Unit 1

An Introduction to Financial System

Q1) Define financial system. Discuss the components of financial system. 12

A1) Financial system is an organised mechanism that facilitates transfer of money from surplus area to deficit area of the economy. The financial system composed of financial market, financial intermediary, financial services, financial instruments and regulatory bodies that facilitate smooth functioning of the economy.

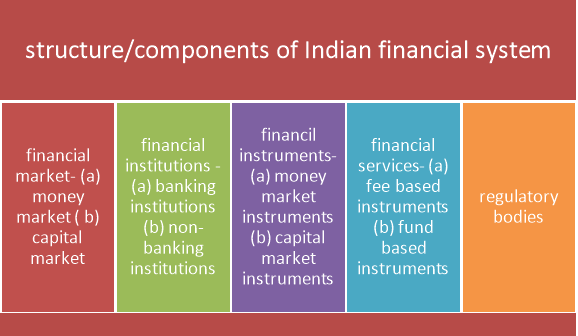

The organisational structure indicates the components/elements of Indian financial system. Such components are financial market, financial institutions, financial instruments, financial services and regulatory bodies. These are outlined in the following fig-

Fig: structure of Indian Financial System

a) Financial Market:

Financial market refers to the intangible market where financial assets/instruments are purchased and sold for both short period and long period. It provides an organised platform to financial institutions, companies, Government, individuals and brokers to trade the financial instruments like share, debenture, bond, treasury bills, commercial papers, commercial bills etc. It facilitates the companies and Government to raise long term and short term funds. Depending on the nature of transactions taken place under this market, financial market is divided into two parts-

- Capital market: It is the financial market where financial instruments are traded for long duration. Financial instruments like shares, debentures, bonds etc. are traded for long duration in this market. It is regulated by the Securities and Exchange Board of India. It is again subdivided as-

- Primary market/new issue market: It is the capital market where fresh securities or newly issued securities are traded.

- Secondary market/stock market: It is the capital market where old securities/second hand securities are traded.

II) Money market: It is the financial market where near money assets are traded short period i.e, less than or up to 365 days. Financial instruments like treasury bills, commercial papers, bills of exchange, promissory notes etc. are traded by banks, companies, government etc. under this market to manage short term fund in the economy. It is regulated by the Reserve Bank of India.

b) Financial Institutions:

Financial institutions are organisation that facilitates transfer of fund from surplus sector to the deficit sector of the economy. It facilitates promotion of savings and investment in the economy by providing different investment opportunities. It is of three types-

1) Banking institutions: Financial institutions that provide banking services are known as banks. It is the creator and also the purveyors of credit. It accepts demand deposits, provides loans, perform agency functions like collection and payment of cheque, transfer of money, purchase and sale of securities, collection and payment of interest, dividend etc., general utility functions like locker facility, tax consultancy service, e-banking services, personal banking services etc. For example, State bank of India, ICICI Bank Ltd., Punjab National Bank etc.

2) Non-banking institutions: Non-banking financial institutions are those institutions which are non-banking in nature, i.e., they are purveyors of credit only. NBFCs like insurance companies, mutual fund companies etc. are provided opportunities for investment and venture capital fund, hire purchase companies, lease financing companies etc. supply funds for investment in business. For example, LICI, SBI mutual fund, CRISIL etc.

3) Development banks: Development banks are specialised financial institutions established to perform activities for development of different segments of the economy. Different specified institutions like National bank for Agriculture and Rural Development (NABARD), National Housing Bank (NHB), Industrial Development Bank of India (IDBI) etc. are some of the examples of development bank.

c) Financial Instruments:

Financial instrument is a claim against a person or an institution for payment of specified sum of money and/or payment of periodic payment in the form interest/dividend at a future date. Such instruments are marketable either in the capital market or money market. Financial instruments represents shares, debentures, bonds, treasury bills, commercial papers, certificate of deposits and commercial bills. Financial instruments can again be subdivided as-

1) Capital market instruments: Capital market instruments are traded for long period like 3 years, 5 years, 10 years etc. Such instruments are used by companies to raise long term funds. For example, shares, debentures and bonds.

2) Money market instruments: Money market instruments are traded for short period like 3 months, 7 days, 6 months, 90 days, 364 days etc. Such instruments are issued by corporates and financial institutions to raise short term fund and adjust short term liquidity in the financial market. For example, treasury bills, commercial papers, certificate of deposits and commercial bills.

d) Financial Services:

Financial service refers to monetary benefit/satisfaction derived from financial instruments, financial products and providers of financial services. Different banks and non-banks provide variety of financial services to users according to their convenience and need. Financial services are again subdivided as-

1) Fee based financial services: Under fee based financial services, the financial service provider charges some fee/commission against the services provided to the users. Some examples of fee based financial services are- merchant banking, stock brokering, credit rating, asset management, portfolio management etc.

2) Fund based/asset based financial services: Under fund based financial services, the financial service user transfer funds to the financial institutions for investment purpose or the financial service provider transfer fund (loan) to the financial service user. Some examples of fund based financial services are- insurance, mutual fund, leasing, hire purchase, bill discounting, factoring and forfaiting, venture capital etc.

e) Regulatory Bodies:

Regulatory bodies are institutions established to regulate the components financial system for uninterrupted and smooth functioning of the economy. It is an organised mechanism where different regulatory bodies formulate plans and policies, rules and regulations, guidelines etc. to control and regulate the financial system. Some of the examples are Reserve Bank of India, Securities and Exchange Board of India, Insurance Regulatory Development Authority, Securities Contract Regulation Act etc.

Q2) Define financial market. Explain the types of financial market. 5

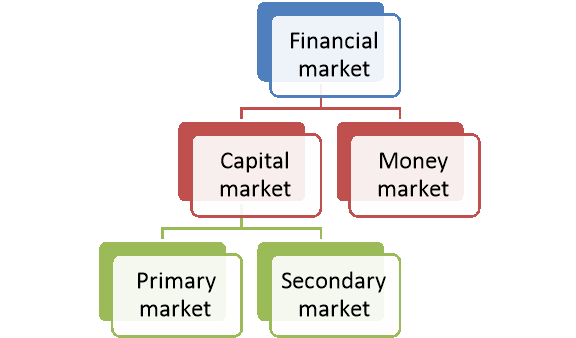

A2) Financial market refers to the intangible market where financial assets/instruments are purchased and sold for both short period and long period. It provides an organised platform to financial institutions, companies, Government, individuals and brokers to trade the financial instruments like share, debenture, bond, treasury bills, commercial papers, commercial bills etc. It facilitates the companies and Government to raise long term and short term funds. Depending on the nature of transactions taken place under this market, financial market is divided into two parts-

Figure: Financial market structure

- Capital market:

It is the financial market where financial instruments are traded for long duration. Financial instruments like shares, debentures, bonds etc. are traded for long duration in this market. It is regulated by the Securities and Exchange Board of India. It is again subdivided as-

- Primary market/new issue market: It is the capital market where fresh securities or newly issued securities are traded.

- Secondary market/stock market: It is the capital market where old securities/second hand securities are traded.

II) Money market:

It is the financial market where near money assets are traded short period i.e, less than or up to 365 days. Financial instruments like treasury bills, commercial papers, bills of exchange, promissory notes etc. are traded by banks, companies, government etc. under this market to manage short term fund in the economy. It is regulated by the Reserve Bank of India.

Q3) What is capital market? Discuss the organisational structure of capital market. 5

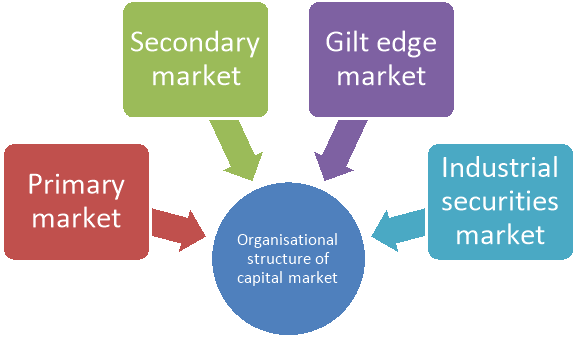

A3) Capital market is the financial market where financial instruments are traded for long duration. Financial instruments like shares, debentures, bonds etc. are traded for long duration in this market. It is regulated by the Securities and Exchange Board of India. The organisational structure capital market are discussed below-

Figure: Organisational structure of capital market

- Primary Market

The primary market is also called “New Issue Market” where a company brings Initial Public Offer (IPO) to get itself listed on the stock exchange for the first time. In the primary market, the mobilisation of funds is done through right issue, private placement and prospectus. The fund collected by the company in the IPO is used for its future expansion and growth. Primary markets help the investors to put their savings into companies that are looking to expand their enterprises.

2. Secondary Market

The secondary market is a type of capital market where the securities that are already listed on the exchange are traded. The trading done on the stock exchange and over the counter falls under the secondary market. Examples of secondary markets in India are National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

3. Government Securities Market/Gilt edge market:

This is also known as the Gilt-edged market. This refers to the market for government and semi-government securities backed by the Reserve Bank of India (RBI).

4. Industrial Securities Market:

This is a market for industrial securities i.e. market for shares and debentures of the existing and new corporate firms. Buying and selling of such instruments take place in this market. This market is further classified into two types such as the New Issues Market (Primary) and the Old (Existing) Issues Market (secondary). In primary market fresh capital is raised by companies by issuing new shares, bonds, units of mutual funds and debentures. However in the secondary market already existing i.e old shares and debentures are traded. This trading takes place through the registered stock exchanges. In India we have three prominent stock exchanges. They are the Bombay Stock Exchange (BSE), the National Stock Exchange (NSE) and Over The Counter Exchange of India (OTCEI).

Q4) Define capital market. Also discuss about the capital market instruments. 5

A4) Capital market is the financial market where financial instruments are traded for long duration. Financial instruments like shares, debentures, bonds etc. are traded for long duration in this market. It is regulated by the Securities and Exchange Board of India.

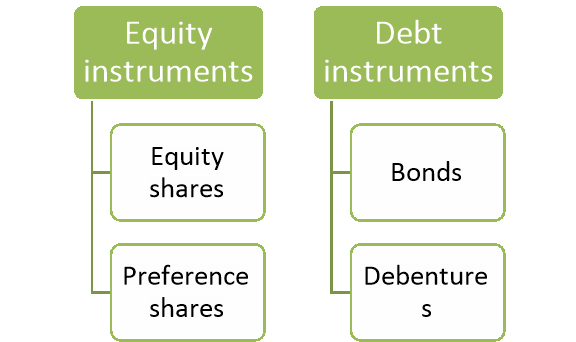

The types of capital market instruments are broadly classified into two types –

Figure: Capital market instruments

- Equity instruments

- Equity shares

These shares are the prime source of finance for a public limited or joint-stock company. When individuals or institutions purchase them, shareholders have the right to vote and also benefit from dividends when such organisation makes profits. Shareholders, in such cases, are regarded as the owners of a company since they hold its shares.

b. Preference shares

These are the secondary sources of finance for a public limited company. As the name suggests, holders of such shares enjoy exclusive rights or preferential treatment by that company in specific aspects. They are likely to receive their dividend before equity shareholders. However, they do not have any voting rights typically.

2. Debt security

- Bonds

It is a fixed income instrument, primarily issued by sovereign and state governments, municipalities, and even companies to finance infrastructural development and other types of projects. It can be viewed as a loaning instrument, where a bond’s issuer is the borrower. Bond holders are considered as creditors concerning such an entity and are entitled to periodic interest payment. Furthermore, bonds carry a fixed lock-in period. Therefore, issuers of bonds are mandated to repay the principal amount on the maturity date to bondholders.

b. Debentures

Debentures are unsecured investment options. Consequently, they are not backed by any asset or collateral. Here, lending is entirely based on mutual trust and, herein, investors act as potential creditors of an issuing institution or company.

Q5) Explain briefly the structure of money market. 8

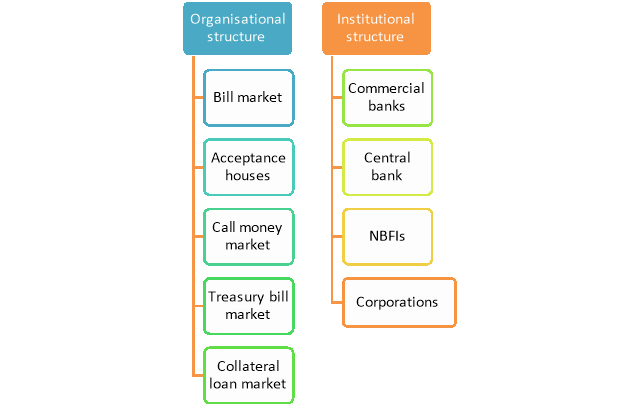

A5) The money market structure is broadly divided as organisational structure and institutional structure. The further sub-classifications are discussed below-

Figure: Constituents/Structure of Money market

A) Organisational structure

1. Call Money Market:

The most important component of organised money market is the call money market. It deals in call loans or call money granted for one day. Since the participants in the call money market are mostly banks, it is also called interbank call money market. The banks with temporary deficit of funds form the demand side and the banks with temporary excess of funds form the supply side of the call money market.

2. Treasury Bill Market:

The treasury bill market deals in treasury bills which are the short-term (i.e., 91, 182 and 364 days) liability of the Government of India. Theoretically these bills are issued to meet the short-term financial requirements of the government. But, in reality, they have become a permanent source of funds to the government. Every year, a portion of treasury bills are converted into long-term bonds. Treasury bills are of two types: ad hoc and regular. Ad hoc treasury bills are issued to the state governments, semi- government departments and foreign central banks. They are not sold to the banks and the general public, and are not marketable. The regular treasury bills are sold to the banks and public and are freely marketable. Both types of ad hoc and regular treasury bills are sold by Reserve Bank of India on behalf of the Central Government. The treasury bill market in India is underdeveloped as compared to the treasury bill markets in the U.S.A. And the U.K.

3. Commercial Bill Market:

Commercial bill market deals in commercial bills issued by the firms engaged in business. These bills are generally of three months maturity. A commercial bill is a promise to pay a specified amount in a specified period by the buyer of goods to the seller of the goods. The seller, who has sold his goods on credit draws the bill and sends it to the buyer for acceptance. After the buyer or his bank writes the word ‘accepted’ on the bill, it becomes a marketable instrument and is sent to the seller. The seller can now sell the bill (i.e., get it discounted) to his bank for cash. In times of financial crisis, the bank can sell the bills to other banks or get them rediscounted from the Reserved Bank. In India, the bill market is undeveloped as compared to the same in advanced countries like the U.K. There is absence of specialised institutions like acceptance houses and discount houses, particularly dealing in acceptance and discounting business.

4. Collateral Loan Market:

Collateral loan market deals with collateral loans i.e., loans backed by security. In the Indian collateral loan market, the commercial banks provide short- term loans against government securities, shares and debentures of the government, etc.

5. Certificate of Deposit and Commercial Paper Markets:

Certificate of Deposit (CD) and Commercial Paper (CP) markets deal with certificates of deposit and commercial papers. These two instruments (CD and CP) were introduced by Reserve Bank of India in March 1989 in order to widen the range of money market instruments and give investors greater flexibility in the deployment of their short-term surplus funds.

B) Institutional structure/participants

1. Central Government:

Central Government is a borrower in the money market through the issue of Treasury Bills (T-Bills). The T-Bills are issued through the RBI. The T-Bills represent zero risk instruments. They are issued with tenure of 91 days (3 months), 182 days (6 months) and 364 days (1 year). Due to its risk free nature, banks, corporates and many such institutions buy the T-Bills and lend to the government as a part of it short- term borrowing programme.

2. Public Sector Undertakings:

Many government companies have their shares listed on stock exchanges. As listed companies, they can issue commercial paper in order to obtain its working capital finance. The PSUs are only borrowers in the money market. They seldom lend their surplus due to the bureaucratic mindset. The treasury operations of the PSUs are very inefficient with huge cash surplus remaining idle for a long period of time.

3. Non-banking financial companies

NBFCs acts as an intermediary in the money market. Some of them are-

- Insurance Companies:

Both general and life insurance companies are usual lenders in the money market. Being cash surplus entities, they do not borrow in the money market. With the introduction of CBLO (Collateralized Borrowing and Lending Obligations), they have become big investors. In between capital market instruments and money market instruments, insurance companies invest more in capital market instruments. As their lending programmes are for very long periods, their role in the money market is a little less.

- Mutual Funds:

Mutual funds offer varieties of schemes for the different investment objectives of the public. There are many schemes known as Money Market Mutual Fund Schemes or Liquid Schemes. These schemes have the investment objective of investing in money market instruments. They ensure highest liquidity to the investors by offering withdrawal by way of a day’s notice or encashment of units through Bank ATMs. Naturally, mutual funds invest the corpus of such schemes only in money market. They do not borrow, but only lend or invest in the money market.

4. Commercial banks:

Scheduled commercial banks are very big borrowers and lenders in the money market. They borrow and lend in call money market, short-notice market, repo and reverse repo market. They borrow in rediscounting market from the RBI and IDBI. They lend in commercial paper market by way of buying the commercial papers issued by corporates and listed public sector units. They also borrow through issue of Certificate of Deposits to the corporates.

5. Corporates:

Corporates borrow by issuing commercial papers which are nothing but short-term promissory notes. They are issued by listed companies after obtaining the necessary credit rating for the CP. They also lend in the CBLO market their temporary surplus, when the interest rate rules very high in the market. They are the lender to the banks when they buy the Certificate of Deposit issued by the banks. In addition, they are the lenders through purchase of Treasury bills.

Q6) Discuss about different money market instruments. 8

A6) The following are some key money market instruments to be considered while investing in India-

Figure: Money market instruments

- Treasury Bills

Treasury bills or T-bills are issued by the Reserve Bank of India on behalf of the Central Government for raising money. T-bills do not pay any interest but are available at a discount to the face value at the time of issue. At maturity, the investor gets the face value amount. This difference between the initial value and face value is the return earned by the investor. Treasury Bills are by far the oldest of money market instruments and are considered to be the safest short term fixed income investments as they are backed by the Government of India. Since T-bills are issued by the government, they offer guaranteed returns and are known to be zero default risk investments. Additionally, T-bills have a short maturity period of up to 1 year. T-Bills are commonly classified on the basis of their maturity period and their type.

a) The maturity-based classification of treasury bills names them as 10-day TBs, 91-day TBs, 182-day TBs, and 364-day TBs

b) The other classification includes auction bills and tap bills. Auction bills follow a multiple price system in order to ensure fair pricing.

c) These bills are also termed as regular bills as they are available for investment by banks and other participating institutions

2. Commercial Papers

Large companies and businesses issue promissory notes to raise capital from investors in order to meet their short term business needs. These promissory notes are known as Commercial Papers (CPs). The firms issuing commercial papers have a high credit rating, owing to which they are unsecured, with the company’s credibility acting as security for the financial instrument. Corporates, primary dealers (PDs) and All-India Financial Institutions (FIs) can issue CPs. CPs have a fixed maturity period ranging from 7 days to 270 days. However, investors can trade this instrument in the secondary market, wherever they offer relatively higher returns compared to that from treasury bills.

3. Certificate of Deposit (CD)

Certificates of deposit are financial assets issued by banks and financial institutions, offering a fixed interest rate on the invested amount, similar to a fixed deposit. The primary difference between a CD and a Fixed Deposit is that of the principal amount. A certificate of deposit is issued only for large sums of money (1 lakh or in multiples of 1 lakh thereafter). Because of the restriction on the minimum investment amount, CDs are more popular among organizations than individuals who are looking to park their surplus for short term and earn interest on the same. The maturity period of Certificates of Deposits ranges from 7 days to 1 year if issued by banks. However, other financial institutions also issue a CD with a maturity period of 1 year to 3 years.

4. Repurchase Agreements or Ready Forward Contract (Repo)

Also known as repos or buybacks, a Repurchase Agreement is a formal agreement between two parties, where one party sells a security to another, with the promise of buying it back at a later date. It is also called a Sell-Buy transaction. The seller buys the security at a predetermined time and amount which also includes the interest rate at which the buyer agreed to buy the security. The interest rate charged by the buyer for agreeing to buy the security is called Repo rate. Repos come-in handy when the seller needs funds for the short-term, s/he can just sell the securities and get the funds to dispose of. The buyer gets an opportunity to earn decent returns on the invested money. Repo rate, fixed by the RBI may be defined as the rate at which domestic Indian banks borrow from other Indian banks or from the RBI. A decreasing repo rate makes it cheaper for banks to borrow money from other banks or the central bank. This, ultimately allows the bank to pass on the lower rate benefit to customers in the form of loans provided at reduced rates

5. Banker’s Acceptance

This is a financial instrument produced by an individual or a corporation in the name of the bank, wherein the issuer must pay a specified amount to the instrument holder on a predetermined date, between 30 and 180 days, starting from the date of issue of the instrument. Banker’s Acceptance is issued at a discounted price, and the actual price is paid to the holder at maturity. The difference between the two is the profit made by the investor. Banker’s acceptance is a secure financial instrument as the payment is guaranteed by a commercial bank

6. Call Money

Call money essentially represents a short term loan for the purpose of making stock exchange transactions with maturities ranging from 1 day to 14 days and is repayable on demand. The call money market participants are allowed to lend and borrow using the call money instruments such as STCI (Securities Trading Corporation of India), DFHI (Discount and Finance House of India), co-operative banks and Indian and foreign commercial banks. Call money loans feature a fixed interest rate, termed as call rate, which being closely related to changes in demand and supply, is quite volatile. Due to this high level of volatility, the call money market is considered to be the most sensitive section of India’s money market

7. Interest Rate Swaps

Interest rate swap is referred to a financial transaction in which two parties sign a deal wherein one pays a fixed rate of interest, and the other pays a floating rate of interest. The fixed rate of interest payable is calculated using a notional principal amount, while the floating rate of interest is paid on the actual principal lent out/borrowed with the rate varying on the basis of market conditions. In India, interest rate swaps are mainly used by commercial banks. However, these are separate products that are not directly linked to the bank’s assets such as money lent to customers in the form of loans. This money market instrument protects the borrower from interest rates changes even though the borrower is on the hook for any variable mark-up payments not covered by the interest rate swap agreement.

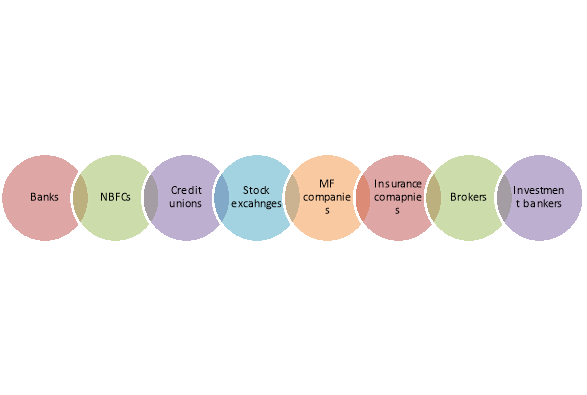

Q7) What is financial intermediation? Discuss about different types financial intermediaries operating in the financial market. 8

A8) Financial intermediary is the organization which acts as a link between the investor and the borrower, to meet the financial objectives of both the parties. These can be seen as business entities which accept deposits from the depositors or investors (lenders) by allowing them low interest on their sum.

Types of Financial Intermediaries

There are several financial intermediaries formed to serve the different aims and objectives of the customers or members or lenders and borrowers. These entities are explained in detail below:

Figure: Types of financial intermediaries

- Banks:

The central and commercial banks are the most well known financial intermediaries simplifying the lending and borrowing process, along with providing various other services to its customers on a large scale.

2. Credit Unions:

These are the cooperative financial units which facilitate lending and borrowing of funds to provide financial assistance to its members.

3. Non-Banking Finance Companies:

A NBFC is a financial company engaged in activities such as advancing loans to its clients at a very high rate of interest.

4. Stock Exchanges:

The stock exchange facilitate the trading of securities and stocks, and in every trading activity, it charges the brokerage from each party which is its profit.

5. Mutual Fund Companies:

The mutual fund organizations club the amount collected from various investors. These investors have identical investment objectives and risk-taking ability. The funds are then collectively invested in the securities, bonds, and other investment options, to ensure a capital gain in the long run.

6. Insurance Companies:

These companies provide insurance policies to the individuals and business entities to secure them against accident, death, risk, uncertainties and default. For this purpose, they accept deposits in the form of premium, which is pooled into profitable investments to gain returns. The insured person can claim the money in case of any mishap as per the agreement.

7. Financial Advisers or Brokers:

The investment brokers also collect the funds from various investors to invest it in the securities, bonds, equities, etc. The financial advisers even provide guidance and expert opinions to the investors.

8. Investment Bankers:

These banks specialize in services like initial public offerings (IPO), other equity offerings, proving for mergers and acquisitions, institutional client’s broker services, underwriting debts, etc.

Q8) Discuss about different sectors of economy associated with the fund flow matrix. 8

A8) For the purpose of FOF accounts, the Indian economy is divided into six sectors, the criteria for the classification being the institutional structure and activity status. The six sectors are Banking, Other Financial Institutions, Private Corporate Business, Government, Rest of the World and Household. Such sectors are discussed below-

Figure: Sectors of economy for FOF matrix

a) Banking Sector:

It covers institutions whose liability consists of currency and deposits. Specifically, the Reserve Bank of India, which is the currency issuing authority, and deposit taking banks comprising commercial banks, co-operative banks and credit societies are included. The commercial bank sub-sector comprises the State Bank of India and its subsidiaries, other nationalised banks, Regional Rural Banks (RRBs), other Indian scheduled and non-scheduled commercial banks, and branches of foreign banks operating in India. The sub-sector ‘co-operative banks and credit societies’ consists of the following: State Co-operative Banks, Central Co-operative Banks, Primary Cooperative Banks, Agricultural and Non-agricultural Credit Societies, Central and Primary Land Development Banks, and Industrial (State and Central) Cooperative Banks.

b) Other Financial Institutions:

Institutions covered under this sector are financial corporations and companies and insurance. Financial corporations and companies include development financial institutions at all India and state levels, Unit Trust of India (UTI), mutual funds, non-banking financial and investment companies, and non-government provident funds. The insurance sub-sector comprises insurance corporations and companies.

c) Private Corporate Business Sector:

Sub-sectors in this category are the cooperative non-credit societies and non-government non-financial companies. The co-operative non-credit societies comprise marketing societies, co-operative sugar factories, cotton ginning and pressing societies, milk supply unions and societies, fisheries societies, farming societies, irrigation societies, consumers’ co-operative stores, housing societies, weavers’ societies, spinning mills, etc. Non-government non-financial companies comprise operating public and private limited companies (including foreign controlled rupee companies), which are registered in India under the Indian Joint Stock Companies Act, 1956, and branches of foreign companies operating in India. Operating companies are defined as companies, which have commenced regular commercial production and started earning income from their main activity. However, the following companies are excluded: (i) companies under construction, (ii) promotional and developmental organisations/associations not functioning for profit, (iii) companies which do not report any business/activity, (iv) companies which are on the verge of liquidation, (v) companies which have sold out their assets, (vi) companies which are under the process of winding up and (vii) companies which have already applied for voluntary liquidation, as on a particular date.

d) Government:

The constituents of this sector are: (a) central government and its departmental commercial undertakings, (b) state governments and union territories including their departmental commercial undertakings, (c) local authorities (covering city corporations, municipalities, panchayats and port trusts) and (d) government non-departmental non-financial commercial undertakings including state electricity boards. The post office savings banks are also included.

e) Rest of the World:

All of them are international institutions.

f) Household:

This is the residual sector comprising the individuals, nongovernment non-corporate enterprises of farm/firm business and non-farm/firm business, like sole proprietorships and partnerships, trusts and non-profit institutions.

g) Sector Not Elsewhere Classified:

It refers to the items of transactions which cannot be classified under any of the sectors mentioned above, but which appear in the balance sheets of different entities and budgets.

Q9) Discuss about the financial instruments grouped under fund flow accounts. 8

A9) The available financial instruments are grouped into the following eleven categories in FOF accounts:

(i) Currency: It includes notes issued by the Reserve Bank in circulation and one-rupee notes and coins issued by the Government of India.

(ii) Deposits: This item consists of bank deposits and other deposits. Under this head, deposits held by RBI, commercial banks, co-operative banks, cooperative credit and non-credit societies as also deposits received by financial corporations, government and Rest of the World are included. Compulsory deposits with RBI, which are shown separately, are excluded.

(iii) Investment: This category covers the following instruments:

- Government Securities: This includes market loans, treasury bills, special bonds (including bearer bonds) and compensation bonds issued by the central and state governments and central government’s borrowing from RBI against compulsory deposits.

- Other Securities of Government (other than small savings): This includes bonds, shares and debentures issued by the port trusts, municipal corporations, housing boards, state electricity boards and non-departmental non-financial undertakings.

- Securities of Banks: This refers to the paid-up capital of RBI and commercial banks; shares and debentures issued by co-operative banks and credit societies.

- Securities of Other Financial Institutions: Shares, units, bonds and debentures issued by financial corporations and insurance companies are covered here.

- Private Corporate Securities: Shares and debentures issued by nongovernment non-financial companies and co-operative non-credit societies are included under this head.

- Foreign Securities: Securities issued by foreign institutions, foreign exchange assets appearing against investments under sources of funds of the Rest of the World sector are covered here.

- Other Securities: When the details of securities are not identified against any sector, they are shown under this category.

(iv) Loans and Advances: Items included under this head are borrowings of all sectors and deposits accepted by non-banking financial and non-financial companies.

(v) Small Savings: Data are reported under sources of Central Government.

(vi) Provident Fund: Non-government provident funds and government provident funds are covered here.

(vii) Life Fund: Items covered under this head are life insurance fund of Life Insurance Corporation of India (LIC), postal insurance fund of central government and state governments’ insurance fund.

(viii) Compulsory Deposits: This refers to deposits held with RBI in pursuance of the legislative requirement, viz., Compulsory Deposits Scheme, 1974. The Scheme has since been withdrawn.

(ix) Trade Credit/Debt: Under this head, trade credit/debt by non-government non-financial companies, government non-departmental undertakings and port trusts is included.

(x) Foreign Claims Not Elsewhere Classified: Certain foreign claims, which could not be classified under any of the instruments listed above are shown here. Such items are (i) commercial banks’ branch adjustments – outside India, (ii) excess of assets over liabilities as per Form ‘X’ and (iii) such other items which may appear under sources/uses of funds.

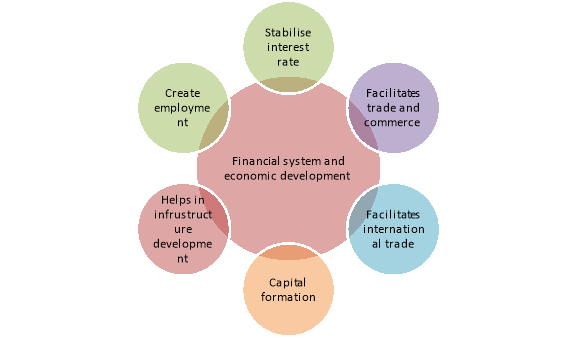

Q10) Explain the relationship between financial system and economic development. 5

A10) An efficient financial system facilitates economic development of a country. A healthy financial system indicates growth of an economy and vice versa. Some of the significant role of financial system in economic development of a country re discussed below-

Figure: Financial system and economic development

1.Interest Rates Stabilization:

The financial system ensures that all the organizations and institutions which it is composed of, behave as one unified system. Generally, healthy competition is promoted between the members of the system. This means that members have to compete with each other by lowering their costs. As a result, the benefits of lower interest rates are passed on to the consumers. It is the existence of the financial system, which ensures that interest rates remain stable across the country. The banking system led by a central bank makes this possible. In the absence of a financial system, each region would have its own interest rate based on the availability of capital. However, with the financial system in place, interest rates remain the same across the entire country. As a result, businessmen and entrepreneurs throughout the country are on an equal footing.

2.Facilitates Trade and Commerce:

Credit risk has always been the main factor that inhibits trade and commerce. If a seller is not sure about whether they will get paid for the goods which they sold, then they will not sell more goods till the earlier payment has been received. This reduces inventory turnaround and leads to a decline in trade and commerce. Financial systems ensure quick and timely payment. With the advent of advanced technology, it is now possible to remit money to any part of the world within a few seconds. Hence, financial markets and institutions aid in trade and commerce and even improve the gross domestic product of a country.

3.Facilitates International Trade:

Financial systems play a very important role in the international trade process. This is because importers and exporters generally use banks as an intermediary in the process. The importer deposits money with the bank in the form of a letter of credit. This letter of credit is then paid to the exporter by the bank when goods are received. As a result, neither party has to rely on each other. Instead, both of them can rely on the bank, which has a higher credit rating and therefore aids in the reduction of risk. Similarly, countries have created special boards for export credit and promotion. These boards provide important services like insurance and payment guarantees in international trade. It would be fair to say that in the absence of financial markets and systems, international trade would be negatively impacted.

4.Helps in capital formation:

Stable financial markets raise investor confidence. As a result, investors from domestic as well as international markets start investing in the capital markets. As a result, more capital becomes available to domestic companies. They can then use this capital to increase economies of scale, which makes them more competitive in the international market. If these financial institutions and markets were not present, foreign investors would find it very difficult to locate investment opportunities and follow through with them.

5.Helps in Infrastructure Development:

Financial markets play a vital role in infrastructure development, as well. This is because the private sector may face great difficulties in raising large amounts of funds for projects with a high gestation period. It is the financial markets that provide the liquidity required by investors. Investors can sell their securities and cash out whenever they want. It is not important for the same investor to hold on to the security for the entire tenure of the loan. Key sectors like power generation, oil, and gas, transport, telecommunication, and railways receive a lot of funding at concessional rates thanks to the financial markets. Financial markets also allow governments to raise large sums of money. This enables them to continue deficit spending. In the absence of financial markets, governments would not be able to continue deficit spending, which is important to fund infrastructure projects in the short run.

6.Help in Employment Creation:

The financial system provides capital to entrepreneurs who want to start a business. When these businesses come into existence, they, directly and indirectly, require the services of a wide variety of personnel. As a result, a lot of employment is generated in the economy. The financial services sector provides a lot of employment. Many of these jobs are high paying white-collar positions that are capable of bringing the employed person into the middle class.

Q11) Write a brief note on overview of Indian financial system. 8

A11) Financial system is a system for the efficient management and creation of finance. According to Robinson, financial system provides a link between savings and investment for the creation of new wealth and to permit portfolio adjustment in the composition of the existing wealth. According to Van Horne, financial system is defined as the purpose of financial markets to allocate savings efficiently in an economy to ultimate users –either for investment in real assets or for consumption. The services that are provided to a person by the various Financial Institutions including banks, insurance companies, pensions, funds, etc. constitute the financial system.

The objectives of the financial system are

1. Accelerating the growth of economic development.

2. Encouraging rapid industrialization

3. Acting as an agent to various economic factors such as industry, agricultural sector, Government etc.

4. Accelerating rural development

5. Providing necessary financial support to industry

6. Financing housing and small scale industries

7. Development of backward areas, infrastructure and livelihood

8. Imposing price control in need

9. Protecting environment. Functions of financial system are distributed from creation of money to efficient Management. It is the sum total of the functions of the various intermediaries.

The features of the Indian Financial system:

- It plays a vital role in the economic development of the country as it encourages both savings and investment

- It helps in mobilising and allocating one’s savings

- It facilitates the expansion of financial institutions and markets

- Plays a key role in capital formation

- It helps form a link between the investor and the one saving

- It is also concerned with the Provision of funds

Different components of financial system are-

Figure: Components of financial system

1. Financial market

Financial market refers to the intangible market where financial assets/instruments are purchased and sold for both short period and long period. It provides an organised platform to financial institutions, companies, Government, individuals and brokers to trade the financial instruments like share, debenture, bond, treasury bills, commercial papers, commercial bills etc.

2. Financial institutions

Financial institutions are organisation that facilitates transfer of fund from surplus sector to the deficit sector of the economy. It facilitates promotion of savings and investment in the economy by providing different investment opportunities.

3. Financial instruments

Financial instrument is a claim against a person or an institution for payment of specified sum of money and/or payment of periodic payment in the form interest/dividend at a future date. Such instruments are marketable either in the capital market or money market. Financial instruments represents shares, debentures, bonds, treasury bills, commercial papers, certificate of deposits and commercial bills.

4. Financial services

Financial service refers to monetary benefit/satisfaction derived from financial instruments, financial products and providers of financial services. Different banks and non-banks provide variety of financial services to users according to their convenience and need.

5. Regulatory bodies

Regulatory bodies are institutions established to regulate the components financial system for uninterrupted and smooth functioning of the economy. It is an organised mechanism where different regulatory bodies formulate plans and policies, rules and regulations, guidelines etc. to control and regulate the financial system. Some of the examples are Reserve Bank of India, Securities and Exchange Board of India, Insurance Regulatory Development Authority, Securities Contract Regulation Act etc.