Unit 4

Overview of financial services industry

Q1) Write a note on merchant banking. 5

A1) According to SEBI (Merchant Bankers) Rules 1992, “A merchant banker has been defined as any person who is engaged in the business of issue management either by making arrangements regarding selling, buying or subscribing to securities or acting as manager, consultant advisor or rendering corporate advisory services in relation to such issue management”. In short, “merchant bank refers to an organization that underwrites securities and advises such clients on issues like corporate mergers, involving in the ownership of commercial ventures”.

Thus merchant banking involves a wide range of activities such as management of customer services, portfolio management, credit syndication, acceptance credit, counselling, insurance, preparation of feasibility reports etc. It is not necessary for a merchant banker to carry out all the above mentioned activities. A merchant banker may specialise in one activity, and take up other activities, which may be complementary or supportive to the specialized activity. In short, merchant banking involves servicing any financial need of the client.

Objectives of Merchant Banking

The objectives of merchant banking are as follows:

1. To help for capital formation.

2. To create a secondary market in order to boost the industrial activities in the country.

3. To assist and promote economic endeavour.

4. To prepare project reports, conduct market research and pre-investment surveys.

5. To provide financial assistance to venture capital.

6. To build a data bank as human resources.

7. To provide housing finance.

8. To provide seed capital to new enterprises.

9. To involve in issue management.

10. To act as underwriters.

11. To identify new projects and render services for getting clearance from government.

12. To provide financial clearance.

13. To help in mobilizing funds from public.

14. To divert the savings of the country towards productive channel.

15. To conduct investors conferences.

16. To obtain consent of stock exchange for listing.

17. To obtain the daily report of application money collected at various branches of banks.

18. To appoint bankers, brokers, underwrites etc.

19. To supervise the process on behalf of NRIs for their ventures.

20. To provide service on fund based activities.

21. To assist in arrangement of loan syndication.

22. To act as an acceptance house.

23. To assist in and arrange mergers and acquisitions.

Q2) Briefly explain the functions of merchant banking. 12

A2) Merchant banks have been playing an important role in procuring the funds for capital market for the corporate sector for financing their operations. They perform some valuable functions. The functions of merchant banks in India are as follows:

Figure: Functions of issue management

- Corporate counselling:

One of the important functions of a merchant banker is corporate counselling. Corporate counselling refers to a set of activities undertaken to ensure efficient functioning of a corporate enterprise through effective financial management. A merchant banker guides the client on aspects of organizational goals, vocational factors, organization size, choice of product, demand forecasting, cost analysis, allocation of resources, investment decisions, capital and expenditure management, marketing strategy, pricing methods etc.

The following activities are included in corporate counselling:

(a) Providing guidance in areas of diversification based on the Government’s economic and licensing policies.

(b) Undertaking appraisal of product lines, analysing their growth and profitability and forecasting future trends.

(c) Rejuvenating old-line companies and ailing sick units by appraising their technology and process, assessing their requirements and restructuring their capital base.

(d) Assessment of the revival prospects and planning for rehabilitation through modernization and diversification and revamping of the financial and organizational structure.

(e) Arranging for the approval of the financial institutions/banks for schemes of rehabilitation involving financial relief, etc.

(f) Monitoring of rehabilitation schemes.

(g) Exploring possibilities for takeover of sick units and providing assistance in making consequential arrangements and negotiations with financial institutions/banks and other interests/authorities involved.

2. Project counselling:

Project counselling relates to project finance. This involves the study of the project, offering advisory services on the viability and procedural steps for its implementation.

Project counselling involves the following activities:

(a) Undertaking the general review of the project ideas/project profile.

(b) Providing advice on procedural aspects of project implementation.

(c) Conducting review of technical feasibility of the project on the basis of the report prepared by own experts or by outside consultants.

(d) Assisting in the preparation of project report from a financial angle, and advising and acting on various procedural steps including obtaining government consents for implementation of the project.

(e) Assisting in obtaining approvals/licenses/permissions/grants, etc from government agencies in the form of letter of intent, industrial license, DGTD registration, and government approval for foreign collaboration.

(f) Identification of potential investment avenues.

(g) Arranging and negotiating foreign collaborations, amalgamations, mergers, and takeovers.

(h) Undertaking financial study of the project and preparation of viability reports to advice on the framework of institutional guidelines and laws governing corporate finance.

(i) Providing assistance in the preparation of project profiles and feasibility studies based on preliminary project ideas, covering the technical, financial and economic aspects of the project from the point of view of their acceptance by financial institutions and banks.

(j) Advising and assisting clients in preparing applications for financial assistance to various national financial institutions, state level institutions, banks, etc.

3. Pre-investment studies:

Another function of a merchant banker is to guide the entrepreneurs in conducting pre-investment studies. It involves detailed feasibility study to evaluate investment avenues to enable to decide whether to invest or not. The important activities involved in pre-investment studies are as follows:

(a) Carrying out an in-depth investigation of environment and regulatory factors, location of raw material supplies, demand projections and financial requirements in order to assess the financial and economic viability of a given project.

(b) Helping the client in identifying and short-listing those projects which are built upon the client’s inherent strength with a view to promote corporate profitability and growth in the long run.

(c) Offering a package of services, including advice on the extent of participation, government regulatory factors and an environmental scan of certain industries in India.

4. Loan syndication:

A merchant banker may help to get term loans from banks and financial institutions for projects. Such loans may be obtained from a single financial institution or a syndicate or consortium. Merchant bankers help corporate clients to raise syndicated loans from commercial banks. The following activities are undertaken by merchant bankers under loan syndication:

(a) Estimating the total cost of the project to be undertaken.

(b) Drawing up a financing plan for the total project cost which conforms to the requirements of the promoters and their collaborators, financial institutions and banks, government agencies and underwriters.

(c) Preparing loan application for financial assistance from term lenders/financial institutions/banks, and monitoring their progress, including pre-sanction negotiations.

(d) Selecting institutions and banks for participation in financing.

(e) Follow-up of term loan application with the financial institutions and banks, and obtaining the approval for their respective share of participation.

(f) Arranging bridge finance.

(g) Assisting in completion of formalities for drawing of term finance sanctioned by institutions by expediting legal documentation formalities, drawing up agreements etc. as prescribed by the participating financial institutions and banks.

(h) Assessing working capital requirements.

5. Issue management:

Issue management involves marketing or corporate securities by offering them to the public. The corporate securities include equity shares, preference shares, bonds, debentures etc. Merchant bankers act as financial intermediaries. They transfer capital from those who own it to those who need it. The security issue function may be broadly classified into two –pre-issue management and post-issue management. The pre-issue management involves the following functions:

(a) Public issue through prospectus.

(b) Marketing and underwriting.

(c) Pricing of issues.

These may be briefly discussed as follows:

(a) Public issue through prospectus:

To being out a public issue, merchant bankers have to coordinate the activities relating to issue with different government and public bodies, professionals and private agencies. First the prospectus should be drafter. The copies of consent of experts, legal advisor, attorney, solicitor, bankers, and bankers to the issue, brokers and underwriters are to be obtained from the company making the issue. These copies are to be filed along with the prospectus To the Registrar Companies. After the prospectus is ready, it has to be sent to the SEBI for clearance. It is only after clearance by SEBI, the prospectus can be filed with the Registrar. The brokers to the issue, principal agent and bankers to issue are appointed by merchant bankers.

(b) Marketing and underwriting:

After sending prospectus to SEBI, the merchant bankers arrange a meeting with company representatives and advertising agents to finalise arrangements relating to date of opening and closing of issue, registration of prospectus, launching publicity campaigns and fixing date of board meeting to approve and pass the necessary resolutions. The role of merchant banker in publicity campaigns to help selecting the media, determining the size and publications in which the advertisement should appear. The merchant bank shall decide the number of copies to be printed, check accuracy of statements made and ensure that the size of the application form and prospectus are as per stock exchange regulations. The merchant banker has to ensure that he material is delivered to the stock exchange at least 21 days before the issue opens and to the brokers to the issue, and underwriters in time.

(c) Pricing of issues:

Pricing of issues is done by companies themselves in consultation with the merchant bankers. An existing listed company and a new company set up by an existing company with 5 year track record and existing private closely held company and existing unlisted company going in for public issues for the first time with 2 ½ years track record of constant profitability can freely price the issue. The premium can be determined after taking into consideration net asset value, profit earning capacity and market price. The price and premium has to be stated in the prospectus. Post-issue management consists of collection of application forms and statement of amount received from bankers, screening applications, deciding allotment procedures, mailing of allotment letters, share certificates and refund orders. Merchant bankers help the company by co-ordinating the above activities.

6. Underwriting of public issue:

In underwriting of public issue the activities performed by merchant bankers are as follows:

(a) Selection of institutional and broker underwriters for syndicating/ underwriting arrangements.

(b) Obtaining the approval of institutional underwriters and stock exchanges for publication of the prospectus.

(c) Co-ordination with the underwriters, brokers and bankers to the issue, and the Stock Exchanges.

7. Portfolio management:

Merchant bankers provide portfolio management service to their clients. Today every investor is interested in safety, liquidity and profitability of his investment. But investors cannot study and choose the appropriate securities. Merchant bankers help the investors in this regard. They study the monetary and fiscal policies of the government. They study the financial statements of companies in which the investments have to be made by investors. They also keep a close watch on the price movements in the stock market. The merchant bankers render the following services in connection with portfolio management:

(a) Undertaking investment in securities.

(b) Collection of return on investment and re-investment of the same in profitable avenues, investment advisory services to the investors and other related services.

(c) Providing advice on selection of investments.

(d) Carrying out a critical evaluation of investment portfolio.

(e) Securing approval from RBI for the purchase/sale of securities (for NRI clients).

(f) Collecting and remitting interest and dividend on investment.

(g) Providing tax counselling and filing tax returns through tax consultants.

8. Merger and acquisition:

A merger is a combination of two or more companies into a single company where one survives and others lose their corporate existence. A takeover refers to the purchase by one company acquiring controlling interest in the share capital of another existing company. Being a professional expert they are apt to safeguard the interest of the shareholders in both the companies. Once the merger partner is proposed, the merchant banker appraises merger/takeover proposal with respect to financial viability and technical feasibility. He negotiates purchase consideration and mode of payment. He gets approval from the government/RBI, drafts scheme of amalgamation and obtains approval from financial institutions.

9. Foreign currency financing:

The finance provided to fund foreign trade transactions is called ‘Foreign Currency Finance’. The provision of foreign currency finance takes the form of export import trade finance, euro currency loans, Indian joint ventures abroad and foreign collaborations.

The main areas that are covered in this type of merchant activity are as follows:

(a) Providing assistance for carrying out the study of turnkey and construction contract projects.

(b) Arranging for the syndication of various types of guarantees, letters of credit, pre-shipment credit, deferred post-shipment credit, bridge loans, and other credit facilities.

(c) Providing assistance in opening and operating bank accounts abroad.

(d) Arranging foreign currency loans under buyer’s credit scheme for importing goods.

(e) Arranging deferred payment guarantees under supplier’s credit scheme for importing capital goods.

(f) Providing assistance in obtaining export credit facilities from the EXIM bank for export of capital goods, and arranging for the necessary government approvals and clearance.

(g) Undertaking negotiations for deferred payment, export finance, buyers credits, documentary credits, and other foreign exchange services like packing credit, etc.

10. Working capital finance:

The finance required for meeting the day-to-day expenses of an enterprise is known as ‘Working Capital Finance’. Merchant bankers undertake the following activities as part of providing this type of finance:

(a) Assessment of working capital requirements.

(b) Preparing the necessary application to negotiations for the sanction of appropriate credit facilities.

11. Acceptance credit and bill discounting:

Merchant banks accept and discount bills of exchange on behalf of clients. Merchant bankers give loans to business enterprises on the security of bill of exchange. For this purpose, merchant bankers collect credit information relating to the clients and undertake rating their creditworthiness.

12. Venture financing:

Another function of a merchant banker is to provide venture finance to projects. It refers to provision of equity finance for funding high-risk and high-reward projects.

13. Lease financing:

Leasing is another function of merchant bankers. It refers to providing financial facilities to companies that undertake leasing. Leasing involves letting out assets on lease for a particular period for use by the lessee. The following services are provided by merchant bankers in connection with lease finance:

(a) Providing advice on the viability of leasing as an alternative source for financing capital investment projects.

(b) Providing advice on the choice of a favourable rental structure.

(c) Providing assistance in establishing lines of lease for acquiring capital equipment, including preparation of proposals, documentations, etc.

Q3) What is issue management? Discuss the pre-issue and post-issue management function. 8

A3) Issue management involves marketing or corporate securities by offering them to the public. The corporate securities include equity shares, preference shares, bonds, debentures etc. The security issue function may be broadly classified into two –pre-issue management and post-issue management.

Figure: Types of issue management

- Pre-issue management

The pre-issue management involves the following functions:

(a) Public issue through prospectus:

To being out a public issue, merchant bankers have to coordinate the activities relating to issue with different government and public bodies, professionals and private agencies. First the prospectus should be drafter. The copies of consent of experts, legal advisor, attorney, solicitor, bankers, and bankers to the issue, brokers and underwriters are to be obtained from the company making the issue. These copies are to be filed along with the prospectus To the Registrar Companies. After the prospectus is ready, it has to be sent to the SEBI for clearance. It is only after clearance by SEBI, the prospectus can be filed with the Registrar. The brokers to the issue, principal agent and bankers to issue are appointed by merchant bankers.

(b) Marketing and underwriting:

After sending prospectus to SEBI, the merchant bankers arrange a meeting with company representatives and advertising agents to finalise arrangements relating to date of opening and closing of issue, registration of prospectus, launching publicity campaigns and fixing date of board meeting to approve and pass the necessary resolutions. The role of merchant banker in publicity campaigns to help selecting the media, determining the size and publications in which the advertisement should appear. The merchant bank shall decide the number of copies to be printed, check accuracy of statements made and ensure that the size of the application form and prospectus are as per stock exchange regulations. The merchant banker has to ensure that he material is delivered to the stock exchange at least 21 days before the issue opens and to the brokers to the issue, and underwriters in time.

(c) Pricing of issues:

Pricing of issues is done by companies themselves in consultation with the merchant bankers. An existing listed company and a new company set up by an existing company with 5 year track record and existing private closely held company and existing unlisted company going in for public issues for the first time with 2 ½ years track record of constant profitability can freely price the issue. The premium can be determined after taking into consideration net asset value, profit earning capacity and market price. The price and premium has to be stated in the prospectus. Post-issue management consists of collection of application forms and statement of amount received from bankers, screening applications, deciding allotment procedures, mailing of allotment letters, share certificates and refund orders. Merchant bankers help the company by co-ordinating the above activities.

2. Post issue management

After the closure of the Issue, Lead Manager has to manage the Post-Issue activities pertaining to the Issue. He is to ensure the submission of the post issue monitoring report as desired by SEBI.

a) Finalisation of Basis of Allotment (BOA):

In case of a public offering, besides post-issue lead-manager, registrar to the issue and regional stock-exchange officials, association of public representative is required to participate in the finalisation of Basis of Allotment. Data of accepted applications is finalised and Regional Stock Exchanges are approached for finalisation of BOA.

b) Despatch of Share Certificates, etc.:

Then follows despatch of share certificates to the successful allottees, demat credit, cancelled stock-invest and refund orders to unsuccessful applicants.

c) Issue of Advertisement in Newspapers:

An announcement in the newspaper is also made regarding BOA, number of applications received and the date of despatch of share certificates and refund orders, etc.

Post-issue Monitoring Reports

SEBI prescribed certain post-issue reports which are required to be submitted by the lead managers. Two post-issue reports each for public issue are to be sent by lead managers to SEBI i.e., (a) 3-day post-issue monitoring report and (b) 78-day post-issue monitoring report. The merchant bankers are expected to keep SEBI informed on important developments about the particular issues being lead managed by them during the intervening period of the reports.

Post-issue Obligations Issue Management

Lead manager responsible for post-issue activities shall maintain close coordination with the Registrars to the Issue, and arrange to depute its officers to the offices of various intermediaries at regular intervals after the closure of the issue to monitor the flow of applications from collecting bank branches, processing of the applications including those accompanied by stock invest and other matter till the basis of allotment is finalised, despatch completed and listing done. Any act of omission or commission on the part of any such intermediaries noticed during such visits should be duly reported to SEBI. SEBI imposes considerable responsibility on merchant bankers for proper redressal of investor grievances. It is, therefore, necessary for the merchant bankers to actively associate themselves with the post-issue refund and allotment activities and regularly monitor investor grievances arising there from. To achieve this, the merchant bankers need to evolve effective inter-linkages with the Issuers and the Registrars to Issue. SEBI has launched an all-out drive to bring down substantially the number of investor grievances. The merchant bankers are to assign high priority to the area of investor grievances and take all preventive steps to minimise the number of complaints. They are also to set up proper grievance monitoring and redressal system in coordination with the issuers and the registrars to Issue, and take all necessary measures to resolve the grievances quickly to avoid penal action. In case of delay in refund, lead manager shall ensure that the issuer pays interest for the delayed period as per provisions of the Companies Act, 1956. The lead manager shall be responsible for ensuring despatch of refund orders/allotment letters/certificates by registered post only.

Q4) Define underwriting. Discuss the types of underwriting. 8

A4) Underwriting is the process of assuring the clients regarding the sale of the public issue of securities. In underwriting of public issue the activities performed by merchant bankers are as follows:

(a) Selection of institutional and broker underwriters for syndicating/ underwriting arrangements.

(b) Obtaining the approval of institutional underwriters and stock exchanges for publication of the prospectus.

(c) Co-ordination with the underwriters, brokers and bankers to the issue, and the Stock Exchanges.

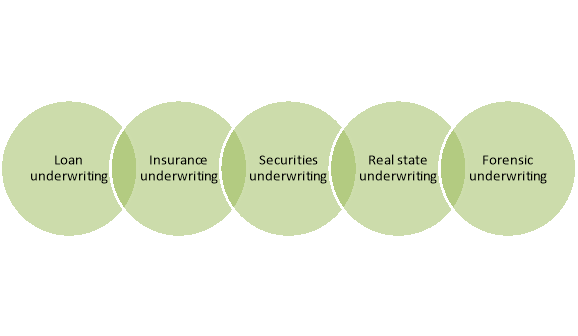

Types of underwriting

There are five types of underwriting that are used to assess risks for a variety of important contracts.

Figure: Types of underwriting

1. Loan underwriting

Loan underwriting involves evaluating and calculating the risks of lending to potential borrowers. Loan underwriters make the assessment of loan repayment based on four main factors: income, appraisal, credit score and asset information.

2. Insurance underwriting

Insurance underwriting is the process of evaluating a prospective insurance candidate for life, health and wellness, property and rental or other types of insurance. It determines the risks of filing large or frequent claims and assessing how much coverage a person can be given, how much they should pay and how much an insurance company is likely to pay to cover the policyholder.

3. Securities underwriting

Investors and investment banks use securities underwriting to determine how profitable investments—such as individual stocks and debt securities—are likely to be. In securities underwriting, an investor identifies profitable securities supplied by a company attempting Initial Public Offering (IPO). The investor, then, sells those securities in the market for a profit. Underwriters involved in this process can form an underwriter syndicate, which is a group of underwriters that buys securities to resell them to dealers or investors who will also sell them to other buyers. When this group makes an income from the difference, it is called an “underwriting spread.”

4. Real estate underwriting

In real estate underwriting, a borrower’s background is assessed, as well as the property they want to get a loan for. The underwriting process will determine whether the property can recoup its value if the borrower cannot pay back the loan.

5. Forensic underwriting

Forensic underwriting occurs when a borrower fails to pay back a loan. In this case, the borrower will be assessed again to determine whether the person can be given a new loan or a refinance.

Q5) Discuss the regulatory measurers of merchant banking. 8

A5) As per RBI’s Master Circular on Para-Banking activities, banks are allowed to undertake merchant banking activities through a separate subsidiary which would be required to comply with SEBI regulations. Banking Institutions performing merchant banking activities are also required to follow the requirements laid down in the prudential exposure norms prescribed by RBI, as well as the statutory limits contained in Section 19(2) & (3) of the Banking Regulation Act, 1949. Merchant banking can also be pursued by entities other than banks (however, they should not be NBFCs as defined under the RBI Act), provided they are registered with SEBI. In case a bank pursues merchant banking activities, it would need a banking license from RBI (to carry out banking activities) and a SEBI registration under the SEBI Merchant Bankers Regulations to carry out merchant banking business. It is to be noted that, those banks and merchant banking subsidiaries which are performing any of the activities under Portfolio Management Scheme (or any similar scheme) are also required to comply with the provisions of the SEBI (Portfolio Managers) Rules and Regulations, 1993. However, RBI exempts a merchant banking company from following requirements:

- Provisions related to mandatory registration, maintenance of liquid assets and creation of reserve funds under the RBI Act, 1934;

- Non-Banking Financial Companies Acceptance of Public Deposits (Reserve Bank) Directions, 1998; and

- Non-Banking Financial Companies Prudential Norms (Reserve Bank) Directions, 1998.

To be eligible for the above exemptions, a merchant banking company would need to fulfil the following criteria:

- It should be registered with SEBI under section 12 of the SEBI Act 1992;

- It should conduct the business of merchant banking in accordance with rules or regulations framed by SEBI;

- It should acquire securities only as part of its merchant banking activities;

- It should not be engaged in any other financial activities as mentioned in section 45I(c) of the RBI Act 1934; and

- It should not accept or hold public deposits.

Provisions related to the registration of a merchant bank are laid down in Chapter-II of SEBI Regulations, which provides for mandatory registration to carry out the business of merchant banking in India. Following are some of the requirements which are taken into consideration for grant of certificate:

- Applicant should be a corporate body other than a Non-Banking Financial Company (as defined under the RBI Act);

- Applicant should not engage in any activity other than those connected to securities market;

- Applicant should have a minimum of two employees having prior experience in merchant banking;

- Applicant must not be related (directly or indirectly) to any other entity which is registered as a merchant banker;

- Applicant has not been found guilty for any economic offence; and

- Applicant should have a minimum capital of 5 crore rupees (for category-I merchant banker).

Many statutes and regulations require certain functions such as valuation of shares under Foreign Exchange Management (Transfer or Issue of Security by a Person Resident outside India) Regulations, 2000 to be performed by SEBI registered Merchant Bankers, and hence for businesses operating in the financial sector, obtaining a merchant banking license can be a strategic advantage. Examples of some of the important functions that are performed by Merchant Bankers are given below:

- Corporate Counselling – After conducting a detailed market analysis to evaluate feasibility of corporate policies, merchant bankers render commercial and strategic advice to improve overall efficiency of a company.

- Project Counselling – Studying the nature and scale of investment in a business project and assisting clients with finance & procedural aspect for the successful implementation of the project.

- Portfolio Management – Advising clients (such as Institutional Investors and high net worth individuals) on managing their investments in order to earn maximum profit in a time bound manner.

- Issue Management – Sponsoring of corporate securities (e.g. IPOs) including marketing, compliance of listing requirements, procuring private subscription and offering securities to existing shareholders of the company.

Due to factors such as growth of primary market, increasing need of corporate restructuring and easing of FDI norms, merchant banking has never been more relevant in India. Therefore, it is very much required that the restrictive norms governing merchant banking, especially those related to capital adequacy and registration, should be relaxed in order to allow small players to enter and further expand the exclusive club of merchant bankers in India.

Q6) State the corporate counselling activities of merchant banker. 5

A6) The following activities are included in corporate counselling:

(a) Providing guidance in areas of diversification based on the Government’s economic and licensing policies.

(b) Undertaking appraisal of product lines, analysing their growth and profitability and forecasting future trends.

(c) Rejuvenating old-line companies and ailing sick units by appraising their technology and process, assessing their requirements and restructuring their capital base.

(d) Assessment of the revival prospects and planning for rehabilitation through modernization and diversification and revamping of the financial and organizational structure.

(e) Arranging for the approval of the financial institutions/banks for schemes of rehabilitation involving financial relief, etc.

(f) Monitoring of rehabilitation schemes.

(g) Exploring possibilities for takeover of sick units and providing assistance in making consequential arrangements and negotiations with financial institutions/banks and other interests/authorities involved.

Q7) State the project counselling activities of merchant banker. 5

A7) Project counselling involves the following activities:

(a) Undertaking the general review of the project ideas/project profile.

(b) Providing advice on procedural aspects of project implementation.

(c) Conducting review of technical feasibility of the project on the basis of the report prepared by own experts or by outside consultants.

(d) Assisting in the preparation of project report from a financial angle, and advising and acting on various procedural steps including obtaining government consents for implementation of the project.

(e) Assisting in obtaining approvals/licenses/permissions/grants, etc from government agencies in the form of letter of intent, industrial license, DGTD registration, and government approval for foreign collaboration.

(f) Identification of potential investment avenues.

(g) Arranging and negotiating foreign collaborations, amalgamations, mergers, and takeovers.

(h) Undertaking financial study of the project and preparation of viability reports to advice on the framework of institutional guidelines and laws governing corporate finance.

(i) Providing assistance in the preparation of project profiles and feasibility studies based on preliminary project ideas, covering the technical, financial and economic aspects of the project from the point of view of their acceptance by financial institutions and banks.

(j) Advising and assisting clients in preparing applications for financial assistance to various national financial institutions, state level institutions, banks, etc.

Q8) Write a note on loan syndication activity of merchant banker. 5

A8) A merchant banker may help to get term loans from banks and financial institutions for projects. Such loans may be obtained from a single financial institution or a syndicate or consortium. Merchant bankers help corporate clients to raise syndicated loans from commercial banks. The following activities are undertaken by merchant bankers under loan syndication:

(a) Estimating the total cost of the project to be undertaken.

(b) Drawing up a financing plan for the total project cost which conforms to the requirements of the promoters and their collaborators, financial institutions and banks, government agencies and underwriters.

(c) Preparing loan application for financial assistance from term lenders/financial institutions/banks, and monitoring their progress, including pre-sanction negotiations.

(d) Selecting institutions and banks for participation in financing.

(e) Follow-up of term loan application with the financial institutions and banks, and obtaining the approval for their respective share of participation.

(f) Arranging bridge finance.

(g) Assisting in completion of formalities for drawing of term finance sanctioned by institutions by expediting legal documentation formalities, drawing up agreements etc. as prescribed by the participating financial institutions and banks.

(h) Assessing working capital requirements

Q9) Write a note on issue management of merchant banker. 5

A9) Issue management involves marketing or corporate securities by offering them to the public. The corporate securities include equity shares, preference shares, bonds, debentures etc. Merchant bankers act as financial intermediaries. They transfer capital from those who own it to those who need it. The security issue function may be broadly classified into two –pre-issue management and post-issue management. The pre-issue management involves the following functions:

(a) Public issue through prospectus.

(b) Marketing and underwriting.

(c) Pricing of issues.

These may be briefly discussed as follows:

(a) Public issue through prospectus:

To being out a public issue, merchant bankers have to coordinate the activities relating to issue with different government and public bodies, professionals and private agencies. First the prospectus should be drafter. The copies of consent of experts, legal advisor, attorney, solicitor, bankers, and bankers to the issue, brokers and underwriters are to be obtained from the company making the issue. These copies are to be filed along with the prospectus To the Registrar Companies. After the prospectus is ready, it has to be sent to the SEBI for clearance. It is only after clearance by SEBI, the prospectus can be filed with the Registrar. The brokers to the issue, principal agent and bankers to issue are appointed by merchant bankers.

(b) Marketing and underwriting:

After sending prospectus to SEBI, the merchant bankers arrange a meeting with company representatives and advertising agents to finalise arrangements relating to date of opening and closing of issue, registration of prospectus, launching publicity campaigns and fixing date of board meeting to approve and pass the necessary resolutions. The role of merchant banker in publicity campaigns to help selecting the media, determining the size and publications in which the advertisement should appear. The merchant bank shall decide the number of copies to be printed, check accuracy of statements made and ensure that the size of the application form and prospectus are as per stock exchange regulations. The merchant banker has to ensure that he material is delivered to the stock exchange at least 21 days before the issue opens and to the brokers to the issue, and underwriters in time.

(c) Pricing of issues:

Pricing of issues is done by companies themselves in consultation with the merchant bankers. An existing listed company and a new company set up by an existing company with 5 year track record and existing private closely held company and existing unlisted company going in for public issues for the first time with 2 ½ years track record of constant profitability can freely price the issue. The premium can be determined after taking into consideration net asset value, profit earning capacity and market price. The price and premium has to be stated in the prospectus. Post-issue management consists of collection of application forms and statement of amount received from bankers, screening applications, deciding allotment procedures, mailing of allotment letters, share certificates and refund orders. Merchant bankers help the company by co-ordinating the above activities.

Q10) Write a note on foreign currency activity of merchant banker. 5

A10) The finance provided to fund foreign trade transactions is called ‘Foreign Currency Finance’. The provision of foreign currency finance takes the form of export import trade finance, euro currency loans, Indian joint ventures abroad and foreign collaborations.

The main areas that are covered in this type of merchant activity are as follows:

(a) Providing assistance for carrying out the study of turnkey and construction contract projects.

(b) Arranging for the syndication of various types of guarantees, letters of credit, pre-shipment credit, deferred post-shipment credit, bridge loans, and other credit facilities.

(c) Providing assistance in opening and operating bank accounts abroad.

(d) Arranging foreign currency loans under buyer’s credit scheme for importing goods.

(e) Arranging deferred payment guarantees under supplier’s credit scheme for importing capital goods.

(f) Providing assistance in obtaining export credit facilities from the EXIM bank for export of capital goods, and arranging for the necessary government approvals and clearance.

(g) Undertaking negotiations for deferred payment, export finance, buyers credits, documentary credits, and other foreign exchange services like packing credit, etc.