Unit 3

Financial Institutions

Q1) Define bank. Discuss the structure of commercial bank. 8

A1) According to section 5(b) of Banking Regulation Act, 1949, “banking” means the accepting, for the purpose of lending or investment, of deposits of money from the public, repayable on demand or otherwise, and withdrawal by cheque, draft, order or otherwise.

According to section 5 (c) of Banking Regulation Act, 1949, “banking company” means any company which transacts the business of banking [in India]. Explanation.—Any company which is engaged in the manufacture of goods or carries on any trade and which accepts deposits of money from the public merely for the purpose of financing its business as such manufacturer or trader shall not be deemed to transact the business of banking within the meaning of this clause.

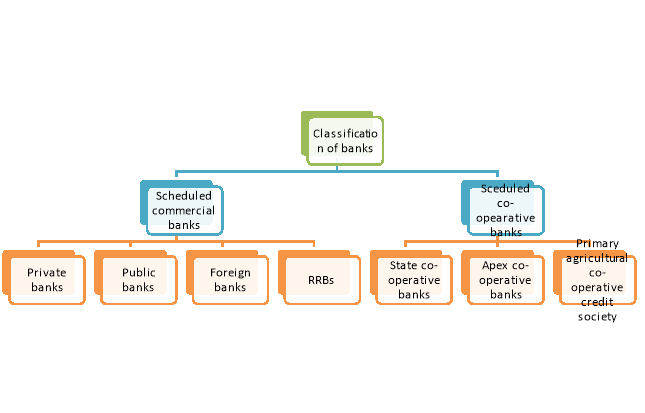

Classification of banks in India

Depending on the nature of activities performed and ownership, the classification of banks are discussed below-

Figure: Classification of banks

A) Scheduled Commercial banks: It refers to the banks established to facilitate trade and industry. It is again sub-divided as follow-

i) Public sector bank: It refers to the commercial banks where more than 50 per cent shares are held by the government. At present there are 12 public sector banks in India. It is again grouped as-

- SBI and its associates

- Other nationalised banks.

Some examples of public sector banks are State Bank of India, Punjab National bank, Union Bank of India etc.

Ii) Private sector bank: It refers to the commercial banks where more than 50 per cent shares are owned by the private individuals. Some examples of private sector bans are Yes bank, ICICI, City bank, Federal bank etc.

Iii) Foreign bank: It refers to the commercial bank which is operating in India but their head office is situated outside India. For example HSBC ban Ltd. Standard Chartered etc.

Iv) Regional Rural Bank: RRBs are commercial banks established to operate at regional level of different states and to focus on the banking needs of rural masses. For example, Maharashtra Garmin bank, Assam Gramin Vikash bank etc.

B) Scheduled Co-operative bank: It refers to the bank established according to the co-operative principle and consumers are the owners of the bank. It provides normal banking services to its customers but it mainly focus on the agriculture and allied activities. It operates under three tier structure-

- State Co-operative banks operate at the State level

- Apex Co-operative banks operate at the District level

- Primary Agricultural Co-operative Credit Society operates at the village level.

Q2) Explain the functions of commercial bank. 8

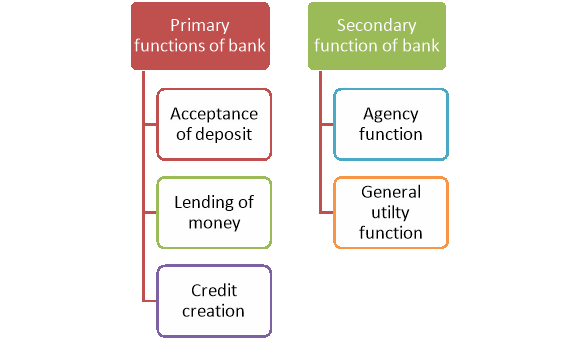

A2) The bank provides variety of service to satisfy the customer needs. The functions of commercial bank are-

Figure: Functions of bank

A) Primary functions: These are the traditional functions of commercial banks.

i) Acceptance of deposit: Banks accept deposit from the public under savings account, current account, recurring deposit account and fixed deposit account. Deposits of savings and current account are repayable on demand and deposit of recurring and fixed account is repayable on maturity.

Ii) Lending of money: Banks lend money to the general public to satisfy their borrowing needs. Different types of lending facilities provided to the customers by banks are bank overdraft, discounting of bills, cash credit and term loans.

Iii) Creation of credit: Banks create credit while lending money to the borrowers. When bank approve any loan of a customer, it opens a secondary/loan account in the name of the borrower and deposit (credit) the sanctioned loan amount. Thus banks create credit through its lending activities.

B) Secondary functions: Secondary functions of bank are grouped under two heads-

i) Agency functions: Bank acts as an agent for its customers. Some of the agency functions performed by banks are-

- Collection and payment of cheque on behalf of customers.

- Purchase and sale of securities through Demat account on behalf of customers.

- Collection of interest and dividend from respective company and credit the same in respective account of customers.

- Payment of premium, bills, standing orders etc. on scheduled date on behalf of the customers.

- Remittance of money from one place to another place etc.

Ii) General utility functions: Banker perform general utility functions to provide the customers retail and more convenient banking services. Some of the general utility functions performed by banks are-

- Gift cheque and travellers cheque facility.

- Tax consultancy service for efficient tax planning of beneficiaries.

- Locker facility service to keep valuable documents and ornaments.

- Plastic money (Debit card, credit card) facility for easy handling of cash.

- Internet banking and mobile banking facility for fast and convenient transfer and payment of money.

- Green channel facility for promotion of cashless transactions etc.

Q3) Discuss the role of commercial bank in project financing and working capital financing. 12

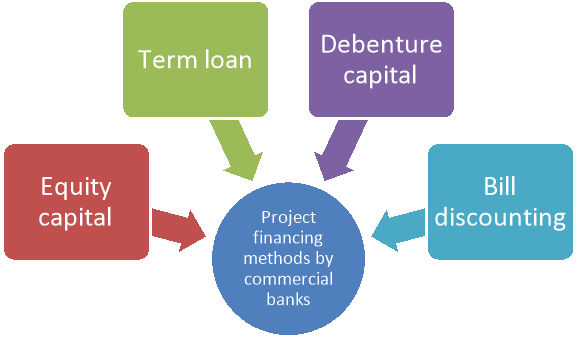

A3) Project financing in India is used for both greenfield and brownfield projects in sectors such as public infrastructure (roads, airports, metro rail and ports, among others), energy (power generation (solar, thermal, wind, hydro), power transmission and so on), construction, manufacturing (cement), education, healthcare, telecommunication. It receives financing facility from both the banks and NBFCs. The commercial banks provides project financing in the following forms-

Figure: Project financing methods by commercial banks

- Equity capital

The commercial banks arranges long term fund investing in equity shares and preference shares of the project. The commercial banks also participate in the management of the company.

2. Term loan

Both long term and medium term loan is provided by commercial banks to projects. Long term loans are supplied for capital investment and short term loan is supplied to arrange their working capital requirements.

3. Debenture capital

The commercial banks supply debt finance to projects by investing in their debenture capital. Such investments are for long duration and bank receives interest for such investment in projects.

4. Bill discounting

Projects also get bill discounting facility from commercial banks to manage their short term fund requirement. The commercial banks provide loans against the bills of exchange to the projects

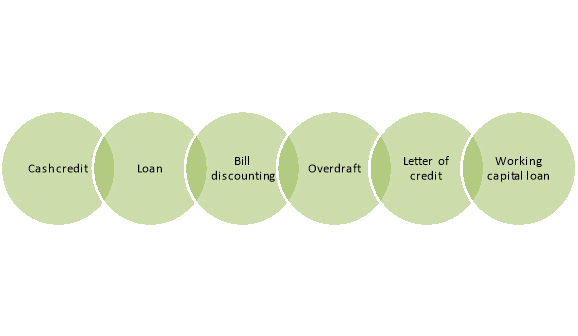

Working capital refers to short term capital required form investment in purchase of raw material, payment of wages, salary, electricity bill, creditors and meeting other miscellaneous expenses. The methods of working capital financing by commercial banks are discussed below-

Figure: Methods of working capital financing by commercial banks

- Cash Credit

Under this facility, the bank specifies a predetermined limit and the borrower is allowed to withdraw funds from the bank up to that sanctioned credit limit against a bond or other security. However, the borrower cannot borrow the entire sanctioned credit in lump sum; he can draw it periodically to the extent of his requirements. Similarly, repayment can be made whenever desired during the period. There is no commitment charge involved and interest is payable on the amount actually utilized by the borrower and not on the sanctioned limit.

2. Overdraft

Under this arrangement, the borrower is allowed to withdraw funds in excess of the actual credit balance in his current account up to a certain specified limit during a stipulated period against a security. Within the stipulated limits any number of withdrawals is permitted by the bank. Overdraft facility is generally available against the securities of life insurance policies, fixed deposits receipts, Government securities, shares and debentures, etc. of the corporate sector. Interest is charged on the amount actually withdrawn by the borrower, subject to some minimum (commitment) charges.

3. Loans

Under this system, the total amount of borrowing is credited to the current account of the borrower or released to him in cash. The borrower has to pay interest on the total amount of loan, irrespective of how much he draws. Loans are payable either on demand or in periodical instalments. They can also be renewed from time to time. As a form of financing, loans imply a financial discipline on the part of the borrowers.

4. Bills Financing

This facility enables a borrower to obtain credit from a bank against its bills. The bank purchases or discounts the bills of exchange and promissory notes of the borrower and credits the amount in his account after deducting discount. Under this facility, the amount provided is covered by cash credit and overdraft limit. Before purchasing or discounting the bills, the bank satisfies itself about the creditworthiness of the drawer and genuineness of the bill.

5. Letter of Credit

While the other forms of credit are direct forms of financing in which the banks provide funds as well as bears the risk, letter of credit is an indirect form of working capital financing in which banks assumes only the risk and the supplier himself provide the funds.

6. Working Capital Loan

Sometimes a borrower may require additional credit in excess of sanctioned credit limit to meet unforeseen contingencies. Banks provide such credit through a Working Capital Demand Loan (WCDL) account or a separate non–operable cash credit account.

Q4) Write a note on development financial institutions. 5

A4) Development financial institutions are specialised financial institutions established by the government to undertake developmental activities in different sectors of the economy. It was established with the Government support for underwriting their losses as also the commitment for making available low cost resources for lending at a lower rate of interest than that demanded by the market for risky projects. In the initial years of development it worked well. Process of infrastructure building and industrialization got accelerated. The financial system was improved considerably as per the needs of projects.

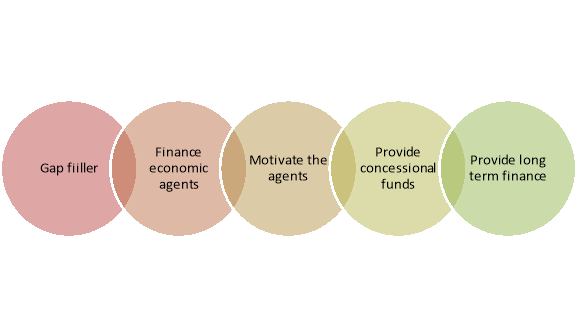

Functions of development financial institutions

The functions performed by development financial institutions are discussed below-

Figure: Functions of development financial institutions

(i) It is supposed to identify the gaps in efficacy of institutions and markets and act as a ‘gap-filler’.

(ii) It makes up for the failure of financial markets and institutions to provide certain kinds of finance to economic agents who are really interested to improve the working of economy.

(iii) It targets at economic activities or agents, which are rationed out of market. It motivates the agent to take risky business with venture finance.

(iv) It helps the funds seekers by providing concessional funds at lower rate of return. Social return of DFIs is quite high. Keeping these facts in mind central banking system also supports development financial institutions.

(v) It is specialized in nature and involved long term finance. It is exclusively meant for infrastructure and industry, finance for agriculture and small and medium enterprises (SME) development and financial products for certain sections of the people who needs funds for development perspectives.

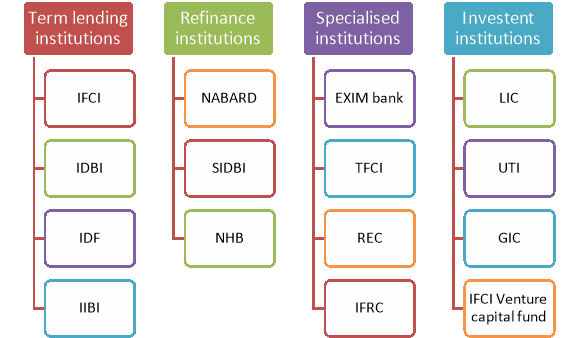

Development Financial Institutions (DFIs) in India – Forms and Types of DFIs in India

Functionally, all-India institutions can be classified as:

Figure: Classification of development financial institutions

(i) Term-lending institutions (IFCI Ltd., IDBI, IDFC Ltd., IIBI Ltd.) extending long- term finance to different industrial sectors.

(ii) Refinancing institutions (NABARD, SIDBI, NHB) extending refinance to banking as well as non-banking intermediaries for finance to agriculture, SSIs and housing sectors.

(iii) Sector-specific/specialised institutions (EXIM Bank, TFCI Ltd., REC Ltd., HUDCO Ltd., IREDA Ltd., PFC Ltd., IRFC Ltd.), and

(iv) Investment institutions (LIC, UTI, GIC, IFCI Venture Capital Funds Ltd., ICICI Venture Funds Management Co. Ltd.). State/regional level institutions are a distinct group and comprise various SFCs, SIDCs and NEDFi Ltd.

Q5) Discuss about the leading development financial institutions in India. 8

A5)

1. Industrial Finance Corporation of India (IFCI Ltd.):

It is India’s first development finance institution, was set up in 1948 on July 1 under the Industrial Finance Corporation Act, 1948 as a statutory corporation to pioneer industrial credit to medium and large scale industries. The constitution of IFCI was changed in May 1993 from a statutory corporation to a company under the Companies Act, 1956 providing the institutions with greater flexibility to respond to the needs of the rapidly changing financial system as also greater access to the capital markets. The operations of IFCI’s comprise project finance, financial services and corporate advisory services. It is providing long-term financial support to all the segments of the Indian industry, export promotion, import substitution, entrepreneurship development, pollution control, energy conservation and generation of both direct and indirect employment. It provides custodial and investor services, rating and venture capital services through its subsidiaries/ associate companies.

2. Industrial Credit and Investment Corporation (ICICI):

It was established in 1955. It facilitated industrial development in line with economic objectives of the time. It evolved several new products to meet the changing needs of the corporate sector. It provided a range of wholesale banking products and services, including project finance, corporate finance, hybrid financial structures, syndication services, treasury-based financial solutions, cash flow based financial products, lease financing, equity financing, risk management tools as well as advisory services. It also played a facilitating role in consolidation in various sectors of the Indian industry by funding mergers and acquisitions. In the context of the emerging competitive scenario in the financial sector ICICI Ltd. Had been integrated into a single full-service banking company as ICICI Bank in May 2002.

3. Industrial Development Bank of India (IDBI):

It was established on 1st July, 1964 under an act of Parliament as a wholly owned subsidiary of the Reserve Bank of India. In February 1976, its ownership was transferred to the Government of India and it was made as the principal financial institutions for coordinating the activities of institutions engaged in financing, promoting and developing industries in the country. Current shareholding of the Government of India is 58.47%. Due to change in operating environment, Government of India decided to transform IDBI into a commercial bank. The IDBI (Transfer of Undertaking and Repeal) Act, 2003 was consequently enacted by Parliament in December 2003. The Act provides for repeal of IDBI Act, corporatisation of IDBI and transformation into a commercial bank. The provisions of the Act have come into force from 2nd July, 2004 in terms of a Government Notification to this effect. The IDBI has already commenced banking business in accordance with the provisions of the new Act in addition to the business being transacted under IDBI Act, 1964.

4. Industrial Investment Bank of India Ltd. (IIBI):

It was set up in 1971 for rehabilitation of sick industrial companies. It was again reconstituted as industrial reconstruction bank of India in 1985 under the IRBI Act, 1984. With a view to converting the institutions, IRBI was incorporated under the Companies Act, 1956, as Industrial Investment Bank of India Ltd. (IIBI) in March 1997. It offers a wide range of products and services, including term loan assistance for project finance, short duration non-project backed financing, working capital/other short term loans to companies, equity subscription, asset credit, equipment finance and investment in capital market and money market instrument.

5. Infrastructure Development Finance Company Ltd. (IDFC):

It was incorporated in 1997. It was conceived as specialized institutions to facilitate the flow of private finance to commercially viable infrastructure projects through innovative products and processes. Telecom, power, roads, ports, railways, urban structure together with food and agriculture-related infrastructure. Besides, it assists the development of urban water and sanitation sectors. It has also taken new initiatives in the areas of tourism, health care and education. It provides assistance by way of debt and equity support, mezzanine structures and advisory services. It encourages banks to participate in infrastructure projects through take-out financing for a specific term and at a preferred risk profile.

Q6) Discuss mutual fund. Discuss the benefits of mutual fund. 5

A6) Mutual fund is an investment avenue where the mutual fund companies collect small savings from investors, pools it and makes investment in the share market. The profits earned from such investments are shared among the investors according to the nature and type of investment. It facilitates the investors to makes investment in the share market who has lack of knowledge in the share market. For example, UTI, SBI mutual fund, ICICI mutual fund etc.

Benefits of mutual fund

The various benefits of investing in a mutual fund are described below:

- Diversified investment: A mutual fund has a number of securities like stocks, bonds, fixed etc. already in its portfolio. Therefore, buying a mutual fund is a simple way to make a diversified investment. Further, diversification also reduces risk which is an added benefit of buying a mutual fund.

- Managed by a financial professional: The Fund manager or managers actively manage a mutual fund. They try to give the maximum returns to the investors using their professional expertise. Hence, those investors who don’t have time to invest by their own can get benefits from the expertise of these fund managers.

- Wide variety of investments: This is one of the greatest advantages of buying a mutual fund. There are a variety of mutual funds available to invest in equity fund (Index funds, growth funds, etc.), fixed income funds, income tax saver funds, balanced funds etc. An investor can easily select the best one which suits his strategy.

- Investors can buy/sell/increase/decrease their mutual funds whenever they want: There is great flexibility to for the investors while investing in mutual funds. They can easily buy, sell, increase or decrease their investment in different funds within seconds. However, please note that it’s suggested to read the mutual fund prospectus carefully before subscribing as some mutual funds have an entry or exit-load.

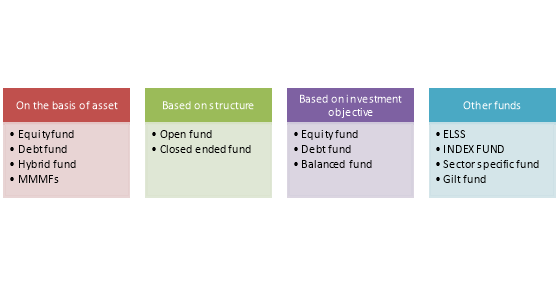

Q7) Discuss about different types of mutual fund. 12

A7) The mutual fund companies provide variety of products to satisfy the investment needs of investors. Such mutual fund companies are classified on the basis nature of investment, objectives of investment, duration and time of investment etc.

Figure: Classification of mutual fund

a) Based on Asset Class

- Equity Funds:

These funds invest the amassed money from investors in equities i.e. the stocks of different companies. The associated risks for these funds are comparatively higher as they invest in the market. However, they also provide higher returns.

2. Debt Funds:

These funds invest in debt instruments like bonds, securities, fixed income assets, the company’s debentures etc. They provide a safer investment option for investors looking for small regular returns with low risk.

3. Hybrid Funds:

As the name suggests, Hybrid or balanced funds invests in both equity and debt instruments like stocks, bonds etc. This ratio can be variable or fixed depending on the fund. This fund helps to bridge the gap between entirely equity or debt fund and suitable for investors looking to take higher risk than debt funds in order to get bigger rewards.

4. Money Market Funds:

These funds invest in liquid instruments such as bonds, T-bills, certificate of deposits etc. The risks associated with these funds are relatively low and suitable for short-term investments, less than 12 months.

b) Based on Structure

- Open End Funds:

The majority of mutual funds in India are open-end funds. These funds are not listed on the stock exchanges are available for subscription through the fund. Hence, the investors have the flexibility to buy and sell these funds at any time at the current asset value price indicated by the mutual fund.

2. Closed-End Funds:

These funds are listed on the stock exchange. They have a fixed number of outstanding shares and operate for a fixed duration. The fund is open for subscription only during a specified period. These funds also terminate on a specified date. Hence, the investors can redeem their units only on a specified date.

C) Based on investment objective

- Equity/Growth Funds

If you are investing in equity growth funds, then you are largely putting your money in stocks. The main objective of these funds is to achieve long-term capital growth. Equity funds invest at least 65% of their corpus in equity and equity-related securities. These funds may invest in a wide range of industries/sectors or focus on one or more sectors. These funds are suitable to invest in if you have a higher risk appetite and you have a long-term financial goal.

2. Debt/Income Funds

Following a simpler approach, debt/income funds usually invest 65% of the amount in fixed income securities such as bonds, corporate debentures, government securities (gilts) and money market instruments. These funds are likely to be less volatile than equity funds.

3. Balanced Funds

With an aim to provide stability of returns and capital appreciation, balanced mutual funds invest in both equities and fixed income instruments. These funds generally tend to invest around 60% in equity and 40% in debt instruments such as bonds and debentures.

D) Other Funds

- Tax Saving (Equity Linked Savings Schemes/ELSS) Funds

The Income Tax Act offers tax deduction under specific provisions of the Income Tax Act, 1961. Designed to generate capital growth, ELSS mutual funds invest primarily in equities and largely suit investors with a higher risk appetite for capital appreciation. Spread over medium to long-term, tax saving funds comes with a lock-in period of 3 years.

2. Index Funds

Index funds are attached to a particular index such as the BSE SENSEX or the S&P CNX NIFTY. Their performance is linked to the results of that index. Here, the portfolio comprises stocks that represent an index and the weightage assigned to each stock is in line with the identified index. Hence, the returns will be more or less similar to those generated by the Index.

3. Sector-specific Funds

Sector-specific funds invest in the securities of a specific sector or industry such as FMCG, Pharmaceuticals, IT, etc. The returns on these funds are directed by the performance of the respective sector/industries.

4. Gilt Fund

Gilt mutual funds invest exclusively in government securities. The Gilt funds do not carry a credit risk - where the issuer of the security can default. However, it comes with an interest rate risk i.e. risk due to the rise or fall in interest rates.

Q8) Define NBFC. Discuss the classification of NBFC. 12

A8) Non-banking financial companies are non-banking in nature. It provides all kinds of financial services other than banking services.

According to Reserve bank of India, a Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature, leasing, hire-purchase, insurance business, chit business but does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of immovable property. A non-banking institution which is a company and has principal business of receiving deposits under any scheme or arrangement in one lump sum or in installments by way of contributions or in any other manner, is also a non-banking financial company (Residuary non-banking company).

NBFCs are categorized as

a) in terms of the type of liabilities into Deposit and Non-Deposit accepting NBFCs,

b) non deposit taking NBFCs by their size into systemically important and other non-deposit holding companies (NBFC-NDSI and NBFC-ND) and

c) by the kind of activity they conduct.

Within this broad categorization the different types of NBFCs are as follows:

- Asset Finance Company (AFC) :

An AFC is a company which is a financial institution carrying on as its principal business the financing of physical assets supporting productive/economic activity, such as automobiles, tractors, lathe machines, generator sets, earth moving and material handling equipments, moving on own power and general purpose industrial machines. Principal business for this purpose is defined as aggregate of financing real/physical assets supporting economic activity and income arising therefrom is not less than 60% of its total assets and total income respectively.

II. Investment Company (IC) :

IC means any company which is a financial institution carrying on as its principal business the acquisition of securities,

III. Loan Company (LC):

LC means any company which is a financial institution carrying on as its principal business the providing of finance whether by making loans or advances or otherwise for any activity other than its own but does not include an Asset Finance Company.

IV. Infrastructure Finance Company (IFC):

IFC is a non-banking finance company a) which deploys at least 75 per cent of its total assets in infrastructure loans, b) has a minimum Net Owned Funds of ₹ 300 crore, c) has a minimum credit rating of ‘A ‘or equivalent d) and a CRAR of 15%.

V. Systemically Important Core Investment Company (CIC-ND-SI): CIC-ND-SI is an NBFC carrying on the business of acquisition of shares and securities which satisfies the following conditions:-

(a) it holds not less than 90% of its Total Assets in the form of investment in equity shares, preference shares, debt or loans in group companies;

(b) its investments in the equity shares (including instruments compulsorily convertible into equity shares within a period not exceeding 10 years from the date of issue) in group companies constitutes not less than 60% of its Total Assets;

(c) it does not trade in its investments in shares, debt or loans in group companies except through block sale for the purpose of dilution or disinvestment;

(d) it does not carry on any other financial activity referred to in Section 45I(c) and 45I(f) of the RBI act, 1934 except investment in bank deposits, money market instruments, government securities, loans to and investments in debt issuances of group companies or guarantees issued on behalf of group companies.

(e) Its asset size is ₹ 100 crore or above and

(f) It accepts public funds

VI. Infrastructure Debt Fund: Non- Banking Financial Company (IDF-NBFC) :

IDF-NBFC is a company registered as NBFC to facilitate the flow of long term debt into infrastructure projects. IDF-NBFC raise resources through issue of Rupee or Dollar denominated bonds of minimum 5 year maturity. Only Infrastructure Finance Companies (IFC) can sponsor IDF-NBFCs.

VII. Non-Banking Financial Company - Micro Finance Institution (NBFC-MFI):

NBFC-MFI is a non-deposit taking NBFC having not less than 85% of its assets in the nature of qualifying assets which satisfy the following criteria:

a. Loan disbursed by an NBFC-MFI to a borrower with a rural household annual income not exceeding ₹ 1,00,000 or urban and semi-urban household income not exceeding ₹ 1,60,000;

b. Loan amount does not exceed ₹ 50,000 in the first cycle and ₹ 1,00,000 in subsequent cycles;

c. Total indebtedness of the borrower does not exceed ₹ 1,00,000;

d. Tenure of the loan not to be less than 24 months for loan amount in excess of ₹ 15,000 with prepayment without penalty;

e. Loan to be extended without collateral;

f. Aggregate amount of loans, given for income generation, is not less than 50 per cent of the total loans given by the MFIs;

g. Loan is repayable on weekly, fortnightly or monthly instalments at the choice of the borrower

VIII. Non-Banking Financial Company –

Factors (NBFC-Factors): NBFC-Factor is a non-deposit taking NBFC engaged in the principal business of factoring. The financial assets in the factoring business should constitute at least 50 percent of its total assets and its income derived from factoring business should not be less than 50 percent of its gross income.

IX. Mortgage Guarantee Companies (MGC) –

MGC are financial institutions for which at least 90% of the business turnover is mortgage guarantee business or at least 90% of the gross income is from mortgage guarantee business and net owned fund is ₹ 100 crore.

X. NBFC- Non-Operative Financial Holding Company (NOFHC)

It is financial institution through which promoter / promoter groups will be permitted to set up a new bank .It’s a wholly-owned Non-Operative Financial Holding Company (NOFHC) which will hold the bank as well as all other financial services companies regulated by RBI or other financial sector regulators, to the extent permissible under the applicable regulatory prescriptions.

Q9) State the objectives of LICI. 5

A9) The objectives of LICI are-

- Spread Life Insurance widely and in particular to the rural areas and to the socially and economically backward classes with a view to reaching all insurable persons in the country and providing them adequate financial cover against death at a reasonable cost.

- Maximize mobilization of people's savings by making insurance-linked savings adequately attractive.

- Bear in mind, in the investment of funds, the primary obligation to its policyholders, whose money it holds in trust, without losing sight of the interest of the community as a whole; the funds to be deployed to the best advantage of the investors as well as the community as a whole, keeping in view national priorities and obligations of attractive return.

- Conduct business with utmost economy and with the full realization that the moneys belong to the policyholders.

- Act as trustees of the insured public in their individual and collective capacities.

- Meet the various life insurance needs of the community that would arise in the changing social and economic environment.

- Involve all people working in the Corporation to the best of their capability in furthering the interests of the insured public by providing efficient service with courtesy.

- Promote amongst all agents and employees of the Corporation a sense of participation, pride and job satisfaction through discharge of their duties with dedication towards achievement of Corporate Objective.

Q10) Define mutual fund. State the classification of mutual fund on the basis of asset. 5

A10) Mutual fund is an investment avenue where the mutual fund companies collect small savings from investors, pools it and makes investment in the share market. The profits earned from such investments are shared among the investors according to the nature and type of investment. It facilitates the investors to makes investment in the share market who has lack of knowledge in the share market. For example, UTI, SBI mutual fund, ICICI mutual fund etc.

1.Equity Funds:

These funds invest the amassed money from investors in equities i.e. the stocks of different companies. The associated risks for these funds are comparatively higher as they invest in the market. However, they also provide higher returns.

3. Debt Funds:

These funds invest in debt instruments like bonds, securities, fixed income assets, the company’s debentures etc. They provide a safer investment option for investors looking for small regular returns with low risk.

4. Hybrid Funds:

As the name suggests, Hybrid or balanced funds invests in both equity and debt instruments like stocks, bonds etc. This ratio can be variable or fixed depending on the fund. This fund helps to bridge the gap between entirely equity or debt fund and suitable for investors looking to take higher risk than debt funds in order to get bigger rewards.

5. Money Market Funds:

These funds invest in liquid instruments such as bonds, T-bills, certificate of deposits etc. The risks associated with these funds are relatively low and suitable for short-term investments, less than 12 months.