UNIT 4

Securitization / Mortgages

Q1) Explain securitization.

A1)

Securitization is the process of transforming the assets of a lending institution into a negotiable instrument. The assets could be in the form of receivables of term lending institution, a housing finance company or automobile loan. It is a structured finance originated in USA in 1970s.

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling said consolidated debt as bonds, pass-through securities, or collateralized mortgage obligation (CMOs), to various investors. The principal and interest on the debt, underlying the security, is paid back to the various investors regularly. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS).

Essential features of a securitization transaction comprise the following:

- Creation of asset pool and its sale

The originator/seller (of assets) creates a pool of assets and executes a legal true sale of the same to a special purpose vehicle (SPV). An SPV in such cases is either a trust or a company, as may be appropriate under applicable law, setup to carry out a restricted set of activities, management of which would usually rest with an independent board of directors.

2. Issuance of the securitised paper

This activity is usually performed by the SPV. Design of the instrument however would be based on the nature of interest that investors would have on the asset pool. In the case of pass-through issuances, the investors will have a direct ownership interest in the underlying assets, while pay-throughs are debt issued by the SPV secured by the assets and their cash flows.

3. Credit Risk

It must be made abundantly clear at the very outset that the accretions on the asset-backed security, i.e., interest, amortisation and redemption payments, are entirely dependent on the performance of the pooled assets, and will have nothing to do with the credit of the originator. By the same argument, such cash flows would also be not influenced by events affecting the condition of the originator, including insolvency.

4. Pool Selection

The process of selecting assets to build a securitization pool would take into careful consideration, loan characteristics that are important from a cash flow, legal, and credit points of view, such as type of asset, minimum and maximum loan size, vintage, rate, maturity and concentration limits (geographic, singleborrower, etc.). 'Cherry-picking' to include only the highest quality assets in the pool should be consciously avoided. Ideal selection would be a random choice among assets conforming only to cash flow or legal criteria. Often, substitution of eligible assets in the place of original assets that mature/prepay in order to maintain the level of asset cover would also be required.

5. Administration

Formal delineation of duties and responsibilities relating to administration of securitised assets, including payment servicing and managing relationship with the final obligors must be spelt out clearly through a contractual agreement with the entity who would perform those functions.

Q2) Explain nature of securitization.

A2)

Securitization is the process of transforming the assets of a lending institution into a negotiable instrument. The assets could be in the form of receivables of term lending institution, a housing finance company or automobile loan. It is a structured finance originated in USA in 1970s.

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling said consolidated debt as bonds, pass-through securities, or collateralized mortgage obligation (CMOs), to various investors. The principal and interest on the debt, underlying the security, is paid back to the various investors regularly. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS).

Essential features of a securitization transaction comprise the following:

- Creation of asset pool and its sale

The originator/seller (of assets) creates a pool of assets and executes a legal true sale of the same to a special purpose vehicle (SPV). An SPV in such cases is either a trust or a company, as may be appropriate under applicable law, setup to carry out a restricted set of activities, management of which would usually rest with an independent board of directors.

2. Issuance of the securitised paper

This activity is usually performed by the SPV. Design of the instrument however would be based on the nature of interest that investors would have on the asset pool. In the case of pass-through issuances, the investors will have a direct ownership interest in the underlying assets, while pay-throughs are debt issued by the SPV secured by the assets and their cash flows.

3. Credit Risk

It must be made abundantly clear at the very outset that the accretions on the asset-backed security, i.e., interest, amortisation and redemption payments, are entirely dependent on the performance of the pooled assets, and will have nothing to do with the credit of the originator. By the same argument, such cash flows would also be not influenced by events affecting the condition of the originator, including insolvency.

4. Pool Selection

The process of selecting assets to build a securitization pool would take into careful consideration, loan characteristics that are important from a cash flow, legal, and credit points of view, such as type of asset, minimum and maximum loan size, vintage, rate, maturity and concentration limits (geographic, singleborrower, etc.). 'Cherry-picking' to include only the highest quality assets in the pool should be consciously avoided. Ideal selection would be a random choice among assets conforming only to cash flow or legal criteria. Often, substitution of eligible assets in the place of original assets that mature/prepay in order to maintain the level of asset cover would also be required.

5. Administration

Formal delineation of duties and responsibilities relating to administration of securitised assets, including payment servicing and managing relationship with the final obligors must be spelt out clearly through a contractual agreement with the entity who would perform those functions.

Nature and scope of securitization

- Marketability: The very purpose of securitization is to ensure marketability to financial claims. Hence, the instrument is structured in such a way as to be marketable. This is one of the most important features of a securitized instrument, and the others that follow are mostly imported only to ensure this feature. Marketability involves two concepts: (1) the legal and systematic possibility of marketing the instrument; (2) the existence of a market for the instrument.

Ii. Merchantable Quality: To be market acceptable a securitized product should be of saleable quality. This concept, in case of physical goods, is something which is acceptable to merchants in normal trade. When applied to financial products, it would mean that the financial commitments embodied in the instruments are secured to the investors’ satisfaction. To the investors satisfaction is a relative term and therefore, the originator of the securitized instrument secures the instrument based on the needs of the investors. For widely distributed securitized instruments, evaluation of the quality, and its certification by an independent expert, viz., rating is common. The rating is for the benefit of the lay investor, who otherwise not expected to be in a position to appraise the degree of risk involved.

Iii. Wide Distribution: The basic purpose of securitization is to distribute the product. The extent of distribution which the originator would like to achieve is based on a comparative analysis of the costs and the benefits that can be achieved Wider distribution leads to a cost benefit, in that the issuer is able to market the product with lower return, and hence, lower financial cost to him. But a wide investor base involves the high cost of distribution and servicing.

Iv. Commodization: Securitization is the process of commoditization, where the basic idea is to take the outcome of this process into the capital market. Thus, the result of every securitization process, whatever might be the area to which it is applied, is to create certain instruments which can be placed in the market.

v. Funding alternative: Being distinct and different from the originator's own obligations, a well structured ABS stands on its own credit rating and thus generates genuine incremental funding. This is so as the originator's existing creditors may invest in the ABS in addition to providing lines of credit to the originator. Further, there may also be other investors in the ABS who do not have a lending relationship with the originator. It is also possible to achieve a superior credit rating for the ABS than the originator's own through appropriate structuring and credit enhancement.

Vi. Balance sheet management: Fundamental benefit of a true sale, i.e., freeing up the capital of the originator would apply in the case of all securitization transactions. In response, the balance sheet gets compressed and becomes more robust. Its ratios improve. Alternately, reduction in leverage post-securitised sale can be restored by adding on new assets to the balance sheet. Thus the asset through-put of the originator's balance sheet increases. Securitization can also generate matched funding for balance sheet assets. Further, it may also enable the disposal of non-core assets through suitable structuring.

Vii. Re-allocation of risks: Securitization transfers much of the credit risk in the portfolio to the ABS investors and helps to quantify the residual credit risk that the originator is exposed to. This is very useful, as the originator can then take larger exposure to individual obligors as well as provides a higher degree of comfort to his creditors. Securitization also transfers the originator's market risks, i.e., liquidity, interest rate and prepayment risks, to ABS investors and reduces risk capital requirement. This can lead to more competitive pricing of the underlying asset products.

Viii. Operating process efficiency: The extent of portfolio analysis and information demanded by securitization programs often lead to serious re-examination and consequent reengineering of operating processes within the originator organisation. Further, specialist handling of various functional components, such as origination, funding, risk management and administration, often achieved through outsourcing, promotes efficiency across operating processes.

Ix. Securitization improves operating leverage: The originator usually assumes the function of the servicer, the issuing and paying agent, and sometimes that of the credit enhancer. Fees accrue on account of all of these. Excess servicing, i.e., the difference between the asset yield and the cost of funds, is also normally extracted by the originator. These income streams can push up the operating leverage of the originator generating income from a larger asset base than what may be otherwise possible for a given capital structure.

x. Low event risk: The pool of assets representing the obligations of a number of entities is usually more resilient to event risks than the obligations of a single borrower – i.e. the risk that the credit rating of the security will deteriorate due to circumstances usually beyond the obligor's control is much higher in the latter case. The diversity that the securitization pool represents makes the ABS largely immune to event risks. Higher yields for lower/similar risk ABS usually offer higher yields over securities of comparable credit and maturities.

Q3) Explain securitization as a Funding Mechanism.

A3)

(i) The process of securitization starts with identification by the company (the originator) the loans or bills receivable in its portfolio, to prepare a basket or pool of assets to be securitized. The package usually forms an optimum mix so as to ensure fair marketability of the instrument to be issued.

Further, the maturities are also so chosen that the package represents one homogeneous lot. The pool of receivables is backed by the underlying securities held by the originator (in the form of mortgage, pledge, charge, etc.).

(ii) The pool of assets so identified is then sold to a specific purpose vehicle (SPV) or trust. Usually an investment banker performs the task of an SPV, which is also called an issuer, as it ultimately issues the securities to investors.

(iii) Once the assets are acquired by SPV, the same are split into individual shares/securities which are reimbursed by selling them to investors. These securities are called ‘Pay or Pass Through Certificates’ (PTC) which are so structured as to synchronize for redemption with the maturity of the securitized loans or bills.

A PTC thus represents a sale of an undivided interest to the extent of the face value of the PTC in the aggregate pool of assets acquired by the SPV from the originator.

(iv) Repayments under the securitized loans or bills keep on being received by the originator and passed on to the SPV. To this end, the contractual relationship between the originator an d the borrowers/obligates is allowed to subsist in terms of the pass through transaction; alternatively a separate agency arrangement is made between the SPV (Principal) and the originator (agent).

(v) Although a PTC could be with recourse to its originator, the usual practice has been to make it without recourse. Accordingly, a PTC holder takes recourse to the SPV and not the originator for payment to the principal and interest on the PTCs held by him. However, a part of the credit risk, as perceived (and not interest risk), can be absorbed by the originator, by transferring the assets at a discount, enabling the SPV to issue the PTCs at a discount to face value.

(vi) The debt to be securitized and the PTC issues are got rated by rating agencies on the eve of the securitization. The issues by the SPV could also be guaranteed by external guarantor-institutions to enhance creditability of the issues. The PTCs, before maturity, are tradable in a secondary market to ensure liquidity for the investors.

From the above, it is evident that the primary participants involved in the issuance of securitization transaction are the originator, obligors, the SPV, the servicer and the credit enhancer. The originator has the assets which are sold or used as collateral for the assets backed securities. Originators are generally manufacturing companies, financial institutions, banks and non-banking finance companies.

The term obligors’ refers to borrowers who have taken loans from the originators resulting in the creation of the underlying asset. The SPV or trust raises funds to buy assets from the originator by selling securities to investors. It uses the cash flow generated by the financial assets in the pool to pay interest and principal to investors and covers its own costs. The servicer/receiving and paying agent is responsible for collecting principal and interest payments on assets when due and for pursuing the collection from delinquent accounts.

The service is usually the originator or an associate of the originator. The credit enhancer provides the required amount of credit support to reduce the overall credit risk of a security issue. Credit enhancement is provided by the originator in the form of senior- subordinate structure over collaterisation or through a cash collateral. Third party credit enhancement generally takes the form of a letter of credit or a surety bond.

Q4) Explain securitization of Residential Real Estate.

A4)

Securitization of Residential Real Estate

Real Estate Securitization as a Concept for Disintermediation of Lending Institutions

In recent times financing for real estate companies has become more and more difficult because banks have become very cautious with loan origination. This is due to the fact that a lot of banks have made an enormous amount of bad loans during the last decade and now those big bad loan portfolios weigh hard on the banks’ balance sheets. However, Capital markets dictate that banks are more bottom line oriented. Therefore a lot of big commercial banks have decided to go away from the classic lending business and go into fee income business. This goes in hand with a second big trend, a trend that has been going on in the financial industry for many years. It can be described as the desintermediation of financial intermediaries; lending banks as such intermediaries will be more and more cut out of the lending process as they only function as an intermediary between the borrower and the capital market. Therefore the current trend in the banking industry can be described as a shift from credit to capital markets.

Different angles to view Real Estate Securitization

Each transaction structure is different and the ultimate structure depends on whichever angle one looks at the securitization.

First of all a categorization into securitizable assets, originator type, and goals and motives of the originator can be made. This makes sense because for instance different originators hold different assets and might have various motives of doing a real estate securitization. The three classifications overlap and most of the time a transaction structure is constructed by looking at it from every angle. Each category will be described in the following chapters.

Categorization by Type of Asset:

All the assets for a real estate securitisation are cash flows that are derived from real estate, in one way or another. Those assets can be summarised in the following categories:

• Real estate rental cash flows

• Future real estate rental cash flows (secured either by the real estate itself or by a leasehold interest in the real estate)

• Future cash flows derived from real estate

o Cash Flows from Toll roads or income from other public infrastructure projects

o Income from usage of oil pipelines or dams

o Ticket sales from football stadiums and multi-purpose arenas

• Real estate sale and leaseback payments

• Future real estate reversion proceeds

• Corporate Real Estate (to be divested)

• Inheritable building rights

• Cash flows from real estate backed Whole Company Securitisations (e.g. Pub deals) ! the assets are the cash flows from the company, but the collateral is the real estate of the company

• Future proceeds from real estate development projects (problem to be solved is how an effective distribution of the risks can be done).

Categorization by Type of Real Estate Originator:

There are various originators of real estate related cash flows and real estate assets in the property industry.

Depending on the type of incorporation, the core competencies and the business model of those originator, it can be delineated for whom a securitisation transaction might be feasible or not.

• Corporates, that have defined real estate as a non-core business and that try to desinvest their real estate holdings in order to raise shareholder value.

• Corporates, that have defined real estate as a core business and that are looking to finance or refinance their existing holdings.

• Real estate holders, that are looking at financing or refinancing their existing real estate. The following list belongs to that category:

- Open-ended real estate funds

- Closed-ended real estate funds

- Listed property companies

- Real estate specialty funds (for insurances etc.)

- Opportunity Funds

Categorization by Motivations of the Originator:

• Real Estate Investors, that are financing new acquisitions by issuing Asset-Backed Securities.

• Real Estate Sellers, that are trying to generate solvency for a sale that will only take place sometime in the future (advance sale)

• Governments that have solvency problems but that also have a lot of real estate holdings. In the European Union, member countries are only allowed to take on a certain amount of debt (Maastricht Criteria). Therefore the governments are looking for ways to access solvency without raising the national debt (compare Italian Treasury Real Estate Securitisation).

• Real estate project developer

• Suppliers of Multi-Seller Platforms; those enable a pool of small originators to pool their assets.

Q5) Explain whole loans.

A5)

Whole loans

The term whole loan is used in the secondary mortgage market to discuss a loan which is sold in entirety rather than being pooled with other mortgages. When a buyer purchases a whole loan the buyer takes on the full obligation associated with the loan, rather than sharing the risks with other investors. Of course, the buyer also obtains all of the potential profits associated with the loan, including late fees, interest payments, and so forth.

Banks buy and sell loans all the time in a variety of ways. Products are packaged for the secondary mortgage market with different types of investment styles in mind so that the bank will be likely to find interested investors who will be prepared to make purchases. Banks in turn use the money they raise by selling loans to increase their capital, which can be used to make more loans and to engage in other financial activities. The debtor who owes money on the loan usually finds out about the sale after the fact. In the case of a whole loan a seller usually buys a group of loans packaged together, rather than just one.

In some cases, buyers will contract with the seller to have the seller handle administration of the loan. The buyer pays a fee for this service and does not have to worry about collecting loan payments and handling other administrative tasks related to the whole loans it holds. Sellers in turn get the money from the sale and can enjoy a steady profit on the loan as long as it is in service.

The risk of an investment in a whole loan varies depending on the credit rating associated with the loan, the economic climate, and other factors. Investors who buy whole loans usually try to distribute their risk so that the failure of some investments will not be catastrophic for the investor's entire portfolio. By contrast, pass through securities and other types of secondary mortgage market products involve groups or pools of loans which people can buy into. Investors do not assume individual loans in the group in the same way that they do with a whole loan and their risk is instead spread out. Lenders trying to sell loans with a mix of credit ratings may use such products to create packages of mixed quality. Investors would not buy loans with poor ratings independently, but they might be willing to take on the risk if the pool also included loans with high credit ratings.

Q6) Explain mortgages.

A6)

A mortgage loan is a loan secured by real property through the use of a mortgage note which evidences the existence of the loan and the encumbrance of that realty through the granting of a mortgage which secures the loan. However, the word mortgage alone, in everyday usage, is most often used to mean mortgage loan.

A home buyer or builder can obtain financing (a loan) either to purchase or secure against the property from a financial institution, such as a bank or credit union, either directly or indirectly through intermediaries. Features of mortgage loans such as the size of the loan, maturity of the loan, interest rate, method of paying off the loan, and other characteristics can vary considerably.

There are many types of mortgages used worldwide, but several factors broadly define the characteristics of the mortgage. All of these may be subject to local regulation and legal requirements.

• Interest: Interest may be fixed for the life of the loan or variable, and change at certain pre-defined periods; the interest rate can also, of course, be higher or lower.

• Term: Mortgage loans generally have a maximum term, that is, the number of years after which an amortizing loan will be repaid. Some mortgage loans may have no amortization, or require full repayment of any remaining balance at a certain date, or even negative amortization.

• Payment amount and frequency: The amount paid per period and the frequency of payments; in some cases, the amount paid per period may change or the borrower may have the option to increase or decrease the amount paid.

• Prepayment: Some types of mortgages may limit or restrict prepayment of all or a portion of the loan, or require payment of a penalty to the lender for prepayment.

The two basic types of amortized loans are the fixed rate mortgage (FRM) and adjustable-rate mortgage (ARM) (also known as a floating rate or variable rate mortgage). In some countries, such as the United States, fixed rate mortgages are the norm, but floating rate mortgages are relatively common. Combinations of fixed and floating rate mortgages are also common, whereby a mortgage loan will have a fixed rate for some period, for example the first five years, and vary after the end of that period.

• In a fixed rate mortgage, the interest rate, and hence periodic payment, remains fixed for the life (or term) of the loan. Therefore the payment is fixed, although ancillary costs (such as property taxes and insurance) can and do change. For a fixed rate mortgage, payments for principal and interest should not change over the life of the loan,

• In an adjustable rate mortgage, the interest rate is generally fixed for a period of time, after which it will periodically (for example, annually or monthly) adjust up or down to some market index. Adjustable rates transfer part of the interest rate risk from the lender to the borrower, and thus are widely used where fixed rate funding is difficult to obtain or prohibitively expensive. Since the risk is transferred to the borrower, the initial interest rate may be, for example, 0.5% to 2% lower than the average 30-year fixed rate; the size of the price differential will be related to debt market conditions, including the yield curve.

The charge to the borrower depends upon the credit risk in addition to the interest rate risk. The mortgage origination and underwriting process involves checking credit scores, debt-to-income, down payments, and assets. Jumbo mortgages and subprime lending are not supported by government guarantees and face higher interest rates. Other innovations described below can affect the rates as well.

Q7) Explain graduated payment.

A7)

Graduated Payments are repayment terms involving gradual increases in the payments on a closed-end obligation. A graduated payment loan typically involves negative amortization, and is intended for young people who currently have low income but foresee a greater future income. These terms are only offered when banks have reason to assume that the borrower's income will rise during the 10 year loan period.

A graduated payment mortgage loan, often referred to as GPM, is a mortgage with low initial monthly payments which gradually increase over a specified time frame. These plans are mostly geared towards young men and women who cannot afford large payments now, but can realistically expect to do better financially in the future. For instance a medical student who is just about to finish medical school might not have the financial capability to pay for a mortgage loan, but once he graduates, it is more than probable that he will be earning a high income. It is a form of negative amortization loan.

Mechanism

GPMs are available in 30 year and 15 year amortization, and for both conforming and jumbo mortgage. Over a period of time, typically 5 to 15 years, the monthly payments increase every year according to a predetermined percentage. For instance, a borrower may have a 30-year graduated payment mortgage with monthly payments that increase by 7% every year for five years. At the end of five years, the increases stop. The borrower would then pay this new increased amount monthly for the rest of the 25-year loan term.

Risk

The graduated payment mortgage seems to be an attractive option for first-time home buyers or those who currently do not have the resources to afford high monthly home mortgage payments. Even though the amounts of payments are drawn out and scheduled, it requires borrowers to predict their future earnings potential and how much they are able to pay in the future, which may be tricky. Borrowers could overestimate their future earning potential and not be able to keep up with the increased monthly payments.

Eventually, even if the graduated payment mortgage lets borrowers save at the present time by paying low monthly amounts; the overall expense of a graduated payment mortgage loan is higher than that of conventional mortgages, especially when negative amortization is involved.

Q8) Explain Process of Dematerialization and Dematerialization.

A8)

Indian investor community has undergone sea changes in the past few years. India now has a very large investor population and ever increasing volumes of trades. However, this continuous growth in activities has also increased problems associated with stock trading. Most of these problems arise due to the intrinsic nature of paper based trading and settlement, like theft or loss of share certificates. This system requires handling of huge volumes of paper leading to increased costs and inefficiencies.

Some of these risks are :

- Delay in transfer of shares.

- Possibility of forgery on various documents leading to bad deliveries, legal disputes etc.

- Possibility of theft of share certificates.

- Prevalence of fake certificates in the market.

- Mutilation or loss of share certificates in transit.

- The physical form of holding and trading in securities also acts as a bottleneck for broking community in capital market operations.

Dematerialization or “Demat” is a process whereby your securities like shares, debentures etc, are converted into electronic data and stored in computers by a Depository. Securities registered in your name are surrendered to depository participant (DP) and these are sent to the respective companies who will cancel them after “Dematerialization” and credit your depository account with the DP. The securities on Dematerialization appear as balances in your depository account. These balances are transferable like physical shares.

Depository

Depository functions like a securities bank, where the dematerialized physical securities are traded and held in custody. This facilitates faster, risk free and low cost settlement. Depository is much like a bank and perform many activities that are similar to a bank.

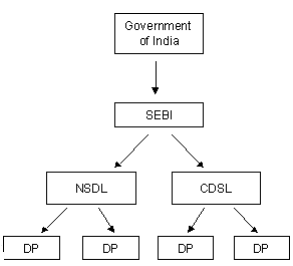

NSDL and CDS

At present there are two depositories in India, National Securities Depository Limited (NSDL) and Central Depository Services (CDS). NSDL is the first Indian depository, it was inaugurated in November 1996. NSDL was set up with an initial capital of US$28mn, promoted by Industrial Development Bank of India (IDBI), Unit Trust of India (UTI) and National Stock Exchange of India Ltd. (NSEIL). Later, State Bank of India (SBI) also became a shareholder.

The other depository is Central Depository Services (CDS). It is still in the process of linking with the stock exchanges. It has registered around 20 DPs and has signed up with 40 companies. It had received a certificate of commencement of business from Sebi on February 8, 1999

These depositories have appointed different Depository Participants (DP) for them. An investor can open an account with any of the depositories’ DP. But transfers arising out of trades on the stock exchanges can take place only amongst account-holders with NSDL’s DPs. This is because only NSDL is linked to the stock exchanges (nine of them including the main ones-National Stock Exchange and Bombay Stock Exchange).

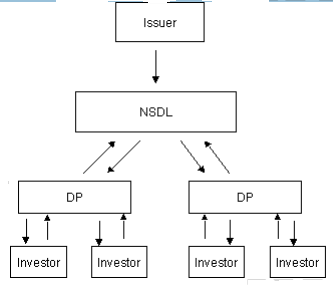

Depository Participant

NSDL carries out its activities through various functionaries called business partners who include Depository Participants (DPs), Issuing corporates and their Registrars and Transfer Agents, Clearing corporations/ Clearing Houses etc. NSDL is electronically linked to each of these business partners via a satellite link through Very Small Aperture Terminals (VSATs). The entire integrated system (including the VSAT linkups and the software at NSDL and each business partner’s end) has been named as the “NEST” (National Electronic Settlement & Transfer) system.

The investor interacts with the depository through a depository participant of NSDL. A DP can be a bank, financial institution, a custodian or a broker. Just as one opens a bank account in order to avail of the services of a bank, an investor opens a depository account with a depository participant in order to avail of depository facilities.

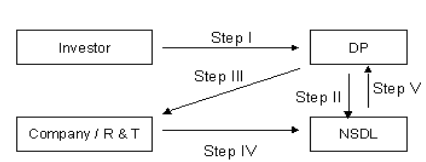

Process of Dematerialization:

- Step I: Investor surrenders the share certificates to a DP.

- Step II: DP generates an electronic request to NSDL.

- Step III: DP forwards the physical certificate to the Company/RT.

- Step IV: Company/RT cancels the certificates and forwards the credits in demat form to NSDL.

- Step V: NSDL releases the credit to the investor's account with the DP.

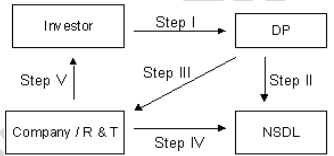

Process of Rematerialization:

- Step I: Investor forwards a physical remat request to his DP.

- Step II: DP will generate an electronic request to NSDL.

- Step III: DP will forward the physical remat request to the Company/RT.

- Step IV: NSDL will confirm the company/RT about the change and nullifies the security electronically.

- Step V: On receipt of the confirmation from NSDL, company/RT will print new certificate and forward it directly to the investor

Q9) Explain Brief description of NSDL and CDSL.

A9)

NSDL

The Government of India enacted the Depositories Act, in August 1996, paving the way for setting up of depositories in India. Thus, pioneering the concept of depositories and ushering in an era of paperless settlement of securities, National Securities Depository Ltd. (NSDL) was inaugurated as the first depository in India on November 1996. Trading in dematerialized securities on the National Stock Exchange (NSE) commenced on December 26, 1996. The Stock Exchange, Mumbai (BSE) also extended the facility of trading in dematerialized securities from December 29, 1997.

NSDL is promoted by Industrial Development Bank of India (the largest development financial institution in India) Unit Trust of India (the largest Mutual Fund in India), National Stock Exchange of India (the largest Stock Exchange in India), State Bank of India (the largest Commercial Bank in India), and the major other stake holders are Canara Bank, Citibank NA Dena Bank, Deutsche Bank AG, Global Trust Bank Limited, HDFC Bank Limited, Hongkong and Shanghai Banking Corporation Limited and Standard Chartered Bank.

CDSL

CDSL is promoted by Bombay Stock Exchange Limited (BSE) jointly with State Bank of India, Bank of India, Bank of Baroda, HDFC Bank, Standard Chartered Bank, Union Bank of India and Centurion Bank.

CDSL was set up in 1999. Central Depository Services Limited (CDSL), is the second Indian central securities depository based in Mumbai. Its main function is the holding securities either in certificated or un-certificated (dematerialized) form, to enable book entry transfer of securities.

Q10) Explain Depository: Meaning, Evolution, Merits and Demerits of Depository.

A10)

A depository is an institution that facilitates the investors in holding securities in a book entry form, which is maintained electronically. It is similar to a bank where one can deposit cash and can be withdrawn and/or transferred to any body at your instruction by issuing a cheque. Similarly your investment can be sold in the stock exchange or transferred to any body at your instruction through a Depository Participant (DP).

On the simplest level, depository is used to refer to any place where something is deposited for storage or security purposes. More specifically, it can refer to a company, bank or an institution that holds and facilitates the exchange of securities. Or a depository can refer to a depository institution that is allowed to accept monetary deposits from customers.

Central security depositories allow brokers and other financial companies to deposit securities where book entry and other services can be performed, like clearance, settlement and securities borrowing and lending

Basics of Depository

Depository is an institution or a kind of organization which holds securities with it, in which trading is done among shares, debentures, mutual funds, derivatives, F&O and commodities. The intermediaries perform their actions in variety of securities at Depository on behalf of their clients. These intermediaries are known as Depositories Participants. Fundamentally, There are two sorts of depositories in India. One is the National Securities Depository Limited(NSDL) and the other is the Central Depository Service (India) Limited(CDSL). Every Depository Participant(DP) needs to be registered under this Depository before it begins its operation or trade in the market

How do Depository operate

Depository interacts with its clients / investors through its agents, called Depository Participants normally known as DPs. For any investor / client, to avail the services provided by the Depository, has to open Depository account, known as Demat A/c, with any of the DPs.

Demat Account Opening

A demat account is opened on the same lines as that of a Bank Account. Prescribed Account opening forms are available with the DP, needs to be filled in. Standard Agreements are to be signed by the Client and the DP, which details the rights and obligations of both parties. Along with the form the client requires to attach Photographs of Account holder, Attested copies of proof of residence and proof of identity needs to be submitted along with the account opening form.

In case of corporate clients, additional attachments required are - true copy of the resolution for Demat a/c opening along with signatories to operate the account and true copy of the Memorandum and Articles of Association is to be attached.

Services provided by Depository

• Dematerialisation (usually known as demat) is converting physical certificates to electronic form

• Rematerialisation, known as remat, is reverse of demat, i.e. getting physical certificates from the electronic securities

• Transfer of securities, change of beneficial ownership

• Settlement of trades done on exchange connected to the Depository

Depository System in India:

India has adopted the Depository System for securities trading in which book entry is done electronically and no paper is involved. The physical form of securities is extinguished and shares or securities are held in an electronic form. Before the introduction of the depository system through the Depository Act, 1996, the process of sale, purchase and transfer of securities was a huge problem, and there was no safety at all.

Evolution

Although India had a vibrant capital market which is more than a century old, the paper-based settlement of trades caused substantial problems such as bad delivery and delayed transfer of title. The enactment of Depositories Act in August 1996 paved the way for establishment of National Securities Depository Limited (NSDL), the first depository in India. It went on to established infrastructure based on international standards that handles most of the securities held and settled in de-materialised form in the Indian capital markets.

NSDL has stated it aims are to ensuring the safety and soundness of Indian marketplaces by developing settlement solutions that increase efficiency, minimise risk and reduce costs. NSDL plays a quiet but central role in developing products and services that will continue to nurture the growing needs of the financial services industry.

In the depository system, securities are held in depository accounts, which are similar to holding funds in bank accounts. Transfer of ownership of securities is done through simple account transfers. This method does away with all the risks and hassles normally associated with paperwork. Consequently, the cost of transacting in a depository environment is considerably lower as compared to transacting in certificates. In August 2009, number of Demat accounts held with NSDL crossed one crore.

Merits and Demerits of Depository

Merits

- Share certificates, on dematerialization, are cancelled and the same will not be sent back to the investor. The shares, represented by dematerialized share certificates are fungible and, therefore, certificate numbers and distinctive numbers are cancelled and become non-operative.

- It enables processing of share trading and transfers electronically without involving share certificates and transfer deeds, thus eliminating the paper work involved in scrip-based trading and share transfer system.

- Transfer of dematerialized securities is immediate and unlike in the case of physical transfer where the change of ownership has to be informed to the company in order to be registered as such, in case of transfer in dematerialized form, beneficial ownership will be transferred as soon as the shares are transferred from one account to another.

- The investor is also relieved of problems like bad delivery, fake certificates, shares under litigation, signature difference of transferor and the like.

- There is no need to fill a transfer form for transfer of shares and affix share transfer stamps.

- There is saving in time and cost on account of elimination of posting of certificates.

- The threat of loss of certificates or fraudulent interception of certificates in transit that causes anxiety to the investors, are eliminated.

Demerits

- Lack of control: Trading in securities may become uncontrolled in case of dematerialized securities.

- Need for greater supervision: It is incumbent upon the capital market regulator to keep a close watch on the trading in dematerialized securities and see to it that trading does not act as a detriment to investors. The role of key market players in case of dematerialized securities, such as stock brokers, needs to be supervised as they have the capability of manipulating the market.

- Complexity of the system: Multiple regulatory frameworks have to be confirmed to, including the Depositories Act, Regulations and the various Bye Laws of various depositories. Additionally, agreements are entered at various levels in the process of dematerialization. These may cause anxiety to the investor desirous of simplicity in terms of transactions in dematerialized securities.

- Current regulations prohibit multiple bids or applications by a single person. But investors open multiple demat accounts and make multiple applications to subscribe to IPOs in the hope of getting allotment of shares.

- Some listed companies had obtained duplicate shares after the originals were pledged with banks and then sold the duplicates in the secondary market to make a profit.

- Promoters of some companies dematerialised shares in excess of the company’s issued capital.

- Certain investors pledged shares with banks and got the same shares reissued as duplicates.

- There is an undue delay in the settlement of complaints by investors against depository participants. This is because there is no single body that is in chargeof ensuring full compliance by these companies.

Q11) explain scope of securitization.

A11)

Securitization is the process of transforming the assets of a lending institution into a negotiable instrument. The assets could be in the form of receivables of term lending institution, a housing finance company or automobile loan. It is a structured finance originated in USA in 1970s.

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling said consolidated debt as bonds, pass-through securities, or collateralized mortgage obligation (CMOs), to various investors. The principal and interest on the debt, underlying the security, is paid back to the various investors regularly. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS).

Essential features of a securitization transaction comprise the following:

- Creation of asset pool and its sale

The originator/seller (of assets) creates a pool of assets and executes a legal true sale of the same to a special purpose vehicle (SPV). An SPV in such cases is either a trust or a company, as may be appropriate under applicable law, setup to carry out a restricted set of activities, management of which would usually rest with an independent board of directors.

2. Issuance of the securitised paper

This activity is usually performed by the SPV. Design of the instrument however would be based on the nature of interest that investors would have on the asset pool. In the case of pass-through issuances, the investors will have a direct ownership interest in the underlying assets, while pay-throughs are debt issued by the SPV secured by the assets and their cash flows.

3. Credit Risk

It must be made abundantly clear at the very outset that the accretions on the asset-backed security, i.e., interest, amortisation and redemption payments, are entirely dependent on the performance of the pooled assets, and will have nothing to do with the credit of the originator. By the same argument, such cash flows would also be not influenced by events affecting the condition of the originator, including insolvency.

4. Pool Selection

The process of selecting assets to build a securitization pool would take into careful consideration, loan characteristics that are important from a cash flow, legal, and credit points of view, such as type of asset, minimum and maximum loan size, vintage, rate, maturity and concentration limits (geographic, singleborrower, etc.). 'Cherry-picking' to include only the highest quality assets in the pool should be consciously avoided. Ideal selection would be a random choice among assets conforming only to cash flow or legal criteria. Often, substitution of eligible assets in the place of original assets that mature/prepay in order to maintain the level of asset cover would also be required.

5. Administration

Formal delineation of duties and responsibilities relating to administration of securitised assets, including payment servicing and managing relationship with the final obligors must be spelt out clearly through a contractual agreement with the entity who would perform those functions.

Scope

Mortgage Backed Securities (MBS) The securitisation of assets historically began with, and in sheer volume remains dominated by residential mortgages. The receivables are generally secured by way of mortgage over the property being financed, thereby enhancing the comfort for investors. This is because mortgaged property does not normally suffer erosion in its value like other physical assets through depreciation. Rather, it is more likely that real estate appreciates in value over time.

Asset Backed Securities (ABS) – Existing assets

(a) Auto loans: Though securitization was made popular by housing finance companies, it has found wide application in other areas of retail financing, particularly financing of cars and commercial vehicles. In India, the auto sector has been thrown open to international participation, greatly expanding the scope of the market. Auto loans (including installment and hire purchase finance) broadly fulfil the features necessary in securitization. The security in this case is also considered good, because of title over a utility asset. The development of a second hand market for cars in India has also meant that foreclosure is an effective tool in the hands of auto loan financiers in delinquent cases. Originators are NBFCs and auto finance divisions of commercial banks.

(b) Investments: Investments in long dated securities as also the periodical interest instruments on these securities can also be pooled and securitized. This is considered relevant particularly for Indian situation wherein the FIs are carrying huge portfolios in Government securities and other debt instruments, which are creating huge asset -liability mismatches for the institutions. Government securities issued domestically in Indian Rupee can be bundled and used to back foreign currency denominated bonds issues. It would more be of the nature of derivative. The subordinated Government securities are intended to absorb depreciation in the value of the rupee thereby protecting to certain extent the senior securities that the Government securities back.

Securitization of infrastructure receivables

Securitisation of wholesale assets refers mainly to the use of securitisation as a technique for infrastructure funding. The availability of an efficient infrastructure framework is vital to the economic growth and prosperity of any country. Traditionally, infrastructure facilities have been developed and provided by Governments and are looked upon as basic privileges of a citizen and have thus been accorded priority for Government investment. The Central Government has envisaged that more than 40% of the annual central plan outlay would be for the development of infrastructure. In the context of India’s size, population, and economic growth, the present infrastructure continues to be inadequate and will require massive incremental investment to sustain economic growth. Hence, the participation of private capital in the development of infrastructure is essential.

Q12) Explain nature and scope of securitization.

A12)

Securitization is the process of transforming the assets of a lending institution into a negotiable instrument. The assets could be in the form of receivables of term lending institution, a housing finance company or automobile loan. It is a structured finance originated in USA in 1970s.

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling said consolidated debt as bonds, pass-through securities, or collateralized mortgage obligation (CMOs), to various investors. The principal and interest on the debt, underlying the security, is paid back to the various investors regularly. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS).

Essential features of a securitization transaction comprise the following:

- Creation of asset pool and its sale

The originator/seller (of assets) creates a pool of assets and executes a legal true sale of the same to a special purpose vehicle (SPV). An SPV in such cases is either a trust or a company, as may be appropriate under applicable law, setup to carry out a restricted set of activities, management of which would usually rest with an independent board of directors.

2. Issuance of the securitised paper

This activity is usually performed by the SPV. Design of the instrument however would be based on the nature of interest that investors would have on the asset pool. In the case of pass-through issuances, the investors will have a direct ownership interest in the underlying assets, while pay-throughs are debt issued by the SPV secured by the assets and their cash flows.

3. Credit Risk

It must be made abundantly clear at the very outset that the accretions on the asset-backed security, i.e., interest, amortisation and redemption payments, are entirely dependent on the performance of the pooled assets, and will have nothing to do with the credit of the originator. By the same argument, such cash flows would also be not influenced by events affecting the condition of the originator, including insolvency.

4. Pool Selection

The process of selecting assets to build a securitization pool would take into careful consideration, loan characteristics that are important from a cash flow, legal, and credit points of view, such as type of asset, minimum and maximum loan size, vintage, rate, maturity and concentration limits (geographic, singleborrower, etc.). 'Cherry-picking' to include only the highest quality assets in the pool should be consciously avoided. Ideal selection would be a random choice among assets conforming only to cash flow or legal criteria. Often, substitution of eligible assets in the place of original assets that mature/prepay in order to maintain the level of asset cover would also be required.

5. Administration

Formal delineation of duties and responsibilities relating to administration of securitised assets, including payment servicing and managing relationship with the final obligors must be spelt out clearly through a contractual agreement with the entity who would perform those functions.

Nature and scope of securitization

- Marketability: The very purpose of securitization is to ensure marketability to financial claims. Hence, the instrument is structured in such a way as to be marketable. This is one of the most important features of a securitized instrument, and the others that follow are mostly imported only to ensure this feature. Marketability involves two concepts: (1) the legal and systematic possibility of marketing the instrument; (2) the existence of a market for the instrument.

Ii. Merchantable Quality: To be market acceptable a securitized product should be of saleable quality. This concept, in case of physical goods, is something which is acceptable to merchants in normal trade. When applied to financial products, it would mean that the financial commitments embodied in the instruments are secured to the investors’ satisfaction. To the investors satisfaction is a relative term and therefore, the originator of the securitized instrument secures the instrument based on the needs of the investors. For widely distributed securitized instruments, evaluation of the quality, and its certification by an independent expert, viz., rating is common. The rating is for the benefit of the lay investor, who otherwise not expected to be in a position to appraise the degree of risk involved.

Iii. Wide Distribution: The basic purpose of securitization is to distribute the product. The extent of distribution which the originator would like to achieve is based on a comparative analysis of the costs and the benefits that can be achieved Wider distribution leads to a cost benefit, in that the issuer is able to market the product with lower return, and hence, lower financial cost to him. But a wide investor base involves the high cost of distribution and servicing.

Iv. Commodization: Securitization is the process of commoditization, where the basic idea is to take the outcome of this process into the capital market. Thus, the result of every securitization process, whatever might be the area to which it is applied, is to create certain instruments which can be placed in the market.

v. Funding alternative: Being distinct and different from the originator's own obligations, a well structured ABS stands on its own credit rating and thus generates genuine incremental funding. This is so as the originator's existing creditors may invest in the ABS in addition to providing lines of credit to the originator. Further, there may also be other investors in the ABS who do not have a lending relationship with the originator. It is also possible to achieve a superior credit rating for the ABS than the originator's own through appropriate structuring and credit enhancement.

Vi. Balance sheet management: Fundamental benefit of a true sale, i.e., freeing up the capital of the originator would apply in the case of all securitization transactions. In response, the balance sheet gets compressed and becomes more robust. Its ratios improve. Alternately, reduction in leverage post-securitised sale can be restored by adding on new assets to the balance sheet. Thus the asset through-put of the originator's balance sheet increases. Securitization can also generate matched funding for balance sheet assets. Further, it may also enable the disposal of non-core assets through suitable structuring.

Vii. Re-allocation of risks: Securitization transfers much of the credit risk in the portfolio to the ABS investors and helps to quantify the residual credit risk that the originator is exposed to. This is very useful, as the originator can then take larger exposure to individual obligors as well as provides a higher degree of comfort to his creditors. Securitization also transfers the originator's market risks, i.e., liquidity, interest rate and prepayment risks, to ABS investors and reduces risk capital requirement. This can lead to more competitive pricing of the underlying asset products.

Viii. Operating process efficiency: The extent of portfolio analysis and information demanded by securitization programs often lead to serious re-examination and consequent reengineering of operating processes within the originator organisation. Further, specialist handling of various functional components, such as origination, funding, risk management and administration, often achieved through outsourcing, promotes efficiency across operating processes.

Ix. Securitization improves operating leverage: The originator usually assumes the function of the servicer, the issuing and paying agent, and sometimes that of the credit enhancer. Fees accrue on account of all of these. Excess servicing, i.e., the difference between the asset yield and the cost of funds, is also normally extracted by the originator. These income streams can push up the operating leverage of the originator generating income from a larger asset base than what may be otherwise possible for a given capital structure.

x. Low event risk: The pool of assets representing the obligations of a number of entities is usually more resilient to event risks than the obligations of a single borrower – i.e. the risk that the credit rating of the security will deteriorate due to circumstances usually beyond the obligor's control is much higher in the latter case. The diversity that the securitization pool represents makes the ABS largely immune to event risks. Higher yields for lower/similar risk ABS usually offer higher yields over securities of comparable credit and maturities.

Scope

Mortgage Backed Securities (MBS) The securitisation of assets historically began with, and in sheer volume remains dominated by residential mortgages. The receivables are generally secured by way of mortgage over the property being financed, thereby enhancing the comfort for investors. This is because mortgaged property does not normally suffer erosion in its value like other physical assets through depreciation. Rather, it is more likely that real estate appreciates in value over time.

Asset Backed Securities (ABS) – Existing assets

(a) Auto loans: Though securitization was made popular by housing finance companies, it has found wide application in other areas of retail financing, particularly financing of cars and commercial vehicles. In India, the auto sector has been thrown open to international participation, greatly expanding the scope of the market. Auto loans (including installment and hire purchase finance) broadly fulfil the features necessary in securitization. The security in this case is also considered good, because of title over a utility asset. The development of a second hand market for cars in India has also meant that foreclosure is an effective tool in the hands of auto loan financiers in delinquent cases. Originators are NBFCs and auto finance divisions of commercial banks.

(b) Investments: Investments in long dated securities as also the periodical interest instruments on these securities can also be pooled and securitized. This is considered relevant particularly for Indian situation wherein the FIs are carrying huge portfolios in Government securities and other debt instruments, which are creating huge asset -liability mismatches for the institutions. Government securities issued domestically in Indian Rupee can be bundled and used to back foreign currency denominated bonds issues. It would more be of the nature of derivative. The subordinated Government securities are intended to absorb depreciation in the value of the rupee thereby protecting to certain extent the senior securities that the Government securities back.

Securitization of infrastructure receivables

Securitisation of wholesale assets refers mainly to the use of securitisation as a technique for infrastructure funding. The availability of an efficient infrastructure framework is vital to the economic growth and prosperity of any country. Traditionally, infrastructure facilities have been developed and provided by Governments and are looked upon as basic privileges of a citizen and have thus been accorded priority for Government investment. The Central Government has envisaged that more than 40% of the annual central plan outlay would be for the development of infrastructure. In the context of India’s size, population, and economic growth, the present infrastructure continues to be inadequate and will require massive incremental investment to sustain economic growth. Hence, the participation of private capital in the development of infrastructure is essential.