Federal Council of Ministers authorized Foreign Direct Investment (FDI) beneath automatic direction to regulated NBFC.

Q2) What are the steps taken by RBI in managing NBFC? Write the main functions of financial divisions. 8

A2) RBI is taking various steps to manage NBFC. The most important of them are listed below.

- Deposit management

The RBI regulates the activities of non-bank financial companies under the 1975 Company (Deposit Acceptance) Regulations. In addition, RBI manages NBFC's deposit acceptance activities by issuing various directives.

Here is an example of such a directive:

1. Direction of NBFC (Reserve Bank), 1977.

2. Directed by other non-banking companies (reserve banks), 1977.

3. Residual non-banking company (reserve bank) instructions, 1987.

4. Direction of Housing Finance Company (National Housing Bank), 1989.

2. Deposit limit

The Reserve Bank of India limits deposits by setting a certain limit on the acceptance of deposits by these non-bank financial companies. Generally, these companies can accept up to 10 times more deposits than net-owned funds.

However, certain NBFCs also allow mitigation. For example, a mutual benefit company accepts only deposits from members, so there is no limit to the amount of deposits.

3. Mediation regulation

The RBI has set certain restrictions on the payment of brokerage fees to brokers.

4. Cash reserve

The RBI has issued instructions requiring certain NBFCs, such as leasing companies and employment purchasing companies, to maintain 10% of their deposits in current assets. This is to maintain liquidity.

5. Compulsory registration with RBI

All financial intermediaries other than banks with a net holding of Rs 50 or more must be forced to register from the RBI. This registration is a prerequisite for a company to further expand its business.

6. Submit regular returns to RBI

All non-bank financial companies are required to submit returns to RBI on a regular basis for various issues related to their operations.

Functions of RBI's financial company division in managing NBFC

The Reserve Bank of India has another division called the Financial Companies Division for handling NBFC. The main purpose of this department is to manage the NBFC to some extent. The head office is in Kolkata. There are four branch offices.

The main functions of the financial company division are as follows.

1. Identify and classify financial companies.

2. Check the classification of such companies.

3. Pay attention to legislative matters. Give instructions to NBFC on various issues.

4. Advise the central and state governments on matters related to NBFC.

5. Receive and scrutinize NBFC's balance sheet, returns, accounts, and statements.

6. NBFC inspection

7. Perform follow-up activities.

8. Handling of companies that strictly violate RBI instructions.

9. Take into account the request for tax exemption.

10. Conduct a survey on the operation of NBFC.

11. Handling complaints received from the public.

12. Perform other work associated with the above functions.

Q3) What are the features of SEBI? 5

A3) Features of SEBI:

1. Scope of law

The law allows for scripture transactions, transfer of ownership via electronic media, and issuance of securities holdings. In accordance with the rules, stocks, corporate bonds, warrants, bonds, mutual fund units, collective investment schemes and rights under venture capital funds, commercial paper, certificates of deposit, money market products and unlisted securities are eligible for acceptance by depository institutions.

2. Deposit handling institution

The SEBI (Deposit Handling Institutions and Participants) Regulatory Act stipulates the establishment of deposit handling institutions based on the Companies Act. Deposit handling institutions are owned by market participants. The depository's minimum net worth must be 100 rupees.

3. Participants of the depository

Depository Participants Established Under Section 3 of the State Financial Companies Act, Public Financial Institutions, Scheduled Banks, RBI Approved Foreign Banks Operating in India, as defined in Section 4A of the Companies Act 1956 It may be a state financial company, an institution engaged in providing. The financial services jointly or individually promoted by any of the above institutions are NBFCs who are managers of securities registered with SEBI and have a net value of 50 rupees or more. These must meet the admission criteria set by SEBI. Depository participants are representatives of investors in the depository system.

4. Investor options

The provisions of the Ordinance allow holders of securities to choose between maintaining non-deposit mode or transitioning to deposit mode. Those who wish to maintain non-deposit mode shall physically own the securities certificate. Investors who choose to hold securities in deposit mode shall open an account with the deposit participant. They are given an identification number that serves as a reference for all transactions with the depository participants. Investors are free to switch from deposit mode to non-deposit mode and vice versa.

5. Free transfer possibility

This law provides for the free transfer of securities. The SEBI (Depositing Institutions and Participants) Regulatory Act removes Section 22A from the Securities Contract Regulation Act and inserts Section 111A into the Companies Act, depriving the company of its right to use the discretion of the transfer of securities. I did. This means that upon payment of the agreed consideration, the buyer is automatically entitled to all rights to the security. Participants in the depository must be informed about the delivery of the securities and then transfer the delivery to the payment. In deposit mode, you do not need to use a transfer deed.

6. Transferee rights

As required by law, the transferee of shares has all rights related to the shares. SEBI may appeal to the Companies Act Committee in the event of a transfer in violation of the provisions of the SEBI Act or the Chic Industrial Companies Act. The strength of such an appeal allows the Companies Act Committee to suspend voting rights on such assignments. However, the transferee is entitled to other benefits in the form of bonuses, rights and dividends associated with the security. Once the inquiry is complete, the Companies Act Commission can instruct the depository to revise the ownership record.

7. Substitutability

Stock certificates do not need to be uniquely numbered and all stocks are part of a substitutable mess. All stock certificates can be exchanged to withdraw money from the bank without comparing the number printed on the banknote to the number of previously deposited banknotes.

8. No stamp duty

Stamp duty is exempt for secondary market transactions in deposit mode. However, if the issuing company issues securities, stamp duty will be paid regardless of the securities holder's holding form. If the investor chooses to leave the depository, stamp duty will be levied on the issuance of the share certificate. In other words, stamp duty is levied on all transactions except in deposit mode.

9. Legal evidence

The record of ownership maintained by the depositary or the depositary's participants serves as legal evidence in the legal process. Investors who remain in deposit mode will be given a passbook or statement of accounts. These documents legally confirm the investor's position.

10. Pledge or hypothesis

Securities left in deposit mode may be subject to pledges or hypotheses. To encourage retail investors to invest in Demat Equity / Debt, the RBI has decided to raise the cap to Rs 20 if the down payment is secured by Demat shares. The minimum margin required for such stocks has been reduced to 25%.

Q4) What is the role of NBFI? 12

A4) Provide liquidity 8 .Reduction of hobby prices to aid, etc.

- Reduce hoarding:

NBFI reduces coins hoarding with the aid of using humans beneathneath the "mattress", as is typically said, with the aid of using connecting the closing lender (or saver) with the closing borrower.

2. Support the family zone:

The family zone is based on NBFI to make exact use of surplus price range and offer patron credit score loans, mortgages and extra. Therefore, NBFI promotes the financial savings and funding conduct of the overall public.

3. Support the commercial enterprise zone.

NBFI additionally helps the non-economic commercial enterprise zone with the aid of using investment the non-economic commercial enterprise zone thru loans, mortgages, constant profits, inventory purchases and extra. Therefore, NBFI allows funding in plants, device and inventories.

4. Support kingdom and nearby governments.

NBFI presents economic aid to kingdom and nearby governments with the aid of using shopping public debt.

5. Support the crucial authorities.

Similarly, they purchase and promote crucial authorities securities and consequently assist the crucial authorities.

6. Both creditors and NBFI earn:

Interest accrues whilst the saver deposits price range in NBFI. When NBFI lends to the very last borrower, they advantage. In fact, the praise for intermediation comes from the distinction among the price of go back at the number one securities held with the aid of using NBFI and the hobby or dividend price paid with the aid of using NBFI on oblique debt.

7. Providing liquidity:

NBFI presents liquidity without dropping financial cost whilst changing belongings to coins without problems and quickly. When NBFI payments and price range itself, banks specially constantly try and stay liquid. This is carried out with the aid of using following rules. One is to elevate cash with the aid of using growing a short-time period mortgage and issuing a declare to your self for an extended length of time. Second, they distribute loans amongst exceptional forms of borrowers.

8. Help decrease hobby prices:

Competition among NBFIs results in decrease hobby prices. NBFI prefers to hold financial savings with NBFI in place of coins. NBFI then invests them in number one securities. As a result, securities fees upward push and hobby prices fall. In addition, as humans keep to maintain coins in secure and liquid NBFI, call for for cash will decline, which in flip will decrease hobby prices.

9. Low hobby prices advantage each savers and buyers.

Both savers and buyers will advantage whilst hobby prices fall. First, the real value of lending to the borrower is reduced. These, in flip, generally tend to lessen the value and charge of products and offerings. As hobby prices fall, so does the go back on time deposits. This will permit savers to deposit price range with NBFI although they're paying low hobby prices.

Nonetheless, NBFI blessings savers with the aid of using presenting safety, comfort and different associated offerings, which boom their actual profits and profits.

10. Loan Fund Broker:

NBFI performs an critical function as a mortgage fund dealer. They act as an middleman among the closing saver and the closing investor. They promote oblique securities to savers and purchase number one securities from buyers. Indirect securities are short-time period debt of economic intermediaries.

Primary securities, on the opposite hand, are their profits belongings, however their borrower's debt. Therefore, NBFI acts as a dealer of mortgage price range with the aid of using changing debt into credit score.

11. Reduce threat.

When non-financial institution economic intermediaries convert debt into credit score, they lessen the threat to the closing lender. First, they invent debt on their very own with the aid of using promoting oblique securities to creditors. Then they purchase the number one protection from the borrower of the price range.

Therefore, with the aid of using performing as an middleman among the lender and the borrower of the price range, NBFI bears its very own threat and mitigates the threat to the closing lender. In addition, they mitigate their very own dangers with the aid of using maintaining exceptional forms of economic belongings. The low go back on a few belongings may be offset with the aid of using the excessive go back on different belongings.

Mobilize financial savings. NBFI increases price range withinside the capital markets and presents credit score to buyers. The expert economic offerings they offer are attracting a bigger percentage of public financial savings. Such offerings consist of smooth liquidity, foremost protection, and the capacity to without problems cut up financial savings into direct securities of diverse values.

The improvement of economic intermediaries apart from the 2 forms of banks allowed them to mobilize extra cash. The first is depository institutions, along with financial savings and mortgage associations, credit score unions, and mutual financial savings banks.

Such establishments that appeal to small savers have a excessive liquidity of financial savings. It additionally troubles fixed-fee belongings that don't extrade in cost just like the marketplace costs of different styles of belongings. The 2d is a agreement middleman that contracts with Saver and gives a huge style of advantages over the lengthy term. Such establishments are pension price range, existence coverage corporations and public fund price range. These styles of economic intermediaries are mainly beneficial for mobilizing public financial savings.

12. Investing price range:

NBFI exists as it desires to benefit from making an investment mobilized financial savings. Different economic intermediaries comply with one of a kind funding rules. For example, financial savings and mortgage institutions and mutual financial savings banks put money into mortgages, and coverage corporations put money into bonds and securities. Therefore, intermediaries mobilize public financial savings and make investments them, thereby assisting capital formation and financial increase.

13. Create new belongings and liabilities.

Gardner Akley says that withinside the mediation among the final lender and direct investors, NBFI will notably boom the inventory of economic belongings to be had to savers and create equal new economic liabilities for every extra asset. Shown. However, brokerage does now no longer have an effect on overall internet worth. He concludes that mediation does now no longer boom overall wealth or income, however it is able to be assumed to boom welfare.

14. Economies of scale:

NBFI enjoys some of specializations and economies of scale in mobilizing financial savings and making investments. It is steeply-priced and tedious for person savers to lend cash to person borrowers. NBFI makes large transactions with the very last lender and borrower.

They specialise in buying and selling massive economic belongings, which reduces the price of purchasing and promoting securities. They rent expert body of workers and green equipment to enhance the productiveness of cash transfers.

15. Bringing balance to capital markets:

NBFI offers generally with lots of belongings and liabilities traded withinside the capital markets. Without NBFI, the deliver and call for of economic belongings and relative yields extrade frequently, destabilizing capital markets. NBFI works withinside the criminal framework and units rules, which brings balance to capital markets and advantages savers and companies thru lots of economic services.

16. Economic advantages:

NBFI may be very beneficial in walking economic markets, imposing relevant financial institution economic and credit score rules, and as a consequence riding financial increase. By shifting price range from surplus to deficit. NBFI creates massive economic belongings and liabilities.

They offer the economic system with the cash deliver and near-cash belongings. Therefore, they assist the economic markets work. As economic markets dominate the workings of the economic system, relevant financial institution financial and credit score rules are every now and then modified to make certain that economic markets feature easily withinside the country.

In fact, financial increase relies upon closely at the right functioning of the economic system, which is predicated closely on NBFI.

17. Supporting the financial increase process:

NBFI helps the financial increase process. They are someplace among the final lender, the saver, and the final borrower, the investor. By appearing this feature, they discourage humans from hoarding, mobilize their financial savings and lend them to investors.

Therefore, NBFI encourages financial savings and investments which might be crucial to riding financial increase. According to a Goldsmith study, NBFI's increase has had a massive effect at the financial increase of evolved countries.

We can finish that NBFI gives liquidity and safety for economic belongings and allows switch price range from the final lender to the final borrower for effective purposes. They boom capital formation, which in flip results in financial increase.

Q5) Critically evaluate the performance of UTI in the last decade. 5

A5) The Indian funding consider enterprise started out in 1963 with the established order of the Indian Unit Trust, led through the Government of India and the Reserve Bank of India. The records of Indian funding trusts may be widely divided into 4 specific phases

First level-1964-1987

The Indian Unit Trust (UTI) changed into hooked up through Parliamentary Act in 1963. It changed into based through the Reserve Bank of India and functioned beneath the regulatory and administrative controls of the Reserve Bank of India. In 1978, UTI changed into separated from RBI and the Indian Industrial Development Bank (IDBI) took over regulatory and administrative manipulate on behalf of RBI. The first scheme initiated through the UTI changed into the unit scheme 1964. At the quit of 1988 UTI had Rs. Assets beneath control of 6,seven-hundred crores.

Phase 2-1987-1993 (Public Sector Funding)

In 1987, non-UTI public area funding trusts hooked up through public area banks and the Indian Life Insurance Corporation (LIC) and the Indian Non-existence Insurance Corporation (GIC) entered the market. The SBI Mutual Fund changed into the primary non-UTI mutual fund hooked up in June 1987, the Can bank Mutual Fund (December 87), the Punjab National Bank Mutual Fund (August 89), and the Indian Bank Mutual Fund (November). 89th), observed through the Indian Bank (ninetieth June). ), Bank of Baroda Mutual Fund (October 92). LIC hooked up funding consider in June 1989, and GIC hooked up an funding consider in December 1990.

At the quit of 1993, the funding consider enterprise had belongings beneath manipulate of Rs. 47,004 Crore.

Phase 3-1993-2003 (access of personal area finances)

With the access of personal area finances in 1993, a brand new generation has started withinside the Indian funding consider enterprise, giving Indian buyers extra alternatives for his or her fund families. In addition, 1993 changed into the 12 months while the primary funding consider regulations had been enacted, beneathneath which all funding trusts besides UTI could be registered and managed. The former Kotari Pioneer (now merged with Franklin Templeton) changed into the primary non-public funding consider registered in July 1993.

The SEBI (Investment Trust) Regulations of 1993 had been changed through the extra complete and revised Investment Trust Regulations in 1996. The enterprise is presently running beneathneath the 1996 SEBI (Investment Trust) Regulations.

The range of mutual fund homes maintains to grow, many overseas mutual finances have installation finances in India, and the enterprise has witnessed numerous mergers and acquisitions. As of the quit of January 2003, there had been 33 funding trusts with general belongings of Rs. 1,21,805 Crore. Rs and Indian unit consider. 44,541 Krolle's belongings beneathneath control some distance passed the ones of different funding trusts.

Phase 4-After February 2003

In February 2003, with the abolition of the Indian Unit Trust Act of 1963, UTI cut up into separate entities. The first is a selected enterprise of an Indian unit consider with belongings beneathneath control of Rupees. As of the quit of January 2003, 29,835 Crore widely represents the belongings of the United States sixty four scheme, assured returns, and different unique schemes. A unique enterprise of an Indian unit consider that works beneathneath the regulations installation through the Government of India beneathneath the control and isn't in the scope of the funding consider regulations.

The 2d is a UTI mutual fund subsidized through SBI, PNB, BOB, and LIC. It is registered with SEBI and capabilities consistent with the funding consider regulations. At the previous UTI department that had extra than Rs in March 2000. With the established order of UTI Mutual Funds in compliance with SEBI Mutual Fund Regulations and latest mergers among numerous non-public finances, the mutual fund enterprise is now withinside the level of integration and boom with 76,000 crores of belongings beneathneath control. ..

Q6) What is bank credit? 5

A6) The term bank credit refers to the amount of credit available to a business or individual in the form of a loan from a banking institution. Therefore, bank credit is the total amount that an individual or company can borrow from a bank or other financial institution. The borrower's bank credit depends on his or her ability to repay the loan and the total amount of credit the bank can lend. Bank credit types include car loans, personal loans, and mortgages.

Understand bank credit

Banks and financial institutions make money from the money they lend to their customers. These funds come from money that clients deposit in checking accounts, savings accounts, or invest in specific investment instruments such as certificates of deposit (CDs). Banks pay customers a small amount of interest on their deposits in return for using the service. As mentioned earlier, this money is lent to others and is known as bank credit.

Bank credit consists of the total amount of total funds that a financial institution provides to an individual or company. This is an agreement between the bank and the borrower that the bank lends to the borrower. By expanding credit, banks basically rely on the borrower to repay the principal balance and interest at a later date. Whether someone is authorized for credit and the amount they receive is based on their credit rating.

Approval is determined by the borrower's credit rating and income or other considerations. This includes the amount of collateral, assets, or debt you already have. There are several ways to ensure approval, such as reducing the total debt-to-revenue (DTI) ratio. The acceptable DTI ratio is 36%, but 28% is ideal. Borrowers are generally advised to keep their card balance below 20% of their credit limit and pay off all late accounts. Banks typically provide credit to borrowers who have an unfavourable credit history under conditions that benefit the bank itself (higher interest rates, lower lines of credit, and more restrictive terms).

Banking regulation is a form of government regulation that imposes specific requirements, restrictions, and guidelines on banks and aims to create market transparency between banking institutions and, among other things, individuals and businesses with which they do business increase. Given the interoperability of the banking industry and the reliance of the national economy on banks, it is important that regulators continue to control the standardized practices of these institutions.

Q7) What is commercial paper ? Write its features. 5

A7) Commercial paper is a brief-time period debt protection together with unsecured and discounted promissory notes issued with the aid of using big corporations with excessive credit score scores and may be effortlessly traded. The tenure does now no longer exceed 270 days. Commercial papers are known as low-hazard investments due to their fantastically brief adulthood and offer buyers with a aggressive go back to catch up on the company's credit score hazard.

Commercial paper is typically unsecured debt, now no longer subsidized with the aid of using any shape of collateral. As a result, simplest corporations with a excessive first-rate debt score can effortlessly discover a purchaser while not having to provide a giant cut price (better cost) for debt problems. Other corporations, monetary institutions, rich individuals, and cash marketplace budget are typically shoppers of industrial paper.

In Nigeria, funding in industrial paper is regulated with the aid of using the Securities and Exchange Commission.

Commercial papers are issued with the aid of using an RBI-authorised organisation with a set adulthood, negotiable with the aid of using approval and delivery, issued in bearer shape, and issued at a par cost cut price that can be deterred with the aid of using the issuing organisation. It is an unsecured promissory note.

Meaning

Commercial papers or CPs are described as brief-time period cash marketplace merchandise and are issued as promissory notes with the aid of using big groups with suitable credit score scores. Securities aren't subsidized with the aid of using collateral, so simplest big groups with huge monetary electricity are allowed to problem securities.

Features of Commercial Paper:

- Commercial paper is a cash marketplace product together with promissory notes with a set adulthood.

- This is a certificates certifying unsecured company debt with a brief adulthood.

- Commercial paper is issued at a reduced rate on a par cost basis, however it may additionally be issued in an interest-bearing format.

- The company guarantees to pay the purchaser a set quantity over a time period within side the future, however to assure that promise, it has no belongings and simplest guarantees liquidity and installed incomes power.

- Commercial papers may be issued at once with the aid of using groups to buyers or via banks / service provider banks.

Q8) Explain commercial paper. What are its advantages? 8

A8) Commercial paper is a brief-time period debt protection together with unsecured and discounted promissory notes issued with the aid of using big corporations with excessive credit score scores and may be effortlessly traded. The tenure does now no longer exceed 270 days. Commercial papers are known as low-hazard investments due to their fantastically brief adulthood and offer buyers with a aggressive go back to catch up on the company's credit score hazard.

Commercial paper is typically unsecured debt, now no longer subsidized with the aid of using any shape of collateral. As a result, simplest corporations with a excessive first-rate debt score can effortlessly discover a purchaser while not having to provide a giant cut price (better cost) for debt problems. Other corporations, monetary institutions, rich individuals, and cash marketplace budget are typically shoppers of industrial paper.

In Nigeria, funding in industrial paper is regulated with the aid of using the Securities and Exchange Commission.

Commercial papers are issued with the aid of using an RBI-authorised organisation with a set adulthood, negotiable with the aid of using approval and delivery, issued in bearer shape, and issued at a par cost cut price that can be deterred with the aid of using the issuing organisation. It is an unsecured promissory note.

Meaning

Commercial papers or CPs are described as brief-time period cash marketplace merchandise and are issued as promissory notes with the aid of using big groups with suitable credit score scores. Securities aren't subsidized with the aid of using collateral, so simplest big groups with huge monetary electricity are allowed to problem securities.

Advantages of Commercial Paper

- Simplicity:

The gain of industrial paper is its simplicity. It consists of few files among the company and the investor.

b. Flexibility:

Issuers can problem industrial papers with maturities which might be tailor-made to the organisation's coins flow.

c. Raising long-time period capital is easy:

Companies that could enhance cash via industrial paper becomes higher recognised within side the monetary industry, thereby setting them in a higher function to elevate capital as wished and so long as possible. Therefore, there are integrated incentives for corporations to stay financially strong.

d. High profit:

Commercial paper offers buyers with better returns than they could get from the banking system.

e. Transfer of budget:

Securitization of loans with the aid of using the Commercial Paper Facility creates a secondary marketplace for paper, correctly transfers budget, and brings coins surplus to coins-poor entities.

Q9) Explain different ways to calculate commercial paper? 5

A9) Companies want to decide the charges related to issuing industrial paper. Investors additionally want to discover the proposed income of CP.

For this purpose, you may calculate:

CP hobby fee calculation

The first component you want to test is the hobby fee paid through the agency, which buyers can earn with industrial paper.

The hobby fee carried out to the agency for the issuance of industrial paper is calculated after deduction of associated charges and earlier than tax deduction.

The components for calculating the hobby fee of industrial paper is as follows.

Net Realized Amount: The internet found out quantity found out through the borrowing agency is the quantity acquired after deducting all applicable reductions and charges. These costs consist of ready facility costs, stamp duty, financial institution charges, organisation costs, and credit score score costs.

The components for figuring out the found out internet quantity is: Realized internet quantity

Calculation of internet fee

The very last fee of the agency related to the issuance of industrial paper is referred to as the internet fee of CP, after summing up the brokerage costs and subtracting the income earned from the finances obtained.

The components for calculating the internet fee of CP is: CP internet fee

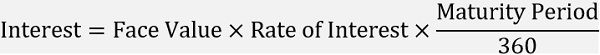

CP Interest: The hobby charged on industrial papers paid through the company to buyers is CP hobby.

The components for figuring out the quantity of hobby charged is:

Interest on CP

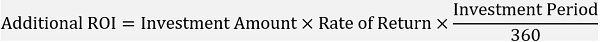

Additional Return on Investment: Companies may also difficulty industrial papers past the desired range of days and gather refundable quantities nicely earlier than the said adulthood date.

In those situations, organizations see this extra duration as an possibility to make a few extra cash from the to be had finances through making an investment in short-time period earnings schemes which includes marketplace securities.

To discover this extra go back on investment, the subsequent components are given: