Unit 2

Financial Markets

Q1) Discuss about the characteristics of money market. 8

A1) Some of the significant characteristics are Indian money market are-

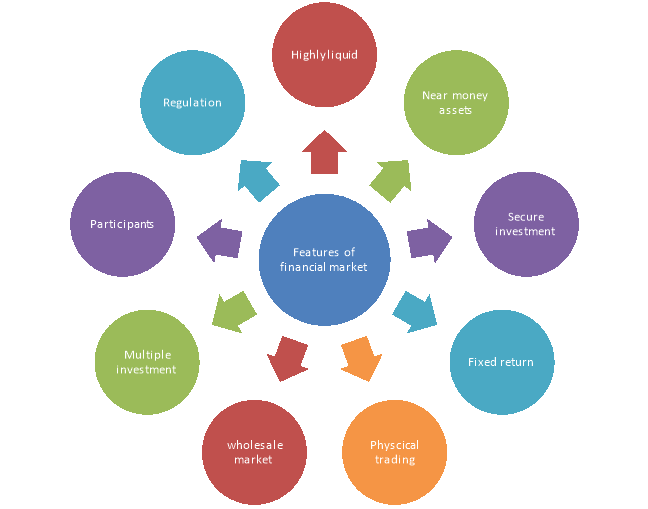

Figure: Features of financial market

1. High Liquidity

One of the key features of these financial assets is high liquidity offered by them. They generate fixed-income for the investor and short term maturity makes them highly liquid. Owing to this characteristic money market instruments are considered as close substitutes of money.

2. Deals with near money assets:

It deals with near money assets like treasury bills, commercial papers, certificate of deposits, repo, certificate of deposits etc. Such financial instruments are called as near money assets because it involves some amount of money.

3. Secure Investment

These financial instruments are one of the most secure investment avenues available in the market. Since issuers of money market instruments have a high credit rating and the returns are fixed beforehand, the risk of losing your invested capital is minuscule.

4. Fixed returns

Since money market instruments are offered at a discount to the face value, the amount that the investor gets on maturity is decided in advance. This effectively helps individuals in choosing the instrument which would suit their needs and investment horizon.

5. Physical trading

Money markets across the world essentially operate over the counter, which implies that the trading of these funds cannot be made online. Hence, investments in the money market are made physically by authorized representatives or in person. Later, a physical certificate is issued to the buyer of the money market instrument.

6. Wholesale Market

Money markets are designed to provide and accept bulk orders. Thus, retail investors who have enough capital can directly participate in money markets, while individual investors must invest in debt mutual funds that invest in money markets in order to benefit from this market.

7. Multiple Instruments

Unlike capital markets which usually trade in one single type of instrument, money markets trade is multiple instruments. These instruments differ in terms of maturity periods, debt structure, credit risk, currency, among others. Money market instruments are therefore considered ideal for diversification through exposure.

8. Key Money Market Participants

Since money markets deal with only bulk orders, they are not open to individual investors. As a result of which, multiple institutional investors such as financial institutions and dealers looking to borrow or lend money for a short term participate in the trading of these instruments.

9. Regulated by RBI

The Indian money market is controlled and regulated by the Reserve Bank of India. RBI is the only institution that can influence the organised sector, while the smaller unorganised sector is largely beyond its control. However, due to the considerably larger size of this organised sector, regulatory actions taken by the RBI can produce a substantial impact on the way in which this entire market operates.

Q2) Explain the functions of Indian financial market. 5

A2) Different functions performed by money market are discussed below-

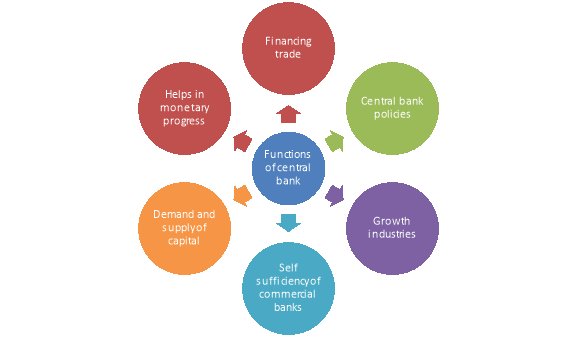

Figure: Functions of central bank

1. Financing Trade

The money market provides financing to local and international traders who are in urgent need of short-term funds. It provides a facility to discount bills of exchange, and this provides immediate financing to pay for goods and services. International traders benefit from the acceptance houses and discount markets. The money market also makes funds available for other units of the economy, such as agriculture and small-scale industries.

2. Central Bank Policies

The central bank is responsible for guiding the monetary policy of a country and taking measures to ensure a healthy financial system. Through the money market, the central bank can perform its policy-making function efficiently. For example, the short-term interest rates in the money market represent the prevailing conditions in the banking industry and can guide the central bank in developing an appropriate interest rate policy. Also, the integrated money markets help the central bank to influence the sub-markets and implement its monetary policy objectives.

3. Growth of Industries

The money market provides an easy avenue where businesses can obtain short-term loans to finance their working capital needs. Due to the large volume of transactions, businesses may experience cash shortages related to buying raw materials, paying employees, or meeting other short-term expenses. Through commercial paper and finance bills, they can easily borrow money on a short-term basis. Although money markets do not provide long-term loans, it influences the capital market and can also help businesses obtain long-term financing. The capital market benchmarks its interest rates based on the prevailing interest rate in the money market.

4. Commercial Banks Self-Sufficiency

The money market provides commercial banks with a ready market where they can invest their excess reserves and earn interest while maintaining liquidity. Short-term investments, such as bills of exchange, can easily be converted to cash to support customer withdrawals. Also, when faced with liquidity problems, they can borrow from the money market on a short-term basis as an alternative to borrowing from the central bank. The advantage of this is that the money market may charge lower interest rates on short-term loans than the central bank typically does.

5. Balance amongst demand and supply of capital

By way of transfer of savings into investments, the money market grants money to be used in a balanced way which maintains the balance amongst demand and supply of the capital amount.

6. Helps in Monetary Progress

For fulfilling the working capital requirements of the various financial institutions, a money market provides short-term capital to them. It boosts the expansion of commerce, industry and trade by discounting the trade bills by way of commercial banks, acceptance houses, brokers, etc.

Q3) Discuss about the participants of money market. 5

A3) The participants of money market are discussed below-

1. Central Government:

Central Government is a borrower in the money market through the issue of Treasury Bills (T-Bills). The T-Bills are issued through the RBI. The T-Bills represent zero risk instruments. They are issued with tenure of 91 days (3 months), 182 days (6 months) and 364 days (1 year). Due to its risk free nature, banks, corporates and many such institutions buy the T-Bills and lend to the government as a part of it short- term borrowing programme.

2. Public Sector Undertakings:

Many government companies have their shares listed on stock exchanges. As listed companies, they can issue commercial paper in order to obtain its working capital finance. The PSUs are only borrowers in the money market. They seldom lend their surplus due to the bureaucratic mindset. The treasury operations of the PSUs are very inefficient with huge cash surplus remaining idle for a long period of time.

3. Non-banking financial companies

NBFCs acts as an intermediary in the money market. Some of them are-

- Insurance Companies:

Both general and life insurance companies are usual lenders in the money market. Being cash surplus entities, they do not borrow in the money market. With the introduction of CBLO (Collateralized Borrowing and Lending Obligations), they have become big investors. In between capital market instruments and money market instruments, insurance companies invest more in capital market instruments. As their lending programmes are for very long periods, their role in the money market is a little less.

- Mutual Funds:

Mutual funds offer varieties of schemes for the different investment objectives of the public. There are many schemes known as Money Market Mutual Fund Schemes or Liquid Schemes. These schemes have the investment objective of investing in money market instruments. They ensure highest liquidity to the investors by offering withdrawal by way of a day’s notice or encashment of units through Bank ATMs. Naturally, mutual funds invest the corpus of such schemes only in money market. They do not borrow, but only lend or invest in the money market.

4. Commercial banks:

Scheduled commercial banks are very big borrowers and lenders in the money market. They borrow and lend in call money market, short-notice market, repo and reverse repo market. They borrow in rediscounting market from the RBI and IDBI. They lend in commercial paper market by way of buying the commercial papers issued by corporates and listed public sector units. They also borrow through issue of Certificate of Deposits to the corporates.

5. Corporates:

Corporates borrow by issuing commercial papers which are nothing but short-term promissory notes. They are issued by listed companies after obtaining the necessary credit rating for the CP. They also lend in the CBLO market their temporary surplus, when the interest rate rules very high in the market. They are the lender to the banks when they buy the Certificate of Deposit issued by the banks. In addition, they are the lenders through purchase of Treasury bills.

Q4) Discuss about the organisational structure of money market. 5

A4) The organisational structure of money market are discussed below-

1. Call Money Market:

The most important component of organised money market is the call money market. It deals in call loans or call money granted for one day. Since the participants in the call money market are mostly banks, it is also called interbank call money market. The banks with temporary deficit of funds form the demand side and the banks with temporary excess of funds form the supply side of the call money market.

2. Treasury Bill Market:

The treasury bill market deals in treasury bills which are the short-term (i.e., 91, 182 and 364 days) liability of the Government of India. Theoretically these bills are issued to meet the short-term financial requirements of the government. But, in reality, they have become a permanent source of funds to the government. Every year, a portion of treasury bills are converted into long-term bonds. Treasury bills are of two types: ad hoc and regular. Ad hoc treasury bills are issued to the state governments, semi- government departments and foreign central banks. They are not sold to the banks and the general public, and are not marketable. The regular treasury bills are sold to the banks and public and are freely marketable. Both types of ad hoc and regular treasury bills are sold by Reserve Bank of India on behalf of the Central Government. The treasury bill market in India is underdeveloped as compared to the treasury bill markets in the U.S.A. And the U.K.

3. Commercial Bill Market:

Commercial bill market deals in commercial bills issued by the firms engaged in business. These bills are generally of three months maturity. A commercial bill is a promise to pay a specified amount in a specified period by the buyer of goods to the seller of the goods. The seller, who has sold his goods on credit draws the bill and sends it to the buyer for acceptance. After the buyer or his bank writes the word ‘accepted’ on the bill, it becomes a marketable instrument and is sent to the seller. The seller can now sell the bill (i.e., get it discounted) to his bank for cash. In times of financial crisis, the bank can sell the bills to other banks or get them rediscounted from the Reserved Bank. In India, the bill market is undeveloped as compared to the same in advanced countries like the U.K. There is absence of specialised institutions like acceptance houses and discount houses, particularly dealing in acceptance and discounting business.

4. Collateral Loan Market:

Collateral loan market deals with collateral loans i.e., loans backed by security. In the Indian collateral loan market, the commercial banks provide short- term loans against government securities, shares and debentures of the government, etc.

5. Certificate of Deposit and Commercial Paper Markets:

Certificate of Deposit (CD) and Commercial Paper (CP) markets deal with certificates of deposit and commercial papers. These two instruments (CD and CP) were introduced by Reserve Bank of India in March 1989 in order to widen the range of money market instruments and give investors greater flexibility in the deployment of their short-term surplus funds.

Q5) Define money market. Discuss the role of RBI in Indian money market. 5

A5) Money market is a part of financial market where near money assets are traded for short period i.e. for less than one year or one year. Money market transactions facilitates to maintain the liquidity position of the economy through dealing in financial instruments like treasury bills, commercial papers, certificate of deposits, repo, certificate of deposits etc. It is regulated by the Reserve Bank of India.

The RBI (central bank) plays a significant role in the money market of India. It takes measures to control short term money supply in the economy. Some of the significant roles of RBI in money market are discussed below-

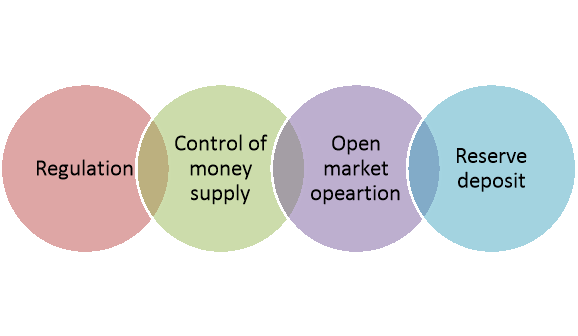

Figure: Role of central bank in money market

- Regulations:

Money market is regulated by RBI by regulating the activities of money market participants. It issues rules, regulations and guidelines for money market transactions and other related operations.

2. Controls money supply:

It controls short term money supply in the economy by regulating bank rates, repo rates, cash reserve and open market operations. If there is excess in short term money supply, RBI tightens the rates. On the other hand if there is deficit in money supply in the economy, it liberalise such rates.

3. Open market operation:

These refer to buying and selling of government securities by central bank to public and banks in the money market. This is done to influence money supply in the country. Sale of government securities to commercial banks means flow of money into the central bank which reduces cash reserves. Consequently, credit availability of commercial banks is curtailed / controlled. When central bank buys securities, it increases cash reserves of the banks and their ability to give credit.

4. Reserve deposit:

The scheduled commercial banks keep reserve deposit with RBI in the form of cash reserve ratio and statutory liquidity ratio. RBI uses such reserves to control credit capacity of commercial banks.

Q6) Write a note on overview of Indian money market. 5

A6) The Indian money market is still in its infant stage and still developing. The rent trends in the Indian money market are discussed below-

1. An increase in secured funding

Secured funding provides an alternative source of term liquidity for the Group balance sheet. In the unsecured market, banks' cash borrowings decreased by 44%. And secured funding is increasing rapidly.

2. Changes in the repo market:

The growing gap between where dealer-banks are willing to finance each other through the vast and shadowy "repo" market vs. What investors charge for such collateralized lending shows the negative feedback loop of heightened regulatory pressures on banks. In a repo, one party sells an asset (usually fixed-income securities) to another party at one price at the start of the transaction and commits to repurchase the fungible assets from the second party at a different price at a future date or (in the case of an open repo) on demand. If the seller defaults during the life of the repo, the buyer (as the new owner) can sell the asset to a third party to offset his loss. The asset therefore acts as collateral and mitigates the credit risk that the buyer has on the seller. As banks continue to repay the liquidity facilities provided by the ECB, they have returned to the repo market for funding. The survey reveals that the market share of euro-denominated repos has recovered from 57% in June 2012 to 66% in December last year. As a result, collateral remains in high demand, not only from central bank holdings (due to asset purchases) and capital requirements, but also from banks attempting to secure funding. Investors such as money-market mutual funds have had the option of parking their cash elsewhere at these times when dealers are shunning them, even as rates are lower.

3. Price Formation and Transmission:

This is very popular trends in money market. Price formation is one of the key elements of market economy functioning. The price of a commodity or a service is formed as a result of numerous economic, political and social processes and this is true for traditional commodity relations as well as for financial markets. In business terms, price transmission means the process in which upstream prices affect downstream prices. Upstream prices should be thought of in terms of main inputs prices (for processing / manufacturing, etc.) or prices quoted on higher market levels (e.g. Wholesale markets).

4. Low Level of Interest Rates:

Currently many banks are offering Low Level of Interest Rates on home loan, car loan etc. for attraction of people.

5. Increase in investment:

Investment by companies and wealthy individuals in zero-risk treasury bills has been on the rise over the last one year.

Q7) Discuss about the functions of capital market. 8

A7) The important functions and significance of the markets have been discussed below: –

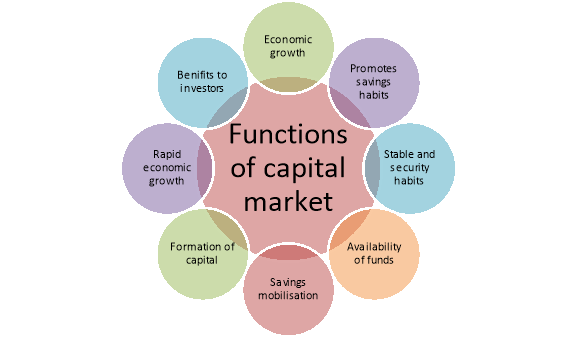

Figure: Functions of capital market

- Economic Growth:

The Capital Markets help to accelerate the process of economic growth. It reflects the general condition of the economy. Capital Market helps in the proper allocation of resources from the people who have surplus capital to the people who are in need of capital. So, we can say that it helps in the expansion of industry and trade of both public and private sectors leading to a balanced economic growth in the country.

2. Promotes Savings Habits:

After the development of Capital Markets, the taxation system, and the banking institutions provide facilities and provisions to the investors to save more. In the absence of Capital Markets, they might have invested in unproductive assets like land or gold or might have indulged in unnecessary spending.

3. Stable and Systematic Security prices:

Apart from the mobilization of funds, the Capital Markets helps to stabilize the prices of stocks. Reduction in the speculative activities and providing capital to borrowers at a lower interest rate help in the stabilization of the security prices.

4. Availability of Funds:

Investments are made in Capital Markets on a continuous basis. Both the buyers and sellers interact and trade their capital and assets through an online platform. Stock Exchanges like NSE and BSE provide the platform for this and thus the transactions in the capital market become easy.

5. Savings Mobilization

Capital market acts as a link between savers and entrepreneurial borrowers. It transfers money from savers (households) to entrepreneurial borrowers (companies who need capital). This way these markets mobilize savings in an economy and divert them into productive investment. Productive usage of funds paves the way for economic growth and prosperity.

6.Formation of Capital

Capital formation is the process of increasing the stock of real capital. It includes the creation of capital goods like factories, machinery, tools, equipment and so on. These capital goods are utilized for the production of other goods. Savings are mobilized through the capital market to various sectors such as the agricultural sector, industrial sector, etc in an optimal manner. Optimal allocation increases the rate of capital formation in an economy.

7.Rapid Economic Growth

The allocation of capital is done optimally, for better utilization of scarce resources. Improvement in capital goods increases the efficiency of labor. Superior and technologically advanced capital goods increase overall productivity. This increased productivity enhances economic growth.

- Benefits to Investors

In the capital market, investors are provided with an avenue for long-term investments. Most importantly, investors are offered a wide variety of instruments like bonds, mutual funds, insurance policies, equities, etc. This enables investors to diversify and channelize their savings into the most profitable avenues. To protect investors from any unscrupulous activities, these markets are strictly regulated.

Q8) What is equity market? What process involved in equity market? 5

A8) Equity market is a place where stocks and shares of companies are traded. The equities that are traded in an equity market are either over the counter or at stock exchanges. Equity markets serve as a platform for both private stocks traded over the counter and public stocks listed on exchanges such as BSE, NSE, etc. Equity markets comprise structured trading and investment and can be defined into two types of platforms, i.e., primary and secondary markets.

Figure: Types of equity market

- Primary market

Each company plans to offer its shares for public trading must start with Initial Public Offering or IPO. In this process, the company offers a part of its total equity to the public for raising capital initially. Once the IPO is complete, the stocks so offered are listed on the stock exchange for further trading. The entire process of introducing the IPO by a company takes place in the primary market. In other words, this market comprises only the IPO introduction and investment.

- Secondary market

Once the shares have already been listed on either of the exchanges, further trading for them is held in the secondary market. Here, the initial investors get an opportunity to exit their investments via stock sale in this live equity market. These stocks can comprise shares, along with other types of securities that can include convertible bonds, corporate bonds, etc.

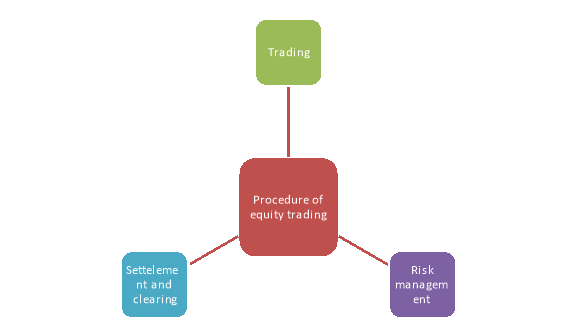

Procedures Involved in the Equity Market

An equity market does not solely serve to facilitate trading. It is functioning also encompasses other procedures. Here’s a gist of these procedures.

Figure: Procedure of equity trading

1.Trading

Trading is a fundamental procedure that involves buying and selling of securities belonging to listed companies. The procedure is completed through the screen-based automated system, with brokering agents providing these services to individual traders against stipulated fees. It serves as an open platform where buyers and sellers can place an order as per trade option availability.

2.Risk management

Risk management is another specific procedure associated with stock markets. As investing in the equity market involves risk, the comprehensive system of risk management ensures that investors’ interest remains protected while exercising any curbs on frauds from a company’s end. The system also enables the stock market to remain updated with any changing trading mechanisms and hedge possible market failures.

3.Settlement and clearing

Every investment or trading made throughout the day is cleared and settled by the end of this particular day. A stock exchange does this through a well-defined cycle of settlement. In Indian exchanges, the T+2 cycle is adopted for such settlements, which means the settlements are made within two days after the trade has been concluded for a specific day, considered day 1.

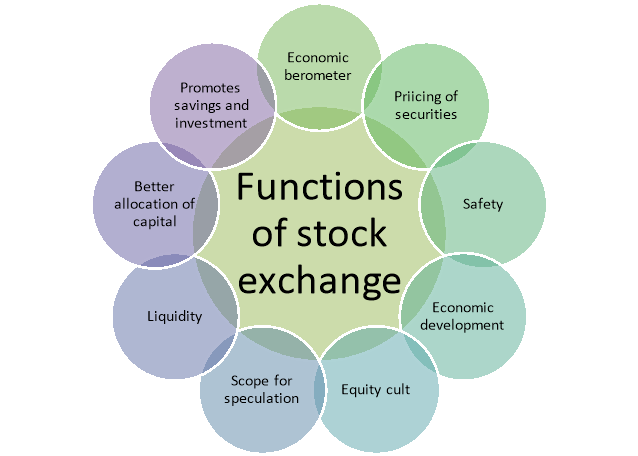

Q9) What is stock exchange? Discuss the functions of stock exchange. 8

A9) Security market also known as known as stock exchange is an organised and well regulated platform for buying and selling of securities. According to section 2(j) of the Securities Contract Regulation Act 1956 “stock exchange” means— for the purpose of assisting, regulating or controlling the business of buying, selling or dealing in securities. The stock exchange performs variety of functions to conduct buying and selling of securities. Such functions are discussed below-

Figure: Functions of stock exchange

1. Economic Barometer:

A stock exchange is a reliable barometer to measure the economic condition of a country. Every major change in country and economy is reflected in the prices of shares. The rise or fall in the share prices indicates the boom or recession cycle of the economy. Stock exchange is also known as a pulse of economy or economic mirror which reflects the economic conditions of a country.

2. Pricing of Securities:

The stock market helps to value the securities on the basis of demand and supply factors. The securities of profitable and growth oriented companies are valued higher as there is more demand for such securities. The valuation of securities is useful for investors, government and creditors. The investors can know the value of their investment, the creditors can value the creditworthiness and government can impose taxes on value of securities.

3. Safety of Transactions:

In stock market only the listed securities are traded and stock exchange authorities include the companies names in the trade list only after verifying the soundness of company. The companies which are listed they also have to operate within the strict rules and regulations. This ensures safety of dealing through stock exchange.

4. Contributes to Economic Growth:

In stock exchange securities of various companies are bought and sold. This process of disinvestment and reinvestment helps to invest in most productive investment proposal and this leads to capital formation and economic growth.

5. Spreading of Equity Cult:

Stock exchange encourages people to invest in ownership securities by regulating new issues, better trading practices and by educating public about investment.

6. Providing Scope for Speculation:

To ensure liquidity and demand of supply of securities the stock exchange permits healthy speculation of securities.

7. Liquidity:

The main function of stock market is to provide ready market for sale and purchase of securities. The presence of stock exchange market gives assurance to investors that their investment can be converted into cash whenever they want. The investors can invest in long term investment projects without any hesitation, as because of stock exchange they can convert long term investment into short term and medium term.

8. Better Allocation of Capital:

The shares of profit making companies are quoted at higher prices and are actively traded so such companies can easily raise fresh capital from stock market. The general public hesitates to invest in securities of loss making companies. So stock exchange facilitates allocation of investor’s fund to profitable channels.

9. Promotes the Habits of Savings and Investment:

The stock market offers attractive opportunities of investment in various securities. These attractive opportunities encourage people to save more and invest in securities of corporate sector rather than investing in unproductive assets such as gold, silver, etc.

Q10) Discuss about different money market instruments. 8

A10) The following are some key money market instruments to be considered while investing in India-

Figure: Money market instruments

- Treasury Bills

Treasury bills or T-bills are issued by the Reserve Bank of India on behalf of the Central Government for raising money. T-bills do not pay any interest but are available at a discount to the face value at the time of issue. At maturity, the investor gets the face value amount. This difference between the initial value and face value is the return earned by the investor. Treasury Bills are by far the oldest of money market instruments and are considered to be the safest short term fixed income investments as they are backed by the Government of India. Since T-bills are issued by the government, they offer guaranteed returns and are known to be zero default risk investments. Additionally, T-bills have a short maturity period of up to 1 year. T-Bills are commonly classified on the basis of their maturity period and their type.

a) The maturity-based classification of treasury bills names them as 10-day TBs, 91-day TBs, 182-day TBs, and 364-day TBs

b) The other classification includes auction bills and tap bills. Auction bills follow a multiple price system in order to ensure fair pricing.

c) These bills are also termed as regular bills as they are available for investment by banks and other participating institutions

2. Commercial Papers

Large companies and businesses issue promissory notes to raise capital from investors in order to meet their short term business needs. These promissory notes are known as Commercial Papers (CPs). The firms issuing commercial papers have a high credit rating, owing to which they are unsecured, with the company’s credibility acting as security for the financial instrument. Corporates, primary dealers (PDs) and All-India Financial Institutions (FIs) can issue CPs. CPs have a fixed maturity period ranging from 7 days to 270 days. However, investors can trade this instrument in the secondary market, wherever they offer relatively higher returns compared to that from treasury bills.

3. Certificate of Deposit (CD)

Certificates of deposit are financial assets issued by banks and financial institutions, offering a fixed interest rate on the invested amount, similar to a fixed deposit. The primary difference between a CD and a Fixed Deposit is that of the principal amount. A certificate of deposit is issued only for large sums of money (1 lakh or in multiples of 1 lakh thereafter). Because of the restriction on the minimum investment amount, CDs are more popular among organizations than individuals who are looking to park their surplus for short term and earn interest on the same. The maturity period of Certificates of Deposits ranges from 7 days to 1 year if issued by banks. However, other financial institutions also issue a CD with a maturity period of 1 year to 3 years.

4. Repurchase Agreements or Ready Forward Contract (Repo)

Also known as repos or buybacks, a Repurchase Agreement is a formal agreement between two parties, where one party sells a security to another, with the promise of buying it back at a later date. It is also called a Sell-Buy transaction. The seller buys the security at a predetermined time and amount which also includes the interest rate at which the buyer agreed to buy the security. The interest rate charged by the buyer for agreeing to buy the security is called Repo rate. Repos come-in handy when the seller needs funds for the short-term, s/he can just sell the securities and get the funds to dispose of. The buyer gets an opportunity to earn decent returns on the invested money. Repo rate, fixed by the RBI may be defined as the rate at which domestic Indian banks borrow from other Indian banks or from the RBI. A decreasing repo rate makes it cheaper for banks to borrow money from other banks or the central bank. This, ultimately allows the bank to pass on the lower rate benefit to customers in the form of loans provided at reduced rates

5. Banker’s Acceptance

This is a financial instrument produced by an individual or a corporation in the name of the bank, wherein the issuer must pay a specified amount to the instrument holder on a predetermined date, between 30 and 180 days, starting from the date of issue of the instrument. Banker’s Acceptance is issued at a discounted price, and the actual price is paid to the holder at maturity. The difference between the two is the profit made by the investor. Banker’s acceptance is a secure financial instrument as the payment is guaranteed by a commercial bank

6. Call Money

Call money essentially represents a short term loan for the purpose of making stock exchange transactions with maturities ranging from 1 day to 14 days and is repayable on demand. The call money market participants are allowed to lend and borrow using the call money instruments such as STCI (Securities Trading Corporation of India), DFHI (Discount and Finance House of India), co-operative banks and Indian and foreign commercial banks. Call money loans feature a fixed interest rate, termed as call rate, which being closely related to changes in demand and supply, is quite volatile. Due to this high level of volatility, the call money market is considered to be the most sensitive section of India’s money market

7. Interest Rate Swaps

Interest rate swap is referred to a financial transaction in which two parties sign a deal wherein one pays a fixed rate of interest, and the other pays a floating rate of interest. The fixed rate of interest payable is calculated using a notional principal amount, while the floating rate of interest is paid on the actual principal lent out/borrowed with the rate varying on the basis of market conditions. In India, interest rate swaps are mainly used by commercial banks. However, these are separate products that are not directly linked to the bank’s assets such as money lent to customers in the form of loans. This money market instrument protects the borrower from interest rates changes even though the borrower is on the hook for any variable mark-up payments not covered by the interest rate swap agreement.

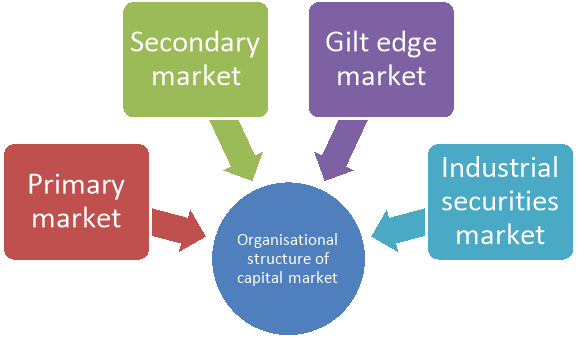

Q11) Explain the structure of capital market. 5

A11) The organisational structure capital market are discussed below-

Figure: Organisational structure of capital market

- Primary Market

The primary market is also called “New Issue Market” where a company brings Initial Public Offer (IPO) to get itself listed on the stock exchange for the first time. In the primary market, the mobilisation of funds is done through right issue, private placement and prospectus. The fund collected by the company in the IPO is used for its future expansion and growth. Primary markets help the investors to put their savings into companies that are looking to expand their enterprises.

2. Secondary Market

The secondary market is a type of capital market where the securities that are already listed on the exchange are traded. The trading done on the stock exchange and over the counter falls under the secondary market. Examples of secondary markets in India are National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

3. Government Securities Market/Gilt edge market:

This is also known as the Gilt-edged market. This refers to the market for government and semi-government securities backed by the Reserve Bank of India (RBI).

4. Industrial Securities Market:

This is a market for industrial securities i.e. market for shares and debentures of the existing and new corporate firms. Buying and selling of such instruments take place in this market. This market is further classified into two types such as the New Issues Market (Primary) and the Old (Existing) Issues Market (secondary). In primary market fresh capital is raised by companies by issuing new shares, bonds, units of mutual funds and debentures. However in the secondary market already existing i.e old shares and debentures are traded. This trading takes place through the registered stock exchanges. In India we have three prominent stock exchanges. They are the Bombay Stock Exchange (BSE), the National Stock Exchange (NSE) and Over The Counter Exchange of India (OTCEI).